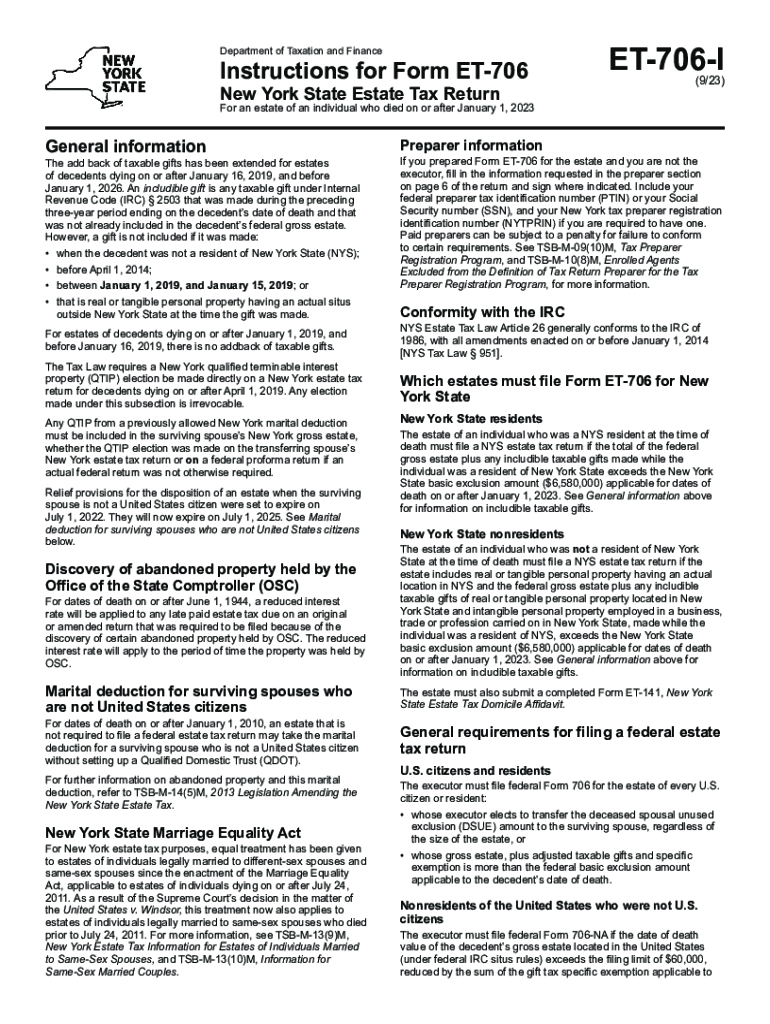

Instructions for Form ET 706 New York State Estate Tax Return for an Estate of an Individual Who Died on or After January 1, Rev 2023-2026

Understanding Form ET 706 Instructions

The Instructions for Form ET 706 pertain to the New York State Estate Tax Return for estates of individuals who passed away on or after January 1, 2019. This form is essential for reporting the value of an estate and calculating the estate tax due. It is specifically designed for estates that exceed the exempt threshold set by New York State law. Understanding these instructions is crucial for ensuring compliance with state tax regulations.

Steps to Complete the ET 706 Instructions

Completing the ET 706 instructions requires careful attention to detail. Here are the primary steps involved:

- Gather all necessary documents, including the deceased's financial records, property valuations, and any existing tax returns.

- Determine the gross estate value by calculating the total value of all assets owned by the deceased at the time of death.

- Identify any deductions applicable to the estate, such as debts, funeral expenses, and administrative costs.

- Calculate the net taxable estate by subtracting the allowable deductions from the gross estate value.

- Complete the form by accurately filling in all required fields, ensuring that all calculations are correct.

- Review the completed form for accuracy before submission.

Required Documents for Form ET 706

To successfully complete the ET 706 instructions, several documents are required. These documents provide the necessary information to accurately report the estate's value and tax obligations:

- Death certificate of the deceased.

- Appraisals for real estate and personal property.

- Records of any debts or liabilities owed by the deceased.

- Documentation of any gifts made by the deceased within three years prior to death.

- Financial statements, including bank accounts, investments, and retirement accounts.

Filing Deadlines for Form ET 706

Timely filing of Form ET 706 is crucial to avoid penalties. The estate tax return must be filed within nine months of the date of death. If the return is not filed by this deadline, the estate may incur interest and penalties on any tax owed. It is advisable to plan ahead and gather all necessary information to meet this deadline.

Legal Use of Form ET 706 Instructions

The ET 706 instructions serve a legal purpose by ensuring that estates comply with New York State tax laws. Filing this form accurately is essential for the legal distribution of the deceased's assets. Executors or administrators of the estate are responsible for completing the form and ensuring that all legal obligations are met. Failure to comply can lead to legal repercussions, including fines and additional taxes.

Examples of Using Form ET 706 Instructions

Utilizing the ET 706 instructions can vary based on the specific circumstances of the estate. For example:

- An estate with significant real estate holdings may require detailed appraisals to determine the fair market value.

- Estates with complex financial portfolios may need to consult with financial advisors to ensure accurate reporting.

- In cases where the deceased made substantial gifts prior to death, it is important to document these transactions to comply with tax regulations.

Quick guide on how to complete instructions for form et 706 new york state estate tax return for an estate of an individual who died on or after january 1 702368057

Complete Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, Rev effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the right format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, amend, and eSign your documents swiftly without delays. Handle Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, Rev on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and eSign Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, Rev with ease

- Obtain Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, Rev and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, Rev to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form et 706 new york state estate tax return for an estate of an individual who died on or after january 1 702368057

Create this form in 5 minutes!

How to create an eSignature for the instructions for form et 706 new york state estate tax return for an estate of an individual who died on or after january 1 702368057

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are ET 706 instructions, and how can they benefit my business?

ET 706 instructions are guidelines provided for the electronic filing of Form 706, which pertains to estate tax. Utilizing these instructions can simplify your tax filing process, ensuring accuracy and compliance with regulations. By integrating ET 706 instructions into your document management practices, you can save time and reduce errors.

-

How does airSlate SignNow facilitate the use of ET 706 instructions?

airSlate SignNow streamlines the eSigning process for documents related to ET 706 instructions. With our user-friendly platform, you can easily prepare, send, and eSign important estate tax documents without hassle. This ensures a smooth experience from document creation to final signing.

-

Are there any costs associated with using airSlate SignNow to manage ET 706 instructions?

Yes, there are several pricing plans available for airSlate SignNow, tailored to fit various business needs. Each plan provides access to essential features that assist in managing ET 706 instructions efficiently. For specific details on pricing, you can visit our website or contact our sales team.

-

What features does airSlate SignNow offer for handling ET 706 instructions?

airSlate SignNow offers features such as document templates, automated workflows, and secure signing options, all tailored for handling ET 706 instructions. These tools enhance efficiency and ensure that your documents remain compliant with legal requirements. Our platform is designed for ease of use, helping you manage your document needs effectively.

-

Can I integrate other applications with airSlate SignNow for better management of ET 706 instructions?

Absolutely! AirSlate SignNow supports integration with various applications, allowing you to streamline workflows related to ET 706 instructions and other business processes. This allows for improved collaboration and data management across platforms, enhancing overall efficiency.

-

Is it secure to use airSlate SignNow for documents related to ET 706 instructions?

Yes, airSlate SignNow prioritizes security, offering encrypted storage and secure signing options for documents handling ET 706 instructions. Our compliance with industry standards ensures your sensitive information is protected throughout the signing process. You can trust that your documents are safe with us.

-

How can my team collaborate on ET 706 instructions using airSlate SignNow?

With airSlate SignNow, your team can collaborate in real time on documents related to ET 706 instructions. You can share templates, comment on specific sections, and track changes for seamless teamwork. This collaborative approach helps ensure that everyone is on the same page and that documents are completed quickly.

Get more for Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, Rev

Find out other Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, Rev

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free