Schedule CA 540NR California Adjustments Nonresidents or Part Year Residents Schedule CA 540NR California Adjustments Nonresiden 2021

What is the Schedule CA 540NR?

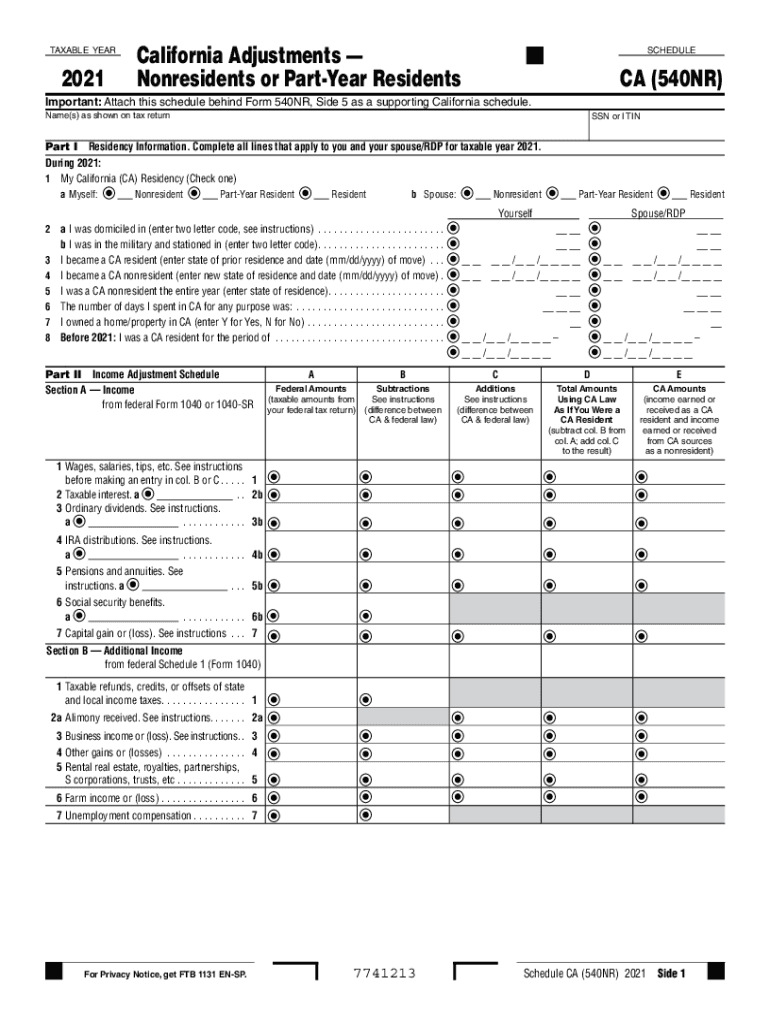

The Schedule CA 540NR is a tax form used by nonresidents and part-year residents of California to report adjustments to their income. This form is essential for accurately calculating California tax obligations based on income earned within the state. It allows taxpayers to make necessary adjustments to their federal income, ensuring compliance with California tax laws. Understanding this form is crucial for anyone who has income from California sources but does not reside in the state for the entire tax year.

Steps to Complete the Schedule CA 540NR

Completing the Schedule CA 540NR involves several key steps:

- Gather necessary documents: Collect your federal tax return and any other relevant financial documents.

- Fill out personal information: Include your name, address, and Social Security number at the top of the form.

- Report income: Enter your total income and make adjustments as required for California tax purposes.

- Claim deductions: Identify and apply any allowable deductions specific to California.

- Calculate tax owed: Use the provided tax tables to determine your tax liability based on the adjusted income.

- Sign and date the form: Ensure that you sign the form to validate it before submission.

Key Elements of the Schedule CA 540NR

Several key elements are essential when filling out the Schedule CA 540NR:

- Income adjustments: This includes modifications to federal income to reflect California-specific tax regulations.

- Deductions: Taxpayers can claim various deductions that are unique to California, which can significantly affect the overall tax owed.

- Tax credits: Certain credits may be available to reduce tax liability based on specific criteria.

- Filing status: Your filing status impacts the calculations and adjustments made on the form.

Legal Use of the Schedule CA 540NR

The Schedule CA 540NR is legally recognized as a binding document when completed accurately and submitted on time. It is essential to ensure that all information provided is truthful and complete to avoid penalties. The form must comply with California tax laws, and any discrepancies can lead to audits or additional tax liabilities. Utilizing a reliable e-signature platform can enhance the legal standing of the document, ensuring that it meets all necessary requirements.

Filing Deadlines for the Schedule CA 540NR

Filing deadlines for the Schedule CA 540NR typically align with the federal tax deadlines. For most taxpayers, this means the form must be submitted by April 15 of the following tax year. However, if you are unable to file by this date, it is advisable to request an extension to avoid penalties. Keeping track of these deadlines is crucial for compliance and to ensure that you do not incur unnecessary fees.

How to Obtain the Schedule CA 540NR

The Schedule CA 540NR can be obtained through several channels:

- California Franchise Tax Board (FTB) website: The form is available for download directly from the FTB's official website.

- Tax preparation software: Many tax software programs include the Schedule CA 540NR as part of their filing options.

- Local tax offices: Physical copies may also be available at local tax offices or libraries.

Quick guide on how to complete 2021 schedule ca 540nr california adjustments nonresidents or part year residents 2021 schedule ca 540nr california adjustments

Complete Schedule CA 540NR California Adjustments Nonresidents Or Part Year Residents Schedule CA 540NR California Adjustments Nonresiden effortlessly on any device

Online document organization has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly and without delays. Manage Schedule CA 540NR California Adjustments Nonresidents Or Part Year Residents Schedule CA 540NR California Adjustments Nonresiden on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to edit and eSign Schedule CA 540NR California Adjustments Nonresidents Or Part Year Residents Schedule CA 540NR California Adjustments Nonresiden with ease

- Obtain Schedule CA 540NR California Adjustments Nonresidents Or Part Year Residents Schedule CA 540NR California Adjustments Nonresiden and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or conceal sensitive information using the tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal value as a traditional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you intend to send your form, via email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing out new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Schedule CA 540NR California Adjustments Nonresidents Or Part Year Residents Schedule CA 540NR California Adjustments Nonresiden and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 schedule ca 540nr california adjustments nonresidents or part year residents 2021 schedule ca 540nr california adjustments

Create this form in 5 minutes!

People also ask

-

What is the schedule ca 540nr form?

The schedule ca 540nr form is a critical document for non-residents filing their California income tax returns. It helps taxpayers report their California-sourced income. Completing the schedule ca 540nr accurately is essential for compliance and to avoid penalties.

-

How can airSlate SignNow help me schedule ca 540nr submissions?

With airSlate SignNow, you can create, send, and eSign your schedule ca 540nr documents efficiently. Our platform streamlines the workflow, allowing you to manage and track document submissions easily. This ensures that your tax forms are completed and submitted on time.

-

What are the benefits of using airSlate SignNow for schedule ca 540nr?

Using airSlate SignNow for your schedule ca 540nr offers several advantages, including enhanced security, ease of use, and cost-effectiveness. Our platform provides templates and tools to simplify the signing process, making it faster to finalize your tax return. This means you can focus more on your business, knowing your taxes are managed.

-

Is there a cost associated with using airSlate SignNow for schedule ca 540nr?

Yes, airSlate SignNow operates on a subscription-based model with various pricing plans to suit different needs. Pricing is competitive, ensuring that even small businesses can afford to schedule ca 540nr submissions. You can choose a plan based on your volume of documents and features required.

-

Can I integrate airSlate SignNow with other software for schedule ca 540nr filings?

Absolutely! airSlate SignNow offers robust integrations with a wide range of software, including accounting and tax preparation tools. This feature allows for seamless data transfer and enhances your ability to schedule ca 540nr and manage documents more efficiently.

-

How secure is airSlate SignNow when handling schedule ca 540nr documents?

airSlate SignNow employs top-notch security measures to protect your schedule ca 540nr and other sensitive documents. Our platform uses encryption and secure servers, ensuring that your data remains confidential and safe from unauthorized access. This reliability is crucial when dealing with important tax filings.

-

What features are offered by airSlate SignNow for schedule ca 540nr management?

airSlate SignNow offers features such as customizable templates, audit trails, and real-time notifications, specifically designed for managing schedule ca 540nr. These tools help you stay organized and informed throughout the document signing process. Easy access to all your tax documents ensures a smoother workflow.

Get more for Schedule CA 540NR California Adjustments Nonresidents Or Part Year Residents Schedule CA 540NR California Adjustments Nonresiden

- Mechanic lien form

- Quitclaim deed by two individuals to husband and wife ohio form

- Ohio general deed form

- Limited warranty deed from two individuals to husband and wife ohio form

- Ohio transfer death form

- General warranty deed limited liability company to an individual ohio form

- Request for ordinary mail service ohio form

- Individual to trust 497322188 form

Find out other Schedule CA 540NR California Adjustments Nonresidents Or Part Year Residents Schedule CA 540NR California Adjustments Nonresiden

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template

- Sign Colorado Personal loan contract template Mobile

- How Do I Sign Florida Personal loan contract template

- Sign Hawaii Personal loan contract template Safe

- Sign Montana Personal loan contract template Free

- Sign New Mexico Personal loan contract template Myself

- Sign Vermont Real estate contracts Safe