Schedule J Form 1040 Internal Revenue Service 2020

What is the Schedule J Form 1040

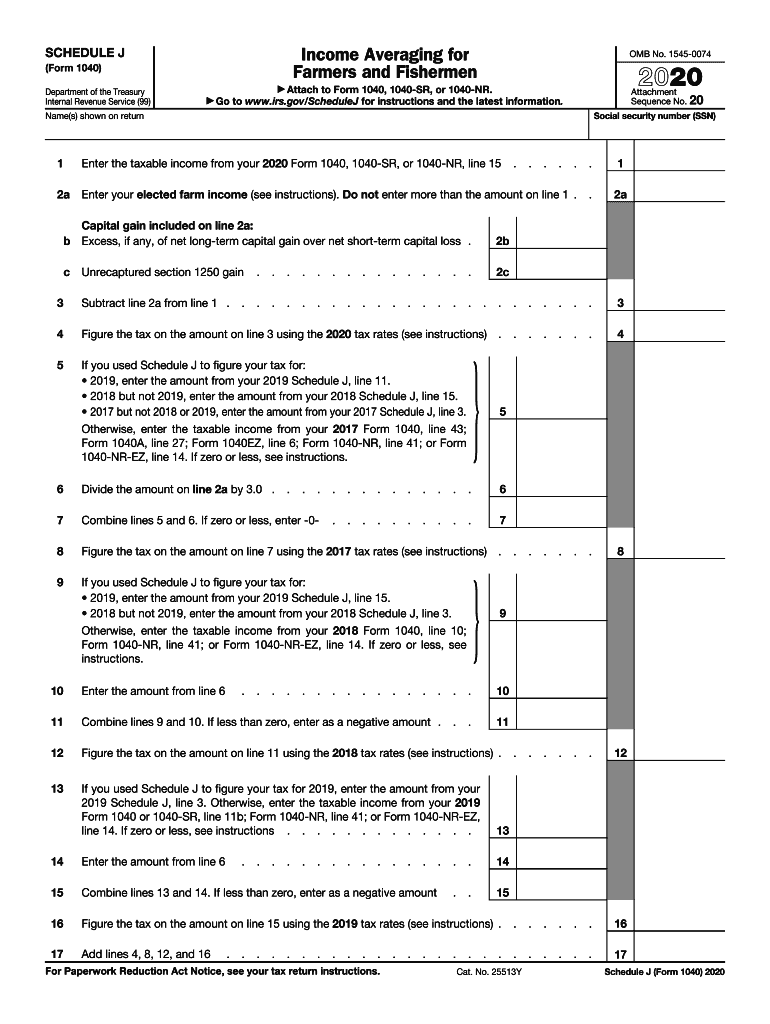

The Schedule J Form 1040 is a tax form used by individuals to calculate their income tax liability based on a specific method of averaging income. This form is particularly beneficial for farmers and fishermen who may experience fluctuating income throughout the year. By allowing taxpayers to average their income over a period of time, the Schedule J helps to smooth out tax obligations, making it easier to manage financial responsibilities. This form is filed along with the standard Form 1040 to report annual income to the Internal Revenue Service (IRS).

How to use the Schedule J Form 1040

To effectively use the Schedule J Form 1040, taxpayers must first determine if they qualify for income averaging. This typically applies to those with farming or fishing income. Once eligibility is confirmed, taxpayers should gather their income records for the previous three years. The form requires detailed input of income figures from these years to calculate the average. After completing the calculations, the average income is reported on the main Form 1040, which ultimately affects the overall tax liability.

Steps to complete the Schedule J Form 1040

Completing the Schedule J Form 1040 involves several key steps:

- Gather income records from the previous three years, including any relevant tax documents.

- Fill out the income section of the form by entering total income amounts for each of the three years.

- Calculate the average income by dividing the total income by three.

- Transfer the average income figure to the appropriate section on the Form 1040.

- Review the completed form for accuracy and ensure all calculations are correct.

Legal use of the Schedule J Form 1040

The Schedule J Form 1040 is legally recognized by the IRS as a valid method for calculating tax obligations for eligible taxpayers. It is crucial that the information provided on the form is accurate and truthful, as any discrepancies may lead to penalties or audits. Taxpayers should ensure they comply with all IRS guidelines when completing the form, including retaining supporting documentation for income claims.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule J Form 1040 align with the standard tax filing deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. If taxpayers require additional time, they may file for an extension, which grants an additional six months to submit their forms. However, any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Required Documents

To complete the Schedule J Form 1040 accurately, taxpayers should have the following documents ready:

- Income statements for the previous three years, including W-2s and 1099 forms.

- Records of any farming or fishing income.

- Previous tax returns for reference and verification.

- Any additional documentation related to deductions or credits that may apply.

Penalties for Non-Compliance

Failure to comply with the requirements of the Schedule J Form 1040 can result in various penalties. The IRS may impose fines for inaccuracies or late submissions. Additionally, taxpayers who do not report their income correctly may face audits, which can lead to further financial consequences. It is essential to ensure accuracy and timeliness when filing to avoid these potential penalties.

Quick guide on how to complete 2020 schedule j form 1040 internal revenue service

Effortlessly Prepare Schedule J Form 1040 Internal Revenue Service on Any Device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the right form and safely store it online. airSlate SignNow provides all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle Schedule J Form 1040 Internal Revenue Service on any device with the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The Easiest Way to Modify and eSign Schedule J Form 1040 Internal Revenue Service with Ease

- Obtain Schedule J Form 1040 Internal Revenue Service and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically provides for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to send your form—via email, SMS, or invite link, or download it to your computer.

No more worries about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Adjust and eSign Schedule J Form 1040 Internal Revenue Service and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 schedule j form 1040 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the 2020 schedule j form 1040 internal revenue service

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The best way to generate an electronic signature for a PDF file on Android

People also ask

-

What is the 1040 schedule j form and why do I need it?

The 1040 schedule j form is a tax document that helps farmers and fishermen calculate their income and taxes owed. It allows eligible taxpayers to average their income over three years for a more consistent tax approach. Utilizing airSlate SignNow can simplify the eSigning process for this form, making it easier for you to complete your tax filings.

-

How can airSlate SignNow help me with the 1040 schedule j form?

airSlate SignNow offers a user-friendly platform for sending and eSigning the 1040 schedule j form. With its streamlined interface, you can quickly fill out, sign, and send your documents securely, ensuring compliance and efficiency in your tax submissions. This hassle-free solution enhances your productivity during tax season.

-

Is there a cost associated with using airSlate SignNow for the 1040 schedule j form?

Yes, airSlate SignNow operates on a subscription model with various pricing plans. Each plan offers different features tailored to your business needs, including the ability to handle the 1040 schedule j form smoothly. The cost is often offset by the time savings and efficiency gained from using our services.

-

Are there any features specific to the 1040 schedule j form in airSlate SignNow?

airSlate SignNow includes features such as customizable templates and automated reminders specifically for the 1040 schedule j form. These tools help ensure that your documents are completed and signed on time, improving your overall tax filing experience. Additionally, you can track the status of your documents in real-time.

-

Can I integrate airSlate SignNow with other software for filing the 1040 schedule j form?

Absolutely! AirSlate SignNow can easily integrate with various accounting and tax preparation software, making the handling of the 1040 schedule j form even more seamless. This integration allows you to streamline your workflow and ensures that all your documents are readily accessible and securely shared.

-

How secure is airSlate SignNow when handling the 1040 schedule j form?

Security is a top priority at airSlate SignNow. Our platform uses advanced encryption and secure storage methods to protect sensitive information related to the 1040 schedule j form. You can confidently send and eSign your documents knowing that they are safe and compliant with the latest regulations.

-

What benefits can I expect when using airSlate SignNow for my 1040 schedule j form?

Using airSlate SignNow for your 1040 schedule j form provides numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy. You will save time on manual processes and have a clear audit trail of all transactions. This can signNowly lessen stress during tax season and enhance your overall experience.

Get more for Schedule J Form 1040 Internal Revenue Service

Find out other Schedule J Form 1040 Internal Revenue Service

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast