Form 8892 Rev December 2024-2026

What is the Form 8892 Rev December

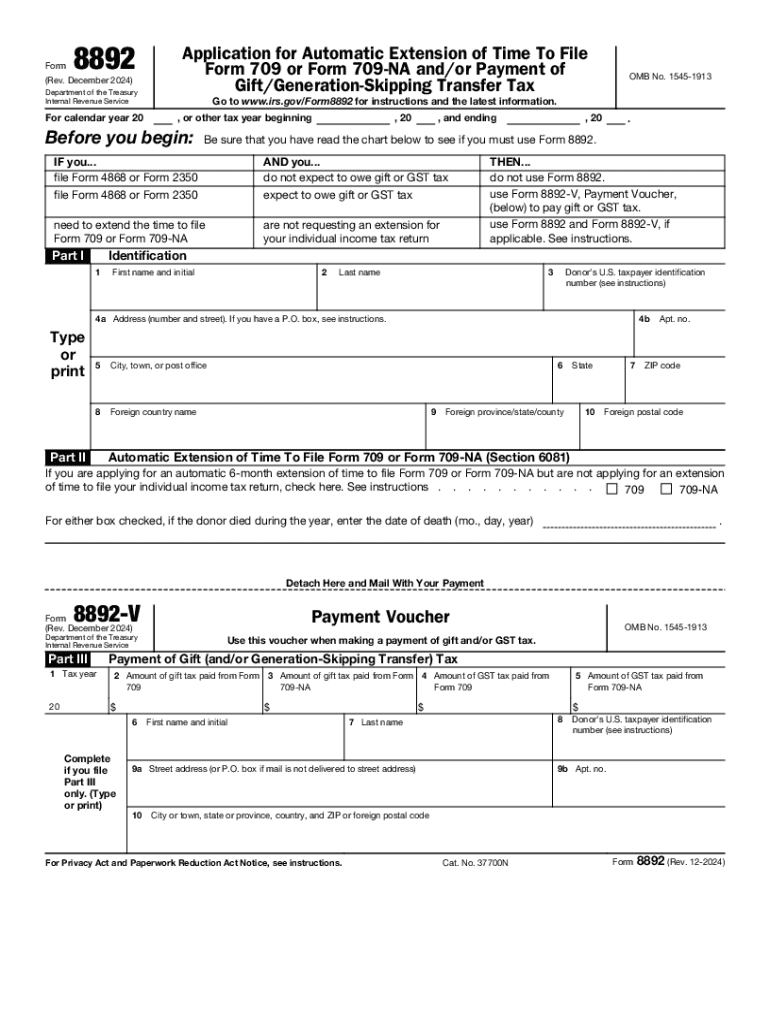

The Form 8892, also known as the Application for Automatic Extension of Time to File Form 1065, is a tax form used by partnerships to request an automatic extension of time to file their tax return. This form is specifically designed for partnerships that need additional time to prepare their tax documents, allowing them to avoid late filing penalties while ensuring compliance with IRS regulations. The most recent revision of this form was released in December and includes specific instructions and requirements for proper completion.

How to use the Form 8892 Rev December

To use the Form 8892 effectively, partnerships must complete the form accurately and submit it to the IRS by the original due date of the Form 1065. The form requires basic information about the partnership, including the name, address, and Employer Identification Number (EIN). It is essential to ensure that all details are correct to avoid processing delays. Once completed, the form can be filed electronically or mailed to the appropriate IRS address, depending on the partnership's preference.

Steps to complete the Form 8892 Rev December

Completing the Form 8892 involves several steps:

- Gather necessary information, including the partnership's name, address, and EIN.

- Fill out the form with accurate details, ensuring all sections are completed as required.

- Review the form for any errors or omissions to prevent delays in processing.

- Decide on the submission method, either electronically or by mail.

- Submit the form by the due date to ensure compliance with IRS regulations.

Filing Deadlines / Important Dates

The deadline for submitting the Form 8892 coincides with the due date for the Form 1065. Generally, this is the fifteenth day of the third month following the end of the partnership's tax year. For partnerships operating on a calendar year, this means the deadline is March 15. It is important for partnerships to remember this date to avoid penalties and interest associated with late filings.

Required Documents

When preparing to file the Form 8892, partnerships should have several documents on hand, including:

- The partnership's tax identification number (EIN).

- Financial records and statements relevant to the tax year.

- Any previous year’s tax returns, if applicable, for reference.

- Details of any partners involved in the partnership.

Penalties for Non-Compliance

Failing to file the Form 8892 by the due date can result in significant penalties for partnerships. The IRS may impose late filing penalties, which can accumulate over time. Additionally, if the Form 1065 is not filed on time, the partnership may face further penalties for late submission of the tax return itself. It is crucial for partnerships to adhere to filing deadlines to avoid these financial repercussions.

Create this form in 5 minutes or less

Find and fill out the correct form 8892 rev december

Create this form in 5 minutes!

How to create an eSignature for the form 8892 rev december

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8892 form and why is it important?

The 8892 form is a crucial document used for specific tax-related purposes. It allows businesses to request an extension for filing certain tax returns. Understanding the 8892 form is essential for ensuring compliance and avoiding penalties.

-

How can airSlate SignNow help with the 8892 form?

airSlate SignNow simplifies the process of completing and eSigning the 8892 form. With our user-friendly platform, you can easily fill out the form, add signatures, and send it securely. This streamlines your workflow and ensures timely submission.

-

Is there a cost associated with using airSlate SignNow for the 8892 form?

Yes, airSlate SignNow offers various pricing plans tailored to meet different business needs. Our plans are cost-effective and provide access to features that enhance the management of documents like the 8892 form. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the 8892 form?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking specifically for the 8892 form. These tools help you manage your documents efficiently and ensure that all necessary steps are completed accurately.

-

Can I integrate airSlate SignNow with other applications for the 8892 form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to manage the 8892 form alongside your existing tools. This enhances your workflow and ensures that all your documents are easily accessible.

-

What are the benefits of using airSlate SignNow for the 8892 form?

Using airSlate SignNow for the 8892 form provides numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled with care, allowing you to focus on your core business activities.

-

How secure is airSlate SignNow when handling the 8892 form?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage solutions to protect your 8892 form and other sensitive documents. You can trust that your information is safe with us.

Get more for Form 8892 Rev December

Find out other Form 8892 Rev December

- Electronic signature West Virginia Orthodontists Living Will Online

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter