Statistical Abstract of North Carolina Taxes NCDOR 2022

Key elements of the nc d 400 form 2016

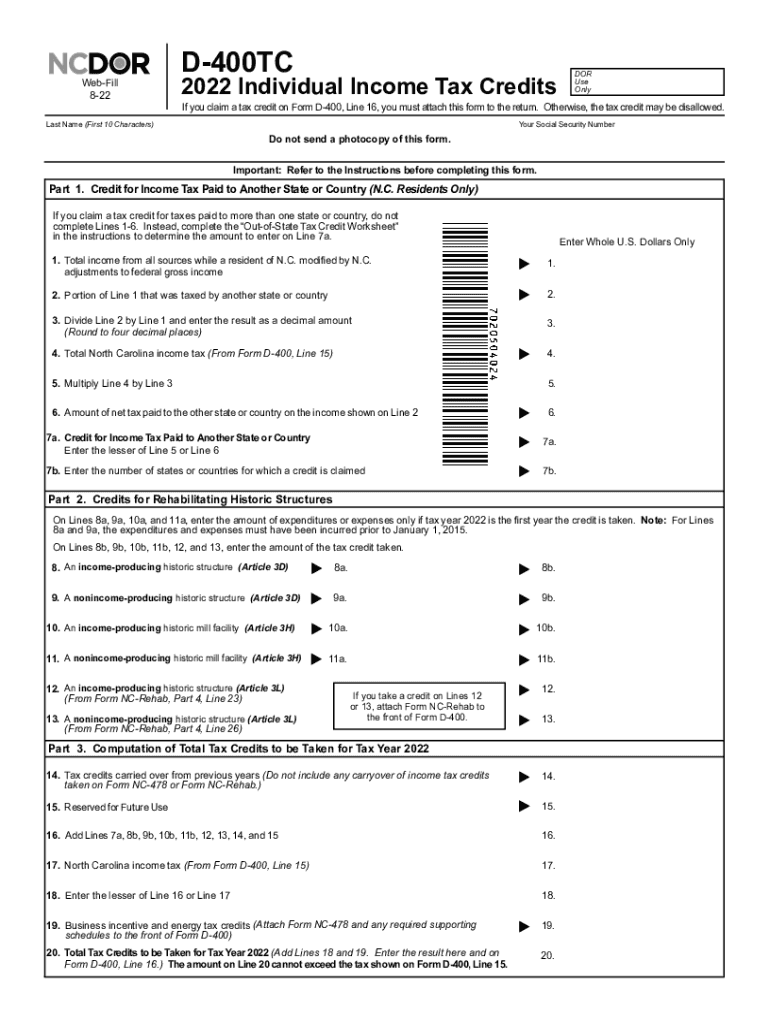

The nc d 400 form 2016 is a crucial document for individuals filing their North Carolina state income tax returns. This form is specifically designed for residents and non-residents who need to report their income and calculate their tax liability. Key elements of the form include:

- Personal Information: This section requires your name, Social Security number, and address.

- Filing Status: You must select your filing status, which can affect your tax rates and deductions.

- Income Reporting: This section is where you report all sources of income, including wages, dividends, and interest.

- Deductions and Credits: You can claim various deductions and credits that may apply to your situation, reducing your overall tax liability.

- Signature: The form must be signed and dated to validate the information provided.

Steps to complete the nc d 400 form 2016

Completing the nc d 400 form 2016 requires careful attention to detail to ensure accuracy. Here are the steps to follow:

- Gather Documentation: Collect all necessary documents, including W-2s, 1099s, and other income statements.

- Fill Out Personal Information: Enter your name, Social Security number, and address accurately.

- Select Filing Status: Choose the appropriate filing status that reflects your situation.

- Report Income: Enter all income sources in the designated sections of the form.

- Claim Deductions and Credits: Review applicable deductions and credits, and fill them in accordingly.

- Review and Sign: Double-check all entries for accuracy, then sign and date the form.

Filing deadlines for the nc d 400 form 2016

It is essential to be aware of the filing deadlines for the nc d 400 form 2016 to avoid penalties. The general deadline for filing your North Carolina state income tax return is typically April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Additionally, if you need extra time, you can file for an extension, but this does not extend the time to pay any taxes owed.

Form submission methods for the nc d 400 form 2016

There are several methods available for submitting the nc d 400 form 2016. Taxpayers can choose from the following options:

- Online Submission: Use the North Carolina Department of Revenue's e-filing system to submit your form electronically.

- Mail: Print the completed form and send it to the appropriate address provided in the instructions.

- In-Person: You may also deliver the form directly to your local North Carolina Department of Revenue office.

Penalties for non-compliance with the nc d 400 form 2016

Failing to file the nc d 400 form 2016 on time can result in significant penalties. The North Carolina Department of Revenue may impose a late filing penalty, which is typically a percentage of the tax due. Additionally, if taxes owed are not paid by the deadline, interest will accrue on the unpaid balance. It is crucial to file the form accurately and on time to avoid these financial repercussions.

IRS guidelines related to the nc d 400 form 2016

While the nc d 400 form 2016 is specific to North Carolina, it is essential to understand how it relates to federal tax obligations. The IRS provides guidelines that may affect your state filing, including:

- Federal Adjusted Gross Income: Your federal AGI is often the starting point for calculating your state income tax.

- Tax Credits: Some federal tax credits may also be applicable at the state level, influencing your overall tax liability.

- Filing Status Consistency: Ensure that your filing status aligns between federal and state returns for accuracy.

Quick guide on how to complete statistical abstract of north carolina taxes 2008 ncdor

Complete Statistical Abstract Of North Carolina Taxes NCDOR effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Statistical Abstract Of North Carolina Taxes NCDOR on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest method to modify and eSign Statistical Abstract Of North Carolina Taxes NCDOR without hassle

- Obtain Statistical Abstract Of North Carolina Taxes NCDOR and click Get Form to begin.

- Utilize the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you would like to share your form, via email, SMS, invite link, or download it to your PC.

Say goodbye to lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Statistical Abstract Of North Carolina Taxes NCDOR and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct statistical abstract of north carolina taxes 2008 ncdor

Create this form in 5 minutes!

People also ask

-

What is the nc d 400 form 2016?

The nc d 400 form 2016 is a tax form used by individuals and businesses in North Carolina to report income and calculate tax liabilities. It is essential for compliance with state tax laws and ensuring accurate tax filings. Understanding this form is crucial for anyone looking to file taxes in North Carolina.

-

How can airSlate SignNow help with the nc d 400 form 2016?

airSlate SignNow provides a seamless solution for sending and electronically signing the nc d 400 form 2016. With our user-friendly platform, you can expedite the process of filling out and submitting this important form, ensuring accuracy and efficiency. Our tools simplify document management, making your tax filing experience hassle-free.

-

Is there a cost associated with using airSlate SignNow for the nc d 400 form 2016?

Yes, there is a subscription cost associated with using airSlate SignNow, but it is designed to be cost-effective. Our pricing plans offer various options to meet different business needs. By using our service, you may save time and reduce errors when handling the nc d 400 form 2016.

-

What features does airSlate SignNow offer for managing the nc d 400 form 2016?

airSlate SignNow includes features such as document templates, electronic signatures, and real-time collaboration. These tools are designed to streamline the process of completing the nc d 400 form 2016, making it easier to gather necessary information and obtain signatures. Additionally, our platform ensures that all documents are securely stored and accessible.

-

Can I integrate airSlate SignNow with other software for the nc d 400 form 2016?

Absolutely! airSlate SignNow offers integration capabilities with various popular applications, enhancing your workflow for the nc d 400 form 2016. This means you can easily connect our e-signature solution with your existing software, such as accounting or document management tools, to simplify your entire process.

-

What are the benefits of using airSlate SignNow for the nc d 400 form 2016?

Using airSlate SignNow for the nc d 400 form 2016 simplifies the process of document management, reduces turnaround time, and enhances compliance with legal standards. Our platform provides a secure environment to handle sensitive information, ensuring that your tax filings are both safe and efficient. Additionally, you can track the status of your documents in real-time.

-

Is airSlate SignNow suitable for individual users filing the nc d 400 form 2016?

Yes, airSlate SignNow is suitable for both individual users and businesses filing the nc d 400 form 2016. Our platform is user-friendly and designed to accommodate various user needs, regardless of their experience level. Individuals will appreciate the ease of use and efficiency that our service brings to their tax filing process.

Get more for Statistical Abstract Of North Carolina Taxes NCDOR

Find out other Statistical Abstract Of North Carolina Taxes NCDOR

- eSign Wisconsin Codicil to Will Online

- eSign Hawaii Guaranty Agreement Mobile

- eSign Hawaii Guaranty Agreement Now

- How Can I eSign Kentucky Collateral Agreement

- eSign Louisiana Demand for Payment Letter Simple

- eSign Missouri Gift Affidavit Myself

- eSign Missouri Gift Affidavit Safe

- eSign Nevada Gift Affidavit Easy

- eSign Arizona Mechanic's Lien Online

- eSign Connecticut IOU Online

- How To eSign Florida Mechanic's Lien

- eSign Hawaii Mechanic's Lien Online

- How To eSign Hawaii Mechanic's Lien

- eSign Hawaii IOU Simple

- eSign Maine Mechanic's Lien Computer

- eSign Maryland Mechanic's Lien Free

- How To eSign Illinois IOU

- Help Me With eSign Oregon Mechanic's Lien

- eSign South Carolina Mechanic's Lien Secure

- eSign Tennessee Mechanic's Lien Later