Form 13614 C 2019

What is the Form 13614 C

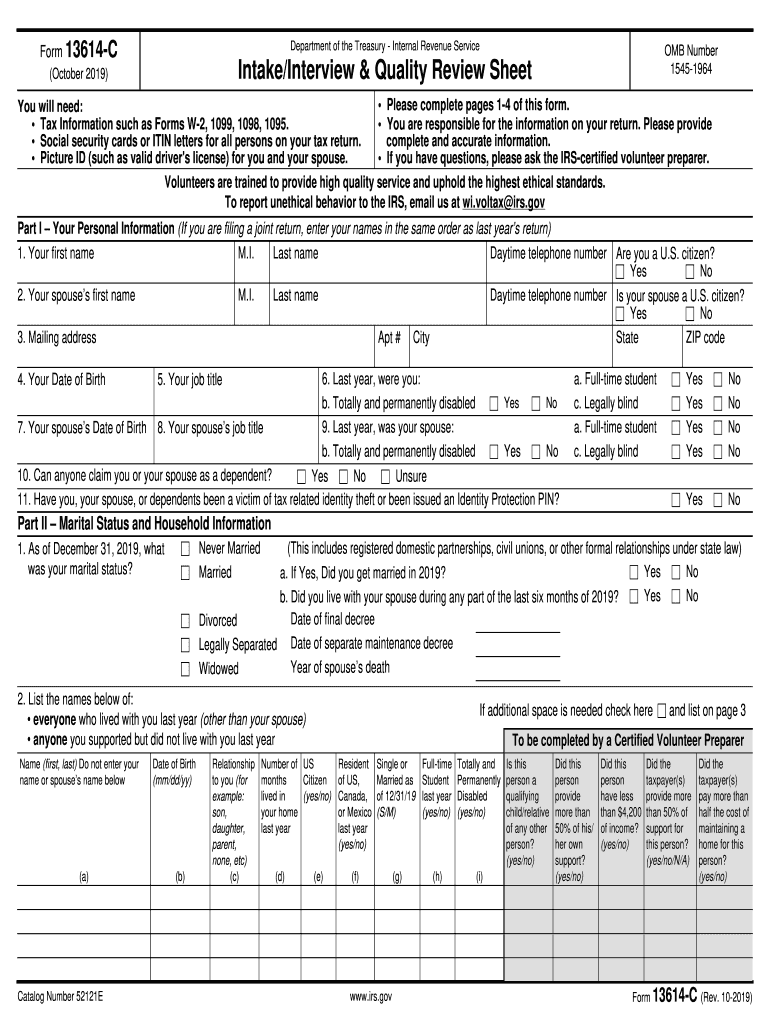

The Form 13614 C, also known as the 2019 sheet tax, is a crucial document used by taxpayers in the United States to provide essential information for tax preparation. This form is primarily utilized by the IRS to collect data from individuals seeking assistance with their tax returns. It includes details such as personal information, income sources, and deductions, which help tax preparers accurately assess a taxpayer's financial situation.

How to use the Form 13614 C

Using the Form 13614 C involves several steps that ensure accurate completion and submission. Taxpayers should begin by gathering all necessary personal and financial documents, such as W-2s, 1099s, and any other relevant income statements. Once the required information is collected, individuals can fill out the form, ensuring that all sections are completed accurately. After filling out the form, it can be submitted to a tax preparer or directly to the IRS, depending on the chosen filing method.

Steps to complete the Form 13614 C

Completing the Form 13614 C involves a systematic approach:

- Step 1: Gather all relevant financial documents, including income statements and previous tax returns.

- Step 2: Fill in personal information, such as name, address, and Social Security number.

- Step 3: Provide details about your income, including wages, self-employment income, and any other sources.

- Step 4: List potential deductions and credits that may apply to your situation.

- Step 5: Review the completed form for accuracy before submission.

Legal use of the Form 13614 C

The Form 13614 C is legally recognized by the IRS as a valid document for tax preparation. It is essential that taxpayers complete the form truthfully and accurately, as any discrepancies can lead to penalties or audits. The form serves as a foundational tool for ensuring compliance with federal tax laws and regulations, making it vital for anyone filing taxes in the United States.

Filing Deadlines / Important Dates

Filing deadlines for the Form 13614 C typically align with the general tax filing deadlines set by the IRS. For the 2019 tax year, the deadline to file individual tax returns was April 15, 2020. It is important for taxpayers to be aware of these deadlines to avoid late fees and penalties. Additionally, extensions may be available, but they must be requested in advance.

Required Documents

To accurately complete the Form 13614 C, taxpayers need to gather several key documents:

- W-2 forms from employers

- 1099 forms for freelance or contract work

- Records of any other income sources

- Receipts for deductible expenses

- Previous year’s tax return for reference

Form Submission Methods (Online / Mail / In-Person)

The Form 13614 C can be submitted through various methods, depending on the taxpayer's preference. It can be filed online using approved tax software, mailed to the IRS, or submitted in person at designated IRS offices or tax preparation sites. Each method has its own advantages, such as convenience for online filing or personal assistance when submitting in person.

Quick guide on how to complete fillable online irs form 13614 c department of the

Effortlessly Prepare Form 13614 C on Any Device

Digital document management has gained signNow traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly without any delays. Manage Form 13614 C on any device with the airSlate SignNow apps available for Android or iOS and enhance any document-related process today.

How to Modify and eSign Form 13614 C With Ease

- Obtain Form 13614 C and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive details with tools specifically offered by airSlate SignNow for this task.

- Create your eSignature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method to send your form, such as email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from your selected device. Edit and eSign Form 13614 C to ensure outstanding communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online irs form 13614 c department of the

Create this form in 5 minutes!

How to create an eSignature for the fillable online irs form 13614 c department of the

How to create an eSignature for your Fillable Online Irs Form 13614 C Department Of The online

How to generate an electronic signature for your Fillable Online Irs Form 13614 C Department Of The in Chrome

How to create an electronic signature for putting it on the Fillable Online Irs Form 13614 C Department Of The in Gmail

How to generate an electronic signature for the Fillable Online Irs Form 13614 C Department Of The from your mobile device

How to create an eSignature for the Fillable Online Irs Form 13614 C Department Of The on iOS devices

How to generate an electronic signature for the Fillable Online Irs Form 13614 C Department Of The on Android

People also ask

-

What is the 2019 sheet tax and how can airSlate SignNow help?

The 2019 sheet tax refers to the specific tax forms and guidelines related to the tax year 2019. airSlate SignNow allows users to easily send and eSign these important documents, ensuring they are completed accurately and on time.

-

Is airSlate SignNow suitable for managing 2019 sheet tax documents?

Yes, airSlate SignNow is ideal for managing 2019 sheet tax documents. Our platform facilitates the secure sending and signing of tax forms, helping you maintain compliance while saving time during tax season.

-

Are there any features in airSlate SignNow specifically for tax paperwork?

Absolutely! airSlate SignNow offers features such as document templates, secure storage, and collaboration tools to streamline the management of 2019 sheet tax documents, making the process smooth and efficient.

-

How does pricing for airSlate SignNow compare for businesses needing to handle 2019 sheet tax documents?

Our pricing for airSlate SignNow is competitive and offers various plans to suit your business needs, especially if you're focused on managing 2019 sheet tax documents. We provide a cost-effective solution without compromising on features or service quality.

-

Can airSlate SignNow integrate with other accounting software for 2019 sheet tax preparation?

Yes, airSlate SignNow integrates seamlessly with several accounting and tax preparation software. This ensures that you can handle your 2019 sheet tax documents alongside your other financial processes efficiently.

-

What benefits does airSlate SignNow provide for eSigning the 2019 sheet tax forms?

Using airSlate SignNow to eSign your 2019 sheet tax forms offers numerous benefits, including speed, convenience, and enhanced security. You can complete your tax paperwork from anywhere, ensuring timely submissions.

-

How does airSlate SignNow ensure the security of my 2019 sheet tax documents?

airSlate SignNow prioritizes security, employing advanced encryption and strict compliance measures to protect your 2019 sheet tax documents. You can trust that your sensitive information is safe while using our platform.

Get more for Form 13614 C

- Dass 21 form

- Pre exercise screening forms

- Rental application form stockdale amp leggo

- Mod r form

- Australia 147 2011 2019 form

- Form 36a list of documents magistrates court of western australia magistratescourt wa gov

- Personal professional folio cover page personal professional folio cover page education qld gov form

- I agree to have eyelash extensions applied to my natural eyelashes andor removed form

Find out other Form 13614 C

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document