Schedule J Form 1040 Income Averaging for Farmers and Fishermen 2023

Understanding the Schedule J Form 1040 for Income Averaging

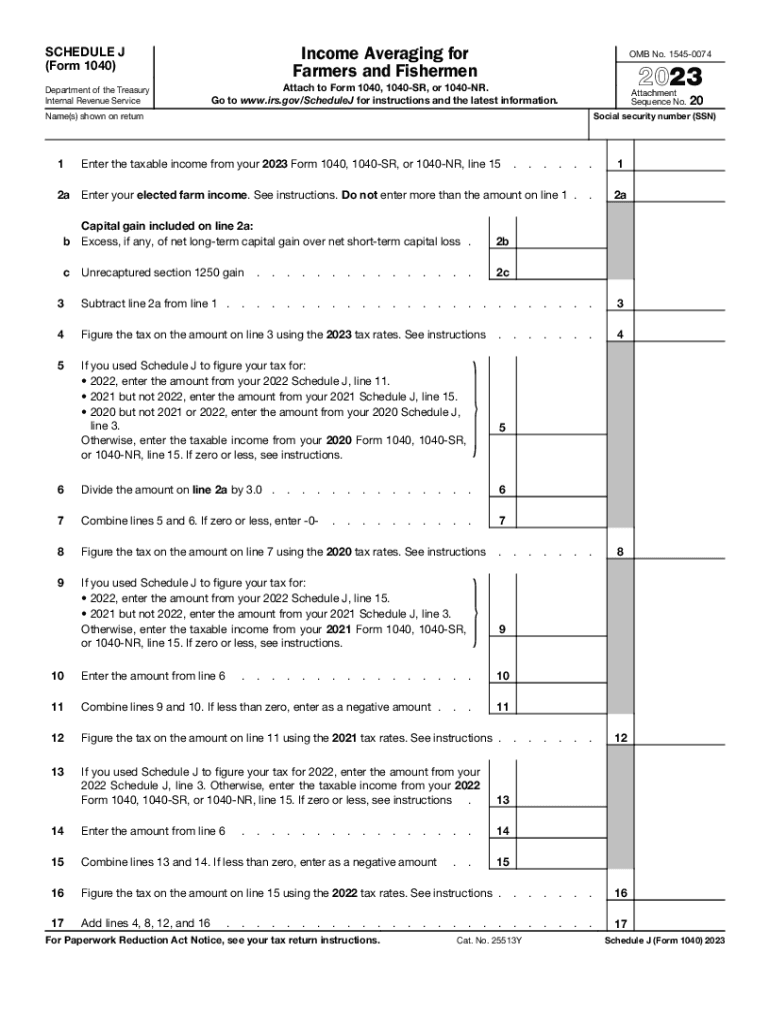

The Schedule J Form 1040 is specifically designed for farmers and fishermen who wish to average their income over a period of three years. This form allows eligible taxpayers to smooth out the tax burden that often comes with fluctuating income levels, which is common in agriculture and fishing industries. By using this form, individuals can potentially reduce their overall tax liability, making it an essential tool for those in these professions.

Steps to Complete the Schedule J Form 1040

Filling out the Schedule J Form 1040 involves several steps to ensure accuracy and compliance with IRS regulations. Begin by gathering your income records for the past three years, as this information is crucial for calculating your average income. Next, complete the income section of the form by entering your total income for each year. After calculating your average income, you will need to determine your tax liability based on this average. Finally, ensure you sign and date the form before submission.

Eligibility Criteria for the Schedule J Form 1040

To qualify for using the Schedule J Form 1040, you must be a farmer or fisherman who meets specific income thresholds. Generally, you should have at least two-thirds of your gross income from farming or fishing activities. Additionally, your income must have significant fluctuations from year to year, making income averaging beneficial. Review the IRS guidelines to confirm your eligibility before proceeding with the form.

Obtaining the Schedule J Form 1040

The Schedule J Form 1040 can be obtained directly from the IRS website. It is available as a downloadable PDF, which you can print and fill out manually. Alternatively, if you prefer digital options, many tax preparation software programs include the Schedule J, allowing for easier completion and submission. Ensure you have the most current version of the form to avoid any issues with your filing.

Key Elements of the Schedule J Form 1040

Key elements of the Schedule J Form include sections for reporting income, calculating the average income, and determining the tax liability based on that average. The form also requires information about your farming or fishing business, including the type of activities you engage in and the income generated from those activities. Properly completing these sections is essential for accurate tax reporting.

IRS Guidelines for Using the Schedule J Form 1040

The IRS provides specific guidelines on how to use the Schedule J Form 1040 effectively. These guidelines include instructions on calculating your average income, determining eligibility, and understanding the implications of income averaging on your overall tax situation. It is important to review these guidelines carefully to ensure compliance and to maximize the benefits of using the form.

Quick guide on how to complete schedule j form 1040 income averaging for farmers and fishermen

Prepare Schedule J Form 1040 Income Averaging For Farmers And Fishermen effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers a fantastic eco-friendly option to traditional printed and signed paperwork, allowing you to locate the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Handle Schedule J Form 1040 Income Averaging For Farmers And Fishermen on any gadget using airSlate SignNow Android or iOS applications and enhance any document-driven activity today.

How to modify and eSign Schedule J Form 1040 Income Averaging For Farmers And Fishermen without hassle

- Locate Schedule J Form 1040 Income Averaging For Farmers And Fishermen and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new document copies. airSlate SignNow caters to all your requirements in document management in just a few clicks from a device of your choice. Modify and eSign Schedule J Form 1040 Income Averaging For Farmers And Fishermen and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule j form 1040 income averaging for farmers and fishermen

Create this form in 5 minutes!

How to create an eSignature for the schedule j form 1040 income averaging for farmers and fishermen

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2017 Schedule J form and why is it important?

The 2017 Schedule J form is used to report income for certain types of businesses and is essential for ensuring compliance with tax regulations. By accurately completing this form, business owners can effectively manage their deductions and taxes owed, ultimately impacting their financial standing.

-

How can airSlate SignNow assist with completing the 2017 Schedule J form?

airSlate SignNow provides an intuitive platform that enables users to fill out and sign the 2017 Schedule J form electronically. With easy-to-use features, you can ensure that your form is filled out correctly, securely signed, and submitted on time, saving you valuable time and minimizing mistakes.

-

Is there a cost associated with using airSlate SignNow for the 2017 Schedule J form?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs, allowing you to choose the most suitable option for handling forms like the 2017 Schedule J. Our plans are designed to be cost-effective, providing great value while ensuring access to essential features.

-

Can I integrate airSlate SignNow with my existing accounting software for the 2017 Schedule J form?

Absolutely! airSlate SignNow seamlessly integrates with several accounting software solutions, making it easier to manage documents like the 2017 Schedule J form. These integrations help streamline your workflow and enhance efficiency by synchronizing your data effortlessly.

-

What features does airSlate SignNow offer for managing the 2017 Schedule J form?

With airSlate SignNow, you have access to features like customized templates, audit trails, and automated reminders for your 2017 Schedule J form. These tools provide ease of use while ensuring that you maintain compliance and accuracy throughout the process.

-

How secure is the airSlate SignNow platform for handling the 2017 Schedule J form?

The security of your documents is our top priority. airSlate SignNow uses advanced encryption methods and secure servers to protect your information while handling sensitive documents such as the 2017 Schedule J form, giving you peace of mind.

-

Can I access my 2017 Schedule J form on mobile devices using airSlate SignNow?

Yes, airSlate SignNow is optimized for mobile devices, allowing you to access and manage your 2017 Schedule J form on the go. This flexibility ensures that you can work from anywhere, making it easier to stay on top of your documents.

Get more for Schedule J Form 1040 Income Averaging For Farmers And Fishermen

- Section 504 student services plan form 11 4

- Modular home purchase contract jbformscom

- Winn dixie pdf form

- Florida early lease termination addendum form

- Sallie mae cosigner release form pdf

- Cosmetology supplemental information form 1 11680953

- Nppsc annual trainingactive duty training atadt checklist previous editions obsolete form

- Airport badging office form

Find out other Schedule J Form 1040 Income Averaging For Farmers And Fishermen

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA