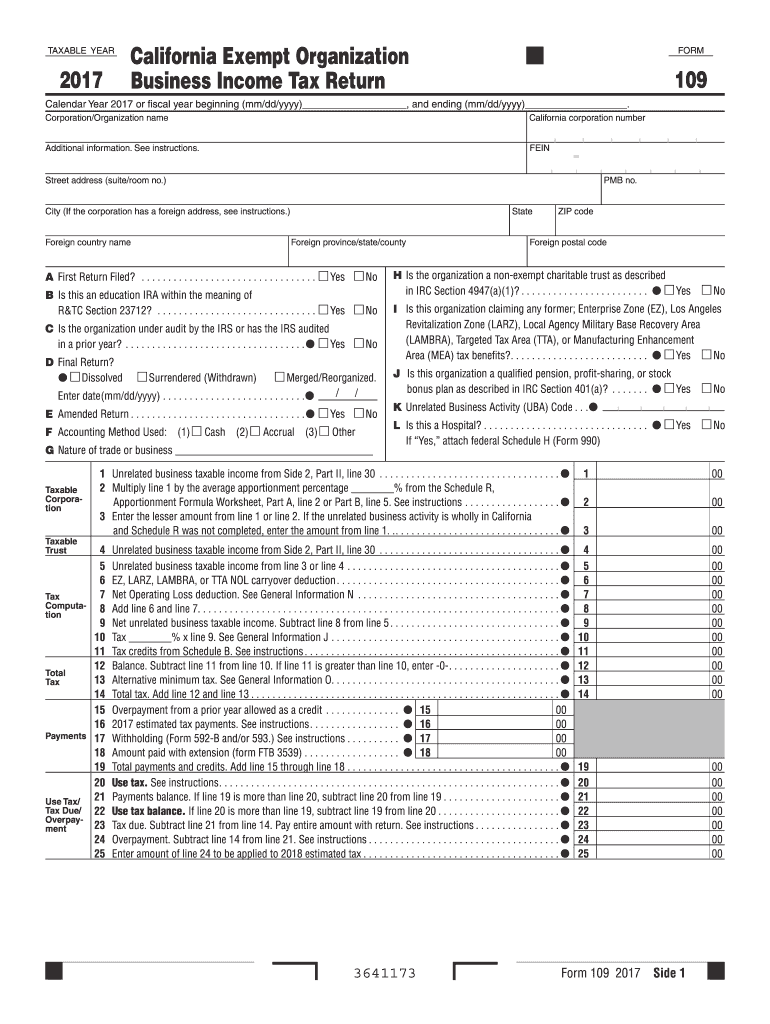

Form 109 2017

What is the Form 109

The Form 109 is a tax document used in the United States for reporting various types of income, including wages, dividends, and retirement distributions. It is part of a series of forms issued by the Internal Revenue Service (IRS) to ensure accurate income reporting and tax compliance. This form is essential for taxpayers, as it provides crucial information that must be reported on their annual tax returns.

How to obtain the Form 109

To obtain the Form 109, taxpayers can visit the IRS website, where they can download the form directly. Additionally, many tax preparation software programs include the form as part of their offerings. Taxpayers may also receive the form from their employers or financial institutions, as these entities are responsible for issuing it to report income paid to individuals throughout the tax year.

Steps to complete the Form 109

Completing the Form 109 involves several key steps:

- Gather all necessary income documentation, such as W-2s or 1099s.

- Fill in personal information, including your name, address, and Social Security number.

- Report the income amounts in the appropriate sections of the form.

- Review the completed form for accuracy before submitting.

Once completed, the form can be submitted electronically or via mail, depending on the requirements set by the IRS.

Legal use of the Form 109

The Form 109 is legally required for accurate income reporting. Taxpayers must ensure that the information provided is truthful and complete. Failure to file the form or providing incorrect information may result in penalties from the IRS. It is important to understand the legal implications of the form to avoid issues during tax season.

Filing Deadlines / Important Dates

The deadlines for filing the Form 109 vary depending on the specific type of income being reported. Typically, the form must be submitted by January thirty-first of the following tax year. Taxpayers should stay informed about any changes to these deadlines, as the IRS may adjust them in response to special circumstances or legislative changes.

Digital vs. Paper Version

Taxpayers have the option to complete the Form 109 digitally or on paper. The digital version offers several advantages, including faster processing times and reduced chances of errors. Electronic filing is generally more secure and allows for easier tracking of submission status. However, some individuals may prefer the traditional paper method for personal reasons, such as familiarity or comfort with physical documents.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the Form 109. These guidelines include instructions on how to report various types of income, the required signatures, and any additional documentation that may be needed. It is essential for taxpayers to review these guidelines carefully to ensure compliance and avoid potential issues with their tax filings.

Quick guide on how to complete form 109 2017

Your assistance manual on how to prepare your Form 109

If you’re wondering how to generate and submit your Form 109, here are some concise instructions on simplifying tax filing.

To begin, you just need to set up your airSlate SignNow profile to transform how you manage documents online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to modify, create, and complete your income tax paperwork with ease. Utilizing its editor, you can toggle between text, check boxes, and electronic signatures and revisit to change details as necessary. Streamline your tax management with sophisticated PDF editing, eSigning, and user-friendly sharing.

Adhere to the steps below to finalize your Form 109 in just a few minutes:

- Establish your account and begin working on PDFs within minutes.

- Utilize our catalog to obtain any IRS tax form; explore versions and schedules.

- Click Get form to launch your Form 109 in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to add your legally-recognized electronic signature (if necessary).

- Inspect your document and correct any errors.

- Store changes, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please remember that paper submissions can result in increased errors and delays in refunds. Naturally, prior to e-filing your taxes, verify the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct form 109 2017

FAQs

-

How do you know if you need to fill out a 1099 form?

Assuming that you are talking about 1099-MISC. Note that there are other 1099s.check this post - Form 1099 MISC Rules & RegulationsQuick answer - A Form 1099 MISC must be filed for each person to whom payment is made of:$600 or more for services performed for a trade or business by people not treated as employees;Rent or prizes and awards that are not for service ($600 or more) and royalties ($10 or more);any fishing boat proceeds,gross proceeds of $600, or more paid to an attorney during the year, orWithheld any federal income tax under the backup withholding rules regardless of the amount of the payment, etc.

-

How many people fill out Form 1099 each year?

There are a few different ways of estimating the numbers and thinking about this question. Data from the most recent years are not available—at least not from a reliable source with rigorous methodology—but here is what I can tell you:The most popular type of 1099 is Form 1099-MISC—the form used to report non-employee income including those for self-employed independent contractors (as well as various other types of “miscellaneous” income)Since 2015, there have been just under 16 million self-employed workers (including incorporated and unincorporated contractor businesses). And the data from the BLS seems to suggest this number has been largely consistent from one year to the next: Table A-9. Selected employment indicatorsNow, the total number of 1099-MISC forms has been inching up each year—along with W-2 form filings—and may have surpassed 100 million filing forms. RE: Evaluating the Growth of the 1099 Workforce But this data only goes to 2014 because, again, it’s hard to find reliable data from recent tax years.In terms of the total number of Form 1099s, you’d have to include Interest and Dividend 1099 forms, real estate and rental income, health and education savings accounts, retirement accounts, etc. I’m sure the total number of all 1099 forms surely ranges in the hundreds of millions.Finally, not everybody who is supposed to get a 1099 form gets one. So if you’re asking about the total number of freelancers, the estimates range from about 7.6 million people who primarily rely on self-employed 1099 income and 53 million people who have some type of supplemental income.If you’re someone who’s responsible for filing Form 1099s to the IRS and payee/recipients, I recommend Advanced Micro Solutions for most small-to-medium accounting service needs. It’s basic but very intuitive and cheap.$79 1099 Software Filer & W2 Software for Small Businesses

-

How do I fill out the CAT Application Form 2017?

CAT 2017 registration opened on August 9, 2017 will close on September 20 at 5PM. CAT online registration form and application form is a single document divided in 5 pages and is to be completed online. The 1st part of CAT online registration form requires your personal details. After completing your online registration, IIMs will send you CAT 2017 registration ID. With this unique ID, you will login to online registration form which will also contain application form and registration form.CAT Registration and application form will require you to fill up your academic details, uploading of photograph, signature and requires category certificates as per the IIMs prescribed format for CAT registration. CAT online application form 2017 consists of programme details on all the 20 IIMs. Candidates have to tick by clicking on the relevant programmes of the IIMs for which they wish to attend the personal Interview Process.

-

How do I fill out the Delhi Polytechnic 2017 form?

Delhi Polytechnic (CET DELHI) entrance examination form has been published. You can visit Welcome to CET Delhi and fill the online form. For more details you can call @ 7042426818

-

Do I have to fill out a 1099 tax form for my savings account interest?

No, the bank files a 1099 — not you. You’ll get a copy of the 1099-INT that they filed.

-

How do I fill out the SSC CHSL 2017-18 form?

Its very easy task, you have to just put this link in your browser SSC, this page will appearOn this page click on Apply buttonthere a dialog box appears, in that dialog box click on CHSL a link will come “ Click here to apply” and you will signNow to registration page.I hope you all have understood the procedure. All the best for your exam

-

How do I fill out the UPSEAT 2017 application forms?

UPESEAT is a placement test directed by the University of Petroleum and Energy Studies. This inclination examination is called as the University of Petroleum and Energy Studies Engineering Entrance Test (UPESEAT). It is essentially an essential sort examination which permits the possibility to apply for the different designing projects on the web. visit - HOW TO FILL THE UPSEAT 2017 APPLICATION FORMS

Create this form in 5 minutes!

How to create an eSignature for the form 109 2017

How to make an eSignature for the Form 109 2017 in the online mode

How to make an eSignature for the Form 109 2017 in Google Chrome

How to generate an electronic signature for signing the Form 109 2017 in Gmail

How to generate an electronic signature for the Form 109 2017 right from your mobile device

How to make an eSignature for the Form 109 2017 on iOS

How to create an eSignature for the Form 109 2017 on Android

People also ask

-

What is Form 109 and how can airSlate SignNow help with it?

Form 109 is a tax form used by businesses and individuals to report various types of income. airSlate SignNow simplifies the process of managing and eSigning Form 109, allowing users to easily send, sign, and store these important documents securely and efficiently.

-

How does airSlate SignNow ensure the security of my Form 109 documents?

airSlate SignNow prioritizes the security of your Form 109 documents with advanced encryption and secure cloud storage. Our platform complies with industry standards, ensuring that your sensitive tax information remains protected and accessible only by authorized users.

-

What features does airSlate SignNow offer for handling Form 109?

airSlate SignNow offers a variety of features for handling Form 109, including customizable templates, automated workflows, and real-time tracking. These tools make it easy to manage the signing process, ensuring you never miss a deadline during tax season.

-

Is there a mobile app for managing Form 109 with airSlate SignNow?

Yes, airSlate SignNow provides a mobile app that allows you to manage Form 109 on the go. You can easily send, sign, and track documents from your smartphone or tablet, making it convenient to handle your tax forms anytime, anywhere.

-

Can I integrate airSlate SignNow with other applications for Form 109 management?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. This integration allows you to streamline the management of Form 109 and other documents within your existing workflows.

-

What pricing options are available for using airSlate SignNow with Form 109?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses. Whether you need basic features for occasional use or advanced options for comprehensive document management, there’s a plan that fits your requirements for handling Form 109 efficiently.

-

How does airSlate SignNow improve the efficiency of processing Form 109?

airSlate SignNow enhances the efficiency of processing Form 109 by automating the signing workflow. This reduces the time spent on manual tasks, allowing you to focus on more important aspects of your business while ensuring your tax documents are handled promptly.

Get more for Form 109

Find out other Form 109

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later

- eSign Iowa Revocation of Power of Attorney Online