F1099div PDF Attention Copy a of This Form is Provided 2022

Understanding the 1098 Form

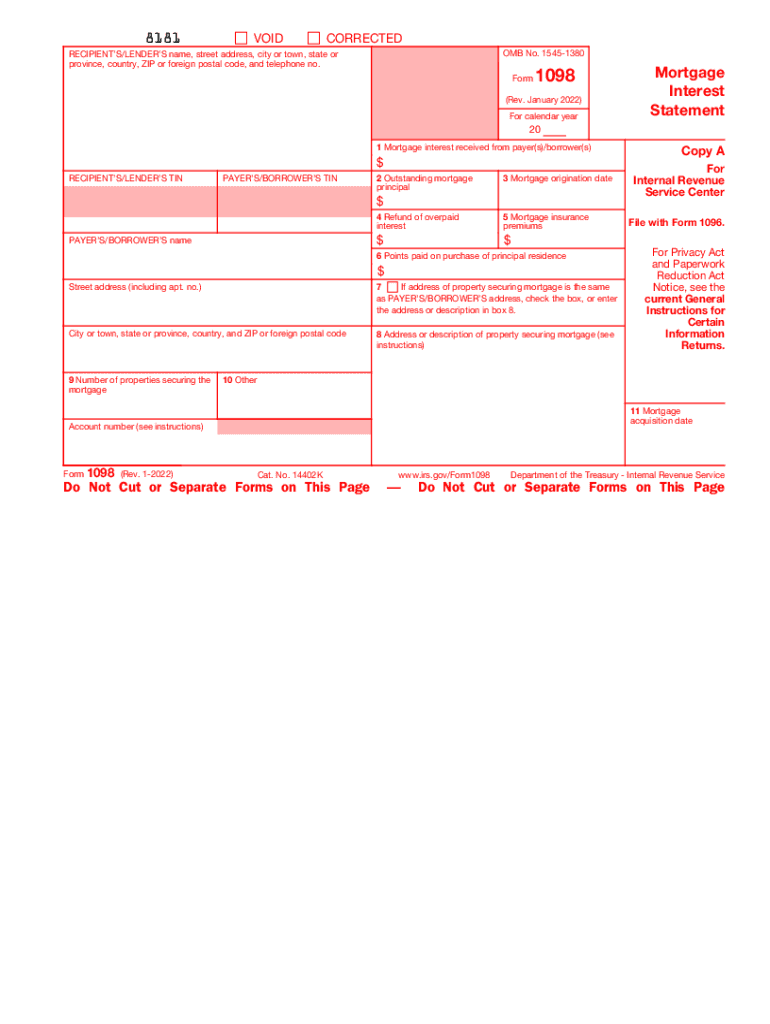

The 1098 form, also known as the mortgage interest statement, is a crucial document for taxpayers in the United States who have a mortgage. This form is issued by lenders to report the amount of mortgage interest paid by the borrower during the tax year. It serves as a record for taxpayers to claim deductions on their tax returns, potentially reducing their taxable income. The information included in the 1098 form is essential for accurately completing federal tax returns, particularly for those who itemize their deductions.

Key Elements of the 1098 Form

The 1098 form contains several important pieces of information that borrowers need to be aware of:

- Borrower's Information: This includes the name, address, and taxpayer identification number of the borrower.

- Lender's Information: The lender's name, address, and taxpayer identification number are also provided.

- Mortgage Interest Paid: The total amount of interest paid during the year is reported, which is critical for tax deductions.

- Points Paid: If any points were paid to reduce the interest rate, these are also documented, as they may be deductible.

- Outstanding Mortgage Balance: The form may include the balance of the mortgage at the end of the year.

Steps to Complete the 1098 Form

Completing the 1098 form involves several steps to ensure accuracy and compliance:

- Gather Necessary Information: Collect all relevant details about your mortgage, including loan statements and prior year tax returns.

- Fill Out the Form: Input your personal information, lender details, and the amounts of interest and points paid.

- Review for Accuracy: Double-check all entries to ensure that they match your financial records and statements from your lender.

- Submit the Form: Send the completed form to the IRS along with your tax return, or retain it for your records if you are not itemizing deductions.

IRS Guidelines for the 1098 Form

The IRS provides specific guidelines regarding the use of the 1098 form. It is essential to adhere to these regulations to avoid potential issues with tax filings:

- Filing Requirements: The 1098 form must be filed by lenders for any mortgage interest of $600 or more received during the year.

- Deadline for Submission: Lenders must send the 1098 form to borrowers by January 31 of the following year.

- Record Keeping: Borrowers should retain a copy of the 1098 form for at least three years after filing their tax return in case of an audit.

Penalties for Non-Compliance

Failure to comply with IRS regulations regarding the 1098 form can result in penalties for both lenders and borrowers:

- Lender Penalties: Lenders may face fines for failing to file the 1098 form or for providing incorrect information.

- Borrower Implications: If a borrower fails to report the mortgage interest correctly, they may miss out on potential tax deductions, leading to a higher tax liability.

Digital vs. Paper Version of the 1098 Form

In today’s digital age, the option to fill out and submit the 1098 form electronically is available. Here are some considerations:

- Convenience: Digital forms can be completed and submitted quickly, reducing the time spent on paperwork.

- Security: Using secure eSignature solutions can enhance the protection of sensitive information compared to traditional paper forms.

- Record Keeping: Digital submissions allow for easier organization and retrieval of documents when needed for tax preparation or audits.

Quick guide on how to complete f1099divpdf attention copy a of this form is provided

Prepare F1099div pdf Attention Copy A Of This Form Is Provided seamlessly on any device

Digital document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the features you require to create, modify, and eSign your documents quickly and efficiently. Manage F1099div pdf Attention Copy A Of This Form Is Provided on any platform with airSlate SignNow Android or iOS applications and enhance any document-based process today.

The simplest way to modify and eSign F1099div pdf Attention Copy A Of This Form Is Provided without stress

- Obtain F1099div pdf Attention Copy A Of This Form Is Provided and then click Get Form to begin.

- Utilize the tools we offer to complete your document submission.

- Emphasize key sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and has the same legal standing as a conventional wet ink signature.

- Verify all the information and then click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Adjust and eSign F1099div pdf Attention Copy A Of This Form Is Provided and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct f1099divpdf attention copy a of this form is provided

Create this form in 5 minutes!

People also ask

-

What is a 1098 form and why is it important?

The 1098 form is a tax document used to report mortgage interest paid, which is crucial for homeowners when filing taxes. It helps individuals claim deductions for mortgage interest, potentially lowering their tax liability. Understanding the 1098 form is essential for maximizing tax benefits.

-

How does airSlate SignNow help with the 1098 form?

AirSlate SignNow simplifies the process of filling and signing the 1098 form electronically. With our user-friendly platform, you can easily send, sign, and store your forms securely. This streamlines tax preparation and ensures timely submission.

-

Is there a cost associated with using airSlate SignNow for the 1098 form?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users. We provide a cost-effective solution for managing documents, including the 1098 form. Explore our plans to find the one that best fits your requirements.

-

Can I integrate airSlate SignNow with other software for managing the 1098 form?

Absolutely! AirSlate SignNow offers seamless integrations with popular software applications, enhancing your workflow when managing the 1098 form. This allows you to automate processes and improve efficiency across your document management tasks.

-

What features does airSlate SignNow provide for handling the 1098 form?

Our platform provides essential features like eSignature capabilities, document templates, and secure cloud storage for the 1098 form. These tools ensure that you can complete and manage your forms quickly and securely. Additionally, track changes and send reminders to keep everyone on track.

-

Is airSlate SignNow secure for submitting sensitive documents like the 1098 form?

Yes, airSlate SignNow prioritizes security when handling sensitive documents, including the 1098 form. We use advanced encryption protocols to protect your data and ensure compliance with security standards. You can confidently manage your forms knowing that your information is safe.

-

How can I get support for using airSlate SignNow with the 1098 form?

Our customer support team is ready to assist you with any questions related to the 1098 form and using airSlate SignNow. You can access our help center, contact support via chat, or send an email. We are dedicated to ensuring a smooth user experience.

Get more for F1099div pdf Attention Copy A Of This Form Is Provided

- Ucc1 statement form ucc

- Ohio addendum form

- Financing statement amendment 497322676 form

- Financing statement amendment addendum form

- Legal last will and testament form for single person with no children ohio

- Legal last will and testament form for a single person with minor children ohio

- Legal last will and testament form for single person with adult and minor children ohio

- Legal last will and testament form for single person with adult children ohio

Find out other F1099div pdf Attention Copy A Of This Form Is Provided

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form