Form 2587 Rev 3 Application for Special Enrollment Examination 2022

What is the Form 2587 Application for Special Enrollment Examination

The Form 2587, officially known as the Application for Special Enrollment Examination, is a crucial document used by individuals seeking to become enrolled agents with the IRS. This form allows applicants to demonstrate their competence in federal tax matters, which is essential for representing taxpayers before the IRS. The examination tests knowledge of tax laws, regulations, and procedures, ensuring that only qualified individuals can assist taxpayers in navigating complex tax issues.

Steps to Complete the Form 2587 Application for Special Enrollment Examination

Completing the Form 2587 involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your Social Security number and contact details. Next, carefully fill out each section of the form, paying close attention to the eligibility criteria and any specific instructions provided. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form according to the specified submission methods, ensuring it reaches the appropriate IRS office by the deadline.

Eligibility Criteria for the Form 2587 Application for Special Enrollment Examination

To be eligible for the Form 2587, applicants must meet certain criteria set by the IRS. These include being at least 18 years old, possessing a valid Social Security number, and having a suitable background in tax-related matters. Additionally, applicants should not have any felony convictions related to tax fraud or dishonesty. Meeting these criteria is essential to ensure that only qualified individuals are allowed to take the Special Enrollment Examination.

Form Submission Methods for the Form 2587 Application for Special Enrollment Examination

The Form 2587 can be submitted through various methods, providing flexibility for applicants. The most common submission methods include:

- Online: Applicants can submit the form electronically through the IRS website, ensuring a faster processing time.

- Mail: The completed form can be mailed to the designated IRS address, which is specified in the form instructions.

- In-Person: Some applicants may choose to deliver the form in person at their local IRS office, although this option may vary by location.

IRS Guidelines for the Form 2587 Application for Special Enrollment Examination

The IRS provides specific guidelines for completing and submitting the Form 2587. These guidelines include detailed instructions on how to fill out each section, what supporting documents may be required, and the importance of adhering to deadlines. It is crucial for applicants to familiarize themselves with these guidelines to avoid delays or complications in the application process.

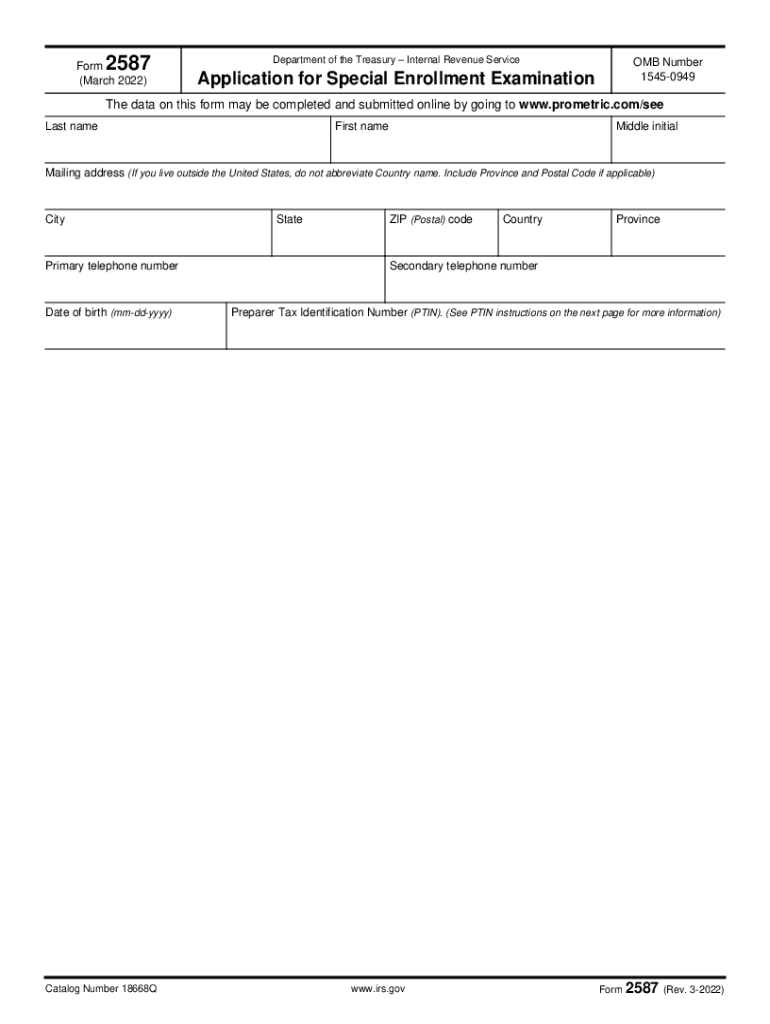

Key Elements of the Form 2587 Application for Special Enrollment Examination

The Form 2587 consists of several key elements that applicants must complete. These include:

- Personal Information: Applicants must provide their name, address, and Social Security number.

- Examination Information: This section details the specific examination date and location preferences.

- Signature: A signature is required to certify that the information provided is accurate and complete.

Understanding these elements is essential for ensuring that the form is filled out correctly and submitted on time.

Quick guide on how to complete form 2587 rev 3 2022 application for special enrollment examination

Prepare Form 2587 Rev 3 Application For Special Enrollment Examination effortlessly on any device

Web-based document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without interruptions. Handle Form 2587 Rev 3 Application For Special Enrollment Examination on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest method to edit and eSign Form 2587 Rev 3 Application For Special Enrollment Examination effortlessly

- Obtain Form 2587 Rev 3 Application For Special Enrollment Examination and click on Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature using the Sign feature, which takes just a few seconds and holds the same legal authority as a conventional ink signature.

- Review the information and click on the Done button to save your adjustments.

- Select your preferred method of submitting your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign Form 2587 Rev 3 Application For Special Enrollment Examination and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2587 rev 3 2022 application for special enrollment examination

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow and how does it relate to '2587'?

airSlate SignNow is an eSignature solution that enables businesses to send and sign documents digitally. With functionality stemming from the industry-standard model ADES-2587, it allows secure and efficient document management. Users leverage SignNow's features to streamline their operations and save valuable time.

-

What are the pricing options for airSlate SignNow in relation to '2587'?

airSlate SignNow offers various pricing plans suitable for different business sizes and needs, including options starting at just $8 per month. Each plan provides access to the features that enhance the document signing experience, in line with the efficient procedures outlined in the ADES-2587 standard. Businesses can choose a plan that fits their specific requirements.

-

What key features should I expect from airSlate SignNow involving '2587'?

Key features of airSlate SignNow include templates, reminders, and real-time tracking, all designed to comply with the ADES-2587 guidelines. These tools aid in the creation and management of documents, ensuring a seamless signing process. Additionally, advanced security features help protect sensitive data throughout the signing journey.

-

How can airSlate SignNow benefit my business related to '2587'?

Using airSlate SignNow can signNowly enhance your business's efficiency and security. By transitioning to a digital signature solution that aligns with the ADES-2587 standard, you can reduce paperwork, facilitate faster transactions, and improve overall productivity. This cost-effective solution helps businesses stay competitive in a rapidly evolving digital landscape.

-

Does airSlate SignNow integrate with other platforms according to '2587'?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, enhancing functionalities around the ADES-2587 standard. This includes CRMs, cloud storage, and collaboration tools, allowing for smoother workflows and improved document management. Such integrations empower businesses to connect their processes more efficiently.

-

Is airSlate SignNow suitable for small businesses focusing on '2587'?

Absolutely! airSlate SignNow is developed to cater to businesses of all sizes, including small enterprises. Its pricing and features are particularly appealing for small businesses looking to adopt the ADES-2587 standard for eSigning, as it delivers a user-friendly and cost-effective solution that simplifies document workflows.

-

What security measures does airSlate SignNow implement in line with '2587'?

airSlate SignNow takes security seriously, implementing robust measures that adhere to the ADES-2587 guidelines. This includes encryption, secure storage, and compliance with various digital signature laws. Users can trust that their sensitive documents are protected throughout the signing process.

Get more for Form 2587 Rev 3 Application For Special Enrollment Examination

- Oh package form

- Ohio guardian legal form

- Affidavit of surviving spouse or joint survivor ohio form

- Oh bankruptcy 7 form

- Ohio southern district bankruptcy form

- Bill of sale with warranty by individual seller ohio form

- Bill of sale with warranty for corporate seller ohio form

- Bill of sale without warranty by individual seller ohio form

Find out other Form 2587 Rev 3 Application For Special Enrollment Examination

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors