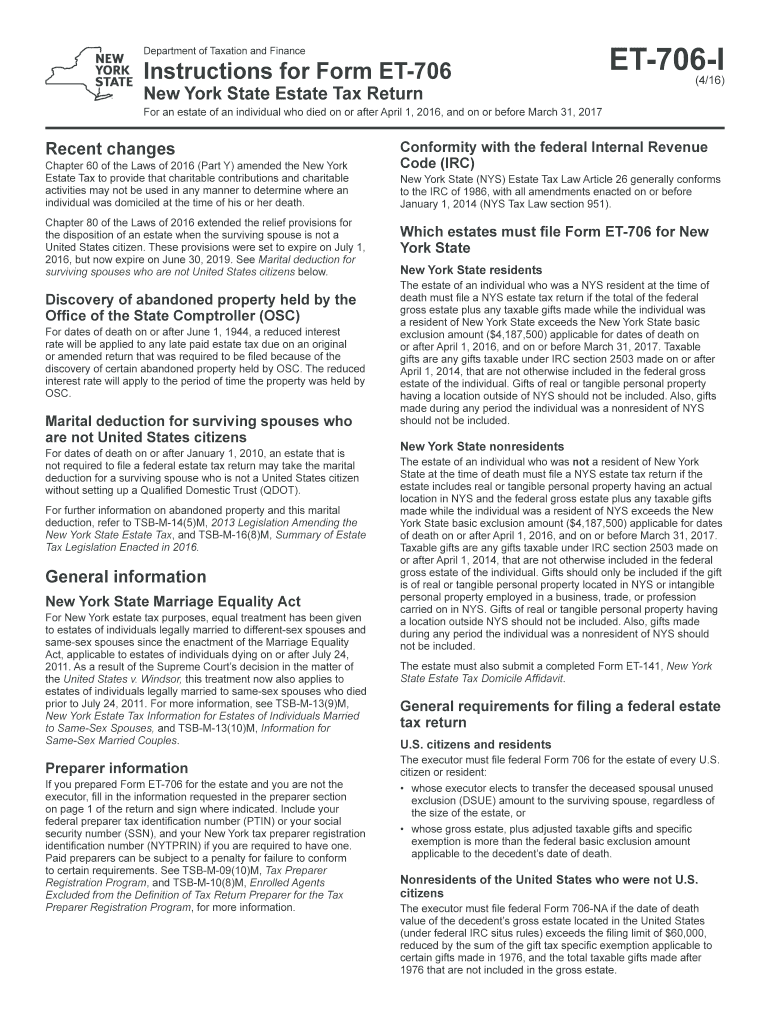

Et 706 Instructions Form 2016

What is the Et 706 Instructions Form

The Et 706 Instructions Form is a crucial document used in the estate tax process in the United States. It provides detailed guidelines for executors and administrators of estates regarding the filing of the federal estate tax return, known as Form 706. This form is essential for reporting the value of an estate and determining the tax liability owed to the Internal Revenue Service (IRS) upon the death of an individual. Understanding the Et 706 Instructions Form is vital for ensuring compliance with federal tax laws and accurately completing the estate tax return.

How to use the Et 706 Instructions Form

Using the Et 706 Instructions Form involves several steps that guide users through the estate tax filing process. First, it is important to gather all necessary documentation related to the deceased's assets, liabilities, and any previous tax returns. The instructions will then outline how to complete each section of Form 706, including the valuation of assets and deductions that may apply. Executors should carefully follow the guidelines provided in the instructions to ensure that all required information is accurately reported. Additionally, the form includes details on how to calculate the estate tax owed, which is crucial for compliance with IRS regulations.

Steps to complete the Et 706 Instructions Form

Completing the Et 706 Instructions Form requires a systematic approach to ensure accuracy and compliance. The following steps are essential:

- Gather all relevant documents, including asset valuations, debts, and previous tax returns.

- Review the Et 706 Instructions Form thoroughly to understand the requirements for each section.

- Begin filling out Form 706, starting with the decedent's information and estate details.

- Accurately report the value of all assets, including real estate, investments, and personal property.

- Calculate any applicable deductions, such as debts and funeral expenses, as outlined in the instructions.

- Review the completed form for accuracy and ensure all necessary signatures are included.

- Submit the form to the IRS by the specified deadline to avoid penalties.

Legal use of the Et 706 Instructions Form

The legal use of the Et 706 Instructions Form is governed by federal tax laws that mandate the reporting of estate values and tax liabilities. Executors are required to adhere to the guidelines set forth in the instructions to ensure that the filing is valid and compliant with IRS regulations. Failure to properly use the form can result in penalties, including fines and interest on unpaid taxes. It is essential for users to understand the legal implications of the information reported on the form and to seek professional advice if necessary to navigate complex estate tax issues.

Filing Deadlines / Important Dates

Filing deadlines for the Et 706 Instructions Form are critical to avoid penalties and interest. The IRS requires that Form 706 be filed within nine months of the decedent's date of death. If additional time is needed, executors may file for an extension, which can provide an additional six months to complete the form. However, it is important to note that any estate tax owed must still be paid by the original deadline to avoid incurring interest and penalties. Executors should keep track of these important dates to ensure timely compliance with federal tax obligations.

Required Documents

Completing the Et 706 Instructions Form requires several key documents to ensure accurate reporting of the estate's value and liabilities. Essential documents include:

- Death certificate of the decedent.

- Asset valuations, including appraisals for real estate and personal property.

- Records of debts and liabilities owed by the decedent.

- Previous tax returns, if applicable, to provide context for the estate's financial history.

- Documentation of any gifts made by the decedent prior to death that may affect the estate's tax liability.

Form Submission Methods (Online / Mail / In-Person)

The Et 706 Instructions Form can be submitted to the IRS through various methods, ensuring flexibility for executors. The primary submission methods include:

- Mail: The completed form can be printed and mailed to the appropriate IRS address, which is specified in the instructions.

- Online: While Form 706 itself cannot be filed electronically, executors can use IRS e-file options for other related forms and documents.

- In-Person: Executors may choose to deliver the form in person at their local IRS office, although this is less common.

Quick guide on how to complete et 706 instructions 2016 form

Complete Et 706 Instructions Form effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow gives you all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Et 706 Instructions Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Et 706 Instructions Form seamlessly

- Obtain Et 706 Instructions Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you prefer to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that require new document copies to be printed. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Et 706 Instructions Form and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct et 706 instructions 2016 form

Create this form in 5 minutes!

How to create an eSignature for the et 706 instructions 2016 form

How to make an eSignature for the Et 706 Instructions 2016 Form in the online mode

How to make an eSignature for your Et 706 Instructions 2016 Form in Google Chrome

How to make an electronic signature for signing the Et 706 Instructions 2016 Form in Gmail

How to make an eSignature for the Et 706 Instructions 2016 Form from your smartphone

How to create an electronic signature for the Et 706 Instructions 2016 Form on iOS

How to make an eSignature for the Et 706 Instructions 2016 Form on Android

People also ask

-

What is the Et 706 Instructions Form?

The Et 706 Instructions Form is a detailed guideline for filing the Estate Tax Return in the United States. This form provides step-by-step instructions for completing and submitting the return accurately to comply with IRS regulations.

-

How can airSlate SignNow assist with the Et 706 Instructions Form?

airSlate SignNow simplifies the process of handling the Et 706 Instructions Form by allowing you to easily eSign, send, and manage documents securely online. With its user-friendly interface, you can streamline your estate tax paperwork efficiently.

-

Is there a cost associated with using airSlate SignNow for the Et 706 Instructions Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes features that enhance the process of managing documents like the Et 706 Instructions Form, providing value for your investment.

-

What features does airSlate SignNow offer for the Et 706 Instructions Form?

airSlate SignNow provides features such as document editing, templates for the Et 706 Instructions Form, and secure cloud storage. Additionally, you can automate workflows and collaborate with multiple users in real-time.

-

Can I integrate airSlate SignNow with other software while working on the Et 706 Instructions Form?

Absolutely! airSlate SignNow offers seamless integrations with various tools and platforms. This allows you to work on the Et 706 Instructions Form alongside your preferred applications for increased productivity.

-

What are the benefits of using airSlate SignNow for the Et 706 Instructions Form?

Using airSlate SignNow for the Et 706 Instructions Form enhances efficiency and accuracy in completing estate tax documents. The platform eliminates paperwork hassles and speeds up the signing process, saving both time and resources.

-

How secure is airSlate SignNow when handling the Et 706 Instructions Form?

airSlate SignNow prioritizes security and compliance, ensuring that all documents, including the Et 706 Instructions Form, are protected. With advanced encryption and access controls, your information remains confidential and secure.

Get more for Et 706 Instructions Form

Find out other Et 706 Instructions Form

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile