Form 2587 Rev 3 2024-2026

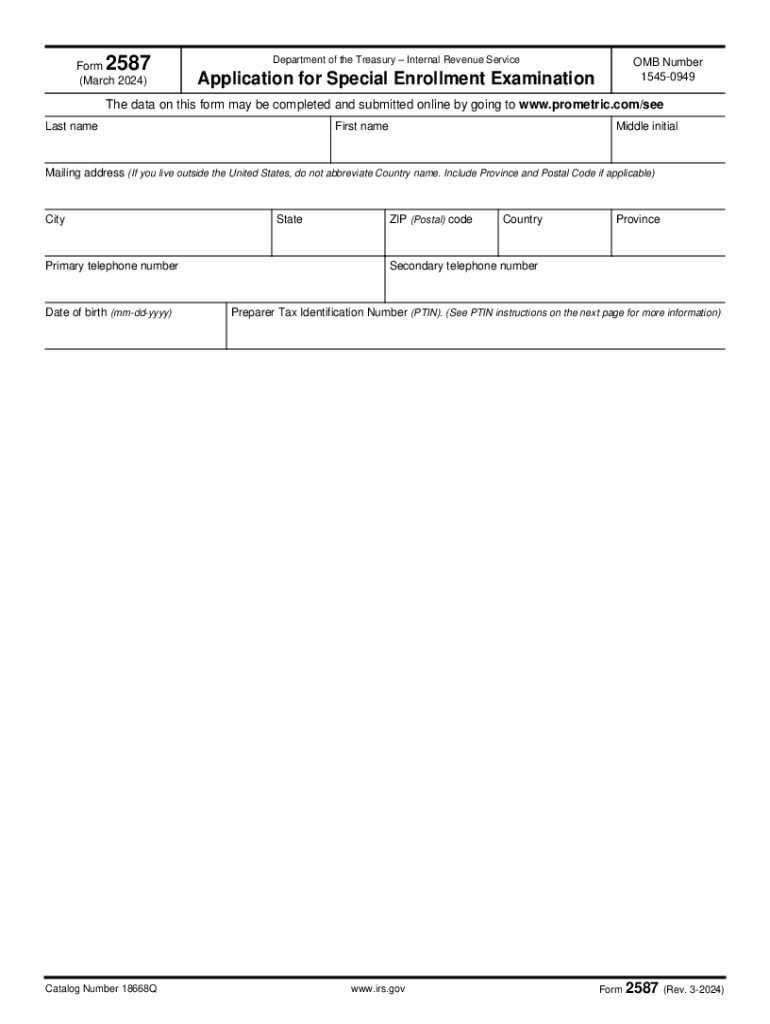

What is the Form 2587?

The Form 2587 is an IRS special form used primarily for specific tax-related applications. This form is essential for individuals and businesses needing to report certain financial information to the Internal Revenue Service. The 2587 application form serves various purposes, including enrollment in specific programs or reporting compliance with tax obligations. Understanding the function of this form is crucial for ensuring proper filing and adherence to IRS guidelines.

How to Obtain the Form 2587

To obtain the IRS 2587 form, individuals can visit the official IRS website, where the form is available for download in PDF format. Users can also request a physical copy through mail by contacting the IRS directly. It is important to ensure that the version of the form is current, as updates may occur periodically. Keeping a copy of the 2587 form on hand can facilitate timely submissions and compliance.

Steps to Complete the Form 2587

Completing the 2587 form requires careful attention to detail. Here are the steps to follow:

- Download the latest version of the 2587 form from the IRS website.

- Read the instructions carefully to understand the requirements.

- Fill in the necessary personal or business information as required.

- Provide any supporting documentation that may be needed.

- Review the completed form for accuracy before submission.

Following these steps can help ensure that the form is filled out correctly, minimizing the risk of delays or issues with processing.

Legal Use of the Form 2587

The legal use of the Form 2587 is governed by IRS regulations. It is important for users to understand that submitting this form incorrectly can lead to penalties or legal repercussions. Compliance with all IRS guidelines is necessary to ensure that the form is used appropriately. Consulting with a tax professional may provide additional clarity on legal obligations associated with the 2587 form.

Filing Deadlines and Important Dates

Filing deadlines for the Form 2587 can vary based on the specific purpose of the application. It is essential to be aware of these deadlines to avoid late submissions, which can result in penalties. Generally, the IRS provides a timeline for when the form must be submitted, and users should keep track of any changes to these dates. Staying informed about important dates can help ensure compliance with IRS requirements.

Required Documents for Form 2587

When submitting the Form 2587, certain documents may be required to support the application. Commonly required documents include:

- Proof of identity, such as a Social Security number or Employer Identification Number.

- Financial statements or tax returns, depending on the purpose of the form.

- Any additional documentation specified in the form instructions.

Gathering the necessary documents ahead of time can streamline the application process and help avoid delays.

Form Submission Methods

The Form 2587 can be submitted through various methods, including online, by mail, or in person. For online submissions, users may need to create an account on the IRS website. Mailing the form requires ensuring that it is sent to the correct address, which can be found in the form instructions. In-person submissions may be available at local IRS offices, providing another option for those who prefer face-to-face assistance.

Quick guide on how to complete form 2587 rev 3

Complete Form 2587 Rev 3 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Form 2587 Rev 3 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Form 2587 Rev 3 without any hassle

- Obtain Form 2587 Rev 3 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight essential parts of your documents or obscure sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misfiled documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 2587 Rev 3 and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 2587 rev 3

Create this form in 5 minutes!

How to create an eSignature for the form 2587 rev 3

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to 2587?

airSlate SignNow is a powerful eSignature solution that allows businesses to send and sign documents electronically. The reference to '2587' highlights a specific feature or pricing tier that may be relevant for users looking for cost-effective solutions. With airSlate SignNow, you can streamline your document workflow while ensuring compliance and security.

-

How much does airSlate SignNow cost, particularly for the 2587 plan?

The pricing for airSlate SignNow varies based on the features included in each plan. The '2587' plan offers a competitive rate that provides access to essential eSignature functionalities. This plan is designed to meet the needs of small to medium-sized businesses looking for an affordable yet comprehensive solution.

-

What features are included in the 2587 plan of airSlate SignNow?

The 2587 plan includes a range of features such as unlimited eSignatures, document templates, and integration capabilities with popular applications. This plan is tailored to enhance productivity and simplify the signing process for users. With airSlate SignNow, you can manage your documents efficiently and securely.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow provides numerous benefits, including increased efficiency, reduced paper usage, and enhanced security for your documents. The '2587' plan specifically caters to businesses looking for a cost-effective solution without compromising on essential features. This empowers teams to focus on their core tasks while ensuring smooth document transactions.

-

Can I integrate airSlate SignNow with other software tools?

Yes, airSlate SignNow offers seamless integrations with various software tools, enhancing your workflow. The '2587' plan supports integrations with popular platforms like Google Drive, Salesforce, and more. This allows you to streamline your processes and manage documents from a single interface.

-

Is airSlate SignNow secure for handling sensitive documents?

Absolutely, airSlate SignNow prioritizes security and compliance, making it a reliable choice for handling sensitive documents. The '2587' plan includes features such as encryption and secure storage to protect your data. You can trust that your documents are safe while using airSlate SignNow.

-

How can I get started with airSlate SignNow and the 2587 plan?

Getting started with airSlate SignNow is easy. Simply visit our website, select the '2587' plan, and follow the prompts to create your account. Once registered, you can begin sending and signing documents immediately, enjoying the benefits of our user-friendly platform.

Get more for Form 2587 Rev 3

Find out other Form 2587 Rev 3

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple