If FEIN Doesnt Exist, Enter Social Security Number of Owner 2020

Understanding the Use of Social Security Number When FEIN is Absent

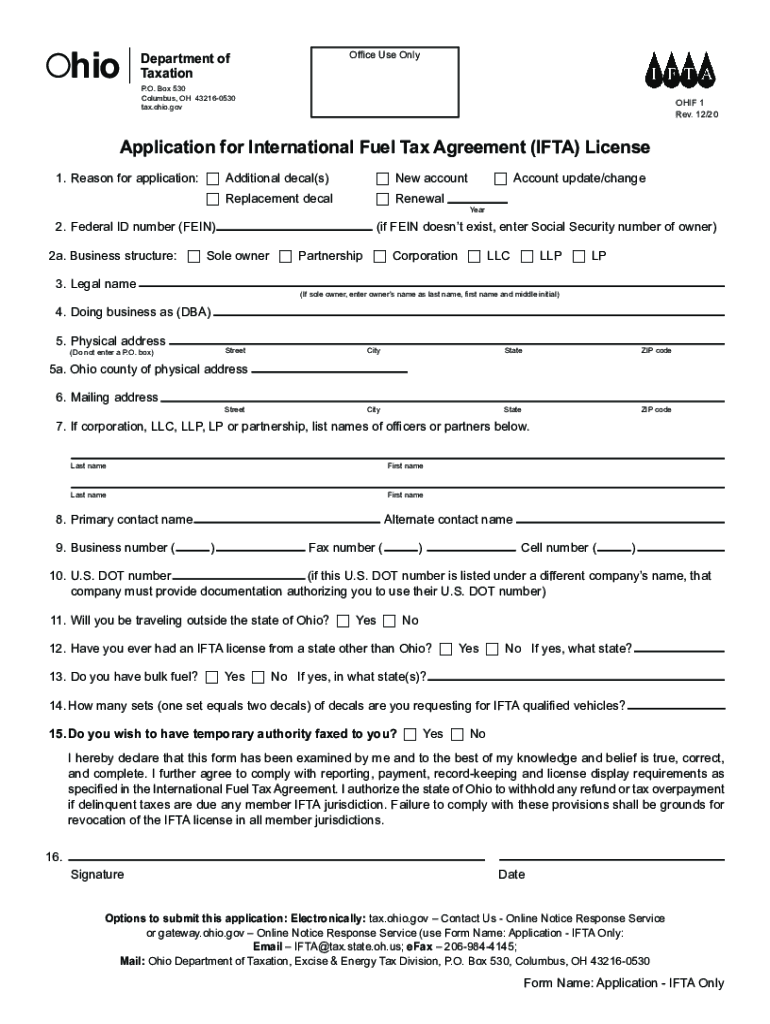

In situations where a Federal Employer Identification Number (FEIN) does not exist, individuals may need to provide the Social Security Number (SSN) of the business owner. This is particularly relevant when filing the Ohio OHIF tax forms. The SSN serves as a unique identifier for individuals and can be used in place of an FEIN for tax purposes.

When using the SSN, it is essential to ensure that the information is accurate and complete, as any discrepancies can lead to delays or issues with processing the application. This practice is common for sole proprietors or small businesses that have not yet obtained an FEIN.

Steps to Complete the Ohio OHIF Tax Form Using SSN

Completing the Ohio OHIF tax form when the FEIN is not available involves several key steps:

- Gather all necessary information, including the owner's SSN and any relevant business details.

- Access the Ohio OHIF tax form online or obtain a physical copy.

- Fill out the form, ensuring to enter the SSN in the designated field where the FEIN would typically be required.

- Review the completed form for accuracy, making sure all information is correct.

- Submit the form according to the specified submission methods, whether online, by mail, or in person.

Legal Considerations for Using SSN in Tax Forms

Using a Social Security Number in place of a FEIN is legally permissible under certain conditions. The IRS allows individuals to use their SSNs for tax reporting purposes, especially for sole proprietorships. However, it is crucial to ensure compliance with all relevant regulations to avoid potential legal issues.

Additionally, businesses should consider obtaining an FEIN as soon as possible to enhance their credibility and streamline tax processes. An FEIN can provide added protections against identity theft and simplify the filing process for future tax obligations.

Required Documents for Ohio OHIF Tax Submission

When preparing to submit the Ohio OHIF tax form, certain documents may be required to support the information provided. These may include:

- Proof of identity, such as a driver's license or state ID.

- Business records that validate the existence and operations of the business.

- Any previous tax documents that may be relevant to the current filing.

Having these documents ready can facilitate a smoother submission process and help avoid delays in processing the application.

Filing Deadlines for Ohio OHIF Tax Forms

It is important to be aware of the filing deadlines for Ohio OHIF tax forms to avoid penalties. Typically, the deadlines align with the federal tax filing dates, but specific state requirements may vary. Keeping track of these dates ensures compliance and helps maintain good standing with tax authorities.

For the most accurate and current deadlines, individuals should consult the Ohio Department of Taxation or relevant state resources.

Penalties for Non-Compliance with Ohio OHIF Tax Regulations

Failure to comply with Ohio OHIF tax regulations can result in various penalties, including fines and interest on unpaid taxes. It is essential for businesses to understand these consequences and take proactive steps to ensure timely and accurate filings.

Common penalties may include:

- Late filing fees for submissions made after the deadline.

- Interest charges on any outstanding tax balances.

- Potential legal action for persistent non-compliance.

Staying informed about tax obligations can help mitigate these risks and ensure a smooth tax experience.

Quick guide on how to complete if fein doesnt exist enter social security number of owner

Prepare if FEIN Doesnt Exist, Enter Social Security Number Of Owner seamlessly on any device

Digital document management has become prevalent among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and eSign your documents quickly without any delays. Manage if FEIN Doesnt Exist, Enter Social Security Number Of Owner on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric procedure today.

How to modify and eSign if FEIN Doesnt Exist, Enter Social Security Number Of Owner effortlessly

- Find if FEIN Doesnt Exist, Enter Social Security Number Of Owner and click Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign if FEIN Doesnt Exist, Enter Social Security Number Of Owner and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct if fein doesnt exist enter social security number of owner

Create this form in 5 minutes!

How to create an eSignature for the if fein doesnt exist enter social security number of owner

How to make an eSignature for a PDF document online

How to make an eSignature for a PDF document in Google Chrome

The way to generate an eSignature for signing PDFs in Gmail

The best way to create an electronic signature right from your smart phone

The best way to make an eSignature for a PDF document on iOS

The best way to create an electronic signature for a PDF on Android OS

People also ask

-

What is Ohio OHIF tax and how is it calculated?

Ohio OHIF tax refers to the Ohio Housing and Infrastructure Fund tax, which is levied to support housing initiatives. The tax rate is calculated based on specific local guidelines and varies by jurisdiction. Understanding the Ohio OHIF tax is crucial for businesses operating in the state to ensure compliance and proper financial management.

-

How can airSlate SignNow help with managing Ohio OHIF tax documentation?

Using airSlate SignNow allows businesses to streamline the signing and management of documents related to Ohio OHIF tax. Our platform ensures that all necessary forms are easily accessible and securely signed, minimizing delays and errors. This enhances the overall efficiency of tax document handling for Ohio companies.

-

Is airSlate SignNow cost-effective for small businesses dealing with Ohio OHIF tax?

Absolutely! airSlate SignNow offers competitive pricing tailored for small businesses, making it a cost-effective choice for managing Ohio OHIF tax documents. With our affordable plans, organizations can reduce overhead costs while accessing powerful eSigning features that simplify tax documentation.

-

What features does airSlate SignNow provide for Ohio OHIF tax compliance?

airSlate SignNow includes robust features designed to aid in Ohio OHIF tax compliance, such as template creation and automated reminders for important deadlines. These features ensure that businesses stay on track with their tax responsibilities. Additionally, the platform offers a secure way to store and retrieve all tax-related documents.

-

Can I integrate airSlate SignNow with other accounting software to manage Ohio OHIF tax?

Yes, airSlate SignNow integrates seamlessly with various accounting software, enabling businesses to manage Ohio OHIF tax more efficiently. This integration allows for the automatic export of signed documents and tax data, saving time and reducing the risk of errors. Streamlining your tax processes has never been easier with our flexible integration options.

-

What are the benefits of using airSlate SignNow for Ohio OHIF tax-related transactions?

Utilizing airSlate SignNow for Ohio OHIF tax transactions offers numerous benefits, including improved accuracy in documentation and faster turnaround times for signed forms. This can signNowly reduce the stress associated with tax season, ensuring that your business remains compliant and organized. The platform also enhances collaboration by allowing multiple parties to sign documents from any location.

-

How secure is airSlate SignNow when handling documents related to Ohio OHIF tax?

AirSlate SignNow prioritizes security, employing advanced encryption and compliance with industry standards to protect documents related to Ohio OHIF tax. Our platform ensures that all sensitive tax information remains confidential and secure. Users can trust that their Ohio tax documentation is safe while utilizing our eSigning services.

Get more for if FEIN Doesnt Exist, Enter Social Security Number Of Owner

- How to filled form 1419 austrelia

- Patrol menu planning worksheet 484407873 form

- Prospecting sheet entrepreneur form

- Loan confirmation letter form

- Mit erfolg zu fit in deutsch 1 pdf download form

- City of owensboro and e 1 form

- Jcpenney rebates 436414610 form

- Fda drugstore inspection checklist philippines form

Find out other if FEIN Doesnt Exist, Enter Social Security Number Of Owner

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation

- How Do I Sign Texas Education Form

- How Do I Sign Utah Education Presentation

- How Can I Sign New York Finance & Tax Accounting Document

- How Can I Sign Ohio Finance & Tax Accounting Word

- Can I Sign Oklahoma Finance & Tax Accounting PPT

- How To Sign Ohio Government Form

- Help Me With Sign Washington Government Presentation

- How To Sign Maine Healthcare / Medical PPT