Form 1098 Mortgage Interest 2008

What is the Form 1098 Mortgage Interest

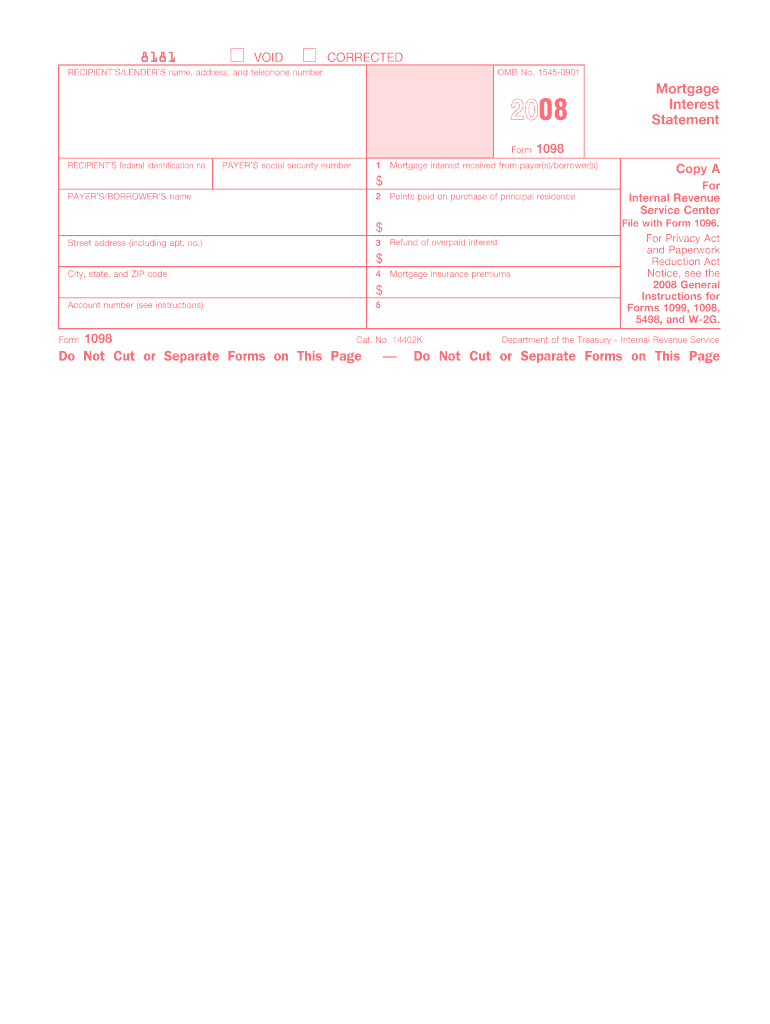

The Form 1098 Mortgage Interest is a tax document used in the United States to report the amount of mortgage interest paid by a borrower during a tax year. This form is typically issued by lenders to individuals who have taken out a mortgage on their property. It is crucial for taxpayers as it allows them to claim mortgage interest deductions on their federal tax returns, potentially reducing their taxable income.

How to use the Form 1098 Mortgage Interest

To use the Form 1098 Mortgage Interest effectively, taxpayers should first ensure they receive this form from their mortgage lender by the end of January each year. The information on the form should be accurately reported on the appropriate section of the IRS Form 1040, specifically Schedule A for itemized deductions. Taxpayers should keep the form for their records, as it may be needed for future reference or in case of an audit.

Steps to complete the Form 1098 Mortgage Interest

Completing the Form 1098 Mortgage Interest involves several steps:

- Gather necessary information such as the lender's name, address, and the borrower's details.

- Enter the total amount of mortgage interest paid during the year, as well as any points paid.

- Provide the mortgage balance as of January first of the tax year.

- Include any additional information required, such as the property address.

- Review the completed form for accuracy before submitting it to the IRS.

Key elements of the Form 1098 Mortgage Interest

The Form 1098 Mortgage Interest includes several key elements that are essential for accurate reporting:

- Lender Information: Name, address, and taxpayer identification number of the lender.

- Borrower Information: Name, address, and taxpayer identification number of the borrower.

- Interest Paid: Total mortgage interest paid during the year.

- Points Paid: Any points paid to reduce the interest rate.

- Mortgage Balance: Outstanding mortgage balance as of January first.

Who Issues the Form 1098 Mortgage Interest

The Form 1098 Mortgage Interest is issued by mortgage lenders, which can include banks, credit unions, and other financial institutions that provide mortgage loans. These lenders are required to send this form to borrowers who have paid at least $600 in mortgage interest during the tax year. It is important for borrowers to ensure they receive this form to accurately report their mortgage interest deductions.

Filing Deadlines / Important Dates

For the Form 1098 Mortgage Interest, lenders must provide the form to borrowers by January thirty-first of the year following the tax year. Borrowers should ensure they have received their forms in time to incorporate the information into their tax returns, which are typically due by April fifteenth. It is advisable to file taxes as soon as possible to avoid penalties for late filing.

Quick guide on how to complete 2008 form 1098 mortgage interest

Complete Form 1098 Mortgage Interest effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools you require to create, edit, and eSign your documents quickly without delays. Manage Form 1098 Mortgage Interest on any platform using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to modify and eSign Form 1098 Mortgage Interest effortlessly

- Locate Form 1098 Mortgage Interest and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight key sections of your documents or obscure sensitive information using the tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to send your form, whether by email, SMS, or an invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and eSign Form 1098 Mortgage Interest while ensuring excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2008 form 1098 mortgage interest

Create this form in 5 minutes!

How to create an eSignature for the 2008 form 1098 mortgage interest

The best way to make an eSignature for your PDF file online

The best way to make an eSignature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

How to generate an electronic signature from your mobile device

How to make an electronic signature for a PDF file on iOS

How to generate an electronic signature for a PDF file on Android devices

People also ask

-

What is the Form 1098 Mortgage Interest?

The Form 1098 Mortgage Interest is a tax document used by lenders to report mortgage interest received from borrowers. It includes important information such as interest paid during the year, points paid on a mortgage, and the borrower’s identifying details. Understanding this form is crucial for accurately filing taxes and claiming mortgage interest deductions.

-

How does airSlate SignNow help with the Form 1098 Mortgage Interest?

airSlate SignNow allows users to easily generate, send, and eSign the Form 1098 Mortgage Interest securely. With our platform, you can streamline the process of collecting necessary signatures and storing documents safely. This can help ensure that all tax-related paperwork is in order and submitted promptly.

-

Is airSlate SignNow cost-effective for handling documents like the Form 1098 Mortgage Interest?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes. Our pricing plans are competitive and provide excellent value for those looking to manage important documents, such as the Form 1098 Mortgage Interest, without breaking the bank. You save time and money with our intuitive document management features.

-

What features does airSlate SignNow offer for electronic signatures?

airSlate SignNow includes robust features for electronic signatures, ID verification, and document storage that are essential for managing forms like the Form 1098 Mortgage Interest. Users can easily track the signing process and send reminders, ensuring timely completion of documents. This enhances operational efficiency and compliance with legal standards.

-

Can I integrate airSlate SignNow with other software I use for managing finances?

Absolutely! airSlate SignNow integrates seamlessly with various financial software and applications, allowing you to manage documents such as the Form 1098 Mortgage Interest alongside your other tools. These integrations streamline workflows, improving productivity by reducing the need to switch between different platforms.

-

How secure is airSlate SignNow when handling sensitive documents like the Form 1098 Mortgage Interest?

Security is a top priority at airSlate SignNow. Our platform utilizes advanced encryption to protect sensitive documents, including the Form 1098 Mortgage Interest, ensuring that your data remains confidential. Additionally, we comply with industry standards and regulations to safeguard your information.

-

What benefits does airSlate SignNow provide for businesses dealing with tax documents?

Using airSlate SignNow to manage tax documents like the Form 1098 Mortgage Interest offers businesses numerous benefits, including faster processing and reduced errors. With eSigning capabilities and easy document sharing, you can enhance collaboration and ensure compliance, all while improving your overall workflow.

Get more for Form 1098 Mortgage Interest

Find out other Form 1098 Mortgage Interest

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure