OH it 1040 Fill Out Tax Template Online US Legal Forms 2022

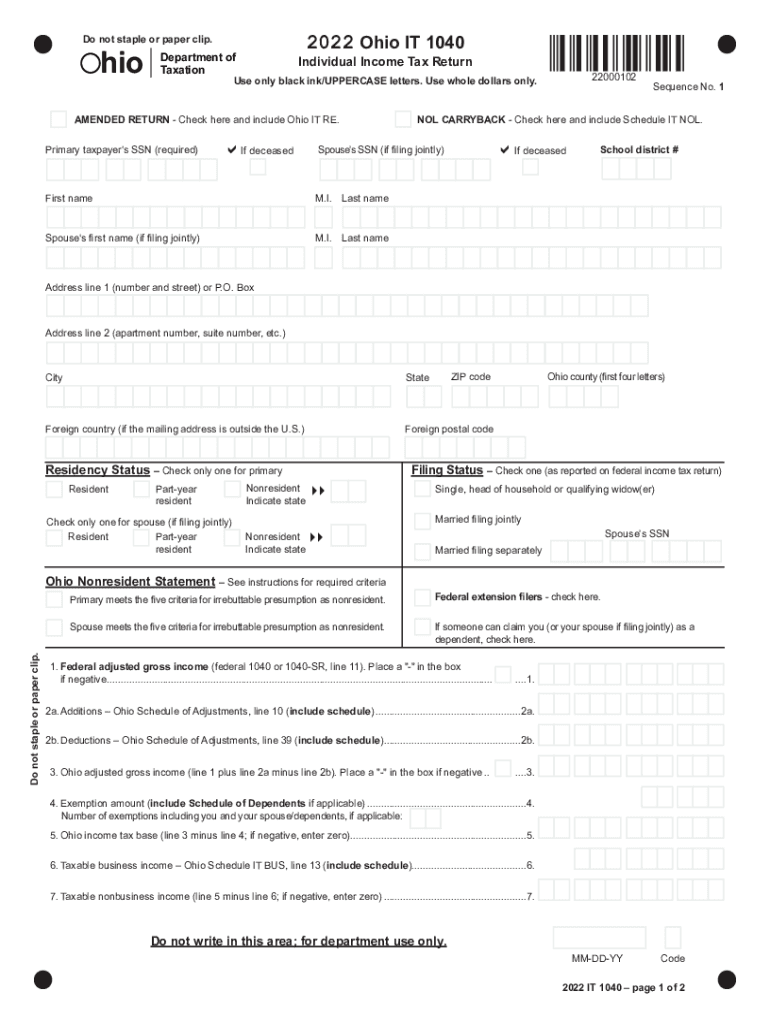

Understanding the OH IT 1040 Form

The OH IT 1040 form is essential for individuals filing their state income taxes in Ohio. This form allows residents to report their income, calculate their tax liability, and determine any refunds or payments due. It is crucial for ensuring compliance with Ohio state tax laws. The form is designed for use by individual taxpayers and includes various sections that capture different types of income and deductions. Understanding the specific requirements and sections of the OH IT 1040 can help taxpayers accurately complete their filings.

Steps to Complete the OH IT 1040 Form

Completing the OH IT 1040 form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and other income statements.

- Fill out personal information, such as your name, address, and Social Security number.

- Report your total income from all sources, including wages, interest, and dividends.

- Claim any applicable deductions or credits to reduce your taxable income.

- Calculate your total tax liability based on the provided tax tables.

- Determine if you owe taxes or if you are eligible for a refund.

- Sign and date the form before submission.

Required Documents for the OH IT 1040 Form

To accurately complete the OH IT 1040 form, taxpayers need to gather several important documents:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Documentation of other income sources, such as rental income or investments

- Records of deductible expenses, including medical costs and charitable contributions

- Any previous tax returns that may provide relevant information

Filing Deadlines for the OH IT 1040 Form

Timely filing of the OH IT 1040 form is crucial to avoid penalties. The standard deadline for filing state income tax returns in Ohio is typically April 15. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any extensions they may apply for, which can provide additional time to file but may require estimated tax payments by the original deadline.

Legal Use of the OH IT 1040 Form

The OH IT 1040 form is legally binding once completed and signed. It must be filed in accordance with Ohio state tax laws to ensure compliance. Using a reliable platform for eSigning and submitting the form can enhance its legal standing. The form must be filled out accurately, as discrepancies can lead to audits or penalties. Understanding the legal implications of the information provided on the form is essential for all taxpayers.

Form Submission Methods for the OH IT 1040

Taxpayers have several options for submitting the OH IT 1040 form:

- Online Submission: Many taxpayers choose to file electronically through approved software or platforms, which can streamline the process and reduce errors.

- Mail Submission: The form can be printed and mailed to the appropriate Ohio tax authority. Ensure that it is sent to the correct address based on your location.

- In-Person Submission: Taxpayers may also submit their forms in person at designated tax offices, providing an opportunity to ask questions directly.

Quick guide on how to complete oh it 1040 2020 2022 fill out tax template online us legal forms

Prepare OH IT 1040 Fill Out Tax Template Online US Legal Forms effortlessly on any device

Online document management has gained traction among organizations and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to generate, modify, and eSign your documents quickly and without delays. Manage OH IT 1040 Fill Out Tax Template Online US Legal Forms on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign OH IT 1040 Fill Out Tax Template Online US Legal Forms without breaking a sweat

- Obtain OH IT 1040 Fill Out Tax Template Online US Legal Forms and then click Get Form to initiate.

- Utilize the tools we offer to fill out your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to finalize your changes.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and eSign OH IT 1040 Fill Out Tax Template Online US Legal Forms and ensure outstanding communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct oh it 1040 2020 2022 fill out tax template online us legal forms

Create this form in 5 minutes!

How to create an eSignature for the oh it 1040 2020 2022 fill out tax template online us legal forms

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Ohio state tax forms and why are they important?

Ohio state tax forms are official documents required for filing taxes in the state of Ohio. They are crucial for accurately reporting income, tax credits, and any deductions. Properly filled Ohio state tax forms ensure compliance with state regulations and can help avoid penalties.

-

How can airSlate SignNow help with Ohio state tax forms?

AirSlate SignNow simplifies the process of preparing and signing Ohio state tax forms with its user-friendly eSignature solution. You can easily fill, sign, and send tax forms electronically, saving time and reducing errors associated with paper forms. This makes managing your tax documents more efficient.

-

Is there a cost associated with using airSlate SignNow for Ohio state tax forms?

Yes, airSlate SignNow offers several pricing plans tailored to different business needs. Each plan includes features that can assist with Ohio state tax forms, such as document templates and secure electronic signatures. It's a cost-effective solution for businesses that require regular tax document management.

-

Can I integrate airSlate SignNow with other software for managing Ohio state tax forms?

Absolutely! AirSlate SignNow integrates seamlessly with various software applications, allowing you to streamline the process of managing Ohio state tax forms. Whether you use accounting software or document management systems, integrating SignNow ensures that your tax forms are organized and easily accessible.

-

What features does airSlate SignNow offer for signing Ohio state tax forms?

AirSlate SignNow provides robust features for signing Ohio state tax forms, including customizable templates, real-time notifications, and secure storage. These features ensure that your documents are signed quickly and securely, enhancing the overall efficiency of your tax filing process.

-

Are templates available for Ohio state tax forms on airSlate SignNow?

Yes, airSlate SignNow offers a range of customizable templates specifically designed for Ohio state tax forms. These templates help users efficiently fill out required information and ensure that all necessary fields are completed. This can simplify tax preparation and reduce the risk of errors.

-

How does airSlate SignNow ensure the security of my Ohio state tax forms?

AirSlate SignNow prioritizes the security of your documents, including Ohio state tax forms, by utilizing top-notch encryption and secure cloud storage. Their platform complies with industry standards to protect sensitive information, ensuring that your tax forms remain confidential and secure from unauthorized access.

Get more for OH IT 1040 Fill Out Tax Template Online US Legal Forms

Find out other OH IT 1040 Fill Out Tax Template Online US Legal Forms

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online