S Hrg 117 459CLOSING the TAX GAP LOST REVENUE from NONCOMPLIANCE 2022

Understanding the IRS 6627 Form

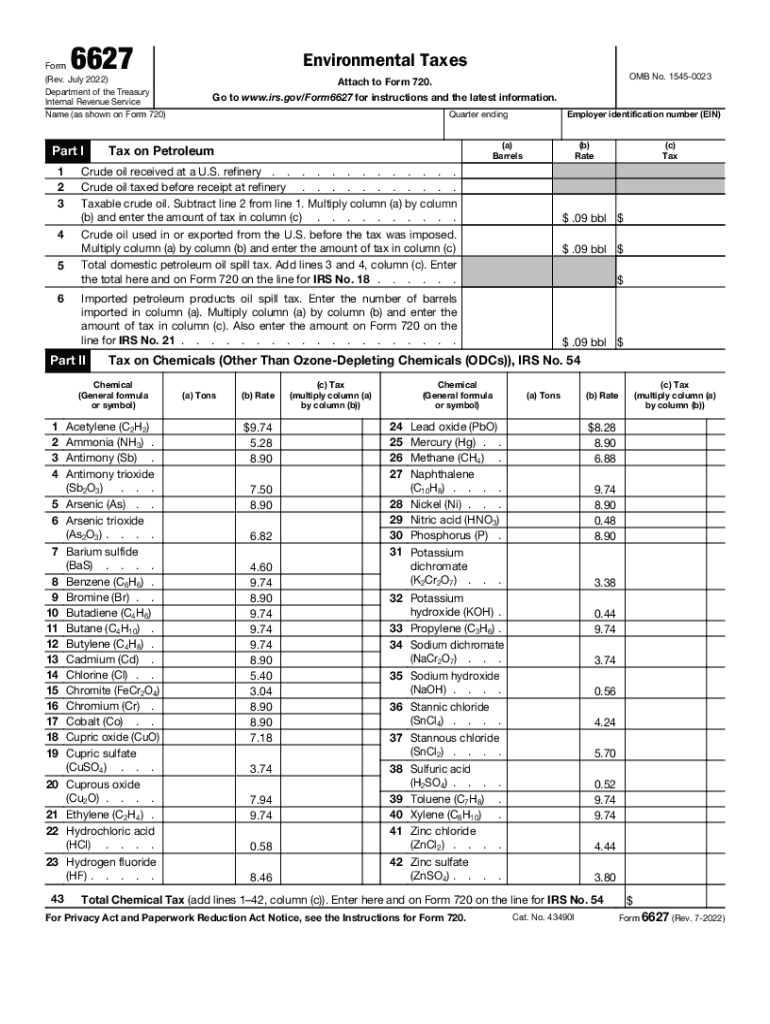

The IRS 6627 form, also known as the Environmental Taxes form, is used to report and pay certain environmental taxes imposed under the Internal Revenue Code. This form is particularly relevant for businesses that engage in activities subject to these taxes, such as the tax on the sale of ozone-depleting chemicals. Completing the 6627 form accurately is essential for compliance with federal tax regulations.

Steps to Complete the IRS 6627 Form

Filling out the IRS 6627 form involves several key steps to ensure accuracy and compliance:

- Gather necessary information, including business details and tax identification numbers.

- Identify the specific environmental taxes applicable to your business activities.

- Fill out the form sections accurately, ensuring all required fields are completed.

- Review the completed form for accuracy before submission.

- Submit the form by the appropriate deadline, either electronically or by mail.

Legal Use of the IRS 6627 Form

The IRS 6627 form serves a crucial legal function in the reporting and payment of environmental taxes. It is legally binding when completed correctly and submitted on time. Failure to comply with the requirements can lead to penalties, including fines and interest on unpaid taxes. Understanding the legal implications of this form is essential for businesses to maintain compliance with federal regulations.

Filing Deadlines for the IRS 6627 Form

Timely filing of the IRS 6627 form is critical to avoid penalties. The filing deadlines generally align with the business's tax return due date. For most businesses, this means submitting the form by April fifteenth of the following tax year. However, specific deadlines may vary based on the business structure and tax year-end, so it is important to verify the exact dates relevant to your situation.

Penalties for Non-Compliance

Non-compliance with the IRS 6627 form requirements can result in significant penalties. These may include monetary fines for late submissions or inaccuracies on the form. Additionally, businesses may face interest charges on any unpaid taxes. Understanding these potential penalties emphasizes the importance of accurate and timely filing.

IRS Guidelines for the 6627 Form

The IRS provides specific guidelines for completing the 6627 form, including detailed instructions on how to report various environmental taxes. These guidelines outline the necessary documentation and calculations required for accurate reporting. Familiarizing yourself with these guidelines can help ensure compliance and reduce the risk of errors in your submission.

Quick guide on how to complete shrg 117 459closing the tax gap lost revenue from noncompliance

Complete S Hrg 117 459CLOSING THE TAX GAP LOST REVENUE FROM NONCOMPLIANCE effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed papers, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to compose, amend, and eSign your documents swiftly without holdups. Manage S Hrg 117 459CLOSING THE TAX GAP LOST REVENUE FROM NONCOMPLIANCE on any device using airSlate SignNow’s Android or iOS applications and enhance any document-oriented process today.

The easiest method to amend and eSign S Hrg 117 459CLOSING THE TAX GAP LOST REVENUE FROM NONCOMPLIANCE without hassle

- Locate S Hrg 117 459CLOSING THE TAX GAP LOST REVENUE FROM NONCOMPLIANCE and then click Get Form to begin.

- Make use of the tools available to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or mislaid documents, tedious form hunts, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you select. Alter and eSign S Hrg 117 459CLOSING THE TAX GAP LOST REVENUE FROM NONCOMPLIANCE and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct shrg 117 459closing the tax gap lost revenue from noncompliance

Create this form in 5 minutes!

People also ask

-

What is the pricing structure for airSlate SignNow 6627?

The pricing structure for airSlate SignNow 6627 is designed to cater to various business needs. We offer tiered subscriptions that allow you to choose a plan based on your document signing volume and specific feature requirements. This ensures that you get the best value for your investment in document management.

-

What features does airSlate SignNow 6627 offer?

airSlate SignNow 6627 provides a robust set of features that include secure eSignature capabilities, document tracking, and template creation. These features are designed to enhance workflow efficiency and ensure that your documents are handled securely and promptly. With airSlate SignNow 6627, you can streamline your entire signing process.

-

How can airSlate SignNow 6627 benefit my business?

airSlate SignNow 6627 can signNowly benefit your business by reducing the time spent on document processing. With our easy-to-use interface, you can send, sign, and manage documents quickly. This efficiency translates into improved productivity and faster turnaround times for contracts and other essential documents.

-

Does airSlate SignNow 6627 integrate with other tools?

Yes, airSlate SignNow 6627 offers seamless integrations with popular tools such as Google Drive, Salesforce, and Microsoft Office. This allows you to utilize airSlate SignNow 6627 without altering your existing workflow. Enhanced integration capabilities mean that you can easily connect documents and data across platforms.

-

Is airSlate SignNow 6627 secure for my documents?

Absolutely. airSlate SignNow 6627 prioritizes security by implementing advanced encryption protocols and compliance with industry standards like GDPR and HIPAA. Your documents are safeguarded throughout the signing process, ensuring that sensitive information remains confidential and protected against unauthorized access.

-

Can multiple users access airSlate SignNow 6627?

Yes, airSlate SignNow 6627 allows multiple users to access the platform under a single account, depending on your subscription plan. This feature is ideal for teams that need to collaborate on document signing and management. Each user can have their own credentials, ensuring a streamlined, collective workflow.

-

What types of documents can I manage with airSlate SignNow 6627?

With airSlate SignNow 6627, you can manage a wide variety of document types, including contracts, agreements, and forms. Our platform supports various file formats, allowing you to upload and send documents easily. This versatility enables businesses to handle all their signing needs in one place.

Get more for S Hrg 117 459CLOSING THE TAX GAP LOST REVENUE FROM NONCOMPLIANCE

- Inventory and condition of leased premises for pre lease and post lease new york form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out new york form

- Property manager agreement new york form

- Partial rent payments form

- Tenants maintenance repair request form new york

- Guaranty attachment to lease for guarantor or cosigner new york form

- Amendment to lease or rental agreement new york form

- Warning notice due to complaint from neighbors new york form

Find out other S Hrg 117 459CLOSING THE TAX GAP LOST REVENUE FROM NONCOMPLIANCE

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement

- Sign Arkansas Real Estate Stock Certificate Myself

- Sign California Real Estate IOU Safe

- Sign Connecticut Real Estate Business Plan Template Simple