Tax Ohio GovothermailingaddressesMailing Addresses Ohio Department of Taxation 2022

Understanding the Ohio IFTA Login Process

The Ohio IFTA (International Fuel Tax Agreement) login process is essential for businesses that operate commercial vehicles across state lines. This process allows users to access their accounts, file fuel tax reports, and manage their IFTA decals and stickers. To begin, users must visit the official Ohio IFTA website and enter their credentials, which typically include a username and password. If you are a first-time user, you may need to register for an account, providing necessary details such as your business name, address, and IFTA account number.

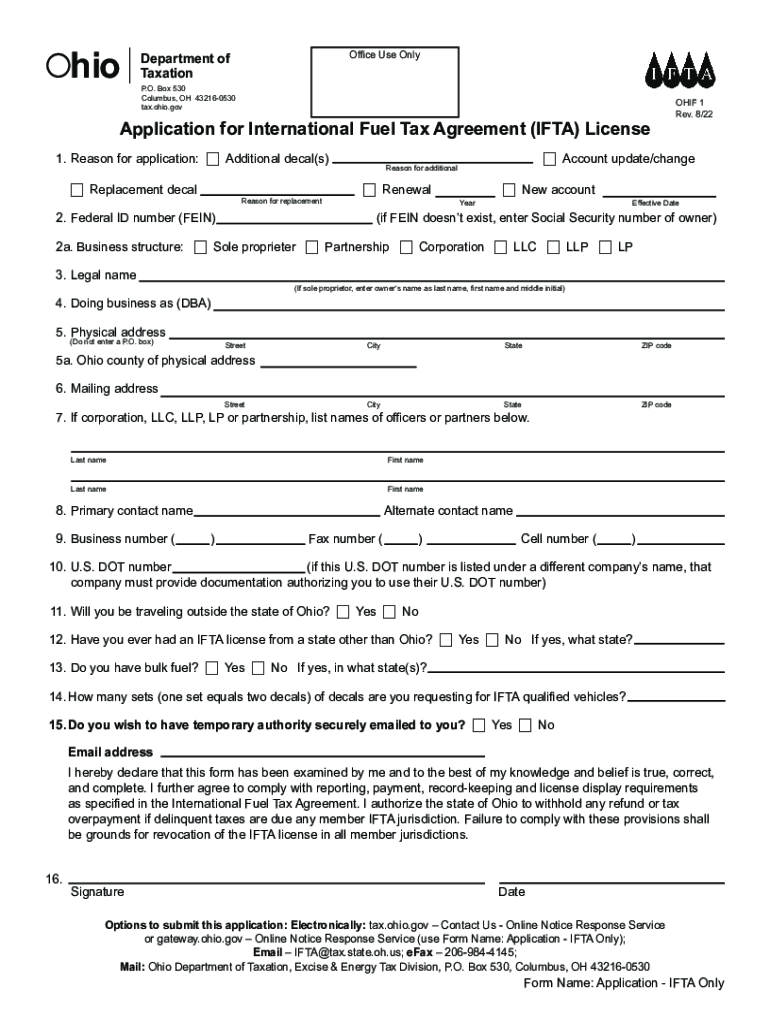

Required Documents for Ohio IFTA Registration

When registering for an Ohio IFTA account, certain documents are required to ensure compliance with state regulations. These may include:

- Your business identification number (EIN or SSN).

- Proof of vehicle registration for each qualified vehicle.

- Records of fuel purchases and mileage for the previous reporting period.

- Any additional documentation requested by the Ohio Department of Taxation.

Having these documents ready will streamline the registration process and help avoid delays.

Steps to Complete the Ohio IFTA Application

Completing the Ohio IFTA application involves several key steps. First, gather all necessary documents as outlined previously. Next, log in to your Ohio IFTA account. Once logged in, navigate to the application section and fill out the required information, including vehicle details and fuel usage. After completing the form, review all entries for accuracy before submitting. It is advisable to keep a copy of the submitted application for your records.

Filing Deadlines and Important Dates

Staying informed about filing deadlines is crucial for IFTA compliance. Ohio typically requires quarterly filings, with deadlines falling on the last day of the month following the end of each quarter. This means that the deadlines are:

- April 30 for the first quarter.

- July 31 for the second quarter.

- October 31 for the third quarter.

- January 31 for the fourth quarter.

Late filings may result in penalties, so it is important to adhere to these dates.

Legal Use of the Ohio IFTA Login

The Ohio IFTA login is governed by specific legal frameworks that ensure the security and integrity of user data. Compliance with regulations such as the ESIGN Act and UETA is essential, as these laws validate electronic signatures and documents. Users should ensure that their login credentials are kept secure and that they utilize strong passwords to protect their accounts. Additionally, the use of two-factor authentication is recommended to further enhance account security.

Penalties for Non-Compliance

Failing to comply with IFTA regulations can lead to significant penalties. Common consequences include:

- Fines for late filings or underreporting fuel usage.

- Revocation of IFTA decals or stickers.

- Increased scrutiny during audits.

Understanding these penalties can help businesses maintain compliance and avoid unnecessary costs.

Eligibility Criteria for Ohio IFTA Registration

To be eligible for Ohio IFTA registration, businesses must operate qualified motor vehicles that travel across state lines. A qualified vehicle typically meets the following criteria:

- Has two axles and a gross vehicle weight exceeding 26,000 pounds.

- Has three or more axles, regardless of weight.

- Is used in combination with a trailer, provided the combined weight exceeds 26,000 pounds.

Meeting these criteria is essential for ensuring compliance with IFTA regulations and obtaining the necessary decals and stickers.

Quick guide on how to complete taxohiogovothermailingaddressesmailing addresses ohio department of taxation

Prepare Tax ohio govothermailingaddressesMailing Addresses Ohio Department Of Taxation effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed documents, as one can find the correct form and securely store it online. airSlate SignNow supplies you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Tax ohio govothermailingaddressesMailing Addresses Ohio Department Of Taxation on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to alter and eSign Tax ohio govothermailingaddressesMailing Addresses Ohio Department Of Taxation with minimal effort

- Obtain Tax ohio govothermailingaddressesMailing Addresses Ohio Department Of Taxation and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight pertinent sections of your documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature with the Sign feature, which takes only seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and click the Done button to save your changes.

- Choose how you wish to send your form, either by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your needs in document management in just a few clicks from any device of your preference. Edit and eSign Tax ohio govothermailingaddressesMailing Addresses Ohio Department Of Taxation and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxohiogovothermailingaddressesmailing addresses ohio department of taxation

Create this form in 5 minutes!

People also ask

-

What is the Ohio IFTA login process?

The Ohio IFTA login process is designed to provide users with easy access to their International Fuel Tax Agreement account. By visiting the airSlate SignNow platform, you can simply enter your credentials to access your documents, track your fuel tax obligations, and manage your records efficiently. Ensure that you have your account details ready for a seamless login experience.

-

How can I reset my Ohio IFTA login password?

If you've forgotten your Ohio IFTA login password, you can easily reset it using the airSlate SignNow password recovery feature. Simply click on the 'Forgot Password?' link on the IFTA login page, enter your registered email, and follow the instructions provided in the email you receive. This ensures that you regain access swiftly and securely.

-

What are the benefits of using airSlate SignNow for Ohio IFTA reporting?

Using airSlate SignNow for Ohio IFTA reporting streamlines your tax filing process by allowing you to eSign documents directly online. This not only saves time but also reduces the risk of errors in your tax submissions. The user-friendly interface ensures that you can manage your fuel tax obligations efficiently, making the Ohio IFTA login a hassle-free experience.

-

Are there any fees associated with the Ohio IFTA login services?

Accessing the Ohio IFTA login through airSlate SignNow may involve subscription fees depending on the plan you choose. However, the investment is justified by the robust features and time-saving capabilities provided by the platform. For more detailed information on pricing, it's best to visit the airSlate SignNow pricing page.

-

Can I integrate other tools with my Ohio IFTA login?

Yes, airSlate SignNow supports integration with several other tools and software, enhancing the functionality of your Ohio IFTA login. This allows you to connect with accounting software, CRM systems, and more to streamline your operations. By integrating these tools, you can automate workflows and improve productivity.

-

How do I contact customer support for Ohio IFTA login issues?

If you encounter any issues with your Ohio IFTA login, you can easily signNow out to customer support through airSlate SignNow's help center. The team is available via chat, email, or phone to provide assistance and resolve any login-related problems. They are committed to ensuring a smooth user experience for all your needs.

-

Is there a mobile app for Ohio IFTA login?

Yes, airSlate SignNow offers a mobile app that allows you to access your Ohio IFTA login on the go. This flexibility enables you to manage your documents, sign forms, and handle your fuel tax requirements from your smartphone or tablet. The mobile experience is designed to mirror the desktop features for convenience.

Get more for Tax ohio govothermailingaddressesMailing Addresses Ohio Department Of Taxation

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts where 497321630 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497321631 form

- Marital domestic separation and property settlement agreement minor children no joint property or debts effective immediately 497321632 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497321633 form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497321635 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts where 497321636 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective 497321637 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497321638 form

Find out other Tax ohio govothermailingaddressesMailing Addresses Ohio Department Of Taxation

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure