Form 8833 Fillable Treaty Based Return Position Disclosure 2021

What is the Form 8833 Fillable Treaty Based Return Position Disclosure

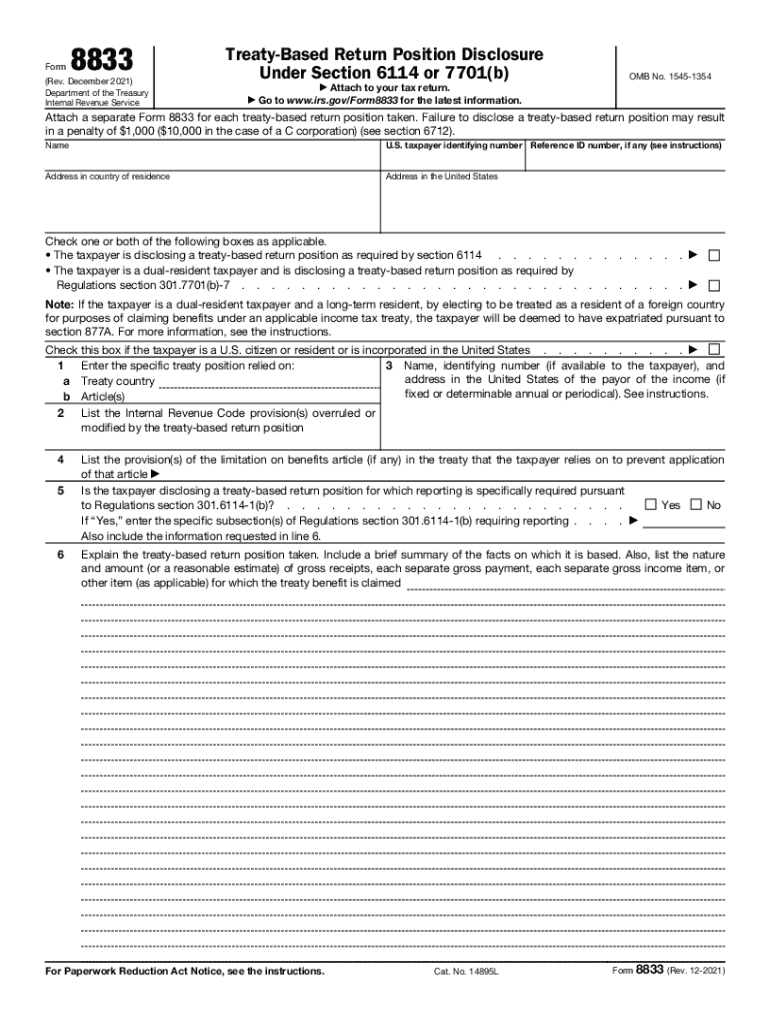

The Form 8833, officially known as the Treaty Based Return Position Disclosure, is a document required by the Internal Revenue Service (IRS) for certain taxpayers who are claiming benefits under an income tax treaty between the United States and another country. This form is essential for individuals or entities that wish to disclose their treaty-based positions to avoid potential tax liabilities. By filing this form, taxpayers can ensure compliance with IRS regulations while taking advantage of treaty provisions that may reduce or eliminate their U.S. tax obligations.

How to use the Form 8833 Fillable Treaty Based Return Position Disclosure

Using Form 8833 involves several straightforward steps. First, taxpayers should determine their eligibility to claim treaty benefits. Once eligibility is confirmed, the form can be filled out, detailing the specific treaty provisions being claimed. It is crucial to provide accurate information, including the taxpayer's identification details and the relevant treaty articles. After completing the form, it should be attached to the taxpayer's income tax return, ensuring that it is filed by the appropriate deadline to avoid penalties.

Steps to complete the Form 8833 Fillable Treaty Based Return Position Disclosure

Completing Form 8833 requires careful attention to detail. The following steps outline the process:

- Gather necessary information, including your tax identification number and details about the treaty.

- Indicate your name, address, and other identifying information in the designated sections.

- Specify the treaty provisions you are claiming and provide a brief explanation of your position.

- Review the form for accuracy and completeness before submission.

- Attach the completed form to your tax return and submit it to the IRS by the deadline.

Key elements of the Form 8833 Fillable Treaty Based Return Position Disclosure

Form 8833 includes several key elements that are vital for proper completion. These elements consist of:

- Taxpayer Information: This section requires the taxpayer's name, address, and identification number.

- Treaty Information: Taxpayers must indicate which tax treaty they are utilizing and the specific articles relevant to their claim.

- Disclosure Statement: A brief explanation of the treaty position being claimed must be provided, detailing the rationale behind the claim.

- Signature: The form must be signed and dated by the taxpayer or an authorized representative.

IRS Guidelines

The IRS provides specific guidelines for the completion and submission of Form 8833. Taxpayers should refer to the IRS instructions for Form 8833 to ensure compliance with all requirements. These guidelines outline the necessary information to include, the proper filing procedures, and the consequences of failing to disclose treaty positions accurately. Adhering to these guidelines is crucial for maintaining good standing with the IRS and avoiding potential penalties.

Filing Deadlines / Important Dates

Filing deadlines for Form 8833 align with the due dates for the taxpayer's annual income tax return. Generally, this means that the form must be submitted by April 15 for most individual taxpayers. If an extension is filed, Form 8833 must also be submitted by the extended deadline. It is important for taxpayers to stay informed about any changes to these dates to ensure timely compliance.

Quick guide on how to complete form 8833 fillable treaty based return position disclosure

Complete Form 8833 Fillable Treaty Based Return Position Disclosure effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed forms, allowing you to access the necessary documents and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage Form 8833 Fillable Treaty Based Return Position Disclosure on any platform with the airSlate SignNow apps for Android or iOS and streamline any document-related task today.

How to modify and eSign Form 8833 Fillable Treaty Based Return Position Disclosure with ease

- Find Form 8833 Fillable Treaty Based Return Position Disclosure and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate issues with lost or misplaced documents, frustrating form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Form 8833 Fillable Treaty Based Return Position Disclosure to ensure exceptional communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8833 fillable treaty based return position disclosure

Create this form in 5 minutes!

How to create an eSignature for the form 8833 fillable treaty based return position disclosure

The way to generate an electronic signature for your PDF document online

The way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature straight from your smart phone

The best way to make an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF document on Android OS

People also ask

-

What is form 8833 and who should use it?

Form 8833, also known as the Treaty-Based Return Position Disclosure, is used by taxpayers to disclose positions taken under tax treaties. Individuals and entities who are claiming benefits under a US tax treaty should use form 8833 to ensure compliance with IRS regulations and avoid penalties.

-

How can airSlate SignNow assist with filling out form 8833?

airSlate SignNow offers a user-friendly platform that simplifies the process of filling out form 8833. With its eSignature capabilities and document management features, users can easily complete and send the form securely, streamlining the submission process.

-

Are there any fees associated with using airSlate SignNow for form 8833?

Yes, airSlate SignNow offers various pricing plans depending on your business needs. You can choose a plan that fits your budget while gaining access to essential features for efficiently managing form 8833 and other documents.

-

Can I track the status of my form 8833 sent via airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking for all documents, including form 8833. You will receive notifications regarding document status, ensuring you know when forms are completed or viewed by the recipients.

-

What features does airSlate SignNow offer for managing form 8833?

airSlate SignNow offers a range of features ideal for managing form 8833, including customizable templates, cloud storage, and the ability to add multiple signers. These tools help simplify the document management process while ensuring compliance and security.

-

Is airSlate SignNow compliant with regulatory standards for form 8833?

Yes, airSlate SignNow complies with necessary regulatory standards to ensure the secure handling of sensitive documents, including form 8833. Our platform uses advanced encryption and security measures to protect your information and maintain confidentiality.

-

How does airSlate SignNow integrate with other applications for form 8833 processing?

airSlate SignNow seamlessly integrates with a variety of applications, enhancing the processing of form 8833. You can connect it with CRM systems, cloud storage, and other tools to streamline your workflow and improve overall efficiency.

Get more for Form 8833 Fillable Treaty Based Return Position Disclosure

- Oklahoma legal last will and testament form for single person with no children

- Oklahoma legal last will and testament form for divorced person not remarried with adult children

- Oklahoma legal last will and testament form for divorced person not remarried with no children

- Oklahoma last will form

- Oklahoma legal last will and testament form for a widow or widower with adult and minor children

- Oregon legal last will and testament for married person with minor children from prior marriage form

- Oregon legal last will and testament form for married person with adult children from prior marriage

- Oregon legal last will and testament form for married person with adult children

Find out other Form 8833 Fillable Treaty Based Return Position Disclosure

- How Can I Sign Wyoming Room lease agreement

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself