Schedule R Forms 941 and Form 940 IRS 2023

What is the Schedule R Forms 941 and Form 940 IRS

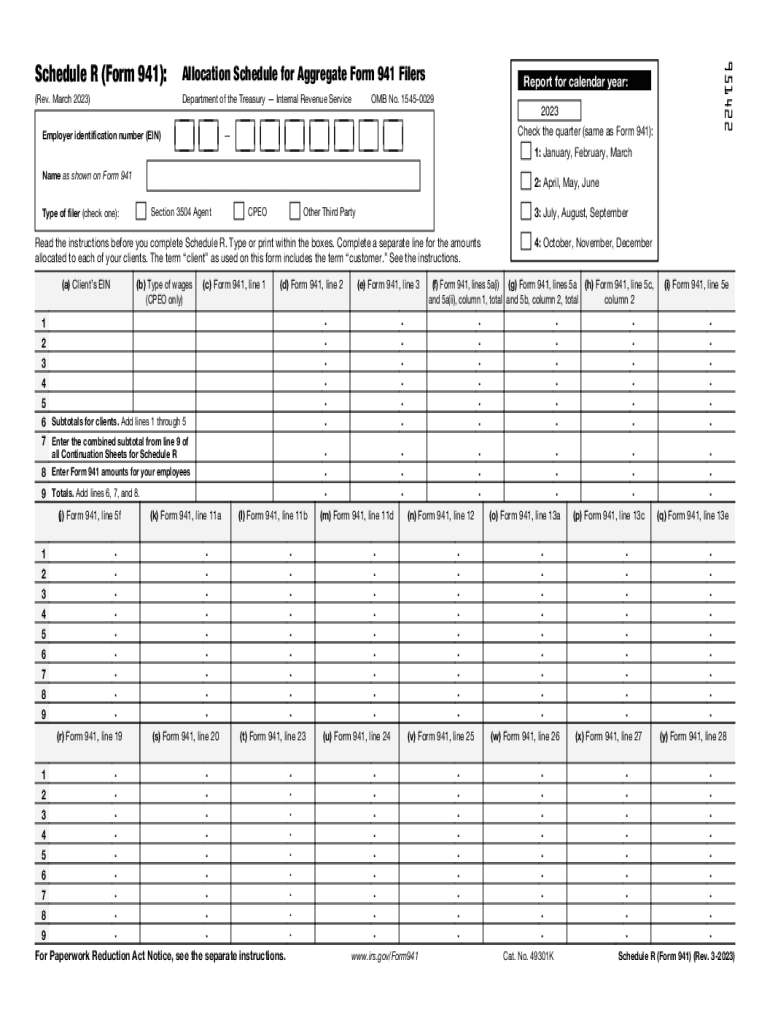

The Schedule R Forms 941 and Form 940 are essential documents used by employers in the United States for reporting employment taxes. The IRS R Form 941 is specifically designed for reporting income taxes withheld from employees, Social Security tax, and Medicare tax. Employers must file this form quarterly. In contrast, Form 940 is an annual report that outlines federal unemployment tax obligations. Understanding these forms is crucial for compliance with federal tax regulations.

Steps to Complete the Schedule R Forms 941 and Form 940 IRS

Completing the Schedule R Forms 941 and Form 940 involves several key steps:

- Gather necessary information, including employee wages, tax withheld, and any adjustments.

- Access the appropriate forms from the IRS website or a trusted source.

- Fill out the forms accurately, ensuring all calculations are correct.

- Review the completed forms for any errors or omissions.

- Submit the forms electronically or via mail, adhering to the specified deadlines.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule R Forms 941 and Form 940 are critical for compliance. For Form 941, the due date is typically the last day of the month following the end of each quarter. For example, the first quarter ends on March 31, so the due date is April 30. Form 940 is due on January 31 of the following year. Employers should be aware of these dates to avoid penalties.

Penalties for Non-Compliance

Failure to file the Schedule R Forms 941 and Form 940 on time can result in significant penalties. The IRS may impose fines for late submissions, which can accumulate quickly. Additionally, incorrect information can lead to further scrutiny and potential audits. It is essential for employers to ensure timely and accurate filing to avoid these consequences.

Legal Use of the Schedule R Forms 941 and Form 940 IRS

The legal use of the Schedule R Forms 941 and Form 940 is governed by IRS regulations. These forms must be completed truthfully and submitted according to the law. Electronic filing is recognized as legally binding, provided it meets specific security and compliance standards. Employers should ensure they use a reliable eSignature solution to maintain the legal integrity of their submissions.

Who Issues the Form

The Schedule R Forms 941 and Form 940 are issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines and instructions for completing these forms, ensuring that employers understand their obligations and the necessary steps for compliance.

Quick guide on how to complete schedule r forms 941 and form 940 irs

Complete Schedule R Forms 941 And Form 940 IRS effortlessly on any device

Online document management has become increasingly popular with businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Schedule R Forms 941 And Form 940 IRS on any platform with airSlate SignNow Android or iOS applications and simplify any document-driven process now.

How to modify and eSign Schedule R Forms 941 And Form 940 IRS with ease

- Find Schedule R Forms 941 And Form 940 IRS and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to submit your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign Schedule R Forms 941 And Form 940 IRS and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule r forms 941 and form 940 irs

Create this form in 5 minutes!

How to create an eSignature for the schedule r forms 941 and form 940 irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the IRS R Form 941, and why do I need it?

The IRS R Form 941 is a quarterly tax form that employers use to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. It's essential for compliance with federal tax regulations. By accurately filing the IRS R Form 941, businesses can avoid penalties and maintain a good standing with the IRS.

-

How can airSlate SignNow help with completing and submitting the IRS R Form 941?

airSlate SignNow provides an intuitive platform that simplifies the process of completing and electronically signing the IRS R Form 941. With its user-friendly interface, businesses can easily fill out the form, ensure all details are accurate, and securely submit it. This streamlines your tax reporting process signNowly.

-

Is airSlate SignNow a cost-effective solution for managing IRS R Form 941?

Yes, airSlate SignNow offers a cost-effective solution for managing various forms, including the IRS R Form 941. By reducing the need for paper storage and enabling electronic signatures, businesses can save both time and money while ensuring compliance with IRS regulations.

-

Can I integrate airSlate SignNow with my existing accounting software for easier IRS R Form 941 submissions?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, making it easy to pull data for your IRS R Form 941. This integration reduces data entry errors and enhances efficiency, allowing you to focus on other critical aspects of your business.

-

What are the security measures in place for submitting IRS R Form 941 through airSlate SignNow?

airSlate SignNow takes security seriously, implementing advanced encryption protocols to protect your IRS R Form 941 and other sensitive documents. All information is securely stored and only accessible to authorized users, ensuring compliance with data protection regulations.

-

How does electronic signing of the IRS R Form 941 through airSlate SignNow work?

Electronic signing of the IRS R Form 941 through airSlate SignNow is straightforward. Users can easily upload the form, add required signatures, and send it to relevant parties for final approval. This process is quick, efficient, and legally binding, streamlining the submission of tax forms.

-

Does airSlate SignNow offer templates for IRS R Form 941?

Yes, airSlate SignNow provides templates for the IRS R Form 941, ensuring that you have a consistent and compliant format for your filings. Utilizing these templates can save time and help prevent mistakes, making it easier to handle your quarterly tax submissions.

Get more for Schedule R Forms 941 And Form 940 IRS

Find out other Schedule R Forms 941 And Form 940 IRS

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe