for Additional Information, Refer to Publication 1854, 'How to Prepare a Collection Information Statement 2020

Understanding IRS Form 433-A

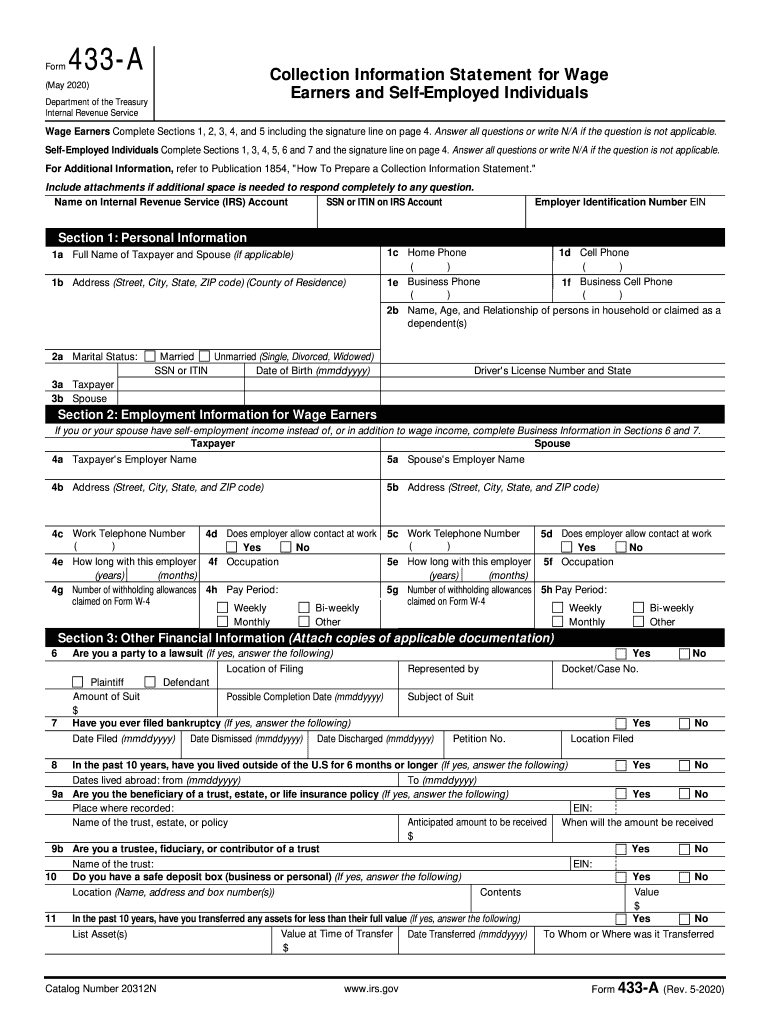

IRS Form 433-A is a Collection Information Statement that individuals use to provide the IRS with detailed information about their financial situation. This form is essential for taxpayers who are seeking to resolve tax debts through installment agreements or offers in compromise. It requires comprehensive disclosure of income, expenses, assets, and liabilities, allowing the IRS to assess the taxpayer's ability to pay. Completing this form accurately is crucial for a favorable outcome in negotiations with the IRS.

Steps to Complete IRS Form 433-A

Completing IRS Form 433-A involves several key steps:

- Gather financial documents, including pay stubs, bank statements, and bills.

- Fill out personal information, including your name, Social Security number, and address.

- Detail your income sources, including wages, self-employment income, and any other earnings.

- List your monthly expenses, categorizing them into necessary living expenses such as housing, utilities, and transportation.

- Disclose your assets, including real estate, vehicles, and bank account balances.

- Provide information on any liabilities, including outstanding debts and loans.

- Review the completed form for accuracy before submission.

Required Documents for IRS Form 433-A

When filling out IRS Form 433-A, you will need to provide supporting documentation to verify the information you report. Commonly required documents include:

- Recent pay stubs or proof of income.

- Bank statements for the last three months.

- Documentation of monthly expenses, such as utility bills and rent or mortgage statements.

- Tax returns for the previous year.

- Proof of any additional income sources, such as rental income or alimony.

Filing Methods for IRS Form 433-A

IRS Form 433-A can be submitted through various methods, allowing flexibility based on your preferences:

- Online submission through the IRS website, if applicable.

- Mailing the completed form to the appropriate IRS address based on your location.

- In-person submission at your local IRS office, which may require an appointment.

IRS Guidelines for Form 433-A

The IRS has specific guidelines regarding the use and submission of Form 433-A. It is essential to adhere to these guidelines to ensure compliance and avoid penalties:

- Submit the form when applying for an installment agreement or offer in compromise.

- Ensure all information is complete and accurate to avoid delays in processing.

- Keep copies of the submitted form and all supporting documents for your records.

Eligibility Criteria for Using IRS Form 433-A

Not all taxpayers may need to use Form 433-A. The eligibility criteria generally include:

- Individuals with outstanding tax debts who wish to negotiate payment options.

- Taxpayers seeking to apply for an offer in compromise based on financial hardship.

- Those who have received a notice from the IRS requesting financial information.

Quick guide on how to complete for additional information refer to publication 1854 quothow to prepare a collection information statement

Complete For Additional Information, Refer To Publication 1854, 'How To Prepare A Collection Information Statement effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly and without delays. Manage For Additional Information, Refer To Publication 1854, 'How To Prepare A Collection Information Statement on any device through the airSlate SignNow Android or iOS applications and simplify your document-related processes today.

How to modify and eSign For Additional Information, Refer To Publication 1854, 'How To Prepare A Collection Information Statement with ease

- Obtain For Additional Information, Refer To Publication 1854, 'How To Prepare A Collection Information Statement and click Get Form to commence.

- Utilize the tools we provide to fill in your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and then click the Done button to save your modifications.

- Select your preferred method for sharing your form—via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign For Additional Information, Refer To Publication 1854, 'How To Prepare A Collection Information Statement and ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct for additional information refer to publication 1854 quothow to prepare a collection information statement

Create this form in 5 minutes!

How to create an eSignature for the for additional information refer to publication 1854 quothow to prepare a collection information statement

How to make an electronic signature for a PDF document online

How to make an electronic signature for a PDF document in Google Chrome

The best way to generate an eSignature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The best way to generate an eSignature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the purpose of form 433 a?

The form 433 a is used by the IRS to collect financial information from taxpayers. This form helps determine an individual's ability to pay or qualify for a payment plan. Accurately completing the form 433 a is critical for effectively managing tax debts.

-

How can airSlate SignNow help me with form 433 a?

airSlate SignNow allows you to easily create, send, and eSign your form 433 a digitally. Our platform streamlines the document management process, ensuring you can complete your tax forms efficiently and securely. You can also track the progress of your form 433 a in real-time.

-

What features does airSlate SignNow offer for managing form 433 a?

airSlate SignNow offers a range of features such as templates for form 433 a, customizable workflows, and integrated eSignature capabilities. These features allow for a seamless signing experience, reducing the time spent on paperwork. You can also store and manage all your tax documents in one place.

-

Is there a cost associated with using airSlate SignNow for form 433 a?

Yes, airSlate SignNow offers various pricing plans tailored to meet the needs of different users, including those who need to manage form 433 a. We provide cost-effective solutions that reduce overhead without compromising on functionality. You can choose a plan that aligns with your volume of document processing.

-

Can I integrate airSlate SignNow with other software while handling form 433 a?

Absolutely! airSlate SignNow easily integrates with numerous applications like Google Drive, Dropbox, and CRM systems. This means you can import and export your form 433 a seamlessly across platforms, enhancing your workflow and productivity.

-

What are the benefits of using airSlate SignNow for filing form 433 a?

Using airSlate SignNow for filing form 433 a provides signNow benefits including speed, security, and ease of use. Our eSignature technology ensures your documents are securely signed and compliant with legal standards. Additionally, it saves time by allowing you to manage all your documents in a single platform.

-

Is airSlate SignNow secure for handling sensitive documents like form 433 a?

Yes, airSlate SignNow employs top-notch security features to protect your sensitive documents, including form 433 a. We use advanced encryption to safeguard your data and comply with industry regulations. You can trust that your information is protected while utilizing our platform.

Get more for For Additional Information, Refer To Publication 1854, 'How To Prepare A Collection Information Statement

- Form dr 907 florida department of revenue

- F 1120n 2018 2019 form

- Form dr 908n florida department of revenue

- Application for property tax relief state of north carolina form

- Objection to addressjurisdiction database for local communications form

- Download form b c 715 formupack

- Limited liability company annual certificate annual certificate sos ok form

- Instructions for closing an estate informally courts state co

Find out other For Additional Information, Refer To Publication 1854, 'How To Prepare A Collection Information Statement

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template

- eSignature Illinois Postnuptial Agreement Template Easy

- eSignature Kentucky Postnuptial Agreement Template Computer

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free