Fillable Online DTE 1 BOR No , Tax Year County Complaint Against the 2022-2026

Understanding the DTE 1 Form

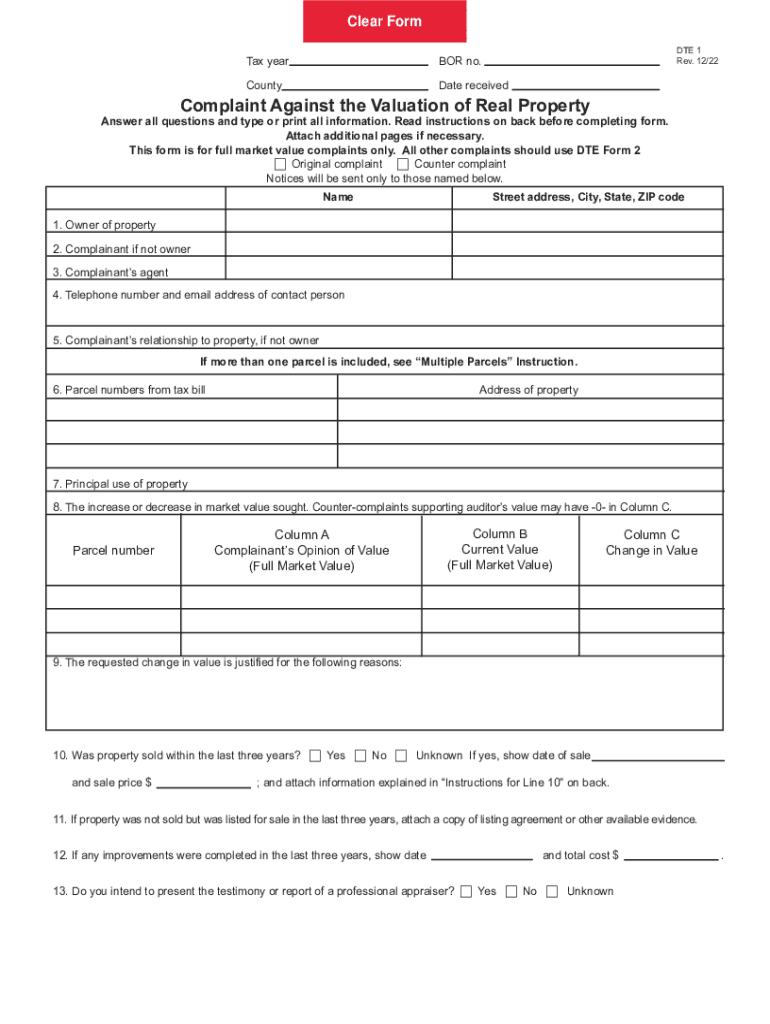

The DTE 1 form, also known as the Ohio DTE 1 form, is a critical document used in the property tax valuation process in Ohio. This form is specifically designed for property owners who wish to file a complaint against the valuation of their property. By submitting the DTE 1 form, property owners can formally contest the assessed value determined by the county auditor, which may affect their property taxes. Understanding the purpose and implications of this form is essential for any property owner looking to ensure their property is fairly assessed.

Steps to Complete the DTE 1 Form

Filling out the DTE 1 form involves several key steps to ensure accuracy and compliance. Begin by gathering necessary information, including your property details and the current valuation. Follow these steps to complete the form:

- Provide your name, address, and contact information.

- Include the property address and parcel number.

- State the reason for your complaint against the valuation.

- Attach any supporting documentation that substantiates your claim.

- Sign and date the form before submission.

Completing these steps thoroughly will help ensure your complaint is taken seriously and processed efficiently.

Legal Use of the DTE 1 Form

The DTE 1 form is legally recognized as a formal complaint regarding property valuation in Ohio. To be considered valid, it must be submitted within the specified timeframe set by the county Board of Revision. The legal framework surrounding the DTE 1 form is designed to protect property owners' rights to contest their property assessments. It is important to adhere to all legal guidelines when completing and submitting this form to avoid potential complications.

Obtaining the DTE 1 Form

Property owners can obtain the DTE 1 form from the Ohio Department of Taxation's website or directly from their county auditor's office. It is available in both paper and fillable online formats, allowing for convenient access. When obtaining the form, ensure you have the correct version for the tax year you are contesting, as forms may vary from year to year.

Key Elements of the DTE 1 Form

The DTE 1 form includes several key elements that must be completed accurately. These elements typically consist of:

- Property owner's information

- Property address and parcel identification number

- Current assessed value of the property

- Requested value or rationale for the complaint

- Signature of the property owner or authorized representative

Ensuring that all key elements are filled out correctly will help facilitate a smoother review process by the Board of Revision.

Filing Deadlines for the DTE 1 Form

Timeliness is crucial when submitting the DTE 1 form. The deadline for filing a complaint typically falls within a specific period following the notification of property valuation by the county auditor. Property owners should be aware of these deadlines to ensure their complaints are considered. Missing the deadline may result in the inability to contest the valuation for that tax year.

Quick guide on how to complete fillable online dte 1 bor no tax year county complaint against the

Finish Fillable Online DTE 1 BOR No , Tax Year County Complaint Against The effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow provides you with all the resources required to create, adjust, and eSign your documents quickly and without interruptions. Manage Fillable Online DTE 1 BOR No , Tax Year County Complaint Against The on any device with the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest method to alter and eSign Fillable Online DTE 1 BOR No , Tax Year County Complaint Against The without effort

- Find Fillable Online DTE 1 BOR No , Tax Year County Complaint Against The and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important parts of your documents or conceal sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and press the Done button to save your changes.

- Select your preferred method for sending your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that require reprinting document copies. airSlate SignNow addresses your document management needs with just a few clicks from any device you choose. Alter and eSign Fillable Online DTE 1 BOR No , Tax Year County Complaint Against The and ensure excellent communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable online dte 1 bor no tax year county complaint against the

Create this form in 5 minutes!

People also ask

-

What is dte 1 valuation in the context of airSlate SignNow?

DTE 1 valuation refers to the assessment of documents and agreements required for seamless electronic signing using airSlate SignNow. Understanding this valuation can help businesses navigate compliance and ensure that their eSigned documents hold legal weight.

-

How does airSlate SignNow streamline the dte 1 valuation process?

AirSlate SignNow simplifies the dte 1 valuation process by providing intuitive workflows and customizable templates. With its user-friendly interface, businesses can quickly prepare and evaluate documents, ensuring that all necessary information is included for accurate valuations.

-

What features does airSlate SignNow offer related to dte 1 valuation?

Key features related to dte 1 valuation in airSlate SignNow include electronic signatures, document tracking, and compliance management. These features help businesses efficiently manage their valuation documents while maintaining security and legal integrity.

-

Are there any pricing plans for airSlate SignNow that include dte 1 valuation support?

Yes, airSlate SignNow offers various pricing plans that cater to businesses requiring dte 1 valuation support. These plans are designed to be cost-effective, providing access to essential features that facilitate document preparation and signing.

-

What are the benefits of using airSlate SignNow for dte 1 valuation?

Using airSlate SignNow for dte 1 valuation allows businesses to enhance efficiency, reduce paper usage, and ensure faster turnaround times. The platform's digital approach minimizes the risk of errors and strengthens document compliance, making it a reliable solution.

-

Can airSlate SignNow integrate with other tools for managing dte 1 valuation?

Yes, airSlate SignNow can integrate with a variety of tools and systems to optimize the dte 1 valuation process. These integrations help businesses to streamline their workflows and ensure that all relevant data is easily accessible and manageable.

-

How secure is the dte 1 valuation process with airSlate SignNow?

The dte 1 valuation process with airSlate SignNow is highly secure, utilizing advanced encryption and authentication protocols. This ensures that all documents are safeguarded against unauthorized access while meeting industry compliance standards.

Get more for Fillable Online DTE 1 BOR No , Tax Year County Complaint Against The

- Entry satisfaction form

- Ohio defendant 497322149 form

- Discovery interrogatories for divorce proceeding for either plaintiff or defendant ohio form

- Quitclaim deed two individuals to one individual ohio form

- Ohio survivorship form

- Ohio interim form

- Quitclaim deed four individuals to three individuals ohio form

- Ohio special deed form

Find out other Fillable Online DTE 1 BOR No , Tax Year County Complaint Against The

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free