13614 C Form 2016

What is the 13614 C Form

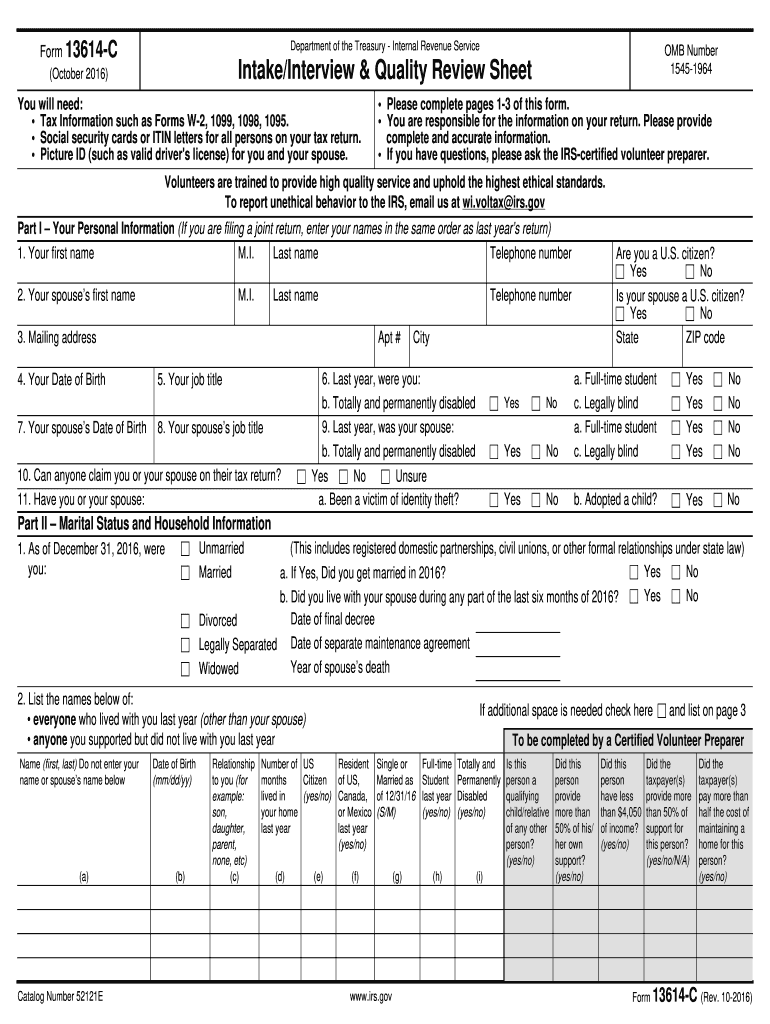

The 13614 C Form is a crucial document used primarily for tax purposes in the United States. It serves as a tool for taxpayers to provide essential information to the Internal Revenue Service (IRS) when filing their tax returns. This form is particularly significant for individuals who require assistance with their tax filings, as it helps tax preparers gather necessary data to ensure accurate and compliant submissions. Understanding the purpose and function of the 13614 C Form is vital for anyone looking to navigate the tax filing process effectively.

How to use the 13614 C Form

Using the 13614 C Form involves several steps aimed at ensuring that all relevant information is accurately captured. First, taxpayers should gather their financial documents, including W-2s, 1099s, and any other income statements. Next, the form should be completed by providing personal information, income details, and deductions. It is important to review the form for accuracy before submitting it to ensure compliance with IRS regulations. Utilizing digital tools, such as eSignature solutions, can streamline this process, making it easier to fill out and sign the form electronically.

Steps to complete the 13614 C Form

Completing the 13614 C Form involves a systematic approach to ensure all necessary information is included. Here are the steps to follow:

- Gather all required financial documents, such as income statements and previous tax returns.

- Fill in personal information, including your name, Social Security number, and address.

- Provide detailed income information, including wages, self-employment income, and any other earnings.

- List potential deductions and credits that apply to your situation.

- Review the completed form for any errors or omissions.

- Sign and date the form, ensuring it is ready for submission.

Legal use of the 13614 C Form

The legal use of the 13614 C Form is governed by IRS regulations, which outline the requirements for tax filings. When used correctly, this form can serve as a legally binding document that supports the information provided in a taxpayer's return. It is essential to ensure that all entries are truthful and accurate, as any discrepancies can lead to penalties or audits. Utilizing a secure platform for electronic submission can further enhance the legal validity of the form, ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the 13614 C Form align with the general tax filing schedule set by the IRS. Typically, individual tax returns are due on April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. Taxpayers should also be aware of any extensions that may apply, allowing additional time to file without penalties. Staying informed about these important dates is crucial for timely and compliant tax submissions.

Required Documents

To effectively complete the 13614 C Form, several documents are required. These typically include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of any other income, such as rental income or dividends

- Documentation for deductions, such as mortgage interest statements or medical expenses

- Previous year’s tax return for reference

Having these documents ready will facilitate a smoother completion process and ensure accuracy in reporting.

Quick guide on how to complete 2016 13614 c form

Accomplish 13614 C Form seamlessly on any gadget

Web-based document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Manage 13614 C Form on any system with airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and electronically sign 13614 C Form with ease

- Obtain 13614 C Form and click on Get Form to begin.

- Utilize the tools provided to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you want to share your form, via email, SMS, or invitation link, or download it to your computer.

Leave behind the worries of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and electronically sign 13614 C Form and maintain clear communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2016 13614 c form

Create this form in 5 minutes!

How to create an eSignature for the 2016 13614 c form

How to create an electronic signature for your 2016 13614 C Form in the online mode

How to create an electronic signature for your 2016 13614 C Form in Chrome

How to generate an electronic signature for putting it on the 2016 13614 C Form in Gmail

How to create an electronic signature for the 2016 13614 C Form straight from your smartphone

How to generate an electronic signature for the 2016 13614 C Form on iOS

How to generate an eSignature for the 2016 13614 C Form on Android OS

People also ask

-

What is a 13614 C Form and why is it important?

The 13614 C Form is a crucial document used in the tax preparation process, specifically for capturing taxpayer information. With airSlate SignNow, you can easily send and eSign the 13614 C Form, ensuring that all necessary data is collected accurately and securely. This form helps streamline the tax filing process, making it essential for both individuals and businesses.

-

How can airSlate SignNow help me with the 13614 C Form?

airSlate SignNow simplifies the process of handling the 13614 C Form by allowing users to electronically sign and send documents. Our platform ensures that your forms are legally binding and securely stored, reducing the hassle of physical paperwork. This enhances efficiency and provides a seamless experience for tax preparation.

-

Is there a cost associated with using airSlate SignNow for the 13614 C Form?

Yes, airSlate SignNow offers a cost-effective solution for managing the 13614 C Form and other documents. We provide various pricing plans to cater to different business needs, ensuring that you can find an option that fits your budget while still enjoying robust eSigning features. Visit our pricing page to learn more about the plans available.

-

What features does airSlate SignNow offer for the 13614 C Form?

airSlate SignNow includes a range of features designed to enhance your experience with the 13614 C Form, such as customizable templates, audit trails, and reminders for signing. These tools help ensure that your documents are completed accurately and on time. Additionally, our user-friendly interface makes it easy to manage your forms.

-

Can I integrate airSlate SignNow with other applications for the 13614 C Form?

Absolutely! airSlate SignNow offers seamless integrations with various applications, making it easy to incorporate the 13614 C Form into your existing workflows. Whether you use CRM systems, cloud storage, or other business tools, our platform allows you to enhance productivity and streamline document management.

-

Is it safe to eSign the 13614 C Form with airSlate SignNow?

Yes, using airSlate SignNow to eSign the 13614 C Form is completely safe. We prioritize the security of your documents with advanced encryption and compliance with industry standards. This ensures that your sensitive information is protected throughout the signing process.

-

What benefits does airSlate SignNow provide for managing the 13614 C Form?

Using airSlate SignNow to manage the 13614 C Form offers numerous benefits, including faster turnaround times and reduced paper clutter. The platform allows for quick eSigning, which accelerates the entire tax preparation process, making it more efficient for both you and your clients. Plus, you'll have access to tracking features to monitor the status of your forms.

Get more for 13614 C Form

- Basketball application form

- Aaumembershipapplication form

- Chula vista wisconsin dells vacation classic form

- New patient forms

- Goodwill application print out form

- App gp99 nwf metropolitan life insurance company one form

- Contractor pre qualification application form

- Blank backflow test forms 250764808

Find out other 13614 C Form

- Electronic signature New Jersey Lease Renewal Free

- Electronic signature Texas Lease Renewal Fast

- How Can I Electronic signature Colorado Notice of Intent to Vacate

- eSignature Delaware Employee Compliance Survey Later

- eSignature Kansas Employee Compliance Survey Myself

- Can I Electronic signature Colorado Bill of Sale Immovable Property

- How Can I Electronic signature West Virginia Vacation Rental Short Term Lease Agreement

- How Do I Electronic signature New Hampshire Bill of Sale Immovable Property

- Electronic signature North Dakota Bill of Sale Immovable Property Myself

- Can I Electronic signature Oregon Bill of Sale Immovable Property

- How To Electronic signature West Virginia Bill of Sale Immovable Property

- Electronic signature Delaware Equipment Sales Agreement Fast

- Help Me With Electronic signature Louisiana Assignment of Mortgage

- Can I Electronic signature Minnesota Assignment of Mortgage

- Electronic signature West Virginia Sales Receipt Template Free

- Electronic signature Colorado Sales Invoice Template Computer

- Electronic signature New Hampshire Sales Invoice Template Computer

- Electronic signature Tennessee Introduction Letter Free

- How To eSignature Michigan Disclosure Notice

- How To Electronic signature Ohio Product Defect Notice