Form 433 a 2019

What is the Form 433 A

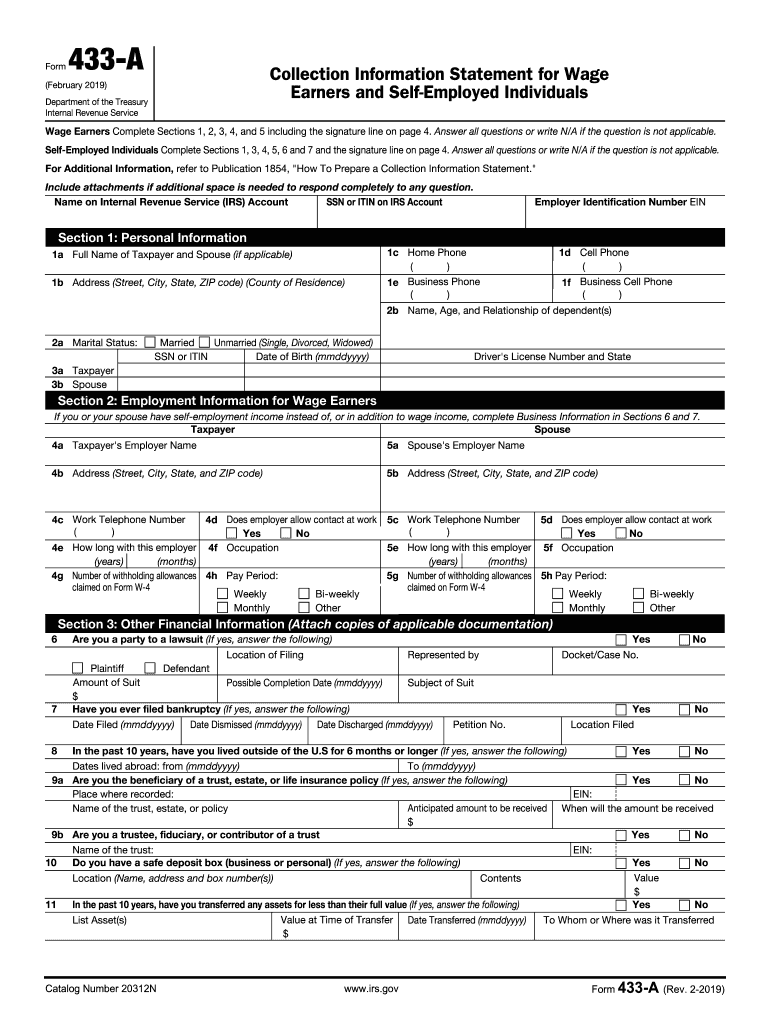

The Form 433 A is an essential document used by individuals to provide the IRS with detailed information about their financial situation. This form is primarily utilized in the context of an Offer in Compromise (OIC) or when negotiating payment plans with the IRS. It helps the agency assess a taxpayer's ability to pay their tax liabilities by collecting data on income, expenses, assets, and liabilities. Understanding the purpose and requirements of the Form 433 A is crucial for taxpayers seeking to resolve their tax debts effectively.

How to use the Form 433 A

Using the Form 433 A involves several steps that ensure accurate and complete submission. First, gather all necessary financial documentation, including income statements, bank statements, and details of assets and liabilities. Next, fill out the form by providing comprehensive information about your financial status. It is important to be honest and thorough, as any discrepancies may lead to delays or denials in processing your application. Once completed, the form should be submitted to the IRS along with any required supporting documents as part of your OIC or payment arrangement request.

Steps to complete the Form 433 A

Completing the Form 433 A requires careful attention to detail. Follow these steps for successful completion:

- Begin with your personal information, including name, address, and Social Security number.

- Provide details about your employment status and income sources, including wages, self-employment income, and any other earnings.

- List your monthly expenses, categorizing them into necessary living costs such as housing, utilities, food, and transportation.

- Detail your assets, including bank accounts, real estate, vehicles, and any other valuable property.

- Outline your liabilities, including debts and obligations that affect your financial situation.

- Review the completed form for accuracy and completeness before submission.

Required Documents

When submitting the Form 433 A, it is crucial to include supporting documents that validate the information provided. Required documents typically include:

- Recent pay stubs or income statements to verify earnings.

- Bank statements for all accounts to confirm available funds.

- Documentation of monthly expenses, such as utility bills and lease agreements.

- Asset valuations, including appraisals for real estate or vehicle titles.

- Proof of liabilities, such as loan statements or credit card bills.

Legal use of the Form 433 A

The Form 433 A must be used in accordance with IRS regulations. It is legally binding, meaning that the information provided must be accurate and truthful. Misrepresentation or failure to disclose pertinent financial information can lead to penalties, including denial of an OIC or other tax relief options. Taxpayers are encouraged to seek professional advice if they are unsure about how to complete the form or if they have complex financial situations that may affect their eligibility for relief.

Form Submission Methods (Online / Mail / In-Person)

The Form 433 A can be submitted to the IRS through various methods, depending on the taxpayer's preference and circumstances. Options include:

- Online Submission: Some taxpayers may have the option to submit the form electronically through the IRS website or authorized e-filing services.

- Mail: The completed form can be mailed to the appropriate IRS address, which varies based on the taxpayer's location and the type of request being made.

- In-Person: Taxpayers may also choose to deliver the form in person at their local IRS office, although this method may require scheduling an appointment.

Quick guide on how to complete form 433 a rev 2 2019 collection information statement for wage earners and self employed individuals

Explore the most efficient method to complete and sign your Form 433 A

Are you still spending time preparing your official documents on paper instead of online? airSlate SignNow offers a superior way to finalize and sign your Form 433 A and related forms for public services. Our intelligent electronic signature system provides all the necessary tools to manage documents swiftly and comply with formal requirements - powerful PDF editing, organizing, securing, signing, and sharing features all available in an intuitive interface.

Only a few steps are needed to fill out and sign your Form 433 A:

- Upload the editable template to the editor using the Get Form option.

- Verify the information you need to include in your Form 433 A.

- Navigate between the fields using the Next button to ensure nothing is overlooked.

- Utilize Text, Check, and Cross tools to fill in the sections with your information.

- Update the content with Text boxes or Images from the top toolbar.

- Emphasize what is signNow or Redact irrelevant sections.

- Select Sign to create a legally valid electronic signature using any method you prefer.

- Insert the Date beside your signature and conclude your task with the Done button.

Store your finalized Form 433 A in the Documents folder within your account, download it, or send it to your chosen cloud storage. Our service also facilitates easy file sharing. There’s no need to print your templates if you need to submit them to the appropriate public office - do it via email, fax, or by requesting USPS “snail mail” delivery from your account. Give it a try today!

Create this form in 5 minutes or less

Find and fill out the correct form 433 a rev 2 2019 collection information statement for wage earners and self employed individuals

Create this form in 5 minutes!

How to create an eSignature for the form 433 a rev 2 2019 collection information statement for wage earners and self employed individuals

How to make an eSignature for your Form 433 A Rev 2 2019 Collection Information Statement For Wage Earners And Self Employed Individuals online

How to create an eSignature for the Form 433 A Rev 2 2019 Collection Information Statement For Wage Earners And Self Employed Individuals in Chrome

How to generate an eSignature for putting it on the Form 433 A Rev 2 2019 Collection Information Statement For Wage Earners And Self Employed Individuals in Gmail

How to generate an eSignature for the Form 433 A Rev 2 2019 Collection Information Statement For Wage Earners And Self Employed Individuals from your smart phone

How to create an electronic signature for the Form 433 A Rev 2 2019 Collection Information Statement For Wage Earners And Self Employed Individuals on iOS

How to create an eSignature for the Form 433 A Rev 2 2019 Collection Information Statement For Wage Earners And Self Employed Individuals on Android

People also ask

-

What is the pusptso utility guide application?

The pusptso utility guide application is a versatile tool designed to streamline document signing and management processes. It allows users to easily send, receive, and eSign documents, all while ensuring compliance and security. With its user-friendly interface, businesses can enhance efficiency in their workflows.

-

How does the pusptso utility guide application improve document signing processes?

The pusptso utility guide application simplifies the document signing process by providing intuitive features that minimize barriers to signing. Users can send documents for eSignature in just a few clicks and track their status in real-time. This efficiency not only saves time but also enhances productivity across teams.

-

Is there a cost associated with the pusptso utility guide application?

Yes, the pusptso utility guide application offers various pricing plans tailored to meet the needs of different users. Whether you are a small business or a large enterprise, you can find a plan that aligns with your budget while receiving maximum value. Each plan comes with a set of features to optimize document workflows.

-

What are the key features of the pusptso utility guide application?

Key features of the pusptso utility guide application include document templates, customizable workflows, and secure cloud storage. Users can easily create reusable templates for frequently used documents, improving efficiency. Additionally, advanced security features ensure that sensitive information is protected during transactions.

-

How can I integrate the pusptso utility guide application with my existing tools?

The pusptso utility guide application seamlessly integrates with various tools and platforms, enabling users to enhance their current workflows. Popular integrations include CRM systems, email platforms, and project management tools, ensuring that businesses can maintain their operational ecosystem without disruption.

-

What benefits can businesses expect from using the pusptso utility guide application?

By utilizing the pusptso utility guide application, businesses can expect increased operational efficiency, cost savings, and improved customer satisfaction. The application's ease of use coupled with its robust features allows for quicker turnaround times on signed documents, which can lead to faster decision-making processes.

-

Is the pusptso utility guide application secure?

Absolutely, security is a top priority for the pusptso utility guide application. It utilizes advanced encryption protocols and compliance with industry standards to ensure the security of all documents throughout the signing process. Users can confidently manage their sensitive information knowing it is protected.

Get more for Form 433 A

- Referral form the everett clinic

- Historia de la biblia 179 form

- Ent referral form sierra nevada ent

- Scia grants application form spinal cord injuries australia scia org

- Form 502w pass through entity withholding tax payment form 502w pass through entity withholding tax payment

- K 40svr property tax relief claim for seniors and form

- Succession agreement template form

- Summary agreement template form

Find out other Form 433 A

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer