IRS Form 13614 C "IntakeInterview & Quality Review Sheet" TemplateRoller 2022

What is IRS Form 13614-C?

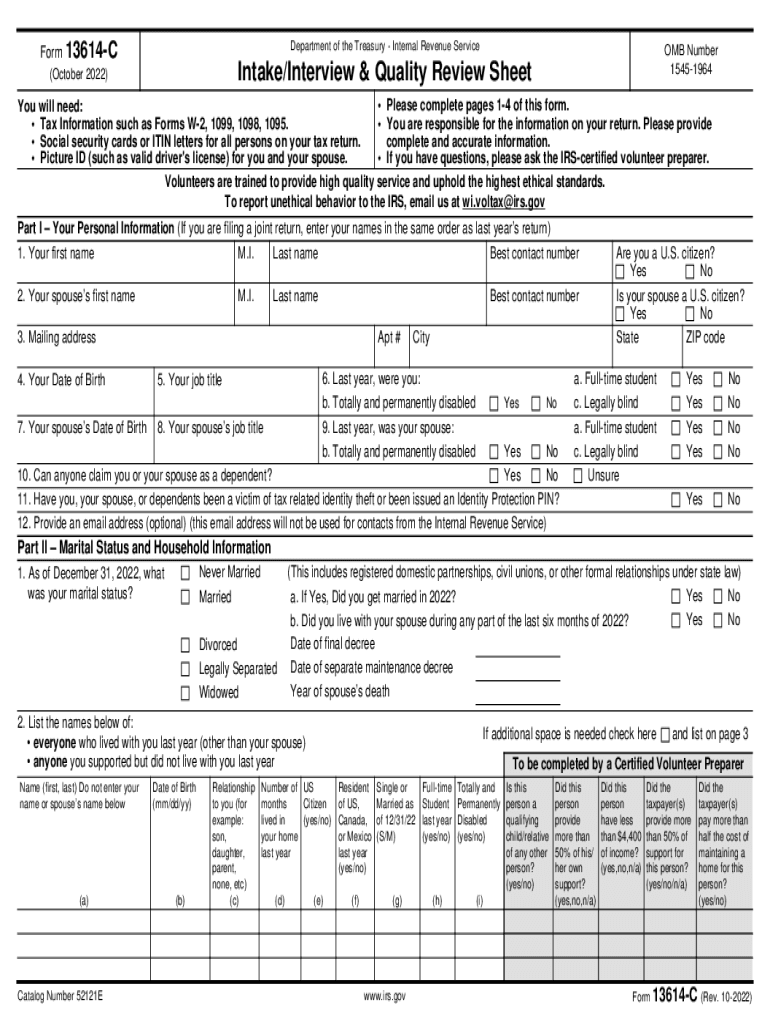

The IRS Form 13614-C, also known as the Intake Interview and Quality Review Sheet, is a crucial document used in the tax preparation process. This form serves as a comprehensive guide for tax preparers to gather essential information from clients. It helps ensure that all necessary data is collected for accurate tax filing. The form includes sections that cover personal information, income details, and deductions, making it an integral part of the tax preparation workflow.

Steps to Complete IRS Form 13614-C

Completing the IRS Form 13614-C involves several key steps:

- Begin by filling out your personal information, including name, address, and Social Security number.

- Provide details about your income sources, such as wages, self-employment income, and any other earnings.

- List any eligible deductions and credits that you may qualify for, which can help reduce your taxable income.

- Review the completed form for accuracy, ensuring that all information is correct and complete.

- Sign and date the form to validate your submission.

Legal Use of IRS Form 13614-C

The IRS Form 13614-C is legally recognized as part of the tax preparation process. When filled out correctly, it can serve as a binding agreement between the taxpayer and the tax preparer regarding the information provided. Compliance with IRS guidelines ensures that the form can be used effectively in the event of an audit or review. Utilizing a reliable electronic signature solution can further enhance the legal standing of the form.

Key Elements of IRS Form 13614-C

Understanding the key elements of IRS Form 13614-C is essential for effective tax preparation. The form consists of several critical sections:

- Personal Information: This section collects basic details about the taxpayer.

- Income Information: Here, taxpayers report all sources of income.

- Deductions and Credits: This section allows taxpayers to identify potential deductions and credits.

- Signature Section: A space for the taxpayer to sign and date the form, confirming the accuracy of the information provided.

How to Obtain IRS Form 13614-C

Obtaining the IRS Form 13614-C is straightforward. The form can be downloaded directly from the IRS website or obtained through tax preparation services. Many tax professionals also provide this form as part of their client intake process. Ensure that you are using the most current version of the form to comply with IRS regulations.

Digital vs. Paper Version of IRS Form 13614-C

Both digital and paper versions of IRS Form 13614-C are available, each with its own advantages. The digital version allows for easier data entry and storage, while the paper version may be preferred by those who are more comfortable with traditional methods. Regardless of the format, it is important to ensure that the form is completed accurately and securely to maintain compliance with IRS requirements.

Quick guide on how to complete irs form 13614 c ampquotintakeinterview ampamp quality review sheetampquot templateroller

Effortlessly Prepare IRS Form 13614 C "IntakeInterview & Quality Review Sheet" TemplateRoller on Any Device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal eco-conscious substitute for traditional printed and signed paperwork, enabling you to locate the right form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Handle IRS Form 13614 C "IntakeInterview & Quality Review Sheet" TemplateRoller on any device using airSlate SignNow apps for Android or iOS and simplify any document-related process today.

How to Modify and Electronically Sign IRS Form 13614 C "IntakeInterview & Quality Review Sheet" TemplateRoller with Ease

- Obtain IRS Form 13614 C "IntakeInterview & Quality Review Sheet" TemplateRoller and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize pertinent sections of your documents or conceal sensitive data using the tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for submitting your form, be it via email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign IRS Form 13614 C "IntakeInterview & Quality Review Sheet" TemplateRoller to ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 13614 c ampquotintakeinterview ampamp quality review sheetampquot templateroller

Create this form in 5 minutes!

People also ask

-

What is form 13614 c and how does it relate to airSlate SignNow?

Form 13614 c is a critical document used in tax preparation, helping taxpayers provide necessary information to prepare their tax returns. With airSlate SignNow, you can easily eSign this form and share it securely with your tax professionals, ensuring a smooth filing process.

-

How can airSlate SignNow help me with eSigning form 13614 c?

AirSlate SignNow offers a user-friendly platform for eSigning form 13614 c, allowing you to complete the document quickly and efficiently. Our solution ensures compliance and security, enabling you to sign this important form from anywhere, at any time.

-

Is there a cost associated with using airSlate SignNow for form 13614 c?

Yes, airSlate SignNow offers various pricing plans to fit your needs when eSigning form 13614 c. Our plans are designed to be cost-effective, ensuring that you can manage your document needs without breaking the bank.

-

What features does airSlate SignNow provide for handling form 13614 c?

AirSlate SignNow provides a range of features designed to streamline the eSigning process for form 13614 c, such as customizable templates, document tracking, and secure file storage. These features enhance efficiency and make document management easier for users.

-

Can I integrate airSlate SignNow with other applications for form 13614 c?

Absolutely! AirSlate SignNow supports seamless integrations with various applications like Google Drive, Dropbox, and accounting software, making it easy to manage form 13614 c alongside your other digital tools. This flexibility enhances your workflow and keeps everything organized.

-

What are the benefits of using airSlate SignNow for form 13614 c?

Using airSlate SignNow for form 13614 c offers numerous benefits, including time savings, enhanced security, and legal compliance. Our platform simplifies the eSigning process, reduces paperwork, and ensures your documents are safely stored.

-

Is there customer support available for airSlate SignNow users regarding form 13614 c?

Yes, airSlate SignNow offers robust customer support to assist users with any queries related to form 13614 c. Our dedicated support team is available via chat, email, and phone, ensuring you have the assistance you need to navigate the eSigning process smoothly.

Get more for IRS Form 13614 C "IntakeInterview & Quality Review Sheet" TemplateRoller

- New mexico form certificate

- New mexico a corporation form

- Sample transmittal letter for articles of incorporation new mexico form

- New resident guide new mexico form

- Satisfaction release of mortgage by mortgagee by corporate lender new mexico form

- Satisfaction release of mortgage by mortgagee individual lender or holder new mexico form

- Partial release of property from mortgage for corporation new mexico form

- Partial release of property from mortgage by individual holder new mexico form

Find out other IRS Form 13614 C "IntakeInterview & Quality Review Sheet" TemplateRoller

- Help Me With Electronic signature New Jersey Non-Profit PDF

- Can I Electronic signature New Jersey Non-Profit Document

- Help Me With Electronic signature Michigan Legal Presentation

- Help Me With Electronic signature North Dakota Non-Profit Document

- How To Electronic signature Minnesota Legal Document

- Can I Electronic signature Utah Non-Profit PPT

- How Do I Electronic signature Nebraska Legal Form

- Help Me With Electronic signature Nevada Legal Word

- How Do I Electronic signature Nevada Life Sciences PDF

- How Can I Electronic signature New York Life Sciences Word

- How Can I Electronic signature North Dakota Legal Word

- How To Electronic signature Ohio Legal PDF

- How To Electronic signature Ohio Legal Document

- How To Electronic signature Oklahoma Legal Document

- How To Electronic signature Oregon Legal Document

- Can I Electronic signature South Carolina Life Sciences PDF

- How Can I Electronic signature Rhode Island Legal Document

- Can I Electronic signature South Carolina Legal Presentation

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF