Www Irs Govpubirs Pdf2021 Schedule J Form 1040 Internal Revenue Service 2021

Understanding the IRS Schedule J Form

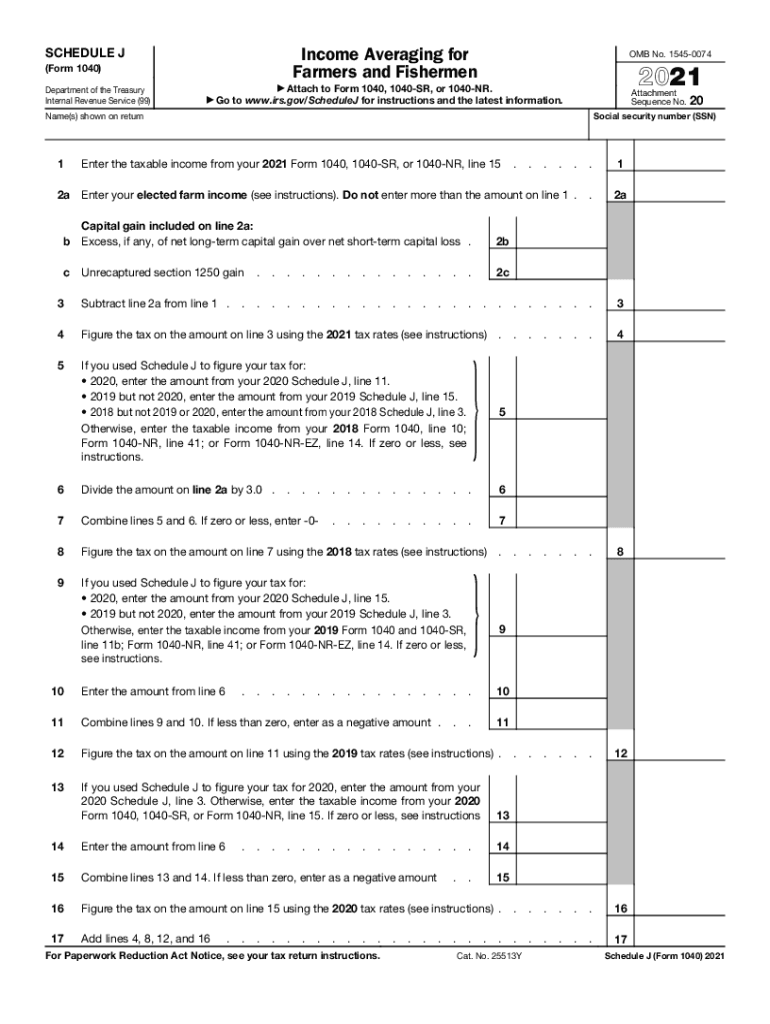

The IRS Schedule J form is utilized for income averaging, primarily for farmers and fishermen. This form allows eligible taxpayers to spread their income over a three-year period, which can help reduce their tax liability during years of fluctuating income. The form is essential for those who experience significant variations in their earnings, enabling them to manage their tax obligations more effectively.

Steps to Complete the IRS Schedule J Form

Completing the IRS Schedule J form involves several key steps:

- Gather necessary financial documents, including income statements and tax returns for the previous three years.

- Calculate your average income from the three years, ensuring to include all relevant sources of income.

- Fill out the Schedule J form, entering your calculated average income and any deductions applicable to your situation.

- Review the completed form for accuracy, ensuring all information is correctly entered.

- Attach the completed Schedule J to your main tax return form before submission.

Legal Use of the IRS Schedule J Form

The IRS Schedule J form is legally recognized for income averaging under U.S. tax law. To ensure its validity, taxpayers must comply with IRS guidelines and provide accurate information. Proper use of the form can help mitigate tax burdens during years of high income, making it a valuable tool for eligible taxpayers. It is crucial to retain documentation supporting the income reported on the form, as the IRS may request verification during audits.

Filing Deadlines and Important Dates

For taxpayers using the IRS Schedule J form, it is essential to be aware of key filing deadlines. Typically, individual tax returns, including those with Schedule J, are due on April 15 of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also consider any extensions that may apply, allowing additional time for filing their returns.

Required Documents for IRS Schedule J Form

To complete the IRS Schedule J form accurately, taxpayers need to gather several documents:

- Previous years' tax returns, including income statements.

- Records of income from farming or fishing activities.

- Documentation of any deductions or credits claimed in prior years.

- Any additional financial statements relevant to income averaging.

Examples of Using the IRS Schedule J Form

Consider a farmer whose income varies significantly due to unpredictable crop yields. By using the IRS Schedule J form, the farmer can average their income over three years, reducing the tax impact of a particularly profitable year. Similarly, a fisherman experiencing fluctuating catches can utilize the form to manage their tax liabilities more effectively, ensuring a fairer tax burden across years.

Quick guide on how to complete wwwirsgovpubirs pdf2021 schedule j form 1040 internal revenue service

Finish Www irs govpubirs pdf2021 Schedule J Form 1040 Internal Revenue Service seamlessly on any device

Digital document management has gained popularity among companies and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without any hold-ups. Handle Www irs govpubirs pdf2021 Schedule J Form 1040 Internal Revenue Service on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Www irs govpubirs pdf2021 Schedule J Form 1040 Internal Revenue Service effortlessly

- Obtain Www irs govpubirs pdf2021 Schedule J Form 1040 Internal Revenue Service and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or conceal sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to store your changes.

- Select your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or mislaid files, frustrating form searching, or errors that necessitate printing new document versions. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Www irs govpubirs pdf2021 Schedule J Form 1040 Internal Revenue Service and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct wwwirsgovpubirs pdf2021 schedule j form 1040 internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the wwwirsgovpubirs pdf2021 schedule j form 1040 internal revenue service

The way to create an e-signature for a PDF document in the online mode

The way to create an e-signature for a PDF document in Chrome

The best way to generate an e-signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The best way to generate an e-signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is Schedule J and how does it relate to airSlate SignNow?

Schedule J is a crucial component in the tax return process that allows businesses to report their income and expenses accurately. Using airSlate SignNow, you can easily manage, send, and eSign documents related to Schedule J, ensuring your financial documents are organized and compliant.

-

How can airSlate SignNow help me with my Schedule J filings?

airSlate SignNow provides smooth document workflow management to streamline your Schedule J filings. With its eSignature capabilities, you can quickly obtain signatures on necessary documents, which can save you time and reduce the risk of errors during the filing process.

-

Is airSlate SignNow a cost-effective solution for managing Schedule J documents?

Yes, airSlate SignNow offers a competitive pricing model that makes it a cost-effective solution for managing your Schedule J documents. By using our platform, you can save both time and money, minimizing administrative costs while enhancing productivity.

-

What are the key features of airSlate SignNow that can assist with Schedule J documentation?

Key features of airSlate SignNow include customizable templates, secure document storage, and easy sharing options for your Schedule J documents. Additionally, our platform offers audit trails for compliance and complete visibility over document status, making it easier to manage your filings.

-

Can I integrate airSlate SignNow with other software for Schedule J-related tasks?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, including accounting tools and document management systems. This means you can easily connect your Schedule J document processes with your existing tech stack for a more efficient workflow.

-

What benefits can businesses gain from using airSlate SignNow for Schedule J management?

Using airSlate SignNow for your Schedule J management brings numerous benefits, such as improved efficiency, enhanced collaboration, and streamlined workflows. Your team can focus more on core business activities while our platform handles the administrative load, ensuring accurate documentation.

-

How secure is airSlate SignNow when handling Schedule J documents?

airSlate SignNow prioritizes the security of your Schedule J documents with advanced encryption and security protocols. Our platform is designed to protect sensitive information, ensuring that your documents are safe from unauthorized access while being easily accessible to authorized users.

Get more for Www irs govpubirs pdf2021 Schedule J Form 1040 Internal Revenue Service

- Forms sell property

- Georgia conservatorship form

- Petition sell property form

- Ga disclosure statement form

- Notice of dishonored check civil keywords bad check bounced check georgia form

- Stopped payment 497303796 form

- Mutual wills containing last will and testaments for unmarried persons living together with no children georgia form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children georgia form

Find out other Www irs govpubirs pdf2021 Schedule J Form 1040 Internal Revenue Service

- eSign Hawaii CV Form Template Online

- eSign Idaho CV Form Template Free

- How To eSign Kansas CV Form Template

- eSign Nevada CV Form Template Online

- eSign New Hampshire CV Form Template Safe

- eSign Indiana New Hire Onboarding Online

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template