1067a Ca 2018

What is the 1067a Ca

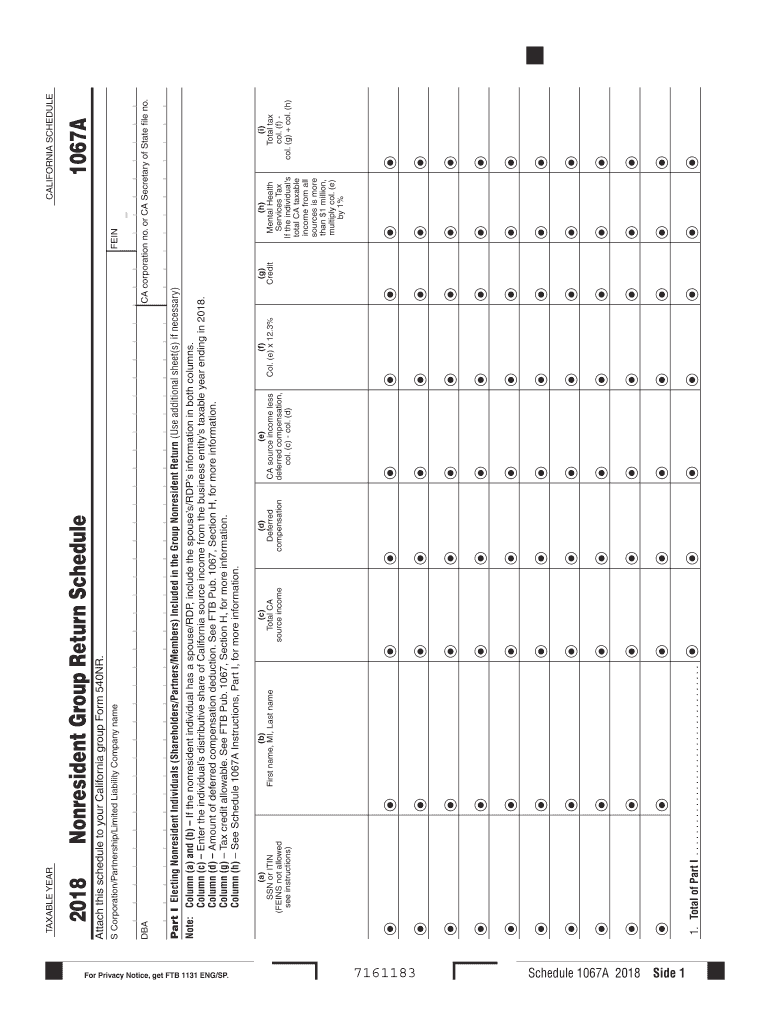

The 1067a California form, often referred to as the 1067a CA, is a crucial document used in the state of California for tax reporting purposes. This form is specifically designed for organizations that are part of the California Schedule Group. It helps in reporting income and expenses accurately, ensuring compliance with state tax regulations. Understanding the purpose of this form is essential for any entity that needs to file taxes in California, as it plays a significant role in maintaining proper financial records.

Steps to complete the 1067a Ca

Completing the 1067a CA form involves several important steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and expense records. Next, fill out the form by entering the required information in the designated fields. It is crucial to double-check all entries for accuracy. After completing the form, sign it electronically using a secure eSignature solution, which is legally accepted by the IRS. Finally, submit the form electronically or by mail, depending on your preference and the requirements set by the California tax authorities.

Legal use of the 1067a Ca

The 1067a CA form is legally recognized for tax reporting in California. Its proper use ensures compliance with state laws and regulations. The Internal Revenue Service (IRS) has acknowledged the validity of electronic signatures on this form, which simplifies the filing process. It is important for users to understand that any inaccuracies or omissions can lead to penalties, making it essential to fill out the form with care and attention to detail.

Filing Deadlines / Important Dates

Filing deadlines for the 1067a CA form are crucial for compliance. Typically, the form must be submitted by April 15 of the tax year. However, extensions may be available under certain circumstances. It is advisable for taxpayers to stay informed about any changes in deadlines, especially during tax season, to avoid late fees or penalties. Keeping a calendar of important dates can help ensure timely submission of the form.

Form Submission Methods (Online / Mail / In-Person)

The 1067a CA form can be submitted through various methods to accommodate different preferences. Users can file the form online through the California tax authority's website, which offers a streamlined process for electronic submissions. Alternatively, the form can be mailed to the appropriate tax office, ensuring it is sent well before the deadline. In-person submissions may also be possible at designated tax offices, providing another option for those who prefer face-to-face interactions.

Key elements of the 1067a Ca

Understanding the key elements of the 1067a CA form is vital for accurate completion. These elements include fields for reporting income, deductions, and any applicable credits. Additionally, the form requires information about the entity's structure, such as whether it is a corporation or partnership. Each section of the form is designed to capture specific financial data, making it essential for users to familiarize themselves with these components to ensure compliance with state tax regulations.

Eligibility Criteria

Eligibility to use the 1067a CA form is generally limited to organizations that are part of the California Schedule Group. This includes specific types of entities that meet the criteria set forth by the California tax authorities. It is important for applicants to verify their eligibility before attempting to complete and submit the form. Understanding the eligibility criteria helps prevent unnecessary complications during the filing process.

Quick guide on how to complete 1067a this form is currently not available

Your assistance manual on how to prepare your 1067a Ca

If you’re wondering how to complete and submit your 1067a Ca, here are some brief instructions on how to simplify tax filing.

To begin, you simply need to establish your airSlate SignNow profile to change how you manage documents online. airSlate SignNow is a highly user-friendly and powerful document solution that enables you to modify, draft, and finalize your tax documents with ease. With its editor, you can toggle between text, check boxes, and eSignatures and go back to alter responses as necessary. Streamline your tax administration with sophisticated PDF editing, eSigning, and intuitive sharing.

Follow the steps below to complete your 1067a Ca in no time:

- Set up your account and start editing PDFs quickly.

- Utilize our directory to access any IRS tax form; browse through versions and schedules.

- Click Access form to open your 1067a Ca in our editor.

- Complete the mandatory fillable sections with your details (text, numbers, check marks).

- Utilize the Signature Tool to insert your legally-binding eSignature (if required).

- Review your document and correct any errors.

- Save changes, print your copy, send it to your recipient, and download it to your device.

Leverage this manual to file your taxes electronically with airSlate SignNow. Please be aware that filing on paper can lead to return errors and delay refunds. Of course, prior to e-filing your taxes, consult the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct 1067a this form is currently not available

FAQs

-

When will the forms for the CBSE improvement exam be available, and what is the procedure to fill out a form, as I will not be joining school?

Just check out the cbse website… CBSEit will come in the end of August…dont worry if it not come..because it can be late it can be in the mid of September also…just thoroughly checkout CBSE website …Procedure…just fill the form online and select the subjects in which u want to give exam again…and yes read the rules carefully…afterward making ur payment i think so for each subject it cost 200 ruppesand then they will send u a letter for ur exam ..or say conformation..then just collect your admit card from the school written in the letter thats it….If any ques..comment down below…don’t hesitate…

-

I need help filling out this IRA form to withdraw money. How do I fill this out?

I am confused on the highlighted part.

-

“You are going to have to fill out this form.” Is that polite?

Yes.Sometimes, just telling a person what they need to do to get what they want is the polite thing to do. Especially if they have come to you with an attitude of condescension and implied superiority. In that case you just speak to them as politely as you must.The bare minimum is still the minimum.Is it the best that person could have done? Probably not. But that wasn’t the question.

-

What is the shipping postal code, and how do I fill out this form?

It seems to me that in your country, you'd call this a Post Code.

-

When will the BAMS application form be available? On which site do we have to fill it out? When is the last date to fill it out?

BAMS application form is available now . uhh can go to ur nearby mponline nd fill the form last date to fill the application form is 30 june ,sooo hurry up !! nd wishing uhh good luck☺

Create this form in 5 minutes!

How to create an eSignature for the 1067a this form is currently not available

How to create an electronic signature for your 1067a This Form Is Currently Not Available in the online mode

How to create an eSignature for your 1067a This Form Is Currently Not Available in Google Chrome

How to make an electronic signature for putting it on the 1067a This Form Is Currently Not Available in Gmail

How to make an eSignature for the 1067a This Form Is Currently Not Available straight from your smart phone

How to make an electronic signature for the 1067a This Form Is Currently Not Available on iOS devices

How to create an eSignature for the 1067a This Form Is Currently Not Available on Android OS

People also ask

-

What is form 1067a 2018 and why is it important?

Form 1067a 2018 is a tax form used to report specific financial information to the IRS. It is essential for individuals and businesses to complete this form accurately to comply with tax regulations and avoid penalties.

-

How can airSlate SignNow help with completing form 1067a 2018?

airSlate SignNow provides an intuitive platform that allows users to easily access, fill out, and eSign form 1067a 2018. Our solution streamlines the process, ensuring that all necessary information is captured efficiently and securely.

-

What features does airSlate SignNow offer for eSigning form 1067a 2018?

With airSlate SignNow, users can enjoy features such as customizable templates, after-signing notifications, and secure cloud storage. These tools enhance the signing experience for form 1067a 2018, making it quick and hassle-free.

-

Is there a cost associated with using airSlate SignNow for form 1067a 2018?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that can help streamline the completion and signing of form 1067a 2018, ensuring you find an option that fits your budget.

-

Can I integrate airSlate SignNow with other software for handling form 1067a 2018?

Absolutely! airSlate SignNow offers robust integrations with various software solutions, including CRM and document management systems. This allows you to seamlessly manage form 1067a 2018 within your existing workflows for greater efficiency.

-

What are the benefits of using airSlate SignNow for form 1067a 2018?

Using airSlate SignNow for form 1067a 2018 provides numerous benefits, including time savings, enhanced security, and improved accuracy. The platform simplifies the eSigning process, allowing you to focus on your core business activities without worrying about document completion.

-

Is airSlate SignNow compliant with legal regulations for form 1067a 2018?

Yes, airSlate SignNow complies with all legal requirements for electronic signatures and document management. This ensures that your completed form 1067a 2018 and associated signatures hold up in a court of law.

Get more for 1067a Ca

Find out other 1067a Ca

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple