it NRS Ohio Nonresident Statement 2021

What is the IT NRS Ohio Nonresident Statement

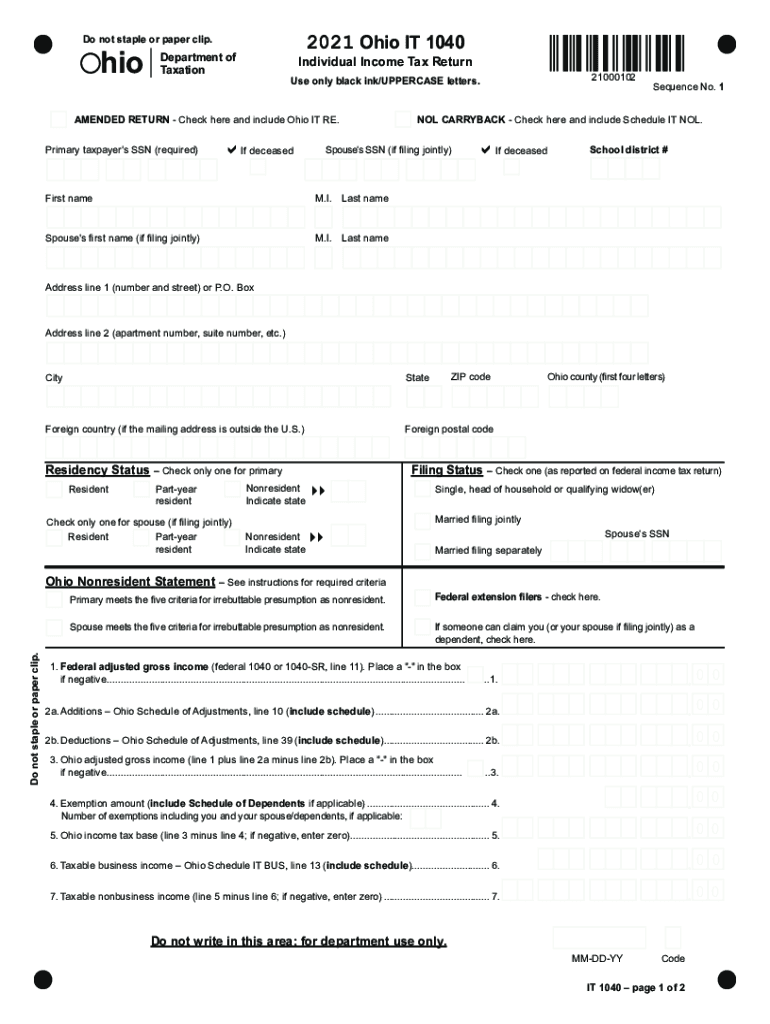

The IT NRS Ohio Nonresident Statement is a tax form used by nonresident individuals who earn income in Ohio. This form is essential for reporting income and ensuring proper tax compliance for those who do not reside in the state but have financial obligations there. It helps determine the appropriate amount of tax owed based on the income generated within Ohio, allowing nonresidents to fulfill their tax responsibilities accurately.

How to use the IT NRS Ohio Nonresident Statement

To use the IT NRS Ohio Nonresident Statement, individuals must first gather all necessary financial documents related to their income earned in Ohio. This includes W-2 forms, 1099 forms, and any other relevant income statements. Once the information is collected, the individual can fill out the form, detailing their income sources and calculating the tax owed. It is crucial to follow the instructions carefully to ensure accurate reporting and compliance with Ohio tax laws.

Steps to complete the IT NRS Ohio Nonresident Statement

Completing the IT NRS Ohio Nonresident Statement involves several key steps:

- Gather all relevant income documentation, including W-2s and 1099s.

- Download the IT NRS form from the Ohio Department of Taxation website or obtain a physical copy.

- Fill in personal information, including name, address, and Social Security number.

- Report all income earned in Ohio accurately.

- Calculate the tax owed based on the provided instructions.

- Review the completed form for accuracy before submission.

Legal use of the IT NRS Ohio Nonresident Statement

The IT NRS Ohio Nonresident Statement is legally binding when filled out accurately and submitted on time. It is essential for nonresidents to understand that failure to file this form can result in penalties and interest charges. The form serves as a formal declaration of income earned in Ohio and helps ensure compliance with state tax laws. Proper use of this form protects individuals from potential legal repercussions related to tax obligations.

Filing Deadlines / Important Dates

Filing deadlines for the IT NRS Ohio Nonresident Statement typically align with the federal tax filing deadlines. Nonresidents must submit their forms by April fifteenth of each year for income earned in the previous calendar year. It is important to stay informed about any changes to these deadlines, as extensions may be available under certain circumstances. Timely submission is crucial to avoid penalties.

Required Documents

When completing the IT NRS Ohio Nonresident Statement, individuals must provide specific documentation to support their income claims. Required documents include:

- W-2 forms from employers for income earned in Ohio.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income.

- Proof of residency in another state, if applicable.

Who Issues the Form

The IT NRS Ohio Nonresident Statement is issued by the Ohio Department of Taxation. This state agency is responsible for administering tax laws and ensuring compliance among residents and nonresidents alike. Individuals can obtain the form directly from the department's website or through authorized tax preparation services.

Quick guide on how to complete it nrs ohio nonresident statement

Complete IT NRS Ohio Nonresident Statement effortlessly on any gadget

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can obtain the correct version and securely store it online. airSlate SignNow equips you with all the necessary tools to produce, modify, and eSign your documents swiftly without delays. Handle IT NRS Ohio Nonresident Statement on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related activity today.

How to adjust and eSign IT NRS Ohio Nonresident Statement with ease

- Obtain IT NRS Ohio Nonresident Statement and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark relevant portions of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your updates.

- Choose how you wish to share your document, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that require reprinting new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Modify and eSign IT NRS Ohio Nonresident Statement and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it nrs ohio nonresident statement

Create this form in 5 minutes!

People also ask

-

What is the IT NRS Ohio Nonresident Statement?

The IT NRS Ohio Nonresident Statement is a tax form used by nonresident individuals to report income earned in Ohio. This form ensures that nonresidents comply with Ohio tax laws while accurately reporting their earnings. Utilizing airSlate SignNow can help simplify the process of preparing and signing this statement.

-

How can airSlate SignNow assist with the IT NRS Ohio Nonresident Statement?

airSlate SignNow provides an easy-to-use platform for filling out and eSigning the IT NRS Ohio Nonresident Statement. With its user-friendly interface, you can quickly complete your statement and ensure compliance with Ohio tax regulations. The platform also allows for secure document storage, making tracking your tax forms effortless.

-

Is there a cost associated with using airSlate SignNow for the IT NRS Ohio Nonresident Statement?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be a cost-effective solution for businesses and individuals. Pricing varies depending on the features you need, ensuring you only pay for what you use. Investing in airSlate SignNow can save you time and effort when completing forms like the IT NRS Ohio Nonresident Statement.

-

What features does airSlate SignNow offer for handling the IT NRS Ohio Nonresident Statement?

AirSlate SignNow offers features such as eSignature capabilities, document templates, and real-time collaboration tools. These features can streamline the process of preparing the IT NRS Ohio Nonresident Statement, making it easier to get documents signed quickly and securely. Additionally, templates specifically for tax forms are available to simplify data entry.

-

Can I integrate airSlate SignNow with other applications for filing the IT NRS Ohio Nonresident Statement?

Yes, airSlate SignNow offers various integrations with popular applications, enhancing your workflow when filing the IT NRS Ohio Nonresident Statement. You can connect with CRMs, cloud storage, and document management systems to ensure seamless document handling. This flexibility allows for better efficiency in managing your tax documents.

-

What benefits does airSlate SignNow provide for completing tax-related documents like the IT NRS Ohio Nonresident Statement?

Using airSlate SignNow for tax-related documents, such as the IT NRS Ohio Nonresident Statement, offers benefits like enhanced security, ease of access, and time savings. With secure cloud storage and a user-friendly design, you can manage your forms without the traditional hassles of paperwork. This leads to an overall smoother filing experience.

-

How can I ensure my IT NRS Ohio Nonresident Statement is compliant?

To ensure compliance when submitting your IT NRS Ohio Nonresident Statement, it's crucial to fill out the form accurately and double-check all entries. AirSlate SignNow provides helpful reminders and templates that can guide you through the process. This support can signNowly reduce the risk of errors that may lead to compliance issues.

Get more for IT NRS Ohio Nonresident Statement

- Nevada guardian form

- Affidavit name change form

- Nv name change form

- Applications for appointment as guardian family name change nevada form

- Nevada consent form

- Nevada change name form

- Applications for appointment as guardian family name change with second child nevada form

- Family name change 497320888 form

Find out other IT NRS Ohio Nonresident Statement

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure