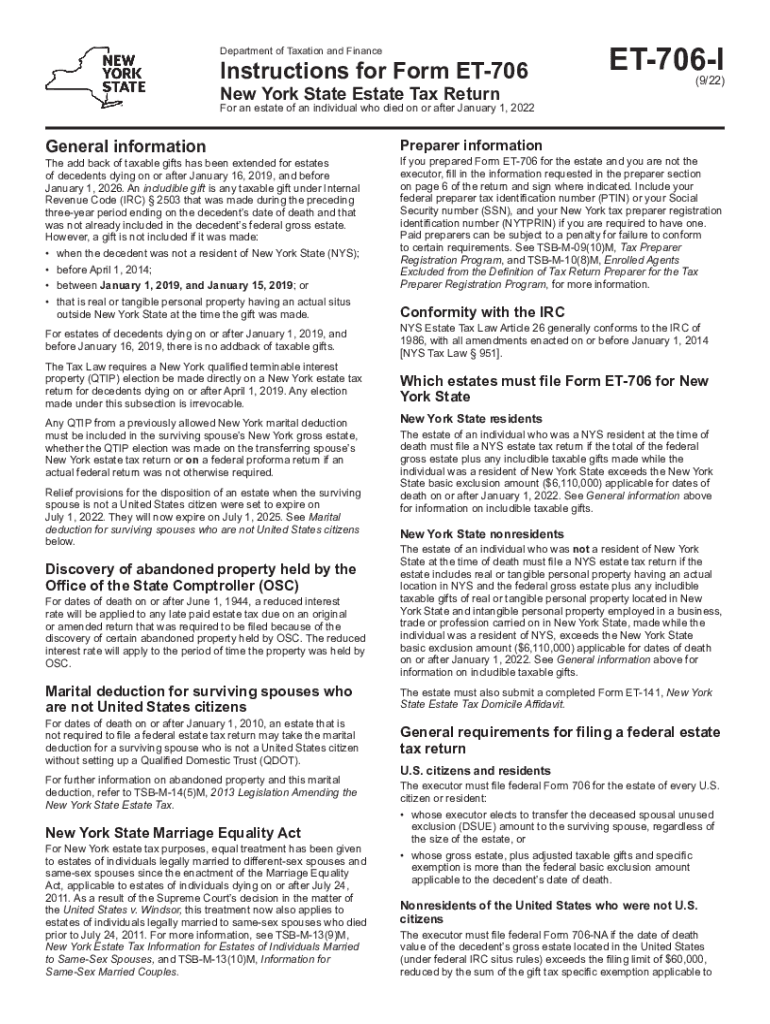

New York State Estate Tax Return Department of Taxation and Finance ET 706 2022

What is the New York State Estate Tax Return ET-706?

The New York State Estate Tax Return, known as ET-706, is a crucial document required by the New York State Department of Taxation and Finance. This form is used to report the estate tax liability of a decedent who passed away while a resident of New York State or who owned property in New York. The estate tax is applicable to estates exceeding a certain value threshold, which is subject to change based on state regulations. Completing this return accurately is essential for compliance with state tax laws and to ensure that the estate is settled properly.

Steps to Complete the New York State Estate Tax Return ET-706

Completing the ET-706 involves several important steps:

- Gather necessary documentation, including the decedent's financial records, property valuations, and any prior tax returns.

- Determine the total value of the estate, including all assets and liabilities.

- Complete the ET-706 form, ensuring that all sections are filled out accurately. Pay special attention to the sections detailing deductions and credits that may apply.

- Review the form for accuracy and completeness, as errors can lead to delays or penalties.

- Submit the completed form by the specified filing deadline, which is typically nine months after the date of death.

Legal Use of the New York State Estate Tax Return ET-706

The ET-706 must be filed to comply with New York State law regarding estate taxes. The legal use of this form ensures that the estate is recognized as settled in accordance with state regulations. It is important to note that failing to file this return can result in penalties, interest on unpaid taxes, and legal complications for the heirs. Therefore, understanding the legal implications and ensuring timely submission is critical for all involved parties.

Filing Deadlines for the New York State Estate Tax Return ET-706

Filing deadlines for the ET-706 are typically set at nine months from the date of the decedent's passing. It is essential to adhere to this timeline to avoid penalties. If additional time is needed, an extension may be requested, but this does not extend the payment deadline for any taxes owed. Understanding these deadlines helps ensure compliance and prevents unnecessary complications.

Required Documents for the New York State Estate Tax Return ET-706

To complete the ET-706, several documents are required, including:

- The decedent's death certificate.

- A complete inventory of the estate's assets and liabilities.

- Documentation of any deductions or exemptions claimed.

- Prior tax returns, if applicable.

Having these documents ready will facilitate a smoother filing process and help ensure that all necessary information is included.

Examples of Using the New York State Estate Tax Return ET-706

There are various scenarios in which the ET-706 is utilized, such as:

- When an individual passes away with an estate exceeding the exemption threshold set by New York State.

- For estates that include real property located within New York State, regardless of the decedent's residency.

- In cases where the estate is subject to federal estate tax, as the state return may require additional disclosures.

Understanding these examples can help clarify when the ET-706 is necessary and how it applies to different estate situations.

Quick guide on how to complete new york state estate tax return department of taxation and finance et 706

Complete New York State Estate Tax Return Department Of Taxation And Finance ET 706 effortlessly on any device

Online document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can access the correct form and safely store it online. airSlate SignNow provides all the resources necessary to create, modify, and electronically sign your documents quickly without delays. Manage New York State Estate Tax Return Department Of Taxation And Finance ET 706 on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to modify and eSign New York State Estate Tax Return Department Of Taxation And Finance ET 706 easily

- Locate New York State Estate Tax Return Department Of Taxation And Finance ET 706 and then click Get Form to begin.

- Employ the tools we offer to fill out your document.

- Highlight key sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Choose how you wish to send your document—via email, text message (SMS), or a shareable link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your preference. Modify and eSign New York State Estate Tax Return Department Of Taxation And Finance ET 706 and ensure smooth communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct new york state estate tax return department of taxation and finance et 706

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to tax et york?

airSlate SignNow is an electronic signature solution designed to streamline the process of signing and sending documents. For businesses focusing on tax et york requirements, it simplifies the management of tax documents, ensuring compliance and efficiency in workflows.

-

How does airSlate SignNow handle document security for tax et york transactions?

Security is paramount at airSlate SignNow, especially for sensitive tax et york documents. The platform employs top-notch encryption, multi-factor authentication, and strict access controls to protect your data against unauthorized access and bsignNowes.

-

Is airSlate SignNow cost-effective for managing tax et york processes?

Yes, airSlate SignNow offers competitive pricing plans that cater to any business size, making it a cost-effective solution for managing tax et york processes. By reducing paperwork and fostering efficient collaboration, businesses can save both time and resources.

-

Can I integrate airSlate SignNow with other tools for tax et york management?

Absolutely! airSlate SignNow integrates seamlessly with various applications commonly used for tax et york administration, such as accounting software and document management systems. This integration helps streamline your processes, reducing duplication of efforts.

-

What features does airSlate SignNow offer that benefit tax et york compliance?

airSlate SignNow offers features such as customizable templates, audit trails, and eSignature capabilities that are particularly beneficial for tax et york compliance. These features ensure that all documents are not only legally binding but also traceable for review and auditing purposes.

-

How user-friendly is airSlate SignNow for those dealing with tax et york?

airSlate SignNow is designed with user experience in mind, making it exceptionally easy for anyone managing tax et york documents. Its intuitive interface allows users to quickly upload, send, and sign documents without needing extensive technical knowledge.

-

What are the main benefits of using airSlate SignNow for tax et york documents?

The primary benefits of using airSlate SignNow for tax et york documents include increased speed, improved accuracy, and enhanced security. This efficiency not only accelerates document turnaround times but also signNowly reduces the risk of errors common in paper-based processes.

Get more for New York State Estate Tax Return Department Of Taxation And Finance ET 706

- Name affidavit of buyer new mexico form

- Name affidavit of seller new mexico form

- Non foreign affidavit under irc 1445 new mexico form

- Owners or sellers affidavit of no liens new mexico form

- New mexico occupancy form

- Complex will with credit shelter marital trust for large estates new mexico form

- Nm marital form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497320203 form

Find out other New York State Estate Tax Return Department Of Taxation And Finance ET 706

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample

- Can I Sign Oregon Lease agreement sample

- How To Sign West Virginia Lease agreement contract

- How Do I Sign Colorado Lease agreement template

- Sign Iowa Lease agreement template Free

- Sign Missouri Lease agreement template Later

- Sign West Virginia Lease agreement template Computer

- Sign Nevada Lease template Myself

- Sign North Carolina Loan agreement Simple

- Sign Maryland Month to month lease agreement Fast

- Help Me With Sign Colorado Mutual non-disclosure agreement

- Sign Arizona Non disclosure agreement sample Online

- Sign New Mexico Mutual non-disclosure agreement Simple

- Sign Oklahoma Mutual non-disclosure agreement Simple

- Sign Utah Mutual non-disclosure agreement Free

- Sign Michigan Non disclosure agreement sample Later

- Sign Michigan Non-disclosure agreement PDF Safe

- Can I Sign Ohio Non-disclosure agreement PDF

- Help Me With Sign Oklahoma Non-disclosure agreement PDF