6627 2021

What is the 6627?

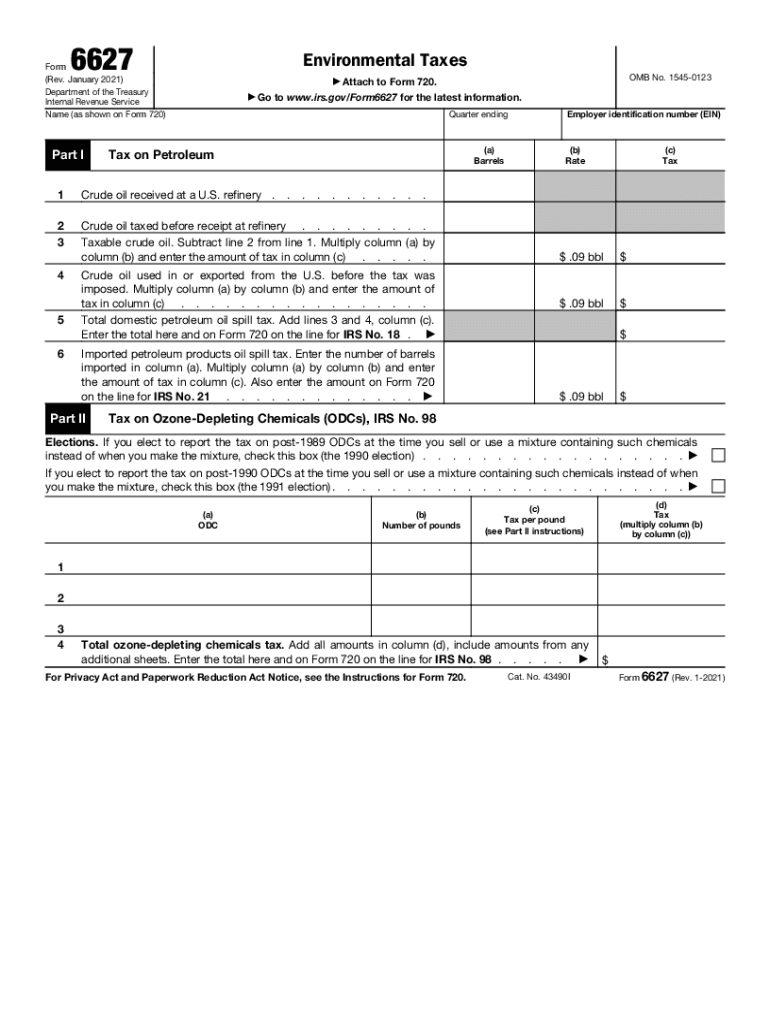

The 6627 form, also known as the IRS 6627, is a tax document used to report environmental taxes imposed on certain activities and products. This form is specifically designed for businesses and individuals who are subject to these taxes, which may include various environmental fees related to the production, importation, or sale of specific goods. Understanding the purpose of the 6627 form is crucial for compliance with federal regulations and ensuring that all applicable taxes are accurately reported and paid.

How to use the 6627

Using the 6627 form involves several key steps to ensure proper completion and submission. First, gather all necessary information regarding the environmental taxes applicable to your business or personal activities. This may include details about the products or services that incur these taxes. Next, accurately fill out the form by entering the required data in the designated fields. It is important to review the information for accuracy before submission. Finally, submit the completed form to the IRS by the specified deadline to avoid any penalties or compliance issues.

Steps to complete the 6627

Completing the 6627 form requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Gather all relevant documentation related to environmental taxes.

- Fill out the form by providing accurate information regarding your tax obligations.

- Double-check all entries for correctness and completeness.

- Sign and date the form as required.

- Submit the form to the IRS, either electronically or via mail, before the deadline.

Legal use of the 6627

The legal use of the 6627 form is governed by federal tax laws and regulations. It is essential to ensure that the form is completed in accordance with the guidelines set forth by the IRS. This includes using the most current version of the form and adhering to all filing requirements. Proper use of the 6627 form not only helps in fulfilling tax obligations but also protects against potential legal issues that may arise from non-compliance.

Filing Deadlines / Important Dates

Filing deadlines for the 6627 form are critical to avoid penalties and interest. Generally, the form must be submitted by the due date of your tax return. For most taxpayers, this means April 15 of the following year. However, specific deadlines may vary based on individual circumstances, such as extensions or changes in tax law. It is advisable to stay informed about any updates regarding filing dates to ensure timely submission.

Who Issues the Form

The IRS is the authoritative body that issues the 6627 form. As part of its responsibility to administer federal tax laws, the IRS provides this form to facilitate the reporting of environmental taxes. Taxpayers can obtain the form directly from the IRS website or through authorized tax professionals who assist with tax preparation and filing.

Quick guide on how to complete 6627

Complete 6627 effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely preserve it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Manage 6627 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to modify and eSign 6627 with ease

- Locate 6627 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and then click on the Done button to save your changes.

- Select how you wish to send your form—via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign 6627 to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 6627

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to the number 6627?

airSlate SignNow is a powerful eSignature solution that allows businesses to efficiently send and sign documents. The number 6627 is often associated with our product code, making it easier for customers to reference when seeking support or information about our features.

-

What are the pricing options available for airSlate SignNow 6627?

The pricing for airSlate SignNow under the code 6627 is designed to be budget-friendly, catering to various business sizes. We offer flexible plans, including monthly and annual subscriptions, ensuring that you only pay for what you need.

-

What key features does airSlate SignNow 6627 offer?

airSlate SignNow 6627 includes features such as document templates, real-time tracking, and automated workflows. These functionalities empower users to streamline their eSigning processes and enhance productivity.

-

How does airSlate SignNow 6627 ensure document security?

Security is a top priority for airSlate SignNow 6627, incorporating military-grade encryption and compliance with leading regulations. This ensures that your documents are safe and secure, giving you peace of mind during the signing process.

-

Can airSlate SignNow 6627 integrate with other software applications?

Yes, airSlate SignNow 6627 seamlessly integrates with various third-party applications like Google Drive, Dropbox, and CRM systems. This integration capability enhances your workflow by allowing you to manage documents directly from your favorite apps.

-

What are the benefits of using airSlate SignNow 6627 for businesses?

Using airSlate SignNow 6627 helps businesses save time and reduce costs associated with traditional signing methods. The efficiency of electronic signatures improves document turnaround time, leading to faster business transactions.

-

Is there a mobile application available for airSlate SignNow 6627?

Yes, airSlate SignNow 6627 offers a mobile application that enables users to send and sign documents on-the-go. The mobile app ensures that you can manage your documents from anywhere, offering flexibility for today’s fast-paced business environment.

Get more for 6627

- Notice of intent to enforce forfeiture provisions of contact for deed west virginia form

- Final notice of forfeiture and request to vacate property under contract for deed west virginia form

- Buyers request for accounting from seller under contract for deed west virginia form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed west virginia form

- General notice of default for contract for deed west virginia form

- West virginia disclosure 497431521 form

- Sellers disclosure of financing terms for residential property in connection with contract or agreement for deed aka land 497431522 form

- West virginia annual form

Find out other 6627

- How Do I Sign Wyoming Life Sciences Confidentiality Agreement

- Sign Iowa Plumbing Contract Safe

- Sign Iowa Plumbing Quitclaim Deed Computer

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form