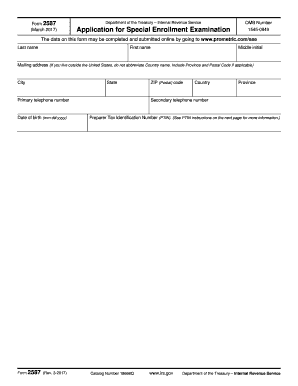

Application for Special Enrollment Examination Irs 2013

What is the Application For Special Enrollment Examination IRS

The Application For Special Enrollment Examination IRS is a form that allows individuals to apply for enrollment to practice before the Internal Revenue Service (IRS). This examination is designed for tax professionals who wish to represent clients in matters before the IRS. The application is essential for those who do not have other professional credentials, such as a CPA or attorney, but want to demonstrate their competency in tax matters.

Steps to complete the Application For Special Enrollment Examination IRS

Completing the Application For Special Enrollment Examination IRS involves several key steps:

- Gather necessary personal information, including your Social Security number and contact details.

- Provide your employment history and any relevant educational background.

- Complete the application form accurately, ensuring all sections are filled out.

- Review the application for any errors or omissions before submission.

- Submit the application along with any required fees to the IRS.

Legal use of the Application For Special Enrollment Examination IRS

The legal use of the Application For Special Enrollment Examination IRS is governed by federal regulations. It is crucial that applicants understand the implications of submitting this form, as it signifies a commitment to adhere to the ethical standards set forth by the IRS. The application must be completed truthfully, as any misrepresentation can lead to penalties or disqualification from the examination process.

Eligibility Criteria

To be eligible for the Application For Special Enrollment Examination IRS, applicants must meet specific criteria, including:

- Being at least eighteen years old.

- Having a valid Social Security number.

- Demonstrating knowledge of federal tax law through the successful completion of the examination.

Required Documents

When submitting the Application For Special Enrollment Examination IRS, applicants must include several required documents. These typically include:

- A completed application form.

- Proof of identity, such as a government-issued ID.

- Payment for the examination fee, if applicable.

Form Submission Methods

The Application For Special Enrollment Examination IRS can be submitted through various methods, including:

- Online submission via the IRS website.

- Mailing the completed form to the designated IRS address.

- In-person submission at an IRS office, if available.

Quick guide on how to complete application for special enrollment examination irs

Effortlessly Prepare Application For Special Enrollment Examination Irs on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents promptly without delays. Manage Application For Special Enrollment Examination Irs on any device using airSlate SignNow's Android or iOS applications and streamline any document-based workflow today.

The easiest method to edit and electronically sign Application For Special Enrollment Examination Irs without hassle

- Obtain Application For Special Enrollment Examination Irs and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information using tools tailored for that purpose by airSlate SignNow.

- Formulate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), invite link, or download to your computer.

Say goodbye to lost or misfiled documents, laborious form searching, and errors that necessitate reprinting new copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you prefer. Edit and electronically sign Application For Special Enrollment Examination Irs and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct application for special enrollment examination irs

Create this form in 5 minutes!

How to create an eSignature for the application for special enrollment examination irs

The best way to create an electronic signature for a PDF in the online mode

The best way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Application For Special Enrollment Examination IRS?

The Application For Special Enrollment Examination IRS is a crucial document that allows tax professionals to apply for a special enrollment examination. This examination is necessary for individuals who wish to represent taxpayers before the IRS. Completing this application is the first step towards earning your credential as an enrolled agent.

-

How can airSlate SignNow assist with the Application For Special Enrollment Examination IRS?

With airSlate SignNow, you can streamline the process of completing the Application For Special Enrollment Examination IRS. Our platform allows you to easily fill out, sign, and send your application securely. This enhances efficiency and signNowly reduces the time it takes to submit your applications to the IRS.

-

Is there a fee associated with the Application For Special Enrollment Examination IRS?

There may be a fee associated with submitting the Application For Special Enrollment Examination IRS, which typically varies based on your specific situation. Additionally, using airSlate SignNow's electronic signature services may involve a subscription cost, but it can save you time and effort in the long run.

-

What features does airSlate SignNow offer for managing the Application For Special Enrollment Examination IRS?

airSlate SignNow offers several features that facilitate the submission of the Application For Special Enrollment Examination IRS, including automatic reminders, customizable templates, and secure storage. These features ensure that your application is completed accurately and submitted on time, minimizing any potential delays.

-

How does using airSlate SignNow benefit my experience with the Application For Special Enrollment Examination IRS?

Using airSlate SignNow for the Application For Special Enrollment Examination IRS simplifies the document management process. You benefit from a user-friendly interface, faster processing times, and enhanced security. This means you can submit your application with confidence and focus on preparing for the examination itself.

-

Can I track the status of my Application For Special Enrollment Examination IRS with airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of your Application For Special Enrollment Examination IRS in real-time. This feature helps you stay informed about when your application is being reviewed by the IRS and when it has been accepted, ensuring peace of mind throughout the process.

-

What integrations does airSlate SignNow offer that can help with my Application For Special Enrollment Examination IRS?

airSlate SignNow integrates seamlessly with various applications and tools, enhancing the management of your Application For Special Enrollment Examination IRS. Whether it's CRM software, cloud storage, or project management tools, these integrations facilitate smooth workflows and centralized data management.

Get more for Application For Special Enrollment Examination Irs

- Chronic pain contract the university of tennessee health uthsc form

- Genetic testing authorization form fax completed form to

- Datesofservicerequested form

- Adult birth sibling application for disclosure form

- Personal care agency functional assessment form

- Wwwmasslooporgwp contentuploadsmassachusetts application for health and dental coverage and form

- Masshealth appeal form

- Dash diet plan pdf form

Find out other Application For Special Enrollment Examination Irs

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent