Nonresident Group Return Schedule CALIFORNIA SCHEDULE 1067A Nonresident Group Return Schedule CALIFORNIA SCHEDULE 1067A 2021-2026

Understanding the California Nonresident Group Return Schedule 1067A

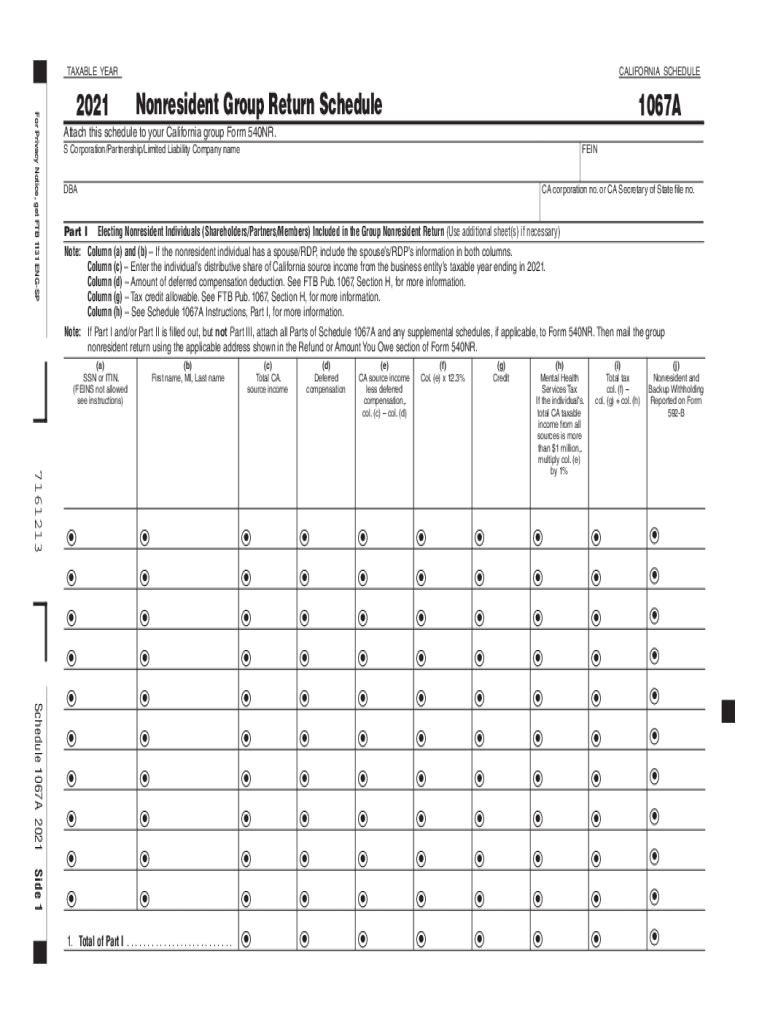

The California Nonresident Group Return Schedule 1067A is designed for nonresident individuals who are part of a group filing. This form allows multiple nonresidents to report their income collectively, simplifying the tax process for those who earned income in California but do not reside there. The 1067A form is essential for ensuring compliance with California tax laws while enabling nonresidents to benefit from group filing provisions.

Steps to Complete the California Nonresident Group Return Schedule 1067A

Completing the 1067A form requires careful attention to detail. Here are the steps to follow:

- Gather necessary information for all group members, including names, addresses, and Social Security numbers.

- Collect income details for each member, ensuring all sources of income earned in California are included.

- Fill out the form accurately, ensuring that all calculations are correct and that each member's share of income is clearly indicated.

- Review the completed form for accuracy and completeness before submission.

How to Obtain the California Nonresident Group Return Schedule 1067A

The 1067A form can be obtained through the California Franchise Tax Board (FTB) website. It is available for download in PDF format, allowing users to print and complete the form manually. Additionally, the form may be accessible through various tax preparation software that supports California tax filings.

Legal Use of the California Nonresident Group Return Schedule 1067A

The 1067A form is legally recognized for tax purposes in California. It must be completed in accordance with state tax regulations to ensure that the group filing is valid. All members of the group are responsible for the accuracy of the information provided, and any discrepancies can lead to penalties or audits by the FTB.

Key Elements of the California Nonresident Group Return Schedule 1067A

Essential components of the 1067A form include:

- Identification of all group members, including their tax identification numbers.

- Details of California-source income for each member.

- Calculations of total income and tax liability for the group.

- Signatures of all members, confirming the accuracy of the information provided.

Filing Deadlines for the California Nonresident Group Return Schedule 1067A

It is crucial to be aware of the filing deadlines associated with the 1067A form. Typically, the form must be submitted by the due date for the individual tax returns of the group members. Extensions may be available, but it is essential to check with the California Franchise Tax Board for specific dates and requirements.

Quick guide on how to complete 2021 nonresident group return schedule california schedule 1067a 2021 nonresident group return schedule california schedule

Effortlessly Prepare Nonresident Group Return Schedule CALIFORNIA SCHEDULE 1067A Nonresident Group Return Schedule CALIFORNIA SCHEDULE 1067A on Any Device

Digital document management has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without hurdles. Manage Nonresident Group Return Schedule CALIFORNIA SCHEDULE 1067A Nonresident Group Return Schedule CALIFORNIA SCHEDULE 1067A on any platform with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

The Easiest Way to Modify and Electronically Sign Nonresident Group Return Schedule CALIFORNIA SCHEDULE 1067A Nonresident Group Return Schedule CALIFORNIA SCHEDULE 1067A with Ease

- Obtain Nonresident Group Return Schedule CALIFORNIA SCHEDULE 1067A Nonresident Group Return Schedule CALIFORNIA SCHEDULE 1067A and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Spotlight important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your changes.

- Select your preferred method for sending your form—via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced files, the hassle of searching for forms, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Nonresident Group Return Schedule CALIFORNIA SCHEDULE 1067A Nonresident Group Return Schedule CALIFORNIA SCHEDULE 1067A and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2021 nonresident group return schedule california schedule 1067a 2021 nonresident group return schedule california schedule

Create this form in 5 minutes!

People also ask

-

What is mycodaccount and how does it work?

mycodaccount is an innovative online account management system that streamlines the eSigning process. It allows users to securely send, receive, and sign documents electronically. With airSlate SignNow's mycodaccount, businesses can easily enhance their document workflows and improve efficiency.

-

How much does mycodaccount cost?

The pricing for mycodaccount varies depending on the chosen plan and features. airSlate SignNow offers flexible billing options, starting with a free trial allowing users to experience the platform's capabilities. Businesses can scale their subscriptions based on their eSigning needs without hidden fees.

-

What features does mycodaccount offer?

mycodaccount includes a range of features designed for user convenience, such as custom templates, mobile signing, and secure storage. Additionally, it offers advanced tracking and reporting functionalities to monitor document statuses. These features are tailored to enhance productivity for businesses of all sizes.

-

How can mycodaccount improve my business processes?

By utilizing mycodaccount, businesses can signNowly reduce the time and costs associated with traditional document signing. The platform automates workflows, allowing for quicker turnaround times and fewer errors. This ultimately leads to improved customer satisfaction and operational efficiency.

-

Is mycodaccount compliant with legal standards?

Yes, mycodaccount is designed to comply with various legal standards, including the ESIGN Act and UETA, making electronic signatures legally binding. airSlate SignNow ensures that all documents signed through mycodaccount meet industry security and compliance requirements. This gives users peace of mind when managing sensitive documents.

-

Can I integrate mycodaccount with other tools?

Absolutely! mycodaccount can seamlessly integrate with a variety of popular business applications, including CRM systems, cloud storage, and productivity tools. These integrations enhance the functionality of airSlate SignNow, ensuring that your document management processes are efficient and streamlined.

-

What support options are available for mycodaccount users?

Users of mycodaccount have access to multiple support options, including a comprehensive knowledge base, online chat, and email support. airSlate SignNow is committed to providing assistance via different channels to ensure that users can resolve issues quickly. Regular training webinars are also offered for deeper insights into the platform.

Get more for Nonresident Group Return Schedule CALIFORNIA SCHEDULE 1067A Nonresident Group Return Schedule CALIFORNIA SCHEDULE 1067A

- Ohio installments fixed rate promissory note secured by residential real estate ohio form

- Ohio note 497322542 form

- Ohio secured form

- Ohio workers compensation 497322544 form

- Notice of option for recording ohio form

- Life documents planning package including will power of attorney and living will ohio form

- General durable power of attorney for property and finances or financial effective upon disability ohio form

- Essential legal life documents for baby boomers ohio form

Find out other Nonresident Group Return Schedule CALIFORNIA SCHEDULE 1067A Nonresident Group Return Schedule CALIFORNIA SCHEDULE 1067A

- Sign Minnesota Employee Appraisal Form Online

- How To Sign Alabama Employee Satisfaction Survey

- Sign Colorado Employee Satisfaction Survey Easy

- Sign North Carolina Employee Compliance Survey Safe

- Can I Sign Oklahoma Employee Satisfaction Survey

- How Do I Sign Florida Self-Evaluation

- How Do I Sign Idaho Disclosure Notice

- Sign Illinois Drug Testing Consent Agreement Online

- Sign Louisiana Applicant Appraisal Form Evaluation Free

- Sign Maine Applicant Appraisal Form Questions Secure

- Sign Wisconsin Applicant Appraisal Form Questions Easy

- Sign Alabama Deed of Indemnity Template Later

- Sign Alabama Articles of Incorporation Template Secure

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval