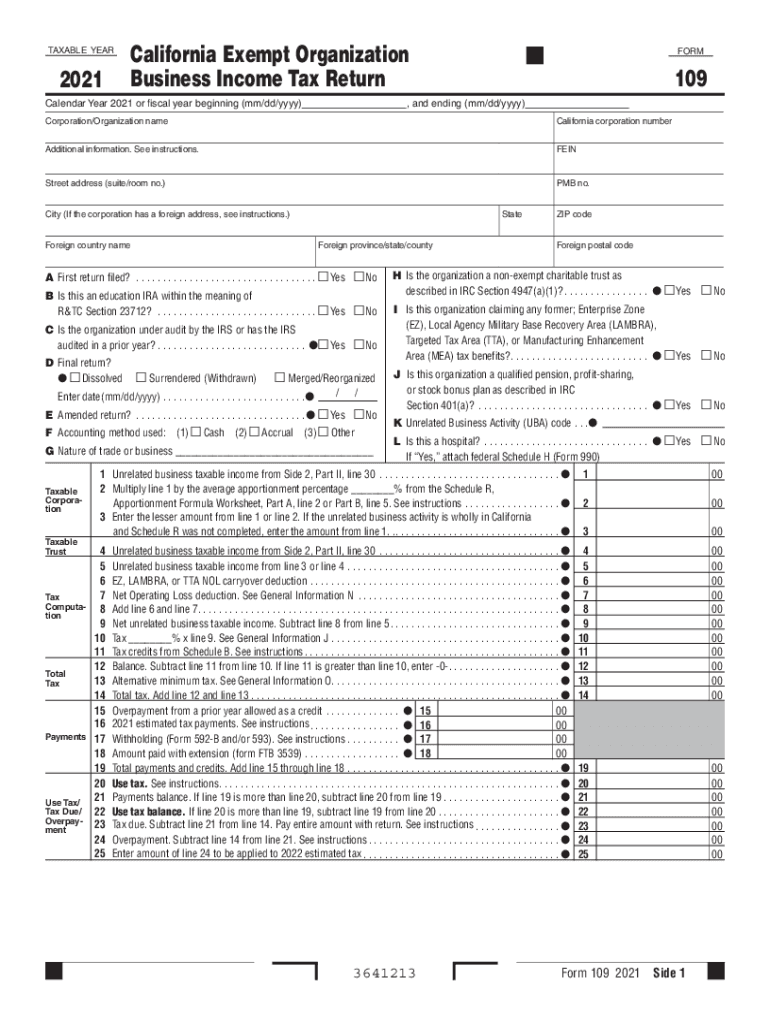

California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax Return for 2021-2026

What is the California Exempt Organization Business Income Tax Return Form 109?

The California Exempt Organization Business Income Tax Return Form 109 is a crucial document for nonprofit organizations in California. This form is designed for organizations that are exempt from federal income tax but may still have to report income generated from business activities. Understanding this form is essential for compliance with state tax regulations and ensuring that your organization maintains its tax-exempt status.

Steps to Complete the California Exempt Organization Business Income Tax Return Form 109

Filling out Form 109 requires careful attention to detail. Here are the key steps to ensure accurate completion:

- Gather Required Information: Collect all necessary financial documents, including income statements and expense reports.

- Complete the Form: Fill in the organization’s name, address, and federal employer identification number (FEIN).

- Report Income: List all business income generated during the tax year, ensuring to separate exempt income from taxable income.

- Detail Expenses: Itemize all allowable expenses that can be deducted from the income reported.

- Review and Sign: Ensure all information is accurate, then sign and date the form before submission.

Legal Use of the California Exempt Organization Business Income Tax Return Form 109

The legal use of Form 109 is paramount for maintaining compliance with California tax laws. This form must be filed by organizations that engage in business activities, even if their primary purpose is charitable. Filing this form correctly helps avoid penalties and ensures that the organization adheres to state regulations regarding income reporting.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for Form 109 to avoid late fees and penalties. The form is typically due on the 15th day of the fifth month after the end of the organization’s fiscal year. For organizations following a calendar year, the deadline is May 15. It is advisable to check for any updates or changes to these deadlines annually.

Required Documents

To complete the California Exempt Organization Business Income Tax Return Form 109, several documents are necessary:

- Financial statements detailing income and expenses.

- Records of any business activities conducted during the year.

- Previous year’s tax return for reference.

- Documentation supporting any deductions claimed.

Who Issues the Form

The California Exempt Organization Business Income Tax Return Form 109 is issued by the California Franchise Tax Board (FTB). This state agency is responsible for overseeing tax compliance and providing guidance for nonprofit organizations regarding their tax obligations.

Quick guide on how to complete 2021 california exempt organization business income tax return form 109 2021 california exempt organization business income tax

Effortlessly Prepare California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax Return For on Any Device

Digital document management has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to access the required forms and securely store them online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents quickly and efficiently. Manage California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax Return For across any platform with airSlate SignNow's Android or iOS applications and enhance your document-related procedures today.

How to Modify and Electronically Sign California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax Return For with Ease

- Locate California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax Return For and select Get Form to begin.

- Utilize the features we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which only takes a few seconds and carries the same legal validity as a traditional hand-written signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about misplaced or lost documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and electronically sign California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax Return For and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 california exempt organization business income tax return form 109 2021 california exempt organization business income tax

Create this form in 5 minutes!

People also ask

-

What is a form 109 and how can airSlate SignNow help with it?

A form 109 is a tax-related document used for reporting various types of income. airSlate SignNow enables users to easily create, send, and eSign form 109 documents, streamlining the process and ensuring compliance with tax regulations.

-

What features does airSlate SignNow offer for managing form 109?

airSlate SignNow provides features like customizable templates, secure eSigning, and document routing specifically designed for managing form 109. These features simplify the signing process and help users track the status of their documents in real time.

-

How does pricing work for using airSlate SignNow for form 109?

airSlate SignNow offers flexible pricing plans based on user needs, starting with a free trial to test its capabilities for handling form 109. This ensures that businesses can find a plan that fits their specific requirements and budget.

-

Can airSlate SignNow integrate with other applications for form 109 management?

Yes, airSlate SignNow integrates seamlessly with popular applications such as Google Drive, Microsoft Office, and others to enhance your workflow when dealing with form 109. This integration allows for easy document access and management across platforms.

-

What benefits does airSlate SignNow provide for eSigning form 109 documents?

Using airSlate SignNow for eSigning form 109 documents enhances efficiency and reduces turnaround time signNowly. The platform also ensures that each signature is legally binding, providing peace of mind throughout the signing process.

-

Is airSlate SignNow compliant with regulations for handling form 109?

Absolutely! airSlate SignNow is designed to comply with industry standards and regulations, ensuring that your form 109 documents are processed securely and in line with legal requirements. This commitment to compliance protects your sensitive information.

-

How do I get started with airSlate SignNow for form 109?

Getting started with airSlate SignNow for form 109 is easy; simply sign up for an account, explore various templates, and begin sending your documents for eSigning. The user-friendly interface makes it simple to manage all your form 109 needs quickly.

Get more for California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax Return For

Find out other California Exempt Organization Business Income Tax Return Form 109 California Exempt Organization Business Income Tax Return For

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed

- Sign Oregon Government Last Will And Testament Mobile

- Sign South Carolina Government Purchase Order Template Simple

- Help Me With Sign Pennsylvania Government Notice To Quit

- Sign Tennessee Government Residential Lease Agreement Fast

- Sign Texas Government Job Offer Free

- Sign Alabama Healthcare / Medical LLC Operating Agreement Online

- Sign Alabama Healthcare / Medical Quitclaim Deed Mobile

- Can I Sign Alabama Healthcare / Medical Quitclaim Deed

- Sign Utah Government Month To Month Lease Myself

- Can I Sign Texas Government Limited Power Of Attorney

- Sign Arkansas Healthcare / Medical Living Will Free

- Sign Arkansas Healthcare / Medical Bill Of Lading Later

- Sign California Healthcare / Medical Arbitration Agreement Free