Schedule R Form 941 Allocation Schedule for Aggregate Form 941 Filers 2022

What is the Schedule R Form 941 Allocation Schedule for Aggregate Form 941 Filers

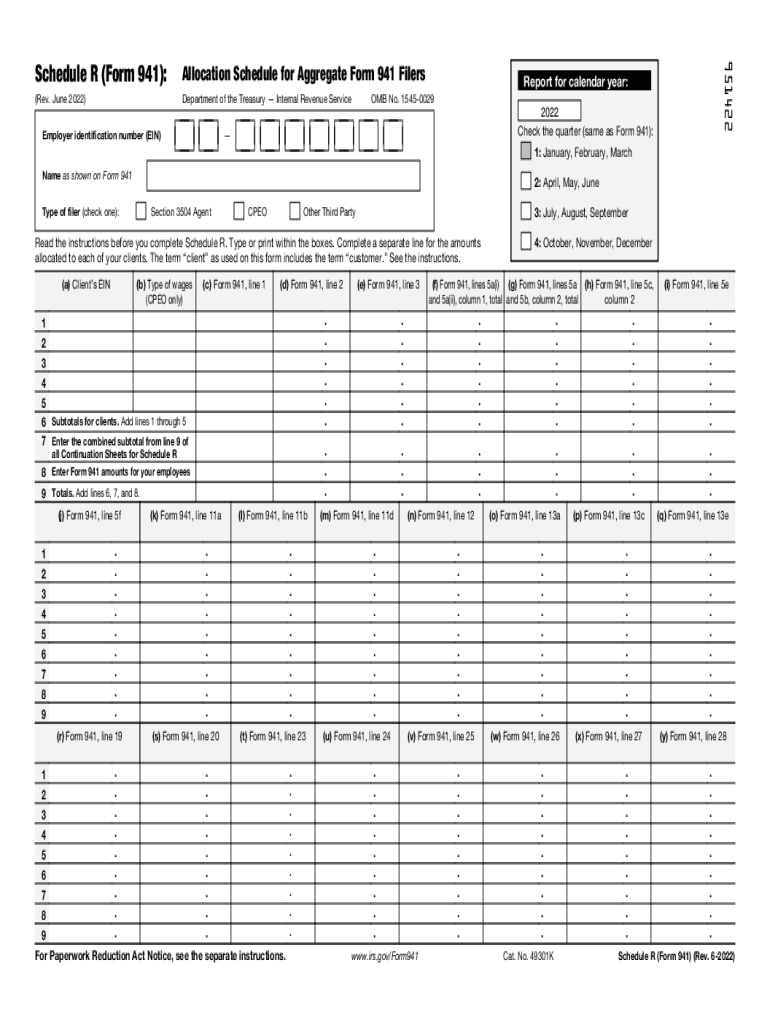

The Schedule R Form 941 is a supplementary form used by employers who file an aggregate Form 941. This form is specifically designed to allocate the employment tax credits among multiple entities within a controlled group. It provides a structured way for businesses to report their share of employment taxes accurately, ensuring compliance with IRS regulations. The Schedule R is essential for those who are part of a group of related employers, as it helps clarify how much each entity owes in payroll taxes.

Steps to Complete the Schedule R Form 941 Allocation Schedule for Aggregate Form 941 Filers

Completing the Schedule R Form 941 involves several key steps:

- Gather necessary information from all entities in the controlled group.

- Determine the total amount of employment taxes owed by the entire group.

- Allocate the employment tax credits among the entities based on their respective shares.

- Fill out the Schedule R Form 941, ensuring accuracy in the reported amounts.

- Attach the completed Schedule R to the aggregate Form 941 before submission.

Following these steps helps ensure that each entity within the group is compliant with IRS requirements and accurately reports its share of taxes.

IRS Guidelines for the Schedule R Form 941 Allocation Schedule for Aggregate Form 941 Filers

The IRS provides specific guidelines for completing the Schedule R Form 941. These guidelines emphasize the importance of accurate reporting and proper allocation of employment taxes. Employers must ensure that all relevant information is included and that the form is completed in accordance with IRS instructions. Failure to adhere to these guidelines may result in penalties or delays in processing. It is advisable for employers to consult the IRS website or a tax professional for the most current guidelines.

Filing Deadlines for the Schedule R Form 941 Allocation Schedule for Aggregate Form 941 Filers

Filing deadlines for the Schedule R Form 941 align with the deadlines for the aggregate Form 941. Generally, these forms are due quarterly, with specific deadlines falling on the last day of the month following the end of each quarter. For example, the deadline for the first quarter (January to March) is April 30. It is crucial for employers to be aware of these deadlines to avoid late filing penalties and ensure timely compliance with tax obligations.

Legal Use of the Schedule R Form 941 Allocation Schedule for Aggregate Form 941 Filers

The legal use of the Schedule R Form 941 is grounded in IRS regulations that govern payroll tax reporting for employers. This form must be used by qualifying employers to report their employment taxes accurately. Proper use of the Schedule R ensures that employers meet their legal obligations and helps prevent potential audits or penalties from the IRS. Understanding the legal implications of this form is vital for maintaining compliance and protecting the interests of the business.

Examples of Using the Schedule R Form 941 Allocation Schedule for Aggregate Form 941 Filers

Employers in various scenarios may need to use the Schedule R Form 941. For instance, a corporation with multiple subsidiaries may file an aggregate Form 941 and use Schedule R to allocate employment taxes among its subsidiaries. Another example includes partnerships that have multiple partners, where each partner must report their share of employment taxes accurately. These examples illustrate the practical application of the Schedule R in ensuring compliance and accurate tax reporting.

Quick guide on how to complete schedule r form 941 allocation schedule for aggregate form 941 filers

Manage Schedule R Form 941 Allocation Schedule For Aggregate Form 941 Filers easily on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Schedule R Form 941 Allocation Schedule For Aggregate Form 941 Filers on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to modify and eSign Schedule R Form 941 Allocation Schedule For Aggregate Form 941 Filers seamlessly

- Obtain Schedule R Form 941 Allocation Schedule For Aggregate Form 941 Filers and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize important parts of the documents or redact confidential information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and eSign Schedule R Form 941 Allocation Schedule For Aggregate Form 941 Filers and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule r form 941 allocation schedule for aggregate form 941 filers

Create this form in 5 minutes!

People also ask

-

What is the 2018 Schedule 941 form?

The 2018 Schedule 941 form is a tax document that employers use to report quarterly payroll taxes withheld from employees, including Social Security, Medicare, and income taxes. Filling out this form correctly is essential for compliance with IRS regulations.

-

How can airSlate SignNow help me with the 2018 Schedule 941 form?

airSlate SignNow allows you to easily eSign and manage your 2018 Schedule 941 form digitally, ensuring a streamlined submission process. Our platform not only makes it simple to fill out the necessary information but also incorporates features for tracking and storing your documents securely.

-

Is there a cost associated with using airSlate SignNow for the 2018 Schedule 941 form?

airSlate SignNow offers a cost-effective solution with various pricing plans tailored to meet the needs of individuals and businesses. You can choose the plan that best fits your requirements, allowing you to efficiently manage the 2018 Schedule 941 form without breaking the bank.

-

Can I integrate airSlate SignNow with other software for the 2018 Schedule 941 form?

Yes, airSlate SignNow integrates seamlessly with various software applications, making it easier to manage your 2018 Schedule 941 form alongside your other business processes. These integrations enhance productivity and allow for smoother data transfers between platforms.

-

What features does airSlate SignNow offer for completing the 2018 Schedule 941 form?

airSlate SignNow provides features such as customizable templates, eSignature capabilities, and document workflows specifically designed to facilitate the completion of the 2018 Schedule 941 form. These tools simplify document management and improve accuracy in your tax reporting.

-

How secure is airSlate SignNow when handling the 2018 Schedule 941 form?

Security is a top priority for airSlate SignNow. When using our platform for the 2018 Schedule 941 form, you can trust that your sensitive information is protected by advanced encryption and strict access controls, ensuring compliance with data protection regulations.

-

Can I access airSlate SignNow on mobile devices while completing the 2018 Schedule 941 form?

Absolutely! airSlate SignNow is mobile-friendly, allowing you to access your documents and complete the 2018 Schedule 941 form on-the-go. This flexibility enables you to manage your paperwork efficiently, no matter where you are.

Get more for Schedule R Form 941 Allocation Schedule For Aggregate Form 941 Filers

- Healthcare declaration form

- Revocation of statutory equivalent of living will or declaration nevada form

- Revised uniform anatomical gift act donation nevada

- Nevada process 497320934 form

- Revocation of anatomical gift donation nevada form

- Employment or job termination package nevada form

- Newly widowed individuals package nevada form

- Employment interview package nevada form

Find out other Schedule R Form 941 Allocation Schedule For Aggregate Form 941 Filers

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure