About Form 6627, Environmental Taxes IRS 2023

What is Form 6627, Environmental Taxes

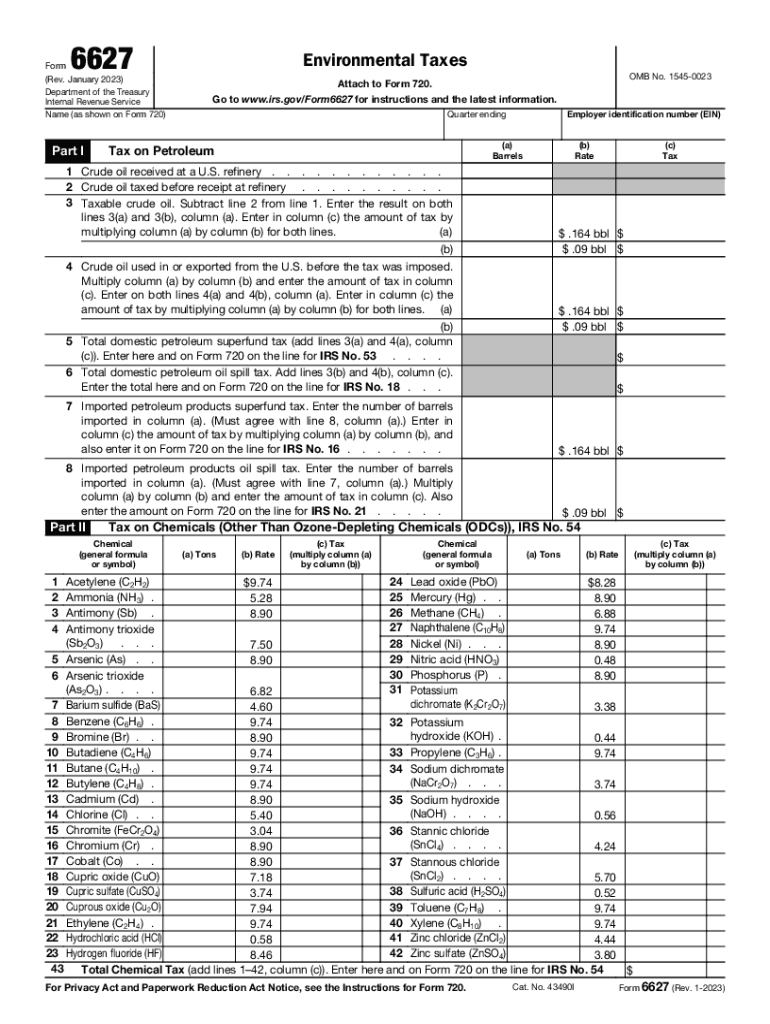

Form 6627, officially known as the Environmental Taxes form, is utilized by businesses and individuals to report and pay environmental taxes imposed by the Internal Revenue Service (IRS). This form is particularly relevant for those who are liable for taxes related to the production and importation of certain products that can negatively impact the environment. These taxes aim to encourage environmentally responsible practices and compliance with federal regulations.

Steps to Complete Form 6627

Completing Form 6627 requires careful attention to detail to ensure accuracy and compliance. Here are the essential steps to follow:

- Gather Necessary Information: Collect all relevant data regarding your environmental tax liabilities, including production and importation details.

- Fill Out the Form: Complete the form by entering the required information in each designated section, ensuring that all figures are accurate.

- Calculate Taxes Owed: Use the provided instructions to calculate the total environmental taxes owed based on the information entered.

- Review for Accuracy: Double-check all entries for accuracy and completeness before submission.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in-person, and ensure it is sent before the deadline.

Legal Use of Form 6627

Form 6627 is legally binding when completed and submitted in accordance with IRS regulations. To ensure its validity, it is crucial to adhere to the guidelines set forth by the IRS, including proper signature requirements and submission protocols. The form must be filed accurately to avoid penalties and ensure compliance with federal tax laws.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Form 6627 is essential to avoid late penalties. Generally, the form must be submitted annually, aligned with the taxpayer's regular tax return deadlines. Specific dates may vary based on the tax year and any extensions granted. It is advisable to keep track of these deadlines to ensure timely filing.

Required Documents

To complete Form 6627, you will need several supporting documents. These may include:

- Records of production and importation of taxable products.

- Previous tax returns that may affect current liabilities.

- Any correspondence from the IRS regarding environmental taxes.

Having these documents readily available will streamline the completion process and help ensure accuracy.

Penalties for Non-Compliance

Failure to file Form 6627 or inaccuracies in reporting can result in significant penalties. The IRS may impose fines for late submissions, underpayment of taxes, or failure to comply with environmental tax regulations. It is crucial to understand these potential repercussions to maintain compliance and avoid unnecessary financial burdens.

Quick guide on how to complete about form 6627 environmental taxes irs

Effortlessly Prepare About Form 6627, Environmental Taxes IRS on Any Device

Web-based document management has gained traction among organizations and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the correct form and securely archive it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents promptly and without complications. Manage About Form 6627, Environmental Taxes IRS on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centric procedure today.

Your Guide to Edit and Electronically Sign About Form 6627, Environmental Taxes IRS with Ease

- Find About Form 6627, Environmental Taxes IRS and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it directly to your computer.

Eliminate concerns about missing or lost files, tedious form searching, or errors that necessitate printing additional document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign About Form 6627, Environmental Taxes IRS to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct about form 6627 environmental taxes irs

Create this form in 5 minutes!

How to create an eSignature for the about form 6627 environmental taxes irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the price of the airSlate SignNow service 6627?

The pricing for airSlate SignNow 6627 is designed to be cost-effective, with various plans tailored to meet the needs of businesses of all sizes. Depending on the features you require, you can choose from monthly or annual billing options that fit your budget. We recommend checking our pricing page for specific details and any ongoing promotions related to 6627.

-

What features does airSlate SignNow 6627 offer?

airSlate SignNow 6627 offers a wide range of features including electronic signatures, document templates, and advanced workflow automation. These tools enable businesses to send, sign, and manage documents efficiently. Additionally, 6627 provides secure storage and real-time tracking to enhance your document management process.

-

How can airSlate SignNow 6627 benefit my business?

Using airSlate SignNow 6627 can signNowly streamline your document management processes, leading to increased productivity and reduced turnaround times. By simplifying the signing process, you can improve customer experience and satisfaction. The overall efficiency gained with 6627 allows your team to focus on core business tasks.

-

Is airSlate SignNow 6627 secure?

Yes, airSlate SignNow 6627 employs industry-standard security measures to protect your documents and personal information. This includes encryption, secure authentication, and compliance with regulations such as GDPR and eIDAS. Users can trust that their data is safe while using 6627 for electronic signatures.

-

Can I integrate airSlate SignNow 6627 with other applications?

Absolutely! airSlate SignNow 6627 offers seamless integrations with popular applications like Salesforce, Google Drive, and Microsoft Office. These integrations allow users to add automated signing workflows directly into their existing processes, enhancing productivity and efficiency.

-

What types of documents can I sign using airSlate SignNow 6627?

With airSlate SignNow 6627, you can sign a variety of document types including contracts, agreements, and forms. The platform allows you to upload documents in multiple formats, ensuring flexibility for your signing needs. This versatility is particularly beneficial for businesses that handle diverse document types.

-

How easy is it to use airSlate SignNow 6627?

airSlate SignNow 6627 is designed with user-friendliness in mind. The intuitive interface allows users to easily navigate the platform, making the document sending and signing process straightforward. Any business can quickly adapt to 6627, no matter their technical expertise.

Get more for About Form 6627, Environmental Taxes IRS

- Joint jud ct form

- Notice of changed condition nonadversarial divorce dissolution of marriage form

- Connecticut jd sc 28 civil form

- Contestacin a la demanda jud ct form

- Connecticut joint divorce form

- Contact a court clerk or an ada contact person jud ct form

- Employer withholder withholding form

- How to fill cv 2013 form

Find out other About Form 6627, Environmental Taxes IRS

- How Can I Sign Maine Real Estate Separation Agreement

- How Do I Sign Massachusetts Real Estate LLC Operating Agreement

- Can I Sign Massachusetts Real Estate LLC Operating Agreement

- Sign Massachusetts Real Estate Quitclaim Deed Simple

- Sign Massachusetts Sports NDA Mobile

- Sign Minnesota Real Estate Rental Lease Agreement Now

- How To Sign Minnesota Real Estate Residential Lease Agreement

- Sign Mississippi Sports Confidentiality Agreement Computer

- Help Me With Sign Montana Sports Month To Month Lease

- Sign Mississippi Real Estate Warranty Deed Later

- How Can I Sign Mississippi Real Estate Affidavit Of Heirship

- How To Sign Missouri Real Estate Warranty Deed

- Sign Nebraska Real Estate Letter Of Intent Online

- Sign Nebraska Real Estate Limited Power Of Attorney Mobile

- How Do I Sign New Mexico Sports Limited Power Of Attorney

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding