Tax Return Check 2023

Understanding the Tax Return Check

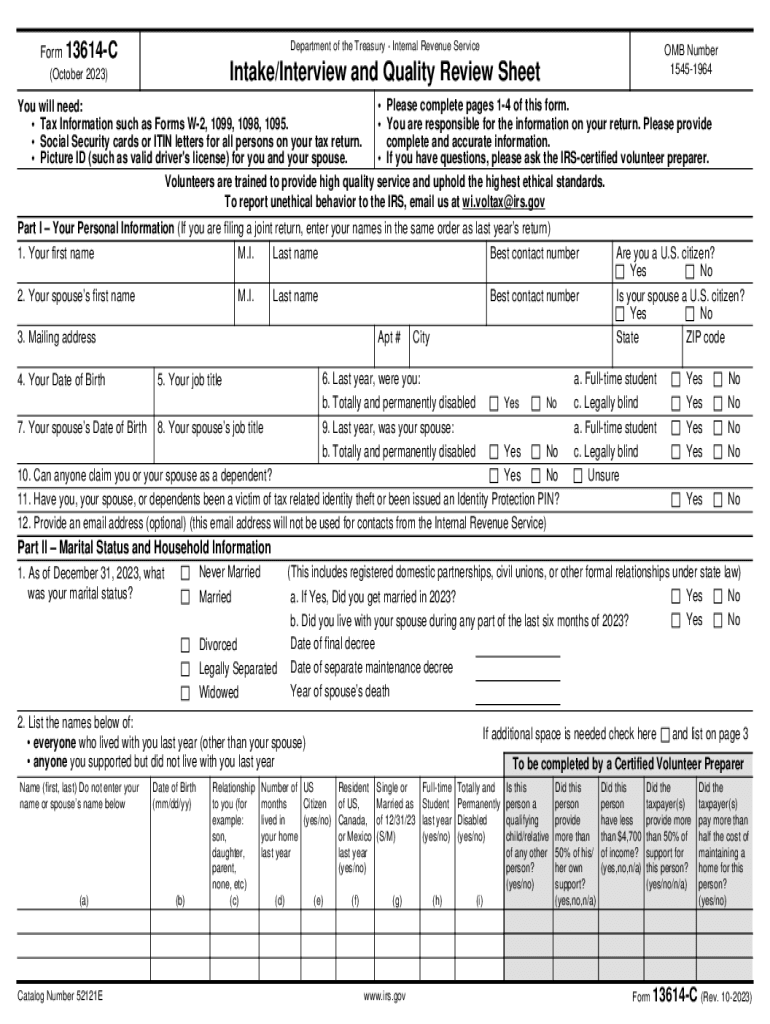

The Tax Return Check is a crucial document used by the IRS to verify the accuracy of the information reported on your tax return. This check serves as a tool for the IRS to ensure compliance with tax laws and to identify any discrepancies that may require further investigation. Receiving a Tax Return Check can indicate that the IRS is conducting a review of your submitted tax information, which may include your income, deductions, and credits claimed.

Steps to Complete the Tax Return Check

Completing the Tax Return Check involves a systematic approach to ensure all necessary information is accurately reported. Here are the steps to follow:

- Gather all relevant tax documents, including W-2s, 1099s, and any other income statements.

- Review the information on your tax return for accuracy, ensuring that all figures match your supporting documents.

- Respond to any IRS inquiries or requests for additional information promptly.

- Keep records of all correspondence with the IRS regarding your Tax Return Check.

Key Elements of the Tax Return Check

Understanding the key elements of the Tax Return Check can help you navigate the process more effectively. Important components include:

- Identification Information: This includes your Social Security number and the tax year in question.

- Income Verification: The IRS will compare the income reported on your return with third-party income reports.

- Deductions and Credits: A review of claimed deductions and credits to ensure they meet IRS guidelines.

IRS Guidelines for the Tax Return Check

The IRS provides specific guidelines regarding the Tax Return Check process. Familiarizing yourself with these guidelines can help you prepare for any potential inquiries. Key points include:

- The IRS may request additional documentation to support your claims.

- Timely responses to IRS requests can prevent delays in processing your tax return.

- Understanding the IRS's review process can help you anticipate potential outcomes.

Required Documents for the Tax Return Check

When preparing for a Tax Return Check, it is essential to have the following documents ready:

- Form 1040 or the applicable tax return form.

- All supporting income documents, such as W-2s and 1099s.

- Receipts and documentation for any deductions claimed.

- Any previous correspondence with the IRS regarding your tax return.

Filing Deadlines and Important Dates

Being aware of filing deadlines is vital for ensuring compliance with the IRS. Important dates include:

- The standard tax filing deadline is April 15 of each year.

- Extensions may be granted, but any taxes owed must still be paid by the original deadline to avoid penalties.

- Keep track of any specific deadlines related to your Tax Return Check process.

Quick guide on how to complete tax return check

Easily Prepare Tax Return Check on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed papers, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Tax Return Check on any platform using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Simplest Way to Edit and eSign Tax Return Check Effortlessly

- Find Tax Return Check and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and eSign Tax Return Check and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tax return check

Create this form in 5 minutes!

How to create an eSignature for the tax return check

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ltr 4464c 2023 in airSlate SignNow?

LTR 4464C 2023 refers to a specific document template in airSlate SignNow that enables users to efficiently manage electronic signatures and document workflows. This template streamlines the process by providing pre-defined fields for signatures, dates, and other crucial information, making it ideal for various business applications.

-

How does pricing work for ltr 4464c 2023 users?

The pricing for using ltr 4464c 2023 with airSlate SignNow is competitive and designed to suit businesses of all sizes. Plans include various features such as customizable workflows and integrations, with options for monthly or annual subscriptions, offering flexibility and cost savings.

-

What are the key features of ltr 4464c 2023?

LTR 4464C 2023 offers several key features, including customizable templates, real-time collaboration, and secure encryption to protect sensitive information. These features help businesses streamline their document management processes while ensuring compliance with legal standards.

-

What benefits does ltr 4464c 2023 provide for businesses?

Using ltr 4464c 2023 with airSlate SignNow enables businesses to save time and reduce administrative costs by automating the eSigning process. It enhances productivity, allows for quicker turnaround times on documents, and provides a reliable method for managing approvals and signatures digitally.

-

Can ltr 4464c 2023 be integrated with other platforms?

Yes, ltr 4464c 2023 can be seamlessly integrated with various platforms such as CRM systems, project management tools, and cloud storage solutions. This capability allows users to enhance their existing workflows and ensure all documents are readily accessible.

-

Is ltr 4464c 2023 compliant with legal standards?

Yes, ltr 4464c 2023 is compliant with various legal standards, ensuring that all electronic signatures made using airSlate SignNow are legally binding. This compliance gives businesses peace of mind when managing sensitive documents and meeting regulatory requirements.

-

How can businesses get started with ltr 4464c 2023?

Getting started with ltr 4464c 2023 is simple; businesses can sign up for airSlate SignNow and access this template right away. Users can also explore tutorials and support resources to maximize the efficiency of their document management processes.

Get more for Tax Return Check

- 60 day notice to vacate pdf form

- Hobsons bay parking permit form

- Et 4207 fillable form

- Crossword puzzle makerworld famous from the teachers form

- Referral form for child contact centres baccs org uk

- Signing powerpoint agreement template form

- Single case agreement template form

- Event sponsorship contract template form

Find out other Tax Return Check

- eSignature Alaska Debt Settlement Agreement Template Safe

- eSignature New Jersey Debt Settlement Agreement Template Simple

- eSignature New Mexico Debt Settlement Agreement Template Free

- eSignature Tennessee Debt Settlement Agreement Template Secure

- eSignature Wisconsin Debt Settlement Agreement Template Safe

- Can I eSignature Missouri Share Transfer Agreement Template

- eSignature Michigan Stock Purchase Agreement Template Computer

- eSignature California Indemnity Agreement Template Online

- eSignature New Mexico Promissory Note Template Now

- eSignature Pennsylvania Promissory Note Template Later

- Help Me With eSignature North Carolina Bookkeeping Contract

- eSignature Georgia Gym Membership Agreement Mobile

- eSignature Michigan Internship Contract Computer

- Can I eSignature Nebraska Student Data Sheet

- How To eSignature Michigan Application for University

- eSignature North Carolina Weekly Class Evaluation Now

- eSignature Colorado Medical Power of Attorney Template Fast

- Help Me With eSignature Florida Medical Power of Attorney Template

- eSignature Iowa Medical Power of Attorney Template Safe

- eSignature Nevada Medical Power of Attorney Template Secure