Form 13614 C Rev 11 IntakeInterview and Quality Review Sheet 2024-2026

What is the Form 13614 C Rev 11 Intake Interview And Quality Review Sheet

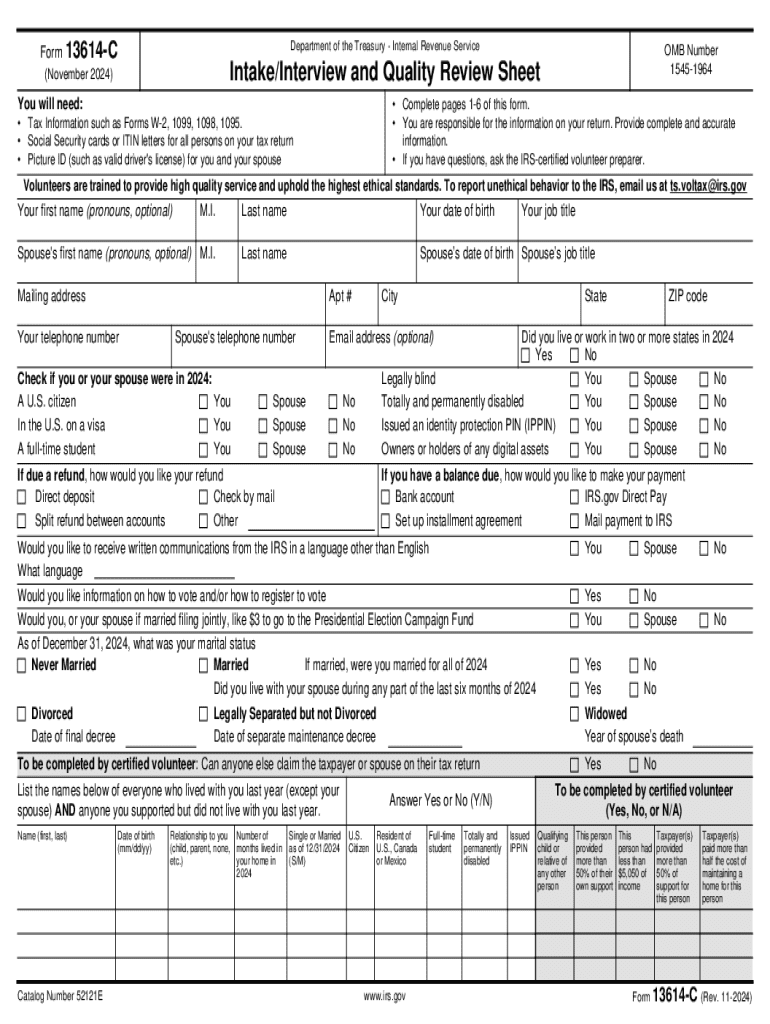

The AARP tax preparation form 13614 C, also known as the Intake Interview and Quality Review Sheet, is a critical document used during the tax preparation process. This form gathers essential information from taxpayers to ensure accurate and efficient filing. It is primarily utilized by volunteers in the Volunteer Income Tax Assistance (VITA) program and AARP Tax-Aide programs. The form helps tax preparers assess the taxpayer's situation, including income, deductions, and credits, thereby facilitating a thorough review of their tax return.

How to use the Form 13614 C Rev 11 Intake Interview And Quality Review Sheet

To effectively use the form 13614 C, taxpayers should first ensure they have all necessary documents at hand, such as W-2s, 1099s, and any other relevant financial statements. The form consists of various sections that require detailed information about the taxpayer’s income, expenses, and personal details. Taxpayers should fill out the form completely and accurately, as this information will guide the tax preparer in filing the return. After completing the form, it should be reviewed for any missing information or errors before submission.

Steps to complete the Form 13614 C Rev 11 Intake Interview And Quality Review Sheet

Completing the form 13614 C involves several key steps:

- Gather all relevant documents, including income statements and deduction records.

- Fill in personal information such as name, address, and Social Security number.

- Provide details about income sources, including wages, self-employment income, and interest.

- List any deductions or credits that may apply, such as education credits or medical expenses.

- Review the form for completeness and accuracy before submitting it to the tax preparer.

Key elements of the Form 13614 C Rev 11 Intake Interview And Quality Review Sheet

The form 13614 C includes several key elements that are essential for tax preparation:

- Taxpayer Information: Basic details including name, address, and Social Security number.

- Income Information: Sections to report various income types, such as wages and self-employment income.

- Deductions and Credits: Areas to list potential deductions and credits that can reduce tax liability.

- Signature Section: A place for the taxpayer to sign, confirming the information provided is accurate.

Required Documents

When completing the form 13614 C, taxpayers should prepare several required documents to ensure accurate information is reported. These documents typically include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of any self-employment income

- Documentation for deductions, such as receipts for medical expenses or education costs

- Any prior year tax returns, if available, for reference

IRS Guidelines

The IRS provides specific guidelines for using the form 13614 C, which include ensuring that all information is accurate and complete. Taxpayers should refer to the IRS instructions for the form to understand how to report income, deductions, and credits correctly. Following these guidelines helps prevent errors and ensures compliance with tax regulations, ultimately leading to a smoother filing process.

Handy tips for filling out Form 13614 C Rev 11 IntakeInterview And Quality Review Sheet online

Quick steps to complete and e-sign Form 13614 C Rev 11 IntakeInterview And Quality Review Sheet online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant platform for maximum simpleness. Use signNow to electronically sign and send out Form 13614 C Rev 11 IntakeInterview And Quality Review Sheet for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct form 13614 c rev 11 intakeinterview and quality review sheet

Create this form in 5 minutes!

How to create an eSignature for the form 13614 c rev 11 intakeinterview and quality review sheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the AARP tax preparation form 13614 C?

The AARP tax preparation form 13614 C is a crucial document used by taxpayers to provide necessary information for tax preparation. It helps tax preparers understand your financial situation and ensures accurate filing. Completing this form is essential for a smooth tax preparation process.

-

How can airSlate SignNow assist with the AARP tax preparation form 13614 C?

airSlate SignNow simplifies the process of completing and signing the AARP tax preparation form 13614 C. Our platform allows you to easily fill out the form electronically, ensuring that all necessary information is captured accurately. This streamlines your tax preparation experience.

-

Is there a cost associated with using airSlate SignNow for the AARP tax preparation form 13614 C?

Yes, airSlate SignNow offers various pricing plans to accommodate different needs. While there may be a fee for using our services, the cost is often outweighed by the convenience and efficiency gained in preparing the AARP tax preparation form 13614 C. We provide a cost-effective solution for document management.

-

What features does airSlate SignNow offer for the AARP tax preparation form 13614 C?

airSlate SignNow provides features such as electronic signatures, document templates, and secure storage for the AARP tax preparation form 13614 C. These features enhance the user experience by making it easy to manage and sign documents online. Our platform is designed to be user-friendly and efficient.

-

Can I integrate airSlate SignNow with other applications for tax preparation?

Absolutely! airSlate SignNow offers integrations with various applications that can enhance your tax preparation process, including accounting software and document management systems. This allows for seamless handling of the AARP tax preparation form 13614 C and other related documents.

-

What are the benefits of using airSlate SignNow for tax preparation?

Using airSlate SignNow for tax preparation, including the AARP tax preparation form 13614 C, provides numerous benefits such as increased efficiency, reduced paperwork, and enhanced security. Our platform ensures that your documents are handled securely and can be accessed anytime, anywhere. This flexibility is ideal for busy individuals.

-

Is airSlate SignNow secure for handling sensitive tax documents?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive tax documents like the AARP tax preparation form 13614 C. We utilize advanced encryption and security protocols to protect your information. You can trust us to keep your data secure during the tax preparation process.

Get more for Form 13614 C Rev 11 IntakeInterview And Quality Review Sheet

- Amcheck form aedda

- Mobile food vendor license renewal nyc online form

- Uscis congress privacy release form sample

- Maturity discharge voucher form

- Montana highway patrol vehicle crash report doj mt form

- Construction receipt template form

- Thermismooth venus ze consent form

- 19 printable hipaa medical records release form templates

Find out other Form 13614 C Rev 11 IntakeInterview And Quality Review Sheet

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document