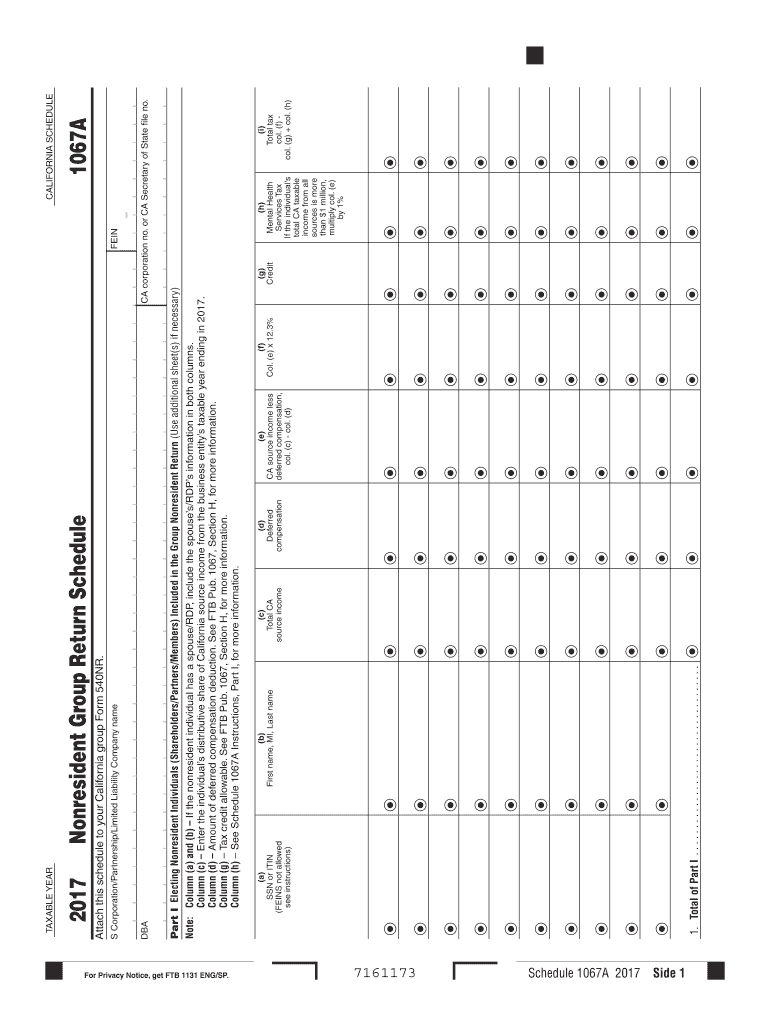

Schedule 1067A Nonresident Group Return Schedule Schedule 1067A Nonresident Group Return Schedule 2017

What is the Schedule 1067A Nonresident Group Return Schedule?

The Schedule 1067A Nonresident Group Return Schedule is a specific tax form used by nonresident individuals to report their income and tax liabilities collectively. This form allows multiple nonresidents to file a single group return, simplifying the tax process for those who qualify. It is essential for ensuring compliance with IRS regulations while taking advantage of potential tax benefits available to nonresident groups.

How to use the Schedule 1067A Nonresident Group Return Schedule

Using the Schedule 1067A Nonresident Group Return Schedule involves gathering necessary information about all group members, including their income, deductions, and tax identification numbers. Each member must consent to be included in the group return. Once the information is compiled, the form can be filled out online or on paper, ensuring all details are accurate and complete before submission.

Steps to complete the Schedule 1067A Nonresident Group Return Schedule

Completing the Schedule 1067A Nonresident Group Return Schedule requires several key steps:

- Collect personal information for each group member, including names, addresses, and tax identification numbers.

- Determine the income and deductions applicable to each member.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the completed form for any errors or omissions.

- Obtain necessary signatures from all group members.

- Submit the form electronically or via mail, adhering to IRS guidelines.

Legal use of the Schedule 1067A Nonresident Group Return Schedule

The legal use of the Schedule 1067A Nonresident Group Return Schedule is governed by IRS regulations. It is crucial for all participants to ensure that they meet eligibility criteria and comply with tax laws. Misuse of this form can lead to penalties, so understanding the legal implications and requirements is essential for all group members.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule 1067A Nonresident Group Return Schedule typically align with the general tax filing deadlines set by the IRS. For most taxpayers, this means the form must be submitted by April 15 of the following tax year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is important to stay informed about any changes to these deadlines to avoid late penalties.

Required Documents

To complete the Schedule 1067A Nonresident Group Return Schedule, several documents are necessary:

- Tax identification numbers for each group member.

- Income statements, such as W-2s or 1099s.

- Documentation of deductions and credits applicable to the group.

- Any previous tax returns that may be relevant.

Quick guide on how to complete 2017 schedule 1067a nonresident group return schedule 2017 schedule 1067a nonresident group return schedule

Your assistance manual on how to prepare your Schedule 1067A Nonresident Group Return Schedule Schedule 1067A Nonresident Group Return Schedule

If you're wondering how to complete and submit your Schedule 1067A Nonresident Group Return Schedule Schedule 1067A Nonresident Group Return Schedule, here are a few concise guidelines on how to make tax submission signNowly simpler.

To begin, you simply need to create your airSlate SignNow account to transform your document management online. airSlate SignNow is an extremely user-friendly and powerful document solution that enables you to edit, draft, and finalize your tax forms effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and revisit to modify answers as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and easy sharing.

Follow the instructions below to complete your Schedule 1067A Nonresident Group Return Schedule Schedule 1067A Nonresident Group Return Schedule in just a few minutes:

- Set up your account and start working on PDFs within minutes.

- Use our directory to access any IRS tax form; explore different versions and schedules.

- Click Get form to launch your Schedule 1067A Nonresident Group Return Schedule Schedule 1067A Nonresident Group Return Schedule in our editor.

- Populate the necessary fields with your details (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-recognized eSignature (if required).

- Examine your document and rectify any errors.

- Preserve changes, print your copy, submit it to your recipient, and download it to your device.

Leverage this manual to electronically file your taxes with airSlate SignNow. Keep in mind that submitting on paper can lead to errors and delay reimbursements. Importantly, before e-filing your taxes, visit the IRS website for submission guidelines in your state.

Create this form in 5 minutes or less

Find and fill out the correct 2017 schedule 1067a nonresident group return schedule 2017 schedule 1067a nonresident group return schedule

FAQs

-

Why do disability recipients have to request a doctor’s FEIN for an IRS Schedule H form for the 2017 tax return?

Are you sure you mean Shedule H? Schedule H is where you report wages paid to a household employee, (along with a W-2 that would need to be issued for the employee). If a person on disability has an in-Home caregiver who is paid by the disabled person, whether full or part time, there is a good chance the caregiver is classified as a “household employee “ under IRS rules (although there is also the possibility that the caregiver might be self-employed or might be working for another agency, in which case the disabled person would not need to file Schedule H).People who are required to file Schedule H must obtain a Federal Employer Identification Number (EIN) for themselves. They may not use their Social Security number in place of an EIN. I don’t know where this idea of needing to obtain a Doctor’s EIN would have come from, unless the doctor is paying the household employee on behalf of the person on disability! Not likely.

-

For a resident alien individual having farm income in the home country, India, how to report the agricultural income in US income tax return? Does the form 1040 schedule F needs to be filled?

The answer is yes, it should be. Remember that you will receive a credit for any Indian taxes you pay.

Create this form in 5 minutes!

How to create an eSignature for the 2017 schedule 1067a nonresident group return schedule 2017 schedule 1067a nonresident group return schedule

How to generate an eSignature for the 2017 Schedule 1067a Nonresident Group Return Schedule 2017 Schedule 1067a Nonresident Group Return Schedule in the online mode

How to create an eSignature for your 2017 Schedule 1067a Nonresident Group Return Schedule 2017 Schedule 1067a Nonresident Group Return Schedule in Google Chrome

How to make an electronic signature for signing the 2017 Schedule 1067a Nonresident Group Return Schedule 2017 Schedule 1067a Nonresident Group Return Schedule in Gmail

How to make an electronic signature for the 2017 Schedule 1067a Nonresident Group Return Schedule 2017 Schedule 1067a Nonresident Group Return Schedule right from your mobile device

How to make an eSignature for the 2017 Schedule 1067a Nonresident Group Return Schedule 2017 Schedule 1067a Nonresident Group Return Schedule on iOS devices

How to make an electronic signature for the 2017 Schedule 1067a Nonresident Group Return Schedule 2017 Schedule 1067a Nonresident Group Return Schedule on Android

People also ask

-

What is the Schedule 1067A Nonresident Group Return Schedule?

The Schedule 1067A Nonresident Group Return Schedule is a specialized tax form designed for nonresident groups to file their tax returns efficiently. It streamlines the process for multiple nonresidents filing together, ensuring compliance with tax regulations.

-

How does airSlate SignNow assist with the Schedule 1067A Nonresident Group Return Schedule?

airSlate SignNow provides an easy-to-use platform for businesses to prepare and eSign the Schedule 1067A Nonresident Group Return Schedule. Our solution offers templates and guidance to simplify the filing process, ensuring accuracy and compliance.

-

What are the pricing options for using airSlate SignNow for the Schedule 1067A Nonresident Group Return Schedule?

Our pricing for airSlate SignNow remains competitive and provides excellent value for businesses needing to handle the Schedule 1067A Nonresident Group Return Schedule. We offer various subscription plans tailored to different business needs, all aimed at cost-effectiveness.

-

Are there any integrations available for airSlate SignNow to facilitate the Schedule 1067A Nonresident Group Return Schedule?

Yes, airSlate SignNow seamlessly integrates with various platforms and software, enhancing your ability to manage the Schedule 1067A Nonresident Group Return Schedule. These integrations help simplify workflows, allowing for more efficient document handling.

-

What features does airSlate SignNow offer to support the Schedule 1067A Nonresident Group Return Schedule?

airSlate SignNow includes features such as customizable templates, secure eSignatures, and cloud storage, all of which are essential for managing the Schedule 1067A Nonresident Group Return Schedule. This functionality ensures quick and efficient processing of your documents.

-

Can airSlate SignNow help with tracking the status of the Schedule 1067A Nonresident Group Return Schedule?

Absolutely! airSlate SignNow provides tracking features that allow you to monitor the status of the Schedule 1067A Nonresident Group Return Schedule in real time. This transparency helps you stay informed about document progress and completion.

-

What benefits does using airSlate SignNow offer when filing the Schedule 1067A Nonresident Group Return Schedule?

Using airSlate SignNow to file the Schedule 1067A Nonresident Group Return Schedule offers numerous benefits, including improved accuracy, faster turnaround times, and enhanced collaboration among signers. Our platform ensures a smoother filing experience.

Get more for Schedule 1067A Nonresident Group Return Schedule Schedule 1067A Nonresident Group Return Schedule

Find out other Schedule 1067A Nonresident Group Return Schedule Schedule 1067A Nonresident Group Return Schedule

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample