About Form 6627, Environmental Taxes 2024-2026

What is the 6627 form, Environmental Taxes

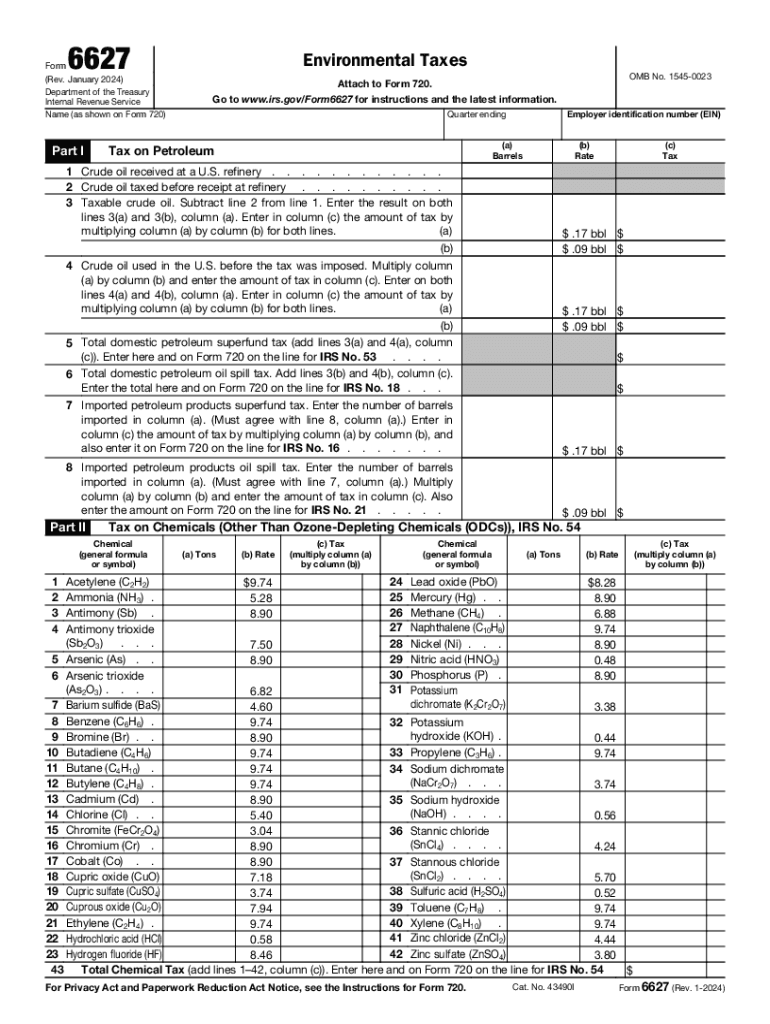

The 6627 form, also known as the Environmental Taxes form, is a document required by the Internal Revenue Service (IRS) for reporting certain environmental taxes. This form is primarily used by businesses and individuals who are liable for taxes related to the importation of specific products that may have environmental impacts, such as fuels and chemicals. The purpose of the form is to ensure compliance with federal environmental tax regulations, which aim to promote environmental responsibility and sustainability.

Steps to complete the 6627 form

Completing the 6627 form involves several key steps to ensure accurate reporting. Begin by gathering all necessary information regarding the products subject to environmental taxes. This includes details about the types and quantities of products imported or produced. Next, fill out the form by providing your identifying information, including your name, address, and taxpayer identification number. Indicate the applicable environmental taxes in the designated sections, ensuring that you calculate the amounts correctly based on the IRS guidelines. Finally, review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines associated with the 6627 form to avoid penalties. Generally, the form must be filed annually, with the deadline aligning with the tax return due date for the reporting year. For most taxpayers, this means the form is due by April 15 of the following year. However, if you are filing for an extension, be sure to check the specific extended deadlines to ensure compliance.

IRS Guidelines

The IRS provides comprehensive guidelines for completing and submitting the 6627 form. These guidelines outline the specific environmental taxes that must be reported, as well as the calculation methods for determining tax liabilities. It is crucial to refer to the latest IRS publications and instructions related to the 6627 form to ensure compliance with any changes in tax laws or regulations. Additionally, the IRS may offer resources, such as FAQs and instructional videos, to assist taxpayers in understanding their obligations.

Penalties for Non-Compliance

Failure to file the 6627 form or inaccuracies in reporting can result in significant penalties. The IRS may impose fines for late submissions, as well as additional penalties for underreporting environmental taxes. In severe cases, non-compliance may lead to audits or further legal action. It is advisable for taxpayers to maintain accurate records and seek assistance if they are uncertain about their filing requirements to mitigate the risk of penalties.

How to obtain the 6627 form

The 6627 form can be obtained directly from the IRS website or through authorized tax professionals. The IRS provides both printable and fillable versions of the form, allowing taxpayers to choose the format that best suits their needs. For those who prefer digital submission, the fillable version can be completed online and submitted electronically, streamlining the filing process. It is important to ensure that you are using the most current version of the form to comply with IRS regulations.

Quick guide on how to complete about form 6627 environmental taxes

Complete About Form 6627, Environmental Taxes effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and physically signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Manage About Form 6627, Environmental Taxes on any device with airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to modify and electronically sign About Form 6627, Environmental Taxes with ease

- Find About Form 6627, Environmental Taxes and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Select how you wish to share your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate worries about missing or lost documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your needs in document management in just a few clicks from any device you choose. Modify and electronically sign About Form 6627, Environmental Taxes to ensure seamless communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 6627 environmental taxes

Create this form in 5 minutes!

How to create an eSignature for the about form 6627 environmental taxes

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow 6627 and how does it work?

airSlate SignNow 6627 is a powerful eSignature solution that allows businesses to send and sign documents electronically. It streamlines the signing process, making it faster and more efficient. With its user-friendly interface, users can easily create, send, and manage documents from anywhere.

-

What are the pricing options for airSlate SignNow 6627?

airSlate SignNow 6627 offers flexible pricing plans to accommodate businesses of all sizes. Whether you are a small startup or a large enterprise, you can choose a plan that fits your budget and needs. Each plan includes essential features to ensure you get the most value out of your investment.

-

What features are included in airSlate SignNow 6627?

airSlate SignNow 6627 includes a variety of features such as document templates, real-time tracking, and customizable workflows. These features enhance productivity and ensure that your documents are processed efficiently. Additionally, the platform supports multiple file formats for added convenience.

-

How can airSlate SignNow 6627 benefit my business?

By using airSlate SignNow 6627, your business can save time and reduce costs associated with traditional paper-based processes. The platform enhances collaboration and speeds up the signing process, allowing you to close deals faster. Overall, it contributes to a more streamlined and efficient workflow.

-

Is airSlate SignNow 6627 secure for document signing?

Yes, airSlate SignNow 6627 prioritizes security with advanced encryption and compliance with industry standards. Your documents are protected throughout the signing process, ensuring that sensitive information remains confidential. This level of security helps build trust with your clients and partners.

-

Can I integrate airSlate SignNow 6627 with other applications?

Absolutely! airSlate SignNow 6627 offers seamless integrations with various applications such as CRM systems, cloud storage services, and productivity tools. This flexibility allows you to enhance your existing workflows and improve overall efficiency by connecting your favorite tools.

-

What support options are available for airSlate SignNow 6627 users?

airSlate SignNow 6627 provides comprehensive support options, including a knowledge base, live chat, and email support. Users can access resources to help them navigate the platform and resolve any issues they may encounter. This ensures that you have the assistance you need to maximize your experience.

Get more for About Form 6627, Environmental Taxes

- Letter from landlord to tenant that sublease granted rent paid by subtenant old tenant released from liability for rent indiana form

- Letter from tenant to landlord about landlords refusal to allow sublease is unreasonable indiana form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration indiana form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497306894 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement indiana form

- Letter landlord rental 497306896 form

- Letter from landlord to tenant as notice to remove unauthorized inhabitants indiana form

- Letter from tenant to landlord utility shut off notice to landlord due to tenant vacating premises indiana form

Find out other About Form 6627, Environmental Taxes

- eSign Delaware Software Development Proposal Template Free

- eSign Nevada Software Development Proposal Template Mobile

- Can I eSign Colorado Mobile App Design Proposal Template

- How Can I eSignature California Cohabitation Agreement

- How Do I eSignature Colorado Cohabitation Agreement

- How Do I eSignature New Jersey Cohabitation Agreement

- Can I eSign Utah Mobile App Design Proposal Template

- eSign Arkansas IT Project Proposal Template Online

- eSign North Dakota IT Project Proposal Template Online

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template