Form 8833, Treaty Based Return Position Disclosure under 2020

What is the Form 8833?

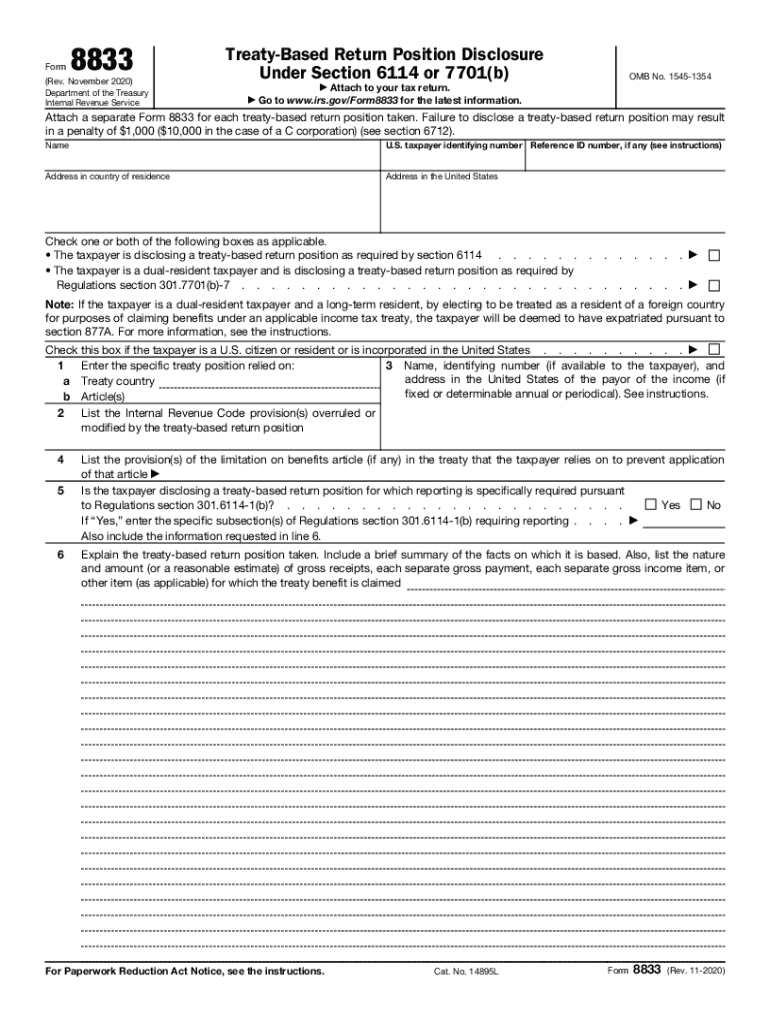

The Form 8833, officially known as the Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b), is a tax form used by U.S. taxpayers to disclose their position regarding tax treaties between the United States and other countries. This form is particularly relevant for nonresident aliens and foreign entities claiming benefits under a tax treaty. By filing this form, taxpayers can avoid double taxation and ensure compliance with U.S. tax laws while taking advantage of treaty benefits.

How to use the Form 8833

Using the Form 8833 involves a clear understanding of your tax treaty position. Taxpayers must accurately report their treaty-based positions when filing their federal income tax returns. The form must be attached to the return, providing detailed information about the specific treaty benefits being claimed. It is essential to ensure that all information is complete and accurate to avoid potential penalties or issues with the IRS.

Steps to complete the Form 8833

Completing the Form 8833 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information about the applicable tax treaty.

- Fill out the identifying information, including name, address, and taxpayer identification number.

- Detail the specific treaty provisions being claimed, including the article number and type of income.

- Provide a description of the facts supporting the treaty position.

- Sign and date the form to certify that the information provided is accurate.

Legal use of the Form 8833

The legal use of the Form 8833 is crucial for ensuring compliance with U.S. tax laws. This form serves as a declaration to the IRS regarding the taxpayer's position under a tax treaty. Filing the form correctly can protect taxpayers from penalties associated with underreporting income or failing to disclose treaty positions. It is advisable to consult a tax professional if there are uncertainties regarding treaty claims or the completion of the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8833 align with the taxpayer's return due date. Generally, individual tax returns are due on April fifteenth. However, if an extension is filed, the deadline may extend to October fifteenth. It is essential to file the Form 8833 by the due date of the tax return to ensure that the treaty benefits are recognized by the IRS.

Penalties for Non-Compliance

Failing to file the Form 8833 or providing inaccurate information can lead to significant penalties. The IRS may impose fines for not disclosing treaty positions, which can include a penalty of up to $1,000 for each failure to file. Additionally, taxpayers may face issues with audits or adjustments to their tax returns. Therefore, it is vital to ensure that the form is completed accurately and submitted on time.

Quick guide on how to complete form 8833 treaty based return position disclosure under

Accomplish Form 8833, Treaty Based Return Position Disclosure Under effortlessly on any device

Digital document management has gained popularity among organizations and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed papers, as you can obtain the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without any delays. Manage Form 8833, Treaty Based Return Position Disclosure Under on any platform with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Form 8833, Treaty Based Return Position Disclosure Under without stress

- Find Form 8833, Treaty Based Return Position Disclosure Under and click on Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the issues of lost or misfiled documents, tedious form searching, or errors that require reprinting new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you select. Alter and eSign Form 8833, Treaty Based Return Position Disclosure Under and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8833 treaty based return position disclosure under

Create this form in 5 minutes!

How to create an eSignature for the form 8833 treaty based return position disclosure under

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The best way to make an eSignature for a PDF on Android OS

People also ask

-

What is form 8833 and why is it important?

Form 8833 is a tax form used by U.S. citizens and residents to claim certain benefits under an income tax treaty. Understanding this form is crucial for ensuring compliance with U.S. tax regulations while benefiting from tax relief. With airSlate SignNow, you can easily prepare, send, and eSign your form 8833 securely.

-

How can airSlate SignNow help with form 8833?

airSlate SignNow streamlines the process of filling out and submitting form 8833. Our user-friendly platform allows you to fill out the form electronically, ensuring accuracy and saving time. Additionally, eSigning your form 8833 with SignNow adds an extra layer of security and efficiency.

-

Is there a cost associated with using airSlate SignNow for form 8833?

Yes, there is a pricing structure for using airSlate SignNow, but it is designed to be cost-effective for businesses. Various plans are available to suit different needs, ensuring you get the best value while managing your form 8833 submissions. Pricing is transparent with no hidden fees.

-

What features does airSlate SignNow offer for document management like form 8833?

airSlate SignNow provides a robust set of features for managing documents such as form 8833, including templates, real-time collaboration, and multiple signing options. These features enhance the efficiency of handling important tax documents while ensuring compliance. Our platform also supports secure storage for all your signed forms.

-

Can I integrate airSlate SignNow with other applications for managing form 8833?

Absolutely! airSlate SignNow offers seamless integrations with popular applications like Google Drive, Dropbox, and CRM systems. This integration allows for a smoother workflow when managing your form 8833 documents and ensuring they are easily accessible across platforms.

-

What benefits does eSigning form 8833 offer over traditional signing methods?

eSigning form 8833 through airSlate SignNow provides numerous benefits, including faster turnaround times and enhanced security. By eliminating the need for physical copies, you reduce the risk of loss or tampering. Moreover, eSigning is more environmentally friendly and convenient, allowing you to sign from anywhere.

-

Is airSlate SignNow secure for submitting sensitive forms like form 8833?

Yes, airSlate SignNow prioritizes security to protect your sensitive documents, including form 8833. We utilize advanced encryption protocols and secure storage solutions to keep your data safe. You can confidently submit your forms knowing that we take privacy seriously.

Get more for Form 8833, Treaty Based Return Position Disclosure Under

Find out other Form 8833, Treaty Based Return Position Disclosure Under

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement