Nys Inheritance Tax Waiver Form 2017

What is the NYS Inheritance Tax Waiver Form?

The NYS Inheritance Tax Waiver Form is a crucial document used in the process of settling an estate in New York State. This form serves as a request for a waiver of the inheritance tax, allowing beneficiaries to claim their inheritance without the burden of tax liabilities. It is essential for individuals who have inherited assets from a deceased relative and wish to ensure a smooth transfer of these assets. The form outlines the necessary information regarding the decedent's estate and the beneficiaries involved, making it a vital component of estate administration.

Steps to Complete the NYS Inheritance Tax Waiver Form

Completing the NYS Inheritance Tax Waiver Form requires careful attention to detail. Here are the key steps to follow:

- Gather necessary information about the decedent, including their full name, date of death, and social security number.

- Collect details about the beneficiaries, such as their names, addresses, and relationship to the decedent.

- Fill out the form accurately, ensuring all required fields are completed to avoid delays.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the appropriate tax authority as instructed.

How to Obtain the NYS Inheritance Tax Waiver Form

The NYS Inheritance Tax Waiver Form can be obtained through several channels. Individuals can visit the New York State Department of Taxation and Finance website, where the form is available for download. Alternatively, individuals may contact their local tax office or estate attorney for assistance in acquiring the form. It is advisable to ensure that you are using the most current version of the form to comply with any recent changes in tax regulations.

Legal Use of the NYS Inheritance Tax Waiver Form

The legal use of the NYS Inheritance Tax Waiver Form is essential for ensuring compliance with New York State tax laws. This form must be completed and submitted correctly to avoid potential legal issues. It serves as a formal request for the waiver of inheritance tax, which can significantly impact the distribution of the decedent's estate. Proper use of the form helps protect the rights of beneficiaries and ensures that the estate is settled in accordance with state regulations.

Required Documents for the NYS Inheritance Tax Waiver Form

When preparing to submit the NYS Inheritance Tax Waiver Form, certain documents are required to support the application. These may include:

- The death certificate of the decedent.

- Proof of relationship to the decedent, such as birth or marriage certificates.

- Documentation of the assets being inherited, including appraisals or account statements.

- Any previous tax returns or estate documents that may be relevant.

Filing Deadlines for the NYS Inheritance Tax Waiver Form

It is important to be aware of filing deadlines associated with the NYS Inheritance Tax Waiver Form. Generally, the form should be submitted within nine months following the decedent's date of death to avoid penalties. However, specific circumstances may affect these deadlines, so it is advisable to consult with a tax professional or legal advisor to ensure compliance with all relevant timelines.

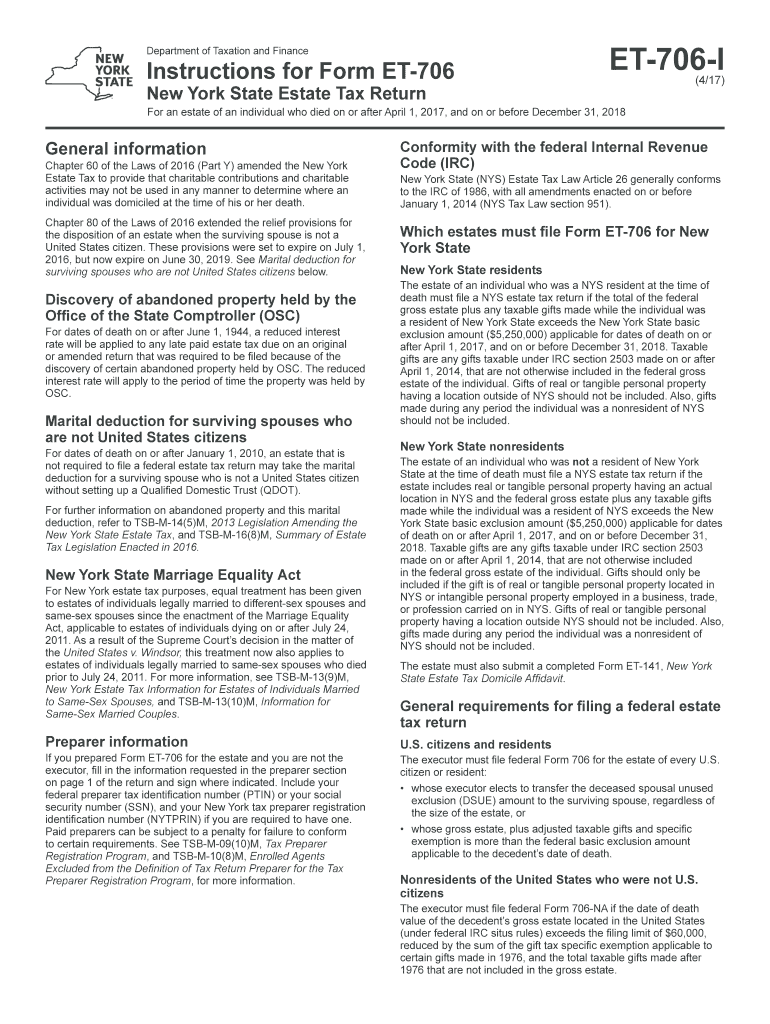

Quick guide on how to complete et 706 instructions 2017 2019 form

Effortlessly prepare Nys Inheritance Tax Waiver Form on any device

The adoption of online document management has surged among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly without any delays. Handle Nys Inheritance Tax Waiver Form on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Nys Inheritance Tax Waiver Form with ease

- Obtain Nys Inheritance Tax Waiver Form and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the information and then click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your PC.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Nys Inheritance Tax Waiver Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct et 706 instructions 2017 2019 form

Create this form in 5 minutes!

How to create an eSignature for the et 706 instructions 2017 2019 form

How to create an electronic signature for the Et 706 Instructions 2017 2019 Form in the online mode

How to make an electronic signature for the Et 706 Instructions 2017 2019 Form in Chrome

How to make an electronic signature for signing the Et 706 Instructions 2017 2019 Form in Gmail

How to generate an electronic signature for the Et 706 Instructions 2017 2019 Form from your smart phone

How to create an eSignature for the Et 706 Instructions 2017 2019 Form on iOS devices

How to create an eSignature for the Et 706 Instructions 2017 2019 Form on Android

People also ask

-

What is the NYS Inheritance Tax Waiver Form?

The NYS Inheritance Tax Waiver Form is a legal document required by the New York State government that certifies the payment of any inheritance taxes owed on an estate. This form helps facilitate the transfer of assets to heirs without unnecessary delays. Understanding the NYS Inheritance Tax Waiver Form is crucial for executors managing an estate.

-

How can airSlate SignNow help with the NYS Inheritance Tax Waiver Form?

airSlate SignNow streamlines the process of filling out and signing the NYS Inheritance Tax Waiver Form. With our user-friendly platform, you can easily create, edit, and electronically sign the form, ensuring that all necessary information is accurately captured. This saves time and reduces the hassle of dealing with paper documents.

-

Is there a cost associated with using airSlate SignNow for the NYS Inheritance Tax Waiver Form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including options for individuals needing to complete the NYS Inheritance Tax Waiver Form. The plans are designed to be cost-effective, providing access to all essential features for document signing and management.

-

What features does airSlate SignNow offer for the NYS Inheritance Tax Waiver Form?

airSlate SignNow provides a range of features for the NYS Inheritance Tax Waiver Form, including customizable templates, secure electronic signatures, and the ability to track document status in real-time. These features enhance the efficiency of completing and managing legal documents, ensuring compliance with New York state regulations.

-

Can I integrate airSlate SignNow with other tools for the NYS Inheritance Tax Waiver Form?

Absolutely! airSlate SignNow supports integration with various third-party applications, making it easy to manage the NYS Inheritance Tax Waiver Form alongside your existing workflows. This ensures that you can seamlessly incorporate document management into your business operations.

-

How does airSlate SignNow ensure the security of the NYS Inheritance Tax Waiver Form?

Security is a top priority at airSlate SignNow. We protect your NYS Inheritance Tax Waiver Form and other sensitive documents with advanced encryption protocols and secure storage solutions, ensuring that your data is safe from unauthorized access.

-

What are the benefits of using airSlate SignNow for the NYS Inheritance Tax Waiver Form?

Using airSlate SignNow for the NYS Inheritance Tax Waiver Form offers numerous benefits, including increased efficiency, reduced turnaround time, and enhanced accuracy in document management. Our platform simplifies the signing process, allowing you to focus on other important aspects of estate management.

Get more for Nys Inheritance Tax Waiver Form

- Form 3 report

- Pre salelot hold agreement meadows back office form

- Savable eta form 9089

- B26official form 26 united states bankruptcy court

- Permitplan review application city of aliso viejo form

- Application for national guard plate mvd express form

- Mvd 10048 form

- New mexico mvd request for refund 2003 form

Find out other Nys Inheritance Tax Waiver Form

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation