Martinez CA540 Form for Privacy Notice Get FTB 1131 ENG 2020

What is the mycodaccount Form?

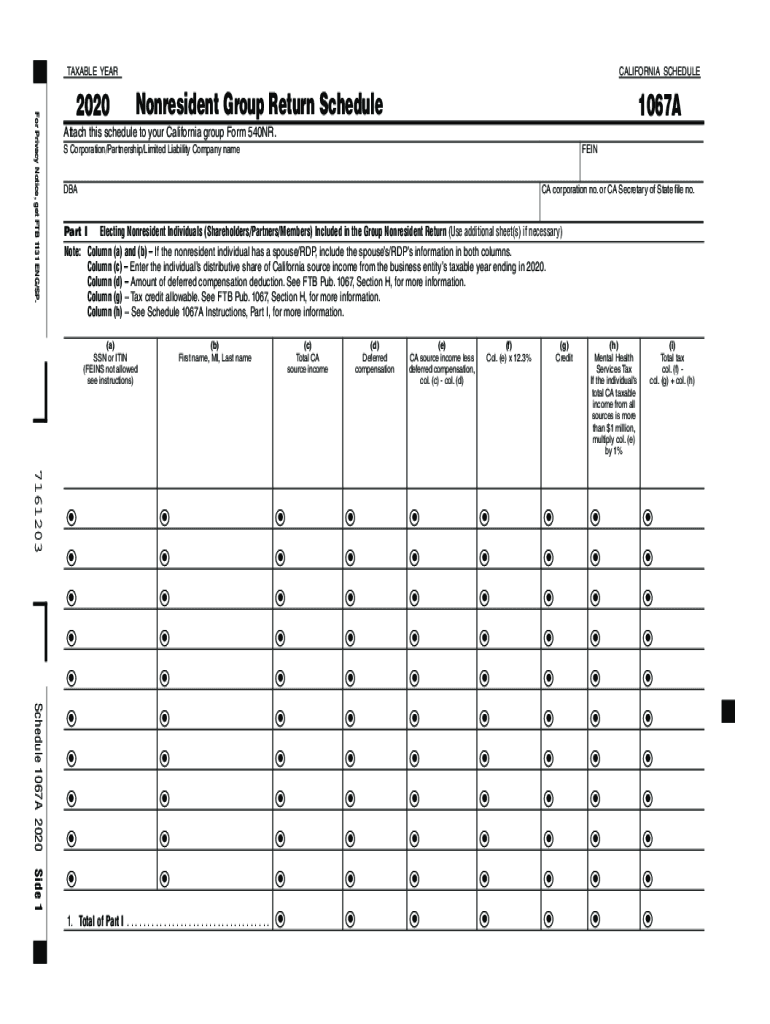

The mycodaccount form is essential for California taxpayers who are part of a nonresident group return. This form facilitates the reporting of income earned in California by individuals who do not reside in the state. It is specifically designed for those who need to file a group return, allowing for a streamlined process that combines the income and deductions of multiple individuals into a single submission. Understanding the purpose of this form is crucial for compliance with California tax regulations.

Steps to Complete the mycodaccount Form

Completing the mycodaccount form involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including income statements and any relevant tax documents for each member of the group. Next, accurately fill out the form by entering the required information for each individual, including their share of income and deductions. After completing the form, review it thoroughly for any errors or omissions. Finally, submit the form electronically through a secure platform or by mail, ensuring that all signatures are included to validate the submission.

Required Documents for the mycodaccount Form

To successfully complete the mycodaccount form, several documents are necessary. These typically include:

- Income statements for each group member, such as W-2s or 1099s.

- Any documentation related to deductions claimed, such as receipts or statements.

- Identification numbers for all individuals involved in the group return.

- Previous tax returns, if applicable, to provide context and history.

Having these documents ready will streamline the completion process and help ensure that all information is accurate and compliant with state regulations.

Legal Use of the mycodaccount Form

The mycodaccount form is legally recognized for reporting income for nonresident groups in California. It complies with the state's tax laws and regulations, ensuring that the income earned by nonresidents is reported correctly. Utilizing this form helps taxpayers avoid penalties associated with incorrect filings. It is important to follow all guidelines set forth by the California Franchise Tax Board to maintain legal compliance when using this form.

Filing Deadlines for the mycodaccount Form

Timely submission of the mycodaccount form is crucial to avoid penalties. The filing deadline typically aligns with the standard tax return due date, which is usually April 15 for most taxpayers. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is advisable to check for any updates or changes to the filing schedule each tax year to ensure compliance.

Examples of Using the mycodaccount Form

Using the mycodaccount form can vary based on individual circumstances. For instance, a group of friends who worked together in California for a summer job may need to file a nonresident group return. Similarly, a partnership of professionals providing services in California while residing in another state would also utilize this form. Each scenario requires careful consideration of income earned and deductions applicable to ensure the group return accurately reflects the tax obligations of all members.

Quick guide on how to complete martinez ca540 form for privacy notice get ftb 1131 eng

Complete Martinez CA540 Form For Privacy Notice Get FTB 1131 ENG effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and electronically sign your documents quickly without delays. Handle Martinez CA540 Form For Privacy Notice Get FTB 1131 ENG on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Martinez CA540 Form For Privacy Notice Get FTB 1131 ENG with ease

- Obtain Martinez CA540 Form For Privacy Notice Get FTB 1131 ENG and click Get Form to begin.

- Utilize the tools we offer to fill in your form.

- Highlight important sections of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Martinez CA540 Form For Privacy Notice Get FTB 1131 ENG and ensure seamless communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct martinez ca540 form for privacy notice get ftb 1131 eng

Create this form in 5 minutes!

How to create an eSignature for the martinez ca540 form for privacy notice get ftb 1131 eng

The way to create an electronic signature for a PDF in the online mode

The way to create an electronic signature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

The way to make an eSignature right from your smart phone

The best way to create an eSignature for a PDF on iOS devices

The way to make an eSignature for a PDF on Android OS

People also ask

-

What is mycodaccount and how does it relate to airSlate SignNow?

Mycodaccount is the central hub for managing your airSlate SignNow account. It allows you to access all features, including document management, eSigning options, and account settings. By logging into mycodaccount, users can streamline their workflow and enhance document collaboration.

-

How much does an airSlate SignNow subscription cost through mycodaccount?

The pricing for airSlate SignNow accessed through mycodaccount is structured into various tiers to suit different needs. Each tier offers distinct features, ensuring that users only pay for what they need. Visit mycodaccount for the most up-to-date pricing and to explore the best plan for your business.

-

What key features can I access with mycodaccount?

When you log into your mycodaccount, you can utilize features such as electronic signatures, document templates, and advanced editing tools. These features are designed to enhance productivity and simplify the eSigning process. Mycodaccount provides a user-friendly interface, making it easy to navigate through these tools.

-

Are there any benefits to using airSlate SignNow through mycodaccount?

Using airSlate SignNow through mycodaccount offers several benefits, including cost savings, increased efficiency, and improved security. With a focus on seamless document handling, users can expedite their workflows and reduce turnaround times. Additionally, mycodaccount ensures your documents are stored securely and comply with industry standards.

-

Can I integrate airSlate SignNow with other applications via mycodaccount?

Yes, mycodaccount allows you to integrate airSlate SignNow with various third-party applications, enhancing your business processes. This integration capability includes tools for CRM systems, cloud storage services, and project management software. Such integrations enable more efficient data transfer and workflow automation.

-

Is there a free trial available for airSlate SignNow through mycodaccount?

Yes, airSlate SignNow offers a free trial that you can access through your mycodaccount. This trial allows users to explore the platform's features without any financial obligation. It's an excellent opportunity to determine how airSlate SignNow can meet your business's eSigning needs.

-

How can I get customer support for mycodaccount issues?

If you encounter any issues with your mycodaccount, customer support for airSlate SignNow is readily available. You can signNow out through the help center or via direct support channels provided in your account. The support team is knowledgeable and committed to resolving your queries efficiently.

Get more for Martinez CA540 Form For Privacy Notice Get FTB 1131 ENG

Find out other Martinez CA540 Form For Privacy Notice Get FTB 1131 ENG

- eSignature Idaho Real Estate Cease And Desist Letter Online

- eSignature Idaho Real Estate Cease And Desist Letter Simple

- eSignature Wyoming Plumbing Quitclaim Deed Myself

- eSignature Colorado Sports Living Will Mobile

- eSignature Iowa Real Estate Moving Checklist Simple

- eSignature Iowa Real Estate Quitclaim Deed Easy

- eSignature Real Estate Form Louisiana Simple

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP