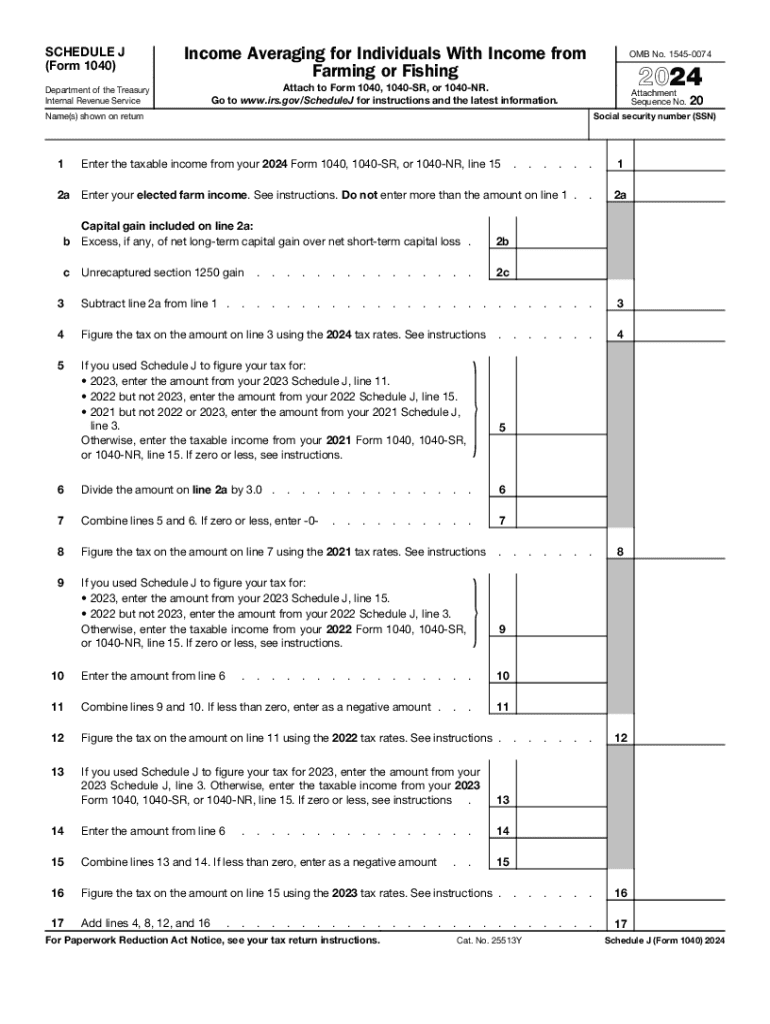

Form 1040 Schedule J 2024

What is the Form 1040 Schedule J

The Form 1040 Schedule J is a tax form used by farmers and fishermen in the United States to calculate their income averaging. This form allows eligible taxpayers to average their income over three years, which can help reduce their overall tax liability during years of fluctuating earnings. By spreading income over multiple years, individuals can potentially lower their taxable income in high-earning years, thus minimizing their tax burden.

How to use the Form 1040 Schedule J

To utilize the Form 1040 Schedule J, taxpayers must first determine their eligibility based on their income sources. Eligible individuals typically include those whose primary income comes from farming or fishing. After confirming eligibility, the taxpayer should gather income records for the past three years. The form requires the reporting of income and deductions for each of those years, which will be averaged to determine the tax liability. Accurate completion of the form is essential to ensure compliance with IRS regulations.

Steps to complete the Form 1040 Schedule J

Completing the Form 1040 Schedule J involves several steps:

- Gather all necessary financial documents, including income statements and expense records from the past three years.

- Fill out the income sections for each year, ensuring all figures are accurate and reflect the actual earnings.

- Calculate the average income by adding the total income from the three years and dividing by three.

- Complete the deductions section, if applicable, to determine the final taxable income.

- Review the completed form for accuracy before submitting it with the main tax return.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1040 Schedule J. Taxpayers must adhere to these guidelines to ensure compliance and avoid penalties. Key points include:

- Only income from farming or fishing qualifies for averaging.

- Taxpayers must file the Schedule J along with their Form 1040.

- There are specific deadlines for submission, typically aligned with the standard tax filing dates.

Eligibility Criteria

To qualify for using the Form 1040 Schedule J, taxpayers must meet certain criteria. These include:

- Being a farmer or fisherman with income primarily derived from these activities.

- Having a fluctuating income over the past three years.

- Not exceeding the income limits set by the IRS for averaging.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040 Schedule J align with the general tax filing deadlines. Typically, taxpayers must submit their forms by April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended. It is crucial for taxpayers to stay informed about any changes in deadlines announced by the IRS to avoid late filing penalties.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 schedule j

Create this form in 5 minutes!

How to create an eSignature for the form 1040 schedule j

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is schedule income averaging and how can it benefit my business?

Schedule income averaging is a financial strategy that allows businesses to manage their income more effectively over time. By spreading income across different periods, businesses can stabilize cash flow and reduce tax liabilities. This approach can enhance financial planning and ensure that your business remains financially healthy.

-

How does airSlate SignNow support schedule income averaging?

airSlate SignNow provides tools that facilitate the documentation and eSigning of agreements related to schedule income averaging. With our platform, you can easily create, send, and manage contracts that outline your income averaging strategy. This streamlines the process and ensures that all parties are on the same page.

-

What features does airSlate SignNow offer for managing schedule income averaging?

Our platform includes features such as customizable templates, automated workflows, and secure eSigning, all of which are essential for managing schedule income averaging. These tools help you create clear agreements and track income over time, making it easier to implement your financial strategies effectively.

-

Is airSlate SignNow cost-effective for small businesses looking to implement schedule income averaging?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. Our pricing plans are flexible and affordable, allowing you to access essential features for managing schedule income averaging without breaking the bank. This ensures that you can focus on your financial strategies without worrying about high costs.

-

Can I integrate airSlate SignNow with other financial tools for schedule income averaging?

Absolutely! airSlate SignNow offers integrations with various financial tools and software that can enhance your schedule income averaging efforts. By connecting our platform with your existing systems, you can streamline your processes and ensure that all your financial data is synchronized and easily accessible.

-

What are the security measures in place for documents related to schedule income averaging?

Security is a top priority at airSlate SignNow. We implement advanced encryption and secure access controls to protect your documents related to schedule income averaging. This ensures that sensitive financial information remains confidential and secure throughout the eSigning process.

-

How can I get started with airSlate SignNow for schedule income averaging?

Getting started with airSlate SignNow is simple! You can sign up for a free trial to explore our features tailored for schedule income averaging. Once you're ready, you can choose a pricing plan that fits your needs and start creating and managing your documents with ease.

Get more for Form 1040 Schedule J

Find out other Form 1040 Schedule J

- How Can I Sign North Carolina Indemnity Agreement Template

- How Do I Sign Delaware Stock Transfer Form Template

- Help Me With Sign Texas Stock Purchase Agreement Template

- Help Me With Sign Nevada Stock Transfer Form Template

- Can I Sign South Carolina Stock Transfer Form Template

- How Can I Sign Michigan Promissory Note Template

- Sign New Mexico Promissory Note Template Now

- Sign Indiana Basketball Registration Form Now

- Sign Iowa Gym Membership Agreement Later

- Can I Sign Michigan Gym Membership Agreement

- Sign Colorado Safety Contract Safe

- Sign North Carolina Safety Contract Later

- Sign Arkansas Application for University Free

- Sign Arkansas Nanny Contract Template Fast

- How To Sign California Nanny Contract Template

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template