Instructions for Form ET 706 New York State Estate Tax Return for an Estate of an Individual Who Died on or After January 1, ;et 2020

Understanding Form ET 706: New York State Estate Tax Return

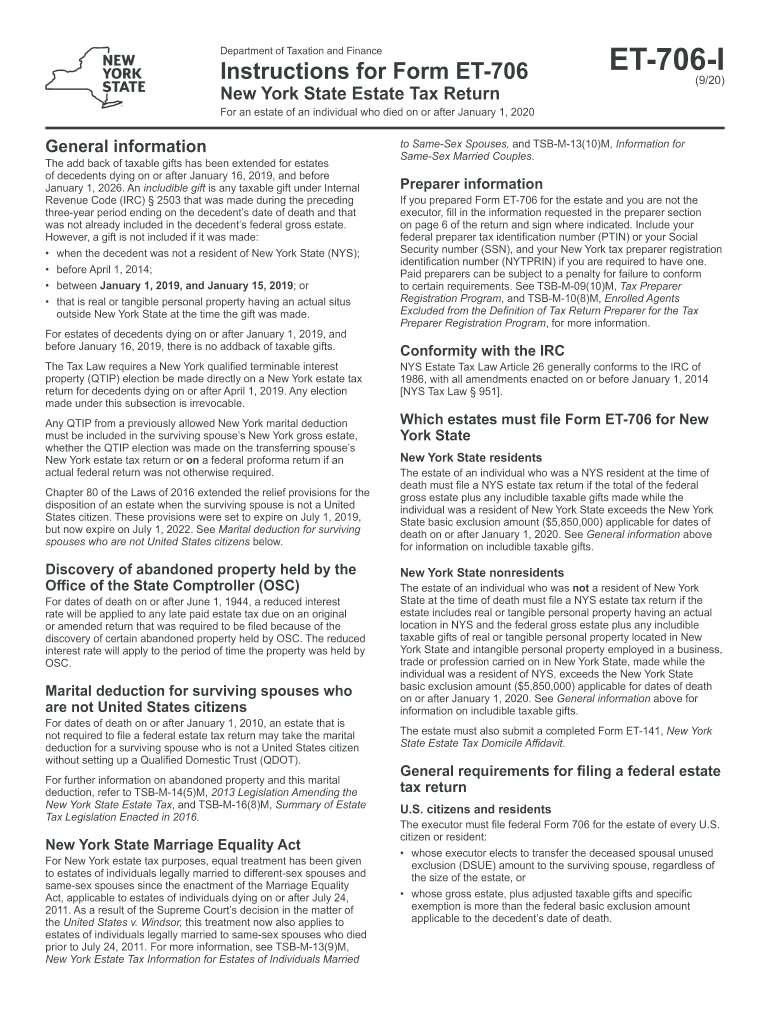

Form ET 706 is a crucial document for the estate tax process in New York. It is specifically designed for estates of individuals who passed away on or after January 1, 2019. This form helps determine the estate tax liability and ensures compliance with state regulations. The instructions for this form guide taxpayers through the necessary steps to accurately report the value of the estate, including all assets, liabilities, and deductions. Understanding the requirements of Form ET 706 is essential for executors and administrators managing the estate.

Steps to Complete Form ET 706

Completing Form ET 706 involves several key steps. First, gather all necessary documentation related to the deceased's assets and liabilities. This includes bank statements, property deeds, and any outstanding debts. Next, fill out the form by providing detailed information about the estate's value and any deductions that may apply. Ensure that all calculations are accurate, as errors can lead to penalties or delays. After completing the form, review it thoroughly before submission to confirm that all information is correct and complete.

Legal Use of Form ET 706

The legal use of Form ET 706 is essential for ensuring that the estate complies with New York State tax laws. This form serves as an official declaration of the estate's value and tax liability. To be legally binding, the form must be signed by the executor or administrator of the estate. Additionally, it is important to adhere to the filing deadlines set by the state to avoid penalties. Understanding the legal implications of submitting this form is critical for the responsible management of the estate.

Filing Deadlines for Form ET 706

Filing deadlines for Form ET 706 are crucial to avoid penalties. The form must be submitted within nine months of the date of death of the individual. If additional time is needed, an extension can be requested, but it is important to file the request before the original deadline. Missing the deadline can result in interest and penalties on the unpaid tax amount, making timely submission vital for estate administrators.

Required Documents for Form ET 706

When preparing to file Form ET 706, it is important to gather all required documents. This includes the death certificate of the deceased, a detailed inventory of all assets, and documentation of any debts or liabilities. Additionally, any prior tax returns related to the estate should be included. Having these documents organized and readily available will facilitate a smoother filing process and help ensure compliance with state regulations.

Examples of Using Form ET 706

Form ET 706 can be utilized in various scenarios. For instance, if an individual passes away leaving behind a house, bank accounts, and investments, the executor must report these assets using this form. Another example is when an estate has significant debts; the executor must accurately report these liabilities to determine the net estate value. Each scenario may have unique considerations, but the underlying requirement to file Form ET 706 remains consistent across different cases.

Quick guide on how to complete instructions for form et 706 new york state estate tax return for an estate of an individual who died on or after january 1

Complete Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, ;et seamlessly on any device

Digital document management has gained immense popularity among businesses and individuals alike. It serves as an ideal eco-conscious substitute for conventional printed and signed paperwork, enabling you to locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and eSign your documents quickly and without delays. Manage Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, ;et across any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The most effective method to modify and eSign Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, ;et effortlessly

- Find Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, ;et and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow has specifically designed for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal standing as a traditional wet ink signature.

- Review the information carefully and click on the Done button to preserve your changes.

- Choose how you wish to share your form: via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced files, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you prefer. Modify and eSign Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, ;et and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form et 706 new york state estate tax return for an estate of an individual who died on or after january 1

Create this form in 5 minutes!

How to create an eSignature for the instructions for form et 706 new york state estate tax return for an estate of an individual who died on or after january 1

How to create an electronic signature for a PDF document online

How to create an electronic signature for a PDF document in Google Chrome

How to generate an eSignature for signing PDFs in Gmail

The way to create an eSignature from your smart phone

How to create an eSignature for a PDF document on iOS

The way to create an eSignature for a PDF file on Android OS

People also ask

-

What is the purpose of airSlate SignNow in relation to 'get et 706 get'?

airSlate SignNow is designed to streamline the process of sending and eSigning documents, making it easier for users to get et 706 get. This solution empowers businesses by increasing efficiency and reducing the time spent on document management.

-

How can I get started with airSlate SignNow to 'get et 706 get'?

To get started with airSlate SignNow and achieve your goal to get et 706 get, simply visit our website and sign up for a free trial. You'll gain access to all our features, allowing you to send documents and collect eSignatures seamlessly.

-

What are the key features of airSlate SignNow that help me 'get et 706 get'?

Key features of airSlate SignNow include an intuitive interface, customizable templates, and robust eSigning capabilities that help you get et 706 get efficiently. Additionally, our platform ensures security and compliance, giving you peace of mind while managing important documents.

-

Is airSlate SignNow a cost-effective solution for 'get et 706 get'?

Yes, airSlate SignNow offers competitive pricing plans that are tailored to meet different business needs, making it a cost-effective solution to get et 706 get. With our tiered pricing, businesses can select a plan that fits their budget while still accessing all necessary features.

-

Can I integrate airSlate SignNow with other tools to 'get et 706 get'?

Absolutely! airSlate SignNow integrates seamlessly with a variety of business applications such as Google Drive, Salesforce, and Dropbox, allowing you to enhance your workflow and get et 706 get more effectively. These integrations help centralize your document management process.

-

What are the benefits of using airSlate SignNow to 'get et 706 get'?

Using airSlate SignNow to get et 706 get offers numerous benefits including increased productivity, faster turnaround times for document signing, and enhanced security features. Our platform simplifies document workflows, enabling teams to focus on core tasks rather than administrative duties.

-

Is training available for new users to 'get et 706 get' with airSlate SignNow?

Yes, airSlate SignNow provides various resources, including tutorials, webinars, and customer support, to help new users get et 706 get with ease. Our goal is to ensure you fully understand how to utilize our platform to its fullest potential.

Get more for Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, ;et

Find out other Instructions For Form ET 706 New York State Estate Tax Return For An Estate Of An Individual Who Died On Or After January 1, ;et

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA