Form 8833 Rev December Treaty Based Return Position Disclosure under Section 6114 or 7701b 2022-2026

What is the Form 8833 Rev December Treaty Based Return Position Disclosure Under Section 6114 Or 7701b

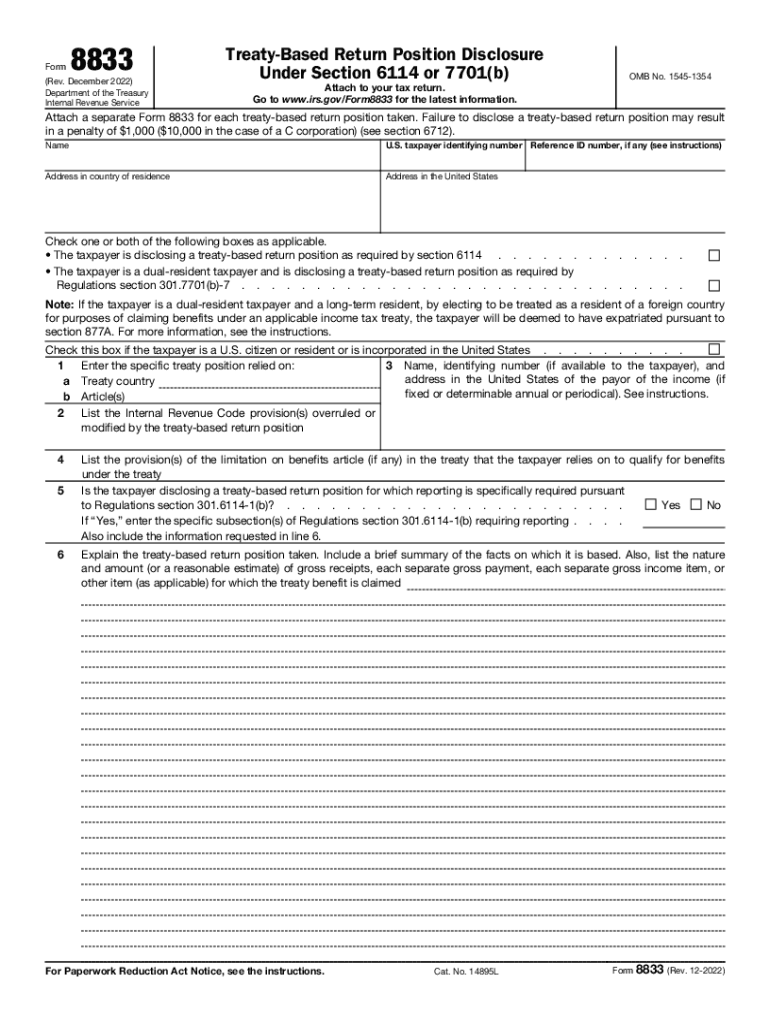

The Form 8833 is a crucial document for individuals and entities claiming a treaty-based return position under U.S. tax law. This form is specifically designed to disclose positions taken under tax treaties that may affect the tax obligations of U.S. taxpayers. By filing this form, taxpayers inform the IRS about their intention to utilize benefits provided by international tax treaties, which can help reduce or eliminate tax liabilities on certain types of income.

Steps to complete the Form 8833 Rev December Treaty Based Return Position Disclosure Under Section 6114 Or 7701b

Completing the Form 8833 involves several key steps to ensure accurate and compliant filing. First, gather all necessary information regarding your tax treaty position, including details about the income you are reporting and the specific treaty provisions you are invoking. Next, carefully fill out the form, ensuring that you provide all required information, such as your name, taxpayer identification number, and the relevant treaty country. After completing the form, review it thoroughly to confirm accuracy before submission.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of Form 8833. Taxpayers must adhere to these guidelines to avoid potential penalties. It is essential to understand the requirements for disclosure, including the necessity to file the form with your tax return and any deadlines associated with it. The IRS also emphasizes the importance of accurately reporting treaty positions to ensure compliance with U.S. tax laws.

Eligibility Criteria

To be eligible to file Form 8833, taxpayers must meet certain criteria. This includes being a U.S. person or a foreign person with income that is subject to U.S. tax. Additionally, the taxpayer must be claiming benefits under a specific tax treaty between the United States and another country. Understanding these eligibility requirements is vital for ensuring that the form is filed correctly and that the taxpayer can legitimately claim treaty benefits.

Disclosure Requirements

Disclosure requirements for Form 8833 are critical for maintaining compliance with U.S. tax regulations. Taxpayers must provide detailed information about their treaty-based positions, including the nature of the income and the specific provisions of the treaty being claimed. Failure to disclose this information accurately can result in penalties or disallowance of the claimed benefits. It is important to follow the IRS guidelines closely to ensure all necessary disclosures are made.

Penalties for Non-Compliance

Non-compliance with the filing requirements for Form 8833 can lead to significant penalties. The IRS may impose fines for failure to file the form or for filing it incorrectly. Additionally, taxpayers may lose the ability to claim treaty benefits, resulting in higher tax liabilities. Understanding these potential penalties underscores the importance of accurate and timely filing of Form 8833.

Quick guide on how to complete form 8833 rev december 2022 treaty based return position disclosure under section 6114 or 7701b

Effortlessly Prepare Form 8833 Rev December Treaty Based Return Position Disclosure Under Section 6114 Or 7701b on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the correct format and securely retain it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without any hold-ups. Manage Form 8833 Rev December Treaty Based Return Position Disclosure Under Section 6114 Or 7701b on any device using the airSlate SignNow Android or iOS applications and streamline any document-related task today.

The simplest method to modify and electronically sign Form 8833 Rev December Treaty Based Return Position Disclosure Under Section 6114 Or 7701b effortlessly

- Obtain Form 8833 Rev December Treaty Based Return Position Disclosure Under Section 6114 Or 7701b and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or mask sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Form 8833 Rev December Treaty Based Return Position Disclosure Under Section 6114 Or 7701b while ensuring excellent communication throughout your form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8833 rev december 2022 treaty based return position disclosure under section 6114 or 7701b

Create this form in 5 minutes!

People also ask

-

What is the index match function excel and how does it work?

The index match function excel is a powerful tool that combines two functions, INDEX and MATCH, to retrieve data from a specific location in a spreadsheet. This allows users to search for a value in a column and return a corresponding value from another column, making data analysis more efficient and accurate.

-

How can the index match function excel improve data accuracy in my reports?

Using the index match function excel enhances data accuracy by reducing the chances of errors that can occur with other lookup methods like VLOOKUP. It provides more flexibility, as you can look up values from any column and retrieve data from any other, ensuring that your reports reflect the correct figures.

-

Is airSlate SignNow compatible with Excel for using the index match function excel?

Yes, airSlate SignNow is fully compatible with Excel, allowing you to utilize the index match function excel alongside document management. This integration helps streamline your workflow by enabling easier eSigning of your Excel reports and templates.

-

What are the pricing options for airSlate SignNow if I plan to use the index match function excel?

airSlate SignNow offers a range of pricing options to accommodate businesses of all sizes. Whether you’re using the index match function excel for personal projects or within an organization, you'll find a cost-effective plan that fits your needs and budget.

-

Can I learn how to use the index match function excel through airSlate SignNow’s resources?

Absolutely! airSlate SignNow provides a wealth of resources, including tutorials and guides, to help users master functions like the index match function excel. These resources are designed to empower users in their document management tasks, enhancing overall productivity.

-

What benefits can I expect from using the index match function excel in my business?

Utilizing the index match function excel brings several benefits including more efficient data retrieval, greater flexibility in formulas, and improved accuracy in your data analysis. This not only saves time but also enhances decision-making by providing reliable information quickly.

-

Are there any specific integrations available with airSlate SignNow that enhance the index match function excel?

Yes, airSlate SignNow integrates with various applications that can complement the use of the index match function excel. These integrations streamline document management processes, enabling seamless workflows and efficient data handling.

Get more for Form 8833 Rev December Treaty Based Return Position Disclosure Under Section 6114 Or 7701b

- Residential lease renewal agreement new york form

- Exercising option purchase 497321510 form

- Assignment of lease and rent from borrower to lender new york form

- Ny assignment form

- Ny lanlord tenant guest law form

- Guaranty or guarantee of payment of rent new york form

- Letter from landlord to tenant as notice of default on commercial lease new york form

- Residential or rental lease extension agreement new york form

Find out other Form 8833 Rev December Treaty Based Return Position Disclosure Under Section 6114 Or 7701b

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself