Form 13614 NR Nonresident Alien Intake and Interview Sheet Formupack 2022

Understanding the 2020 IRS 13614 Form

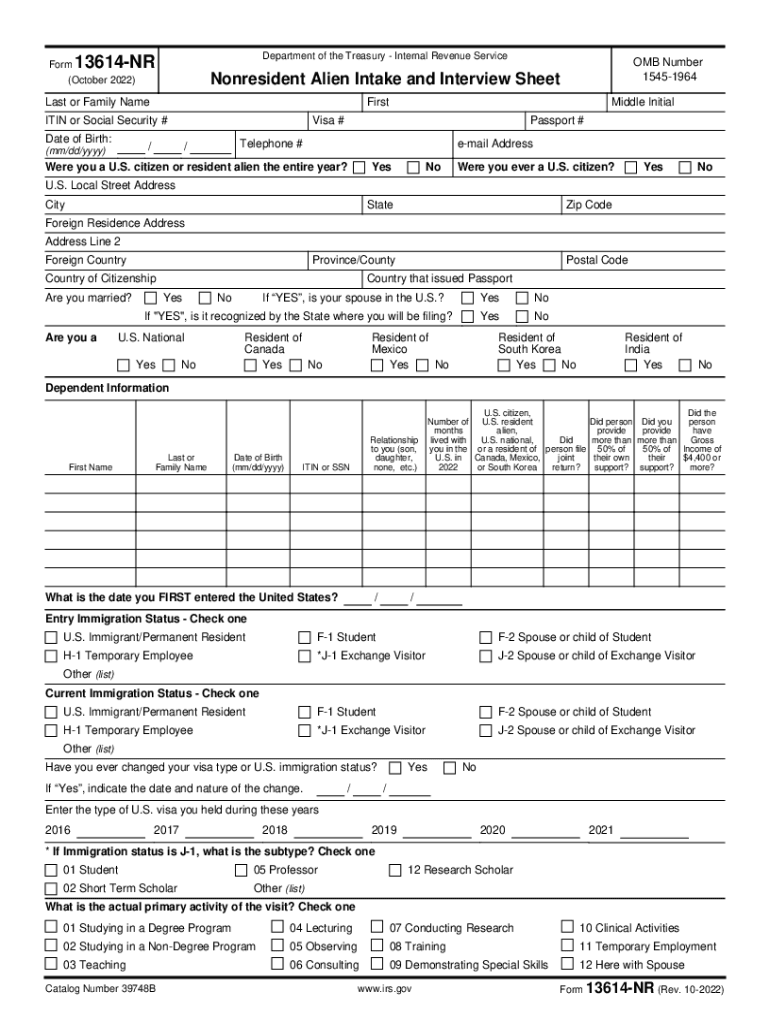

The 2020 IRS 13614 form, also known as the Nonresident Alien Intake and Interview Sheet, is specifically designed for nonresident aliens who need to file taxes in the United States. This form collects essential information regarding the taxpayer’s residency status, income sources, and any applicable deductions or credits. It serves as a foundational document that helps tax professionals understand the unique tax situations of nonresident aliens, ensuring compliance with IRS regulations.

Steps to Complete the 2020 IRS 13614 Form

Completing the 2020 IRS 13614 form involves several important steps to ensure accuracy and compliance. Begin by gathering all necessary documentation, including identification, income statements, and any previous tax returns. Next, fill out the form by providing personal information such as your name, address, and taxpayer identification number. Be sure to accurately report your income sources and any applicable deductions. Finally, review the completed form for any errors before submitting it to ensure that all information is correct.

Legal Use of the 2020 IRS 13614 Form

The 2020 IRS 13614 form is legally recognized as part of the tax filing process for nonresident aliens. Properly completing and submitting this form is crucial for compliance with U.S. tax laws. It helps determine tax liability and eligibility for various tax benefits. Using this form correctly ensures that nonresident aliens fulfill their legal obligations while also providing a clear picture of their tax situation to the IRS.

Required Documents for the 2020 IRS 13614 Form

When preparing to complete the 2020 IRS 13614 form, it is essential to gather all required documents. Key documents include:

- Passport or other identification documents

- Taxpayer Identification Number (TIN) or Social Security Number (SSN)

- Income statements such as W-2s or 1099s

- Any relevant tax treaties or agreements

- Proof of residency status

Having these documents ready will facilitate a smoother completion process and help ensure that all information reported is accurate.

Filing Methods for the 2020 IRS 13614 Form

The 2020 IRS 13614 form can be submitted through various methods, depending on the taxpayer's preference and circumstances. Options include:

- Online submission through authorized e-filing services

- Mailing a physical copy to the appropriate IRS address

- In-person submission at designated IRS offices or tax assistance centers

Choosing the right submission method can help ensure timely processing and compliance with IRS deadlines.

IRS Guidelines for the 2020 IRS 13614 Form

The IRS provides specific guidelines for completing the 2020 IRS 13614 form. These guidelines include instructions on how to report income, claim deductions, and understand tax obligations as a nonresident alien. Familiarizing yourself with these guidelines is crucial for accurate completion of the form and for maximizing potential tax benefits. The IRS website offers detailed resources and instructions that can assist in this process.

Quick guide on how to complete form 13614 nr nonresident alien intake and interview sheet formupack

Effortlessly Prepare Form 13614 NR Nonresident Alien Intake And Interview Sheet Formupack on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents swiftly without delays. Handle Form 13614 NR Nonresident Alien Intake And Interview Sheet Formupack on any device using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

Edit and eSign Form 13614 NR Nonresident Alien Intake And Interview Sheet Formupack with Ease

- Locate Form 13614 NR Nonresident Alien Intake And Interview Sheet Formupack and click on Get Form to begin.

- Utilize the available tools to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it directly to your computer.

Eliminate concerns about lost or mislaid documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from your chosen device. Edit and eSign Form 13614 NR Nonresident Alien Intake And Interview Sheet Formupack and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 13614 nr nonresident alien intake and interview sheet formupack

Create this form in 5 minutes!

People also ask

-

What is the 2020 IRS 13614 form and why is it important?

The 2020 IRS 13614 form is a crucial document used by taxpayers for filing their federal tax returns. It serves as a guide to help individuals gather necessary information and determine their eligibility for tax credits and deductions. Understanding the 2020 IRS 13614 form is essential for ensuring accurate tax filings and maximizing potential refunds.

-

How does airSlate SignNow support the 2020 IRS 13614 process?

AirSlate SignNow offers a streamlined platform for electronically signing and sending the 2020 IRS 13614 form securely. With its user-friendly interface, businesses can easily manage this crucial form, reducing the risk of errors and delays in filing. This efficient handling of the 2020 IRS 13614 can lead to faster processing times and enhanced compliance.

-

What are the pricing options for using airSlate SignNow for the 2020 IRS 13614?

AirSlate SignNow provides various pricing tiers to accommodate different business needs, starting with a free trial for new users. Once the trial expires, users can select from several subscription plans tailored to fit their requirements, ensuring effective management of the 2020 IRS 13614 without breaking the budget. The cost-effectiveness of airSlate SignNow makes it an attractive solution for businesses.

-

Can airSlate SignNow integrate with other financial software for managing the 2020 IRS 13614?

Yes, airSlate SignNow offers integrations with various financial and accounting software applications, allowing users to manage the 2020 IRS 13614 within their existing systems. This seamless integration ensures that all financial data is centralized, making tax preparation and submission more efficient. Users can enhance their workflow by connecting airSlate SignNow to the software they already use.

-

What are the benefits of using airSlate SignNow for eSigning the 2020 IRS 13614?

Using airSlate SignNow to eSign the 2020 IRS 13614 offers several advantages, including faster turnaround times and enhanced security. The platform provides a legally binding electronic signature process that is compliant with regulations, ensuring the legitimacy of your submitted forms. Additionally, users can track the signing process in real-time, adding a layer of transparency and accountability.

-

Is airSlate SignNow suitable for small businesses handling the 2020 IRS 13614?

Absolutely! AirSlate SignNow is designed to cater to businesses of all sizes, including small businesses that need to manage the 2020 IRS 13614 form effectively. Its cost-effective pricing and easy-to-use features make it an ideal choice for small business owners looking to simplify their tax filings without signNow investments in time or resources.

-

How can I ensure my 2020 IRS 13614 is filed accurately with airSlate SignNow?

To ensure your 2020 IRS 13614 is filed accurately using airSlate SignNow, you can utilize the platform's built-in templates and guidance features. These tools help you fill out your information correctly and reduce the chances of errors during the eSigning process. Additionally, you can collaborate with tax professionals through the platform for further assurance.

Get more for Form 13614 NR Nonresident Alien Intake And Interview Sheet Formupack

- Last will and testament package new mexico form

- Subcontractors package new mexico form

- Nm theft 497320343 form

- New mexico identity form

- New mexico theft form

- Identity theft by known imposter package new mexico form

- Organizing your personal assets package new mexico form

- Essential documents for the organized traveler package new mexico form

Find out other Form 13614 NR Nonresident Alien Intake And Interview Sheet Formupack

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later