Irs Schedule R 941 2018

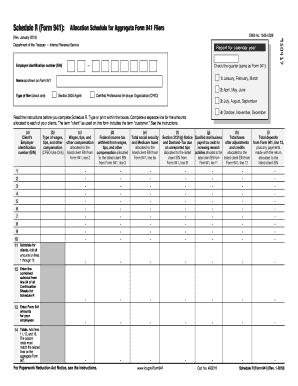

What is the IRS Schedule R 941?

The IRS Schedule R 941 is a tax form used by employers to claim the credit for qualified sick and family leave wages paid to employees under the Families First Coronavirus Response Act (FFCRA). This form is an attachment to the Form 941, which is the Employer's Quarterly Federal Tax Return. The Schedule R allows businesses to report the amount of credit they are eligible for, ensuring they receive the appropriate tax relief for providing paid leave during the COVID-19 pandemic.

How to use the IRS Schedule R 941

To use the IRS Schedule R 941, employers must first determine their eligibility for the credit. This involves assessing the wages paid to employees who took leave for specific COVID-19 related reasons. Once eligibility is confirmed, employers complete the Schedule R by entering the total qualified wages and calculating the credit amount. This information is then reported on the Form 941, allowing the IRS to process the credit efficiently.

Steps to complete the IRS Schedule R 941

Completing the IRS Schedule R 941 involves several key steps:

- Gather necessary information, including employee names, Social Security numbers, and the total wages paid during the applicable quarter.

- Determine the amount of qualified sick and family leave wages paid, ensuring they meet the criteria set by the IRS.

- Fill out the Schedule R, including the total qualified wages and the corresponding credit amount.

- Attach the completed Schedule R to your Form 941 when filing.

- Keep copies of all documentation for your records in case of an audit.

Legal use of the IRS Schedule R 941

The IRS Schedule R 941 is legally valid when completed accurately and submitted in compliance with IRS guidelines. Employers must ensure that the information reported is truthful and corresponds to the actual wages paid. Misrepresentation or errors can lead to penalties or audits. Utilizing a reliable electronic signature tool can help ensure that the form is signed and submitted securely, maintaining compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing deadlines for the IRS Schedule R 941 align with the quarterly deadlines for Form 941. Employers must submit their Form 941, along with the Schedule R, by the last day of the month following the end of each quarter. For example, for the first quarter ending March 31, the deadline is April 30. It is crucial for employers to keep track of these dates to avoid late filing penalties.

Required Documents

To complete the IRS Schedule R 941, employers should have the following documents ready:

- Form 941 - Employer's Quarterly Federal Tax Return

- Records of qualified sick and family leave wages paid

- Employee information, including names and Social Security numbers

- Documentation supporting the reason for leave taken by employees

Penalties for Non-Compliance

Employers who fail to comply with the requirements of the IRS Schedule R 941 may face penalties. These can include fines for late filing, inaccuracies in reported information, or failure to maintain proper documentation. It is essential to adhere to IRS guidelines and ensure all forms are completed accurately to avoid these potential consequences.

Quick guide on how to complete irs schedule r 941

Complete Irs Schedule R 941 seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents quickly without delays. Manage Irs Schedule R 941 on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

How to alter and eSign Irs Schedule R 941 effortlessly

- Locate Irs Schedule R 941 and click on Retrieve Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional ink signature.

- Review all information and click the Finish button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Irs Schedule R 941 and ensure clear communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs schedule r 941

Create this form in 5 minutes!

How to create an eSignature for the irs schedule r 941

The way to make an electronic signature for a PDF file in the online mode

The way to make an electronic signature for a PDF file in Chrome

The best way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

The way to generate an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the Irs Schedule R 941 and how does it relate to airSlate SignNow?

The Irs Schedule R 941 is a specific form used for reporting certain payroll tax credits. With airSlate SignNow, businesses can easily manage their documents related to the Irs Schedule R 941 by quickly sending and eSigning essential forms, ensuring compliance and accuracy in their submissions.

-

How can airSlate SignNow help me complete the Irs Schedule R 941 efficiently?

AirSlate SignNow streamlines the process of completing the Irs Schedule R 941 by providing templates and an intuitive interface for eSigning. This means you can fill out, review, and send your forms electronically, saving time and reducing the likelihood of errors.

-

Is there a cost associated with using airSlate SignNow for managing the Irs Schedule R 941?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans provide access to all features necessary for managing documents like the Irs Schedule R 941, making it a cost-effective solution for businesses of any size.

-

What features does airSlate SignNow offer for handling the Irs Schedule R 941?

AirSlate SignNow provides features such as customizable templates, real-time tracking, and secure cloud storage that are particularly useful for handling the Irs Schedule R 941. These tools help ensure that your forms are completed accurately and are easily accessible whenever needed.

-

Can I integrate airSlate SignNow with other software for my Irs Schedule R 941 processes?

Absolutely! airSlate SignNow offers integrations with various software applications that can enhance your workflow for the Irs Schedule R 941. This includes popular accounting and HR software, allowing for a seamless transition of data between platforms.

-

What are the benefits of using airSlate SignNow for the Irs Schedule R 941 over traditional methods?

Using airSlate SignNow for the Irs Schedule R 941 offers numerous benefits over traditional methods, including increased efficiency, reduced paperwork, and improved accuracy. Digital signatures also expedite the approval process, allowing businesses to meet deadlines more easily.

-

How secure is airSlate SignNow when handling sensitive documents like the Irs Schedule R 941?

AirSlate SignNow prioritizes security, employing advanced encryption and authentication measures to protect sensitive documents, including the Irs Schedule R 941. This ensures that your data remains confidential and secure throughout the signing process.

Get more for Irs Schedule R 941

- Dmm 507 mailer services postal explorer uspscom form

- Fields 34 36 form

- Maine will instructions form

- Fields 38 41 form

- Mississippi will instructions mutual wills for married couple form

- Forms catalog 1pdfnet

- The case name the joint tenant in field 29 form

- Lease of automobile with option to purchase at the end of the term for a price of 1 form

Find out other Irs Schedule R 941

- How Can I Electronic signature New Jersey Courts Document

- How Can I Electronic signature New Jersey Courts Document

- Can I Electronic signature Oregon Sports Form

- How To Electronic signature New York Courts Document

- How Can I Electronic signature Oklahoma Courts PDF

- How Do I Electronic signature South Dakota Courts Document

- Can I Electronic signature South Dakota Sports Presentation

- How To Electronic signature Utah Courts Document

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word