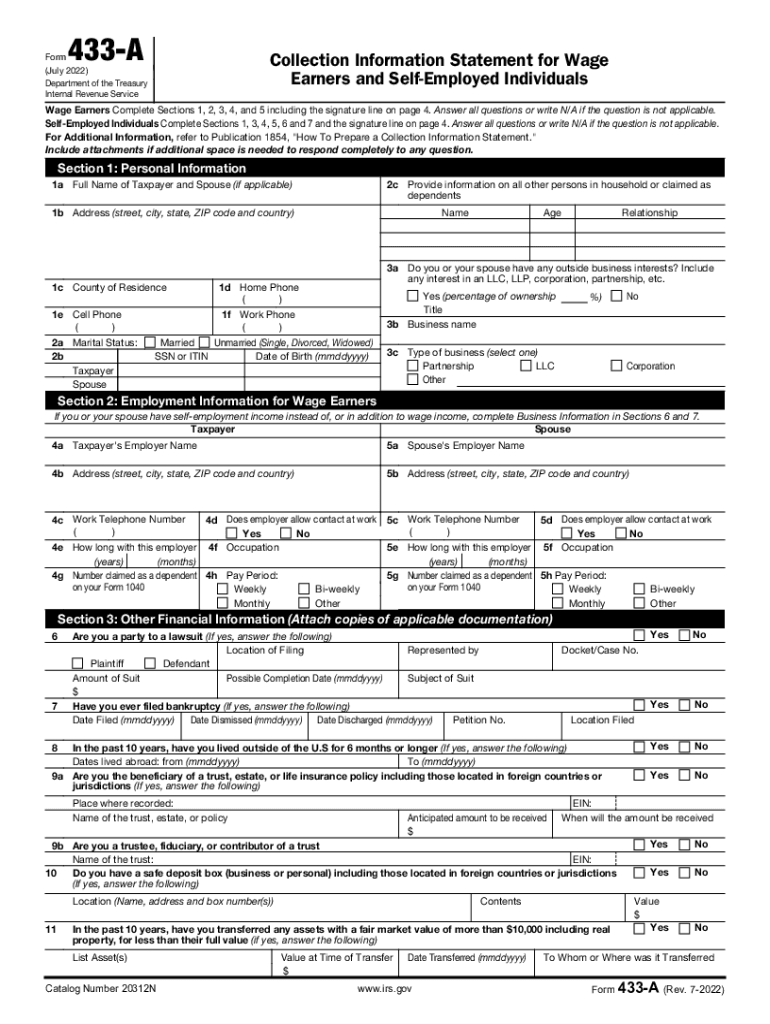

Fillable IRS Form 433 a Collection Information Statement for Wage 2022-2026

Understanding the Fillable IRS Form 433-F

The IRS Form 433-F, also known as the Collection Information Statement, is a crucial document for individuals who owe taxes and seek to negotiate a payment plan with the IRS. This form provides the IRS with a comprehensive overview of your financial situation, including income, expenses, assets, and liabilities. By accurately completing this form, taxpayers can demonstrate their ability to pay or request a reduction in their tax obligations.

Steps to Complete the Fillable IRS Form 433-F

Filling out the IRS Form 433-F involves several key steps:

- Gather Financial Information: Collect details about your income, expenses, assets, and liabilities. This includes pay stubs, bank statements, and bills.

- Complete the Form: Enter your personal information, including your name, address, and Social Security number. Provide accurate details regarding your financial situation in the designated sections.

- Review for Accuracy: Double-check all entries for accuracy and completeness. Inaccurate information can delay processing or lead to complications.

- Sign and Date: Ensure you sign and date the form before submission, as an unsigned form may be considered invalid.

Legal Use of the Fillable IRS Form 433-F

The IRS Form 433-F serves a legal purpose in tax negotiations. It is used to establish your financial status when applying for an installment agreement or an offer in compromise. By providing a clear picture of your financial situation, this form helps the IRS determine your eligibility for various relief options. It is essential to use this form accurately to avoid any potential legal issues or misunderstandings with the IRS.

Required Documents for IRS Form 433-F

When submitting the IRS Form 433-F, certain documents are necessary to support your claims:

- Proof of Income: Recent pay stubs or tax returns to verify your income.

- Bank Statements: Statements from your bank accounts to show your financial activity.

- Expense Documentation: Bills or statements that outline your monthly expenses.

Form Submission Methods for IRS Form 433-F

Taxpayers can submit the IRS Form 433-F through various methods:

- Online Submission: Some taxpayers may have the option to submit the form electronically through the IRS website.

- Mail: You can print the completed form and send it to the appropriate IRS address based on your location.

- In-Person: Alternatively, you may visit a local IRS office to submit the form in person.

Eligibility Criteria for IRS Form 433-F

To use the IRS Form 433-F, taxpayers must meet specific eligibility criteria. This form is typically used by individuals who owe taxes and are seeking to establish a payment plan or negotiate a settlement with the IRS. It is essential to ensure that your financial situation aligns with the requirements set by the IRS for consideration of payment arrangements.

Quick guide on how to complete fillable irs form 433 a collection information statement for wage

Complete Fillable IRS Form 433 A Collection Information Statement For Wage effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents swiftly with no delays. Manage Fillable IRS Form 433 A Collection Information Statement For Wage on any device using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

How to modify and eSign Fillable IRS Form 433 A Collection Information Statement For Wage with ease

- Locate Fillable IRS Form 433 A Collection Information Statement For Wage and click Get Form to begin.

- Utilize the tools we provide to finalize your form.

- Emphasize important parts of the documents or obscure sensitive information with the specialized tools offered by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then hit the Done button to save your changes.

- Choose your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Fillable IRS Form 433 A Collection Information Statement For Wage while ensuring excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable irs form 433 a collection information statement for wage

Create this form in 5 minutes!

People also ask

-

What is IRS Gov Forms Publication 17 and how does it relate to airSlate SignNow?

IRS Gov Forms Publication 17 is a comprehensive guide issued by the IRS that offers essential tax information for individuals. With airSlate SignNow, users can easily eSign and send IRS-related documents, including forms detailed in Publication 17, ensuring compliance and efficiency in tax filing.

-

How can airSlate SignNow help with IRS Gov Forms Publication 17?

airSlate SignNow simplifies the process of preparing and submitting necessary documents linked to IRS Gov Forms Publication 17. By providing a user-friendly platform for eSigning, businesses can ensure they meet deadlines and maintain accuracy in their tax submissions.

-

Is airSlate SignNow cost-effective for managing IRS Gov Forms Publication 17?

Yes, airSlate SignNow offers a cost-effective solution for managing IRS Gov Forms Publication 17. With flexible pricing plans, users can choose options that best fit their needs, saving both time and money while ensuring compliance with IRS guidelines.

-

What features does airSlate SignNow offer for IRS Gov Forms Publication 17?

AirSlate SignNow provides features like document templates, real-time tracking, and secure eSigning, specifically beneficial for handling IRS Gov Forms Publication 17. These features streamline the process of preparing and sending necessary forms, enhancing overall productivity.

-

Can I integrate airSlate SignNow with other software for IRS Gov Forms Publication 17?

Yes, airSlate SignNow supports integrations with various applications, allowing users to efficiently manage IRS Gov Forms Publication 17 across different platforms. This seamless integration facilitates better document management and enhances workflow automation.

-

What benefits does airSlate SignNow provide for businesses dealing with IRS Gov Forms Publication 17?

AirSlate SignNow offers numerous benefits for businesses handling IRS Gov Forms Publication 17, including increased efficiency, reduced paper usage, and enhanced document security. By using our platform, businesses can streamline their tax-related processes and improve accuracy.

-

How does airSlate SignNow ensure security for IRS Gov Forms Publication 17?

AirSlate SignNow employs top-notch security measures to protect sensitive information related to IRS Gov Forms Publication 17. With end-to-end encryption and secure cloud storage, users can trust that their data is safe from unauthorized access.

Get more for Fillable IRS Form 433 A Collection Information Statement For Wage

- Bond for deed contract for deed louisiana form

- Buyers home inspection checklist louisiana form

- Sellers information for appraiser provided to buyer louisiana

- Legallife multistate guide and handbook for selling or buying real estate louisiana form

- Subcontractors agreement louisiana form

- Option to purchase addendum to residential lease lease or rent to own louisiana form

- Louisiana prenuptial premarital agreement with financial statements louisiana form

- Louisiana prenuptial premarital agreement without financial statements louisiana form

Find out other Fillable IRS Form 433 A Collection Information Statement For Wage

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien

- How To Sign Arkansas Lease Renewal

- Sign Georgia Forbearance Agreement Now

- Sign Arkansas Lease Termination Letter Mobile