Solved the Final Tax Return Period for C Corp 2019

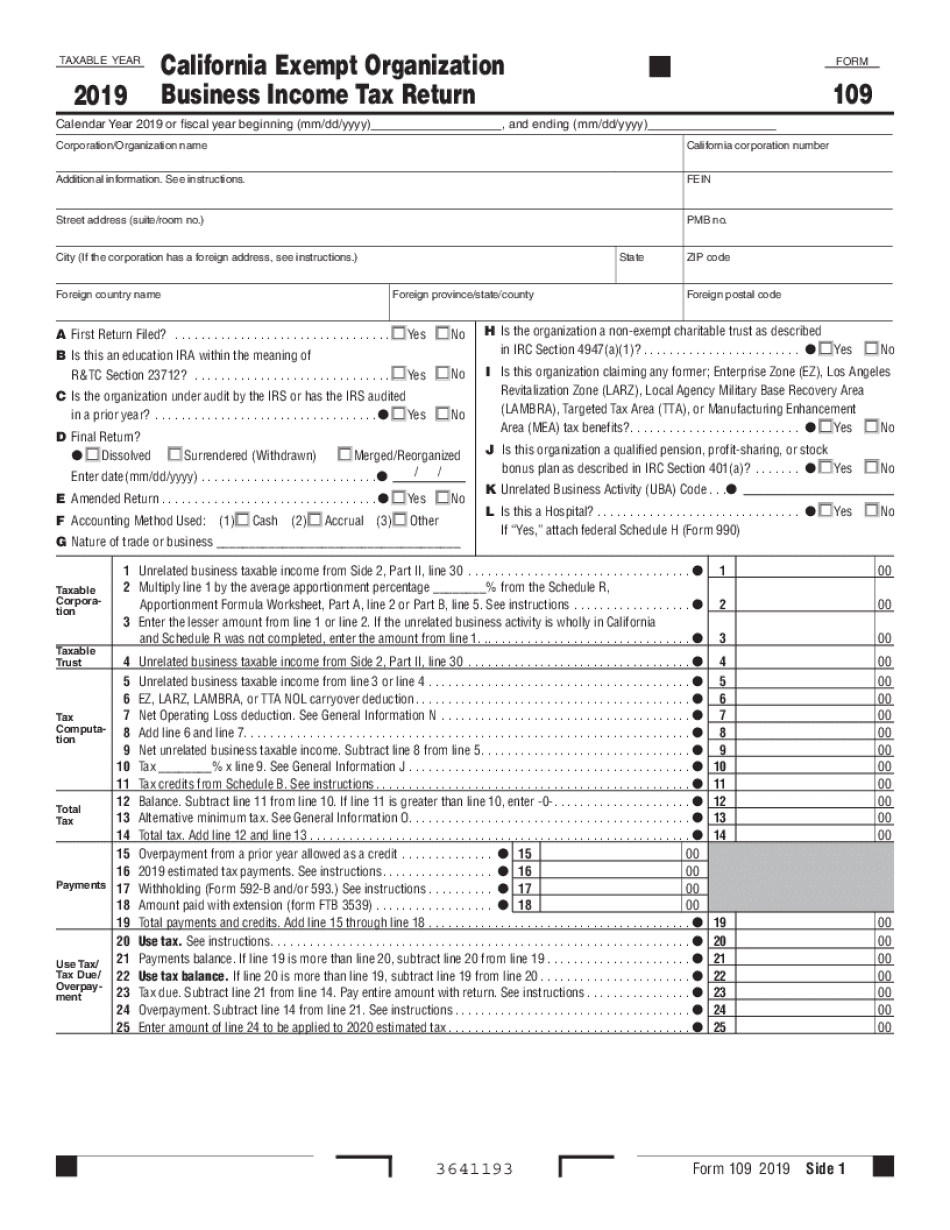

What is form 109?

The form 109 is a tax document used in the United States for various reporting purposes. It is primarily associated with the reporting of income, deductions, and credits for individuals and businesses. Understanding the specific type of form 109 you are dealing with is crucial, as there are several variations, including the 109-MISC and 109-NEC, each serving different reporting functions. This form is essential for ensuring compliance with IRS regulations and accurately reflecting financial activities during the tax year.

Steps to complete form 109

Completing form 109 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, receipts, and any other relevant records. Next, carefully fill out the form, ensuring that all information is correct and matches your records. Pay special attention to the identification numbers, such as your Social Security Number or Employer Identification Number. Once completed, review the form for any errors before submission. Finally, submit the form to the appropriate IRS address or electronically, depending on the specific requirements for the type of form 109 you are using.

IRS Guidelines for form 109

The IRS provides specific guidelines for the completion and submission of form 109. These guidelines include instructions on what information must be reported, deadlines for submission, and penalties for non-compliance. It is important to familiarize yourself with these guidelines to avoid any issues with your tax filings. The IRS also offers resources and publications that can help clarify any uncertainties regarding the use of form 109, ensuring that taxpayers can meet their obligations accurately and on time.

Filing deadlines for form 109

Filing deadlines for form 109 can vary based on the specific type of form being submitted and the method of filing. Generally, the deadline for filing form 109 with the IRS is January thirty-first of the year following the tax year being reported. If you are filing electronically, you may have an extended deadline. It is essential to keep track of these dates to avoid penalties and ensure timely compliance with tax regulations.

Required documents for form 109

When preparing to complete form 109, several documents are typically required. These may include income statements such as W-2s or 1099s, records of expenses, and any other financial documents that support the information reported on the form. Having these documents organized and readily available will facilitate a smoother completion process and help ensure that all reported figures are accurate and substantiated.

Penalties for non-compliance with form 109

Failure to comply with the requirements associated with form 109 can result in significant penalties. The IRS may impose fines for late filing, incorrect information, or failure to file altogether. These penalties can vary based on the severity of the non-compliance and can accumulate over time. Understanding these potential consequences underscores the importance of accurately completing and submitting form 109 in a timely manner.

Quick guide on how to complete solved the final tax return period for c corp

Effortlessly Prepare Solved The Final Tax Return Period For C Corp on Any Device

The management of online documents has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely archive it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your files promptly without obstacles. Handle Solved The Final Tax Return Period For C Corp on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented procedure today.

How to Edit and Electronically Sign Solved The Final Tax Return Period For C Corp with Ease

- Find Solved The Final Tax Return Period For C Corp and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize critical sections of your documents or obscure sensitive data with features that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign feature, which takes just seconds and holds the same legal validity as a customary wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in a few clicks from your chosen device. Edit and electronically sign Solved The Final Tax Return Period For C Corp and guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct solved the final tax return period for c corp

Create this form in 5 minutes!

How to create an eSignature for the solved the final tax return period for c corp

The way to generate an eSignature for your PDF document online

The way to generate an eSignature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

The best way to generate an electronic signature right from your smart phone

The way to create an electronic signature for a PDF document on iOS

The best way to generate an electronic signature for a PDF on Android OS

People also ask

-

What is form 109 and how does airSlate SignNow assist with it?

Form 109 refers to various IRS tax forms related to income reporting. airSlate SignNow helps businesses streamline the process of sending and signing Form 109, ensuring that all necessary signatures are obtained quickly and securely. With our solution, you can easily create, share, and manage your forms in one place.

-

How can I use airSlate SignNow to complete my annual form 109?

Using airSlate SignNow, you can create a customized form 109 that meets your specific requirements. Our platform allows you to fill out the form electronically, gather signatures from relevant parties, and store completed documents securely. This simplifies your tax filing process and saves you time.

-

Is airSlate SignNow affordable for businesses needing to manage form 109?

Yes, airSlate SignNow offers cost-effective pricing plans designed for businesses of all sizes. Our transparent pricing structure means you only pay for the features you need, making it an affordable solution for managing your form 109 and other document signing needs. Check our plans to find the best fit for your business.

-

What are the key features of airSlate SignNow for handling form 109?

Key features of airSlate SignNow include customizable templates for form 109, real-time tracking of document status, and secure cloud storage. Additionally, the platform supports multiple signers, making it easy for you to collect required signatures efficiently. These features enhance your productivity and compliance.

-

Can I integrate airSlate SignNow with other tools for processing form 109?

Absolutely! airSlate SignNow integrates seamlessly with numerous third-party applications, including popular accounting and tax software. This allows you to automate your workflow when managing form 109 and ensures that all your documentation processes are interconnected for greater efficiency.

-

How does airSlate SignNow ensure the security of my form 109?

airSlate SignNow employs top-tier security measures, including encryption and secure servers, to protect your form 109 and other sensitive documents. We prioritize data privacy and comply with relevant regulations to ensure that your information is safe throughout the eSigning process.

-

What are the benefits of using airSlate SignNow for form 109 management?

The benefits of using airSlate SignNow for form 109 management include increased efficiency, reduced paperwork, and simplified signing processes. Our user-friendly interface allows you to quickly prepare, send, and track your forms, resulting in faster turnaround times and improved accuracy in your tax reporting.

Get more for Solved The Final Tax Return Period For C Corp

Find out other Solved The Final Tax Return Period For C Corp

- Electronic signature Kentucky Hold Harmless (Indemnity) Agreement Online

- How To Electronic signature Arkansas End User License Agreement (EULA)

- Help Me With Electronic signature Connecticut End User License Agreement (EULA)

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed