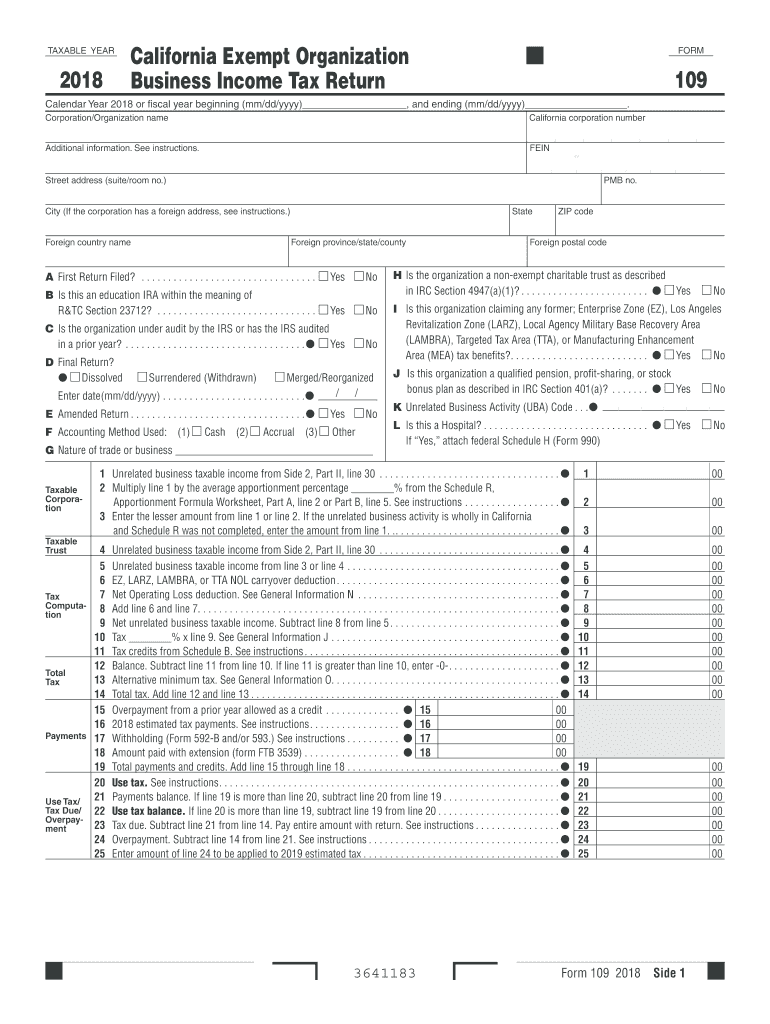

Form 109 2018

What is the Form 109?

The Form 109, specifically the California Form 109, is a tax document used by individuals and businesses to report income and other financial information to the California Franchise Tax Board (FTB). This form is essential for ensuring compliance with state tax laws and for accurately calculating tax liabilities. The Form 109 is particularly relevant for taxpayers who have received income from various sources, such as wages, interest, or dividends, and need to report this information to the state authorities.

How to obtain the Form 109

Obtaining the California Form 109 is a straightforward process. Taxpayers can access the form online through the California Franchise Tax Board's official website. Additionally, physical copies of the form may be available at local tax offices or public libraries. It is important to ensure that you are using the correct version of the form for the tax year in question, as forms may vary from year to year.

Steps to complete the Form 109

Completing the California Form 109 involves several key steps:

- Gather necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income accurately in the designated sections of the form.

- Double-check your entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form 109

The California Form 109 is legally recognized as a valid means of reporting income to the state. It must be completed accurately to avoid potential penalties or audits from the Franchise Tax Board. Taxpayers are encouraged to familiarize themselves with the specific legal requirements associated with the form to ensure compliance with state tax laws.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines associated with the California Form 109. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for most taxpayers. However, specific deadlines may vary based on individual circumstances, such as extensions or special filing situations. Keeping track of these dates helps avoid late fees and penalties.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the California Form 109. The form can be filed online through the California Franchise Tax Board's e-filing system, which offers a convenient and efficient way to submit tax information. Alternatively, taxpayers may choose to mail a physical copy of the form to the appropriate FTB address. In-person submissions are also possible at designated tax offices, providing another avenue for taxpayers who prefer direct interaction.

Quick guide on how to complete form 109 2018 2019

Your assistance manual on how to prepare your Form 109

If you’re pondering how to produce and dispatch your Form 109, here are some concise instructions on making tax submission easier.

To start, you only need to create your airSlate SignNow account to modify how you manage documents online. airSlate SignNow is a very user-friendly and powerful document solution that enables you to edit, draft, and finalize your income tax paperwork effortlessly. Utilizing its editor, you can alternate between text, check boxes, and eSignatures, and return to amend information as necessary. Simplify your tax administration with enhanced PDF editing, eSigning, and straightforward sharing.

Follow the steps below to complete your Form 109 in moments:

- Create your profile and start working on PDFs in minutes.

- Use our directory to find any IRS tax form; browse through variations and schedules.

- Click Obtain form to access your Form 109 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, check marks).

- Utilize the Signing Tool to insert your legally-binding eSignature (if needed).

- Examine your document and correct any errors.

- Save modifications, print your version, send it to your recipient, and download it to your device.

Take advantage of this manual to submit your taxes electronically with airSlate SignNow. Please keep in mind that submitting on paper can increase return errors and postpone reimbursements. Naturally, before e-filing your taxes, consult the IRS website for filing guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 109 2018 2019

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

Which ITR form should an NRI fill out for AY 2018–2019 to claim the TDS deducted by banks only?

ITR form required to be submitted depends upon nature of income. As a NRI shall generally have income from other sources like interest, rental income therefore s/he should file ITR 2.

-

Which ITR form should an NRI fill out for AY 2018–2019 for salary income?

File ITR 2 and for taking credit of foreign taxes fill form 67 before filling ITR.For specific clarifications / legal advice feel free to write to dsssvtax[at]gmail or call/WhatsApp: 9052535440.

-

Can I fill the form for the SSC CGL 2018 which will be held in June 2019 and when will the form for 2019 come out?

No, you can’t fill the form for SSC CGL 2018 as application process has been long over.SSC CGL 2019 : No concrete information at this time. Some update should come by August-September 2019.Like Exambay on facebook for all latest updates on SSC CGL 2018 , SSC CGL 2019 and other upcoming exams

Create this form in 5 minutes!

How to create an eSignature for the form 109 2018 2019

How to create an eSignature for the Form 109 2018 2019 online

How to generate an electronic signature for your Form 109 2018 2019 in Chrome

How to make an electronic signature for signing the Form 109 2018 2019 in Gmail

How to generate an electronic signature for the Form 109 2018 2019 straight from your mobile device

How to generate an eSignature for the Form 109 2018 2019 on iOS devices

How to create an eSignature for the Form 109 2018 2019 on Android OS

People also ask

-

What is form 109 ftb and why is it important?

Form 109 FTB is a tax form used by businesses in California to report adjusted gross income and other taxable income. It is important because it helps ensure compliance with state tax regulations and enables accurate tax reporting. Understanding how to fill out the form correctly can save businesses time and avoid potential penalties.

-

How can airSlate SignNow help with filling out form 109 ftb?

airSlate SignNow provides a user-friendly interface to create, send, and eSign your form 109 FTB, ensuring that all necessary information is captured accurately. The platform streamlines the document workflow, allowing for faster submissions to the tax authority. Using our solution can ease the burden of paperwork during tax season.

-

Is there a cost associated with using airSlate SignNow for form 109 ftb?

Yes, airSlate SignNow offers various pricing plans to fit the needs of businesses, which include the ability to handle form 109 FTB efficiently. Our pricing is designed to be cost-effective, especially considering the time saved by automating document processes. You can choose a plan that offers the best value for your specific requirements.

-

What features does airSlate SignNow offer for managing form 109 ftb documents?

airSlate SignNow includes features such as customizable templates for form 109 FTB, secure eSigning, and real-time tracking of document status. These features ensure that your documents are always up-to-date and that you can monitor their progress. Additionally, you can leverage integrations with other platforms to streamline your workflow.

-

Can I integrate airSlate SignNow with other tools I use for tax purposes?

Yes, airSlate SignNow offers seamless integrations with popular accounting and tax software, which can help in managing your form 109 FTB more effectively. This integration allows for automatic data population and retrieval, simplifying the process. It ensures that all your financial data is cohesive and organized.

-

How does airSlate SignNow ensure the security of my form 109 ftb documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption technology to protect your form 109 FTB documents and ensure that only authorized users can access them. Regular security audits and compliance with industry standards further enhance the safety of your sensitive information.

-

What are the benefits of using airSlate SignNow for electronic signature on form 109 ftb?

Using airSlate SignNow for electronic signatures on form 109 FTB adds convenience, speed, and legal validity to your document handling. It eliminates the need for physical signatures and reduces turnaround time signNowly. Additionally, signed documents are securely stored and easily retrievable when needed.

Get more for Form 109

- Da form 5304 100059293

- Admser chd nic form

- Form c34 other refunds tra go

- Marshall and swift residential cost handbook form

- Massachusetts quitclaim deed 27380560 form

- Firearm proficiency certificate form

- The school district of palm beach county student palmbeachschools form

- Apartment sublet contract template form

Find out other Form 109

- eSign Rhode Island Rental lease agreement forms Now

- eSign Georgia Rental lease agreement template Simple

- Can I eSign Wyoming Rental lease agreement forms

- eSign New Hampshire Rental lease agreement template Online

- eSign Utah Rental lease contract Free

- eSign Tennessee Rental lease agreement template Online

- eSign Tennessee Rental lease agreement template Myself

- eSign West Virginia Rental lease agreement template Safe

- How To eSign California Residential lease agreement form

- How To eSign Rhode Island Residential lease agreement form

- Can I eSign Pennsylvania Residential lease agreement form

- eSign Texas Residential lease agreement form Easy

- eSign Florida Residential lease agreement Easy

- eSign Hawaii Residential lease agreement Online

- Can I eSign Hawaii Residential lease agreement

- eSign Minnesota Residential lease agreement Simple

- How To eSign Pennsylvania Residential lease agreement

- eSign Maine Simple confidentiality agreement Easy

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online