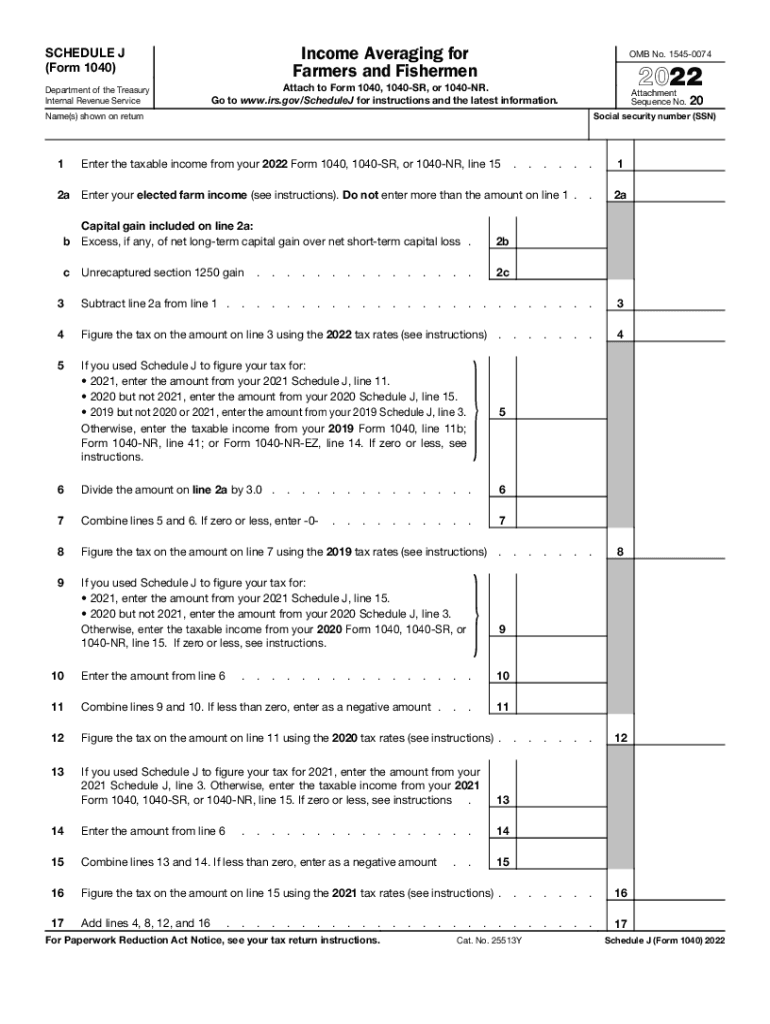

About Schedule J Form 1040, Income IRS Tax FormsFederal 1040 Schedule J Income Averaging for FarmersIncome Averaging for OMB No 2022

Understanding Schedule J Form 1040 for Farmers

The Schedule J Form 1040 is specifically designed for farmers to calculate income averaging. This form allows farmers to average their income over a three-year period, which can help reduce tax liability during years of fluctuating income. By utilizing this form, farmers can potentially smooth out their tax obligations, making it easier to manage finances during lean years.

Steps to Complete Schedule J Form 1040

Completing the Schedule J Form 1040 involves several key steps:

- Gather necessary financial records, including income statements and expense reports for the previous three years.

- Calculate the average income by adding the total income from the three years and dividing by three.

- Fill out the form accurately, ensuring all sections are completed, including income, deductions, and credits.

- Review the completed form for accuracy before submission.

Legal Use of Schedule J Form 1040

The Schedule J Form 1040 is legally recognized for income averaging purposes under IRS guidelines. It is important for farmers to ensure that the form is filled out correctly to comply with tax regulations. Misreporting or errors can lead to penalties or audits, making accuracy crucial for legal compliance.

Eligibility Criteria for Using Schedule J Form 1040

To be eligible to use the Schedule J Form 1040, farmers must meet specific criteria:

- Must be a farmer or a qualified fisherman.

- Income must fluctuate significantly from year to year.

- Must have filed a tax return for the previous three years.

Filing Deadlines for Schedule J Form 1040

Farmers must be aware of the filing deadlines associated with the Schedule J Form 1040. Typically, the form must be submitted by the tax deadline, which is usually April 15 for individual tax returns. If the deadline falls on a weekend or holiday, it may be extended to the next business day.

Examples of Using Schedule J Form 1040

Farmers can benefit from using the Schedule J Form 1040 in various scenarios:

- A farmer experiencing a significant drop in income due to a drought may average income from previous years to lower their tax bill.

- A farmer with fluctuating income from different crops can use this form to balance their tax obligations over years of high and low yield.

Quick guide on how to complete about schedule j form 1040 income irs tax formsfederal 1040 schedule j income averaging for farmersincome averaging for omb no

Complete About Schedule J Form 1040, Income IRS Tax FormsFederal 1040 Schedule J Income Averaging For FarmersIncome Averaging For OMB No effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly substitute to traditional printed and signed paperwork, as you can easily locate the appropriate form and securely maintain it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle About Schedule J Form 1040, Income IRS Tax FormsFederal 1040 Schedule J Income Averaging For FarmersIncome Averaging For OMB No on any device utilizing the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The simplest way to modify and eSign About Schedule J Form 1040, Income IRS Tax FormsFederal 1040 Schedule J Income Averaging For FarmersIncome Averaging For OMB No effortlessly

- Locate About Schedule J Form 1040, Income IRS Tax FormsFederal 1040 Schedule J Income Averaging For FarmersIncome Averaging For OMB No and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your requirements in document management in just a few clicks from any device of your choice. Modify and eSign About Schedule J Form 1040, Income IRS Tax FormsFederal 1040 Schedule J Income Averaging For FarmersIncome Averaging For OMB No and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about schedule j form 1040 income irs tax formsfederal 1040 schedule j income averaging for farmersincome averaging for omb no

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for 2018 j farmers?

airSlate SignNow provides essential features for 2018 j farmers, such as easy document signing, flexible templates, and mobile accessibility. These features help streamline operations by allowing farmers to sign and send crucial documents from any device. Moreover, the platform ensures compliance and security, making it ideal for agricultural businesses.

-

How does airSlate SignNow benefit 2018 j farmers?

For 2018 j farmers, airSlate SignNow enhances productivity through automated workflows and efficient document management. With the ability to eliminate paper processes, farmers can save time and reduce errors in their transactions. This translates to a more organized approach to managing contracts, agreements, and permits.

-

What are the pricing options available for 2018 j farmers using airSlate SignNow?

airSlate SignNow offers competitive pricing plans tailored for 2018 j farmers, ensuring cost-effectiveness without compromising on features. The pricing structure includes various tiers to suit different business needs, from solo farmers to larger agricultural companies. Choosing the right plan can help optimize resources while ensuring all functionalities are accessible.

-

Can 2018 j farmers integrate airSlate SignNow with other tools?

Yes, airSlate SignNow allows for seamless integrations with popular tools and applications commonly used by 2018 j farmers. This includes integration with CRM systems, cloud storage services, and other productivity applications. These integrations help enhance workflow efficiency by allowing farmers to connect their existing systems with ease.

-

Is airSlate SignNow easy to use for 2018 j farmers?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible for 2018 j farmers, regardless of their tech-savviness. The intuitive interface ensures that even those with limited digital experience can easily navigate the platform and manage their document signing needs effectively.

-

What security measures does airSlate SignNow have for 2018 j farmers?

Security is a top priority for airSlate SignNow, especially for 2018 j farmers managing sensitive documents. The platform employs industry-standard encryption and complies with various regulations to safeguard data. Farmers can confidently use the service knowing that their information is protected from unauthorized access.

-

How can 2018 j farmers start using airSlate SignNow?

Starting with airSlate SignNow is simple for 2018 j farmers. Interested users can sign up for a free trial to explore the features before committing to a plan. After registration, users can start sending and signing documents right away, making the transition to electronic processes quick and efficient.

Get more for About Schedule J Form 1040, Income IRS Tax FormsFederal 1040 Schedule J Income Averaging For FarmersIncome Averaging For OMB No

Find out other About Schedule J Form 1040, Income IRS Tax FormsFederal 1040 Schedule J Income Averaging For FarmersIncome Averaging For OMB No

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe